Introduction

Companies that move goods across the globe are still digesting the rapid changes in economies, supply chains and logistics real estate from the past three years. In this report, Prologis Research updates our views on demand, supply and the long-term outlook for logistics real estate.

Four global trends to understand:

- Future logistics real estate cycles will be less volatile because of the multiplier effect on demand and structural discipline in supply.

- For every dollar of U.S. gross domestic product, at least 20% more logistics space is needed than before the COVID-19 pandemic.

- An institutionalized developer and investor base—coupled with rising geographic and regulatory barriers to supply—will limit capacity growth throughout the cycle stages.

- Service levels are fueling demand again. Customer network expansion needs are rooted in offering the speed and choice demanded by the end consumer to compete for revenue.

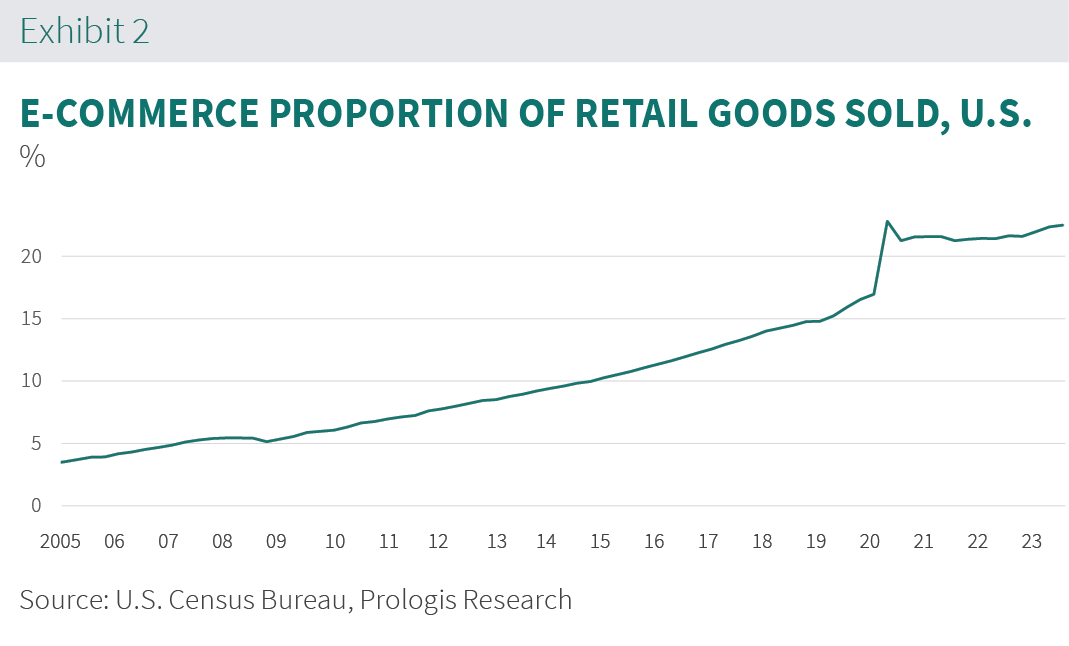

- E-commerce is reaccelerating and on pace to reach more than 23% of U.S. retail goods sold in 2023, up 100 bps year-over-year.1

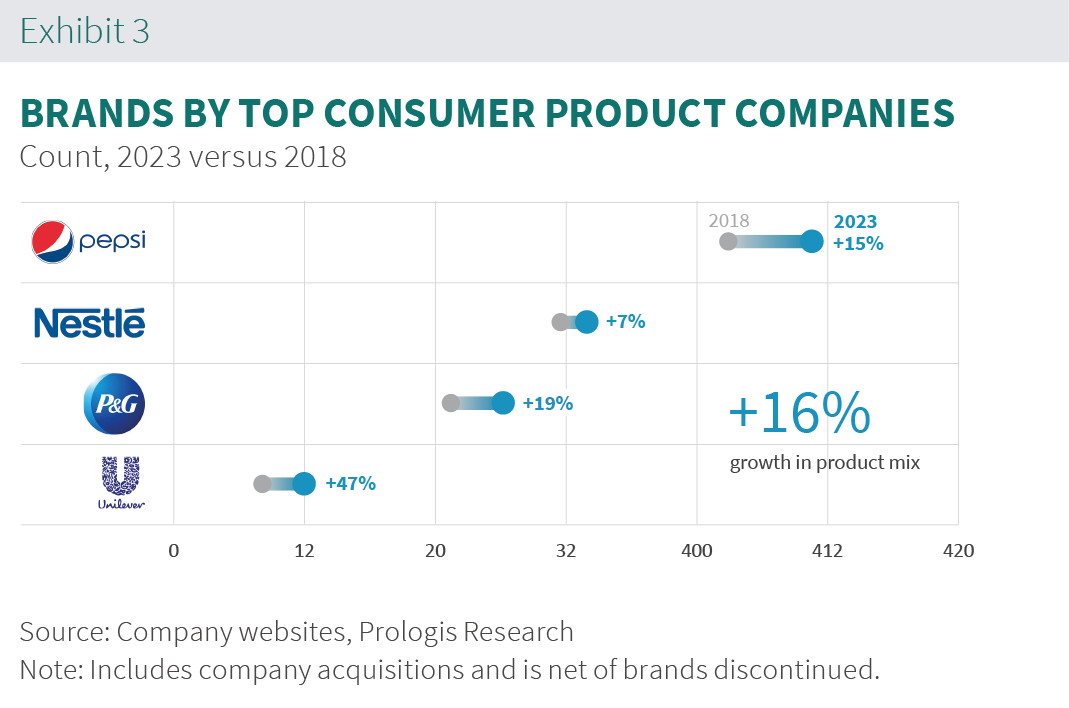

- Product variety is on the rise. The top consumer goods companies increased product mix by 16% from 2018 to 2023.2

- Customers are still building in resilience to manage persistent disruption.

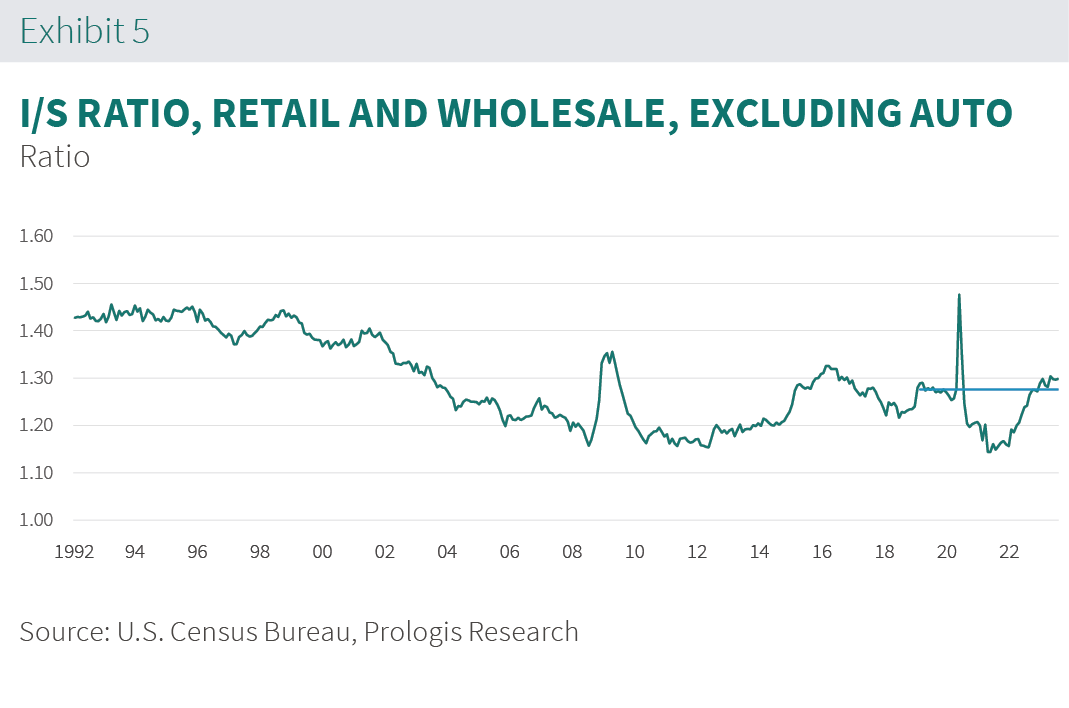

- The shift from just-in-time to just-in-case is on-going. The surge of demand to accommodate inventory growth generated 65%+ higher net absorption than typical from 2020-1H 2023, and I/S and inventories/household ratios recovered to +3% more than pre-pandemic levels. We expect +5% long-term, but economic uncertainty may push some demand into 2024.

- Diversified sourcing and ports of entry will reshape supply chains for years to come, driving incremental demand along trade routes and near newly established production facilities.

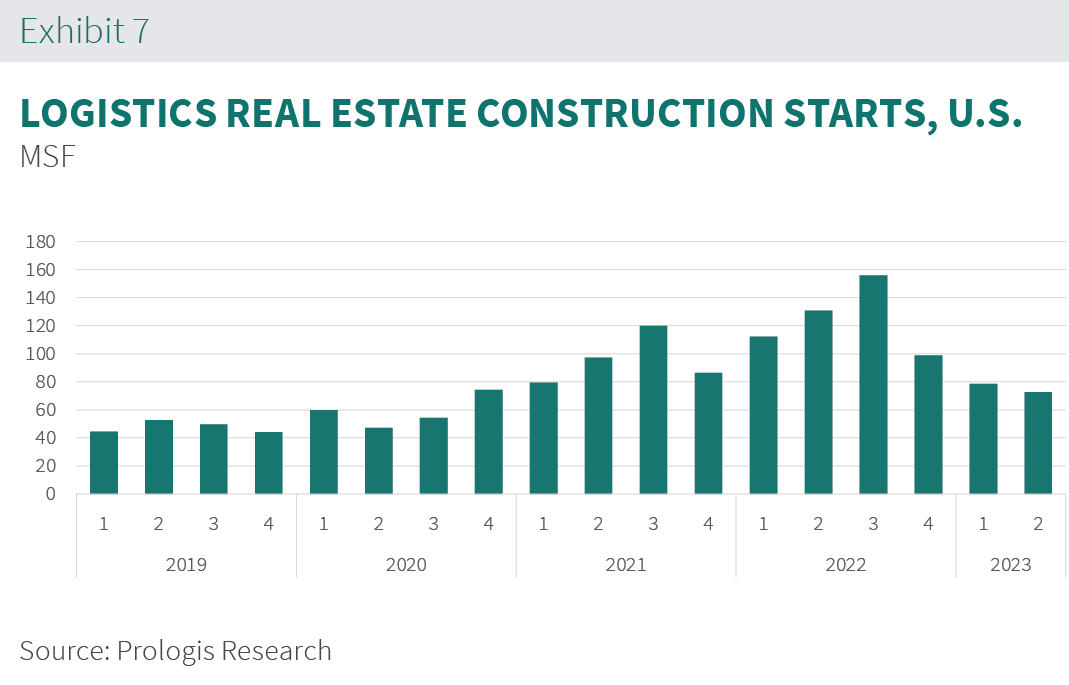

- New building deliveries will contract by 35% or more in the U.S. and Europe in 2024, creating a window for positive demand to take market vacancies further below historic norms in late 2024 and into 2025.3

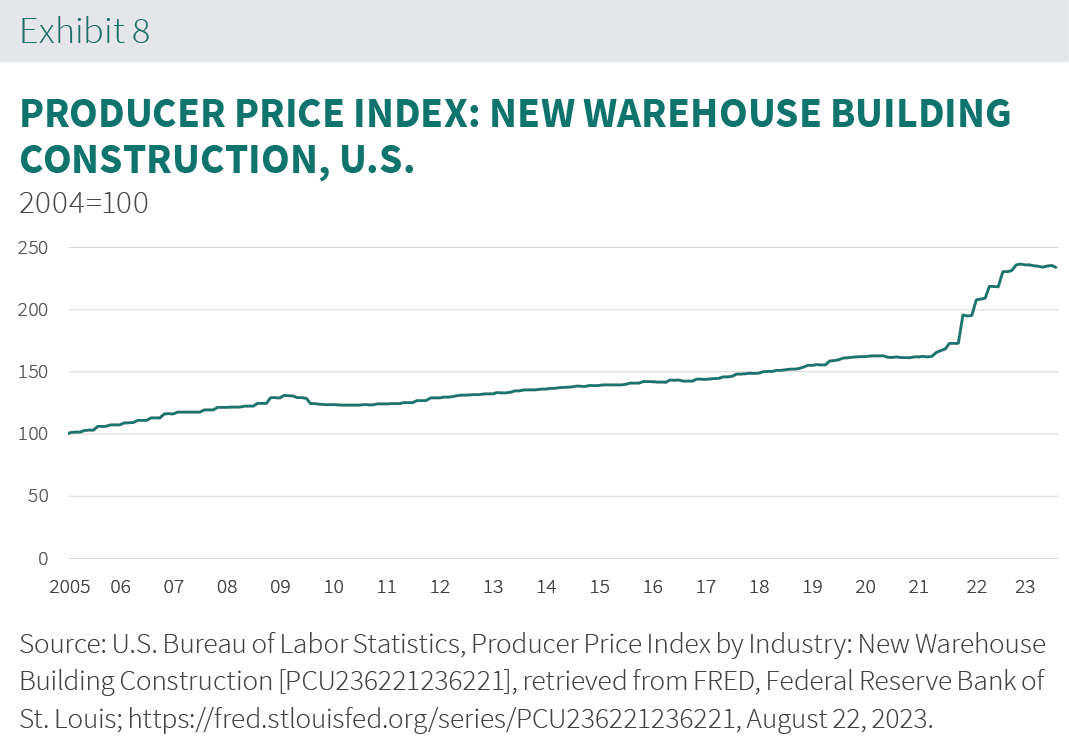

- Replacement costs remain elevated, driven by higher financing costs and competition for construction materials and labor from infrastructure, manufacturing and housing.

- Financial market volatility translated to a greater than 200 bps increase in required returns to warrant new development. At the same time, repricing and tighter lending standards in the debt markets limit financing for development.

Future logistics real estate cycles will be less volatile because of the multiplier effect on demand

Economic activity has shifted toward more logistics real estate-intensive uses over time. Each unit of growth will require more than 20% of additional logistics space than pre-pandemic for three reasons:

- Higher inventory carry (5% or more) for each unit of sale to build in supply chain resilience to disruption.

- Increased product variety will drive the need for more storage space to service each unit of consumption.

- Goods’ share of consumption is poised to remain higher for longer due to demographic trends. We estimate goods will make up approximately 38% of U.S. consumption going forward as millennials enter peak spending years, down from a pandemic high of 40% but above the pre-pandemic share of 36%.

- Online share of goods spending will continue to increase (from 15% in 2019 to 25% by 2025), which will continue to drive the need for more space because e-commerce requires three times the logistics space compared to brick-and-mortar retail.1

Outside of these share shifts, we see signs of increasing logistics real estate intensity, even in traditional retailing models. (Look for more details on this trend in an upcoming paper, “The Supply Chain Productivity Paradox.”)

Future logistics real estate cycles will be less volatile because of the persistent discipline in new supply

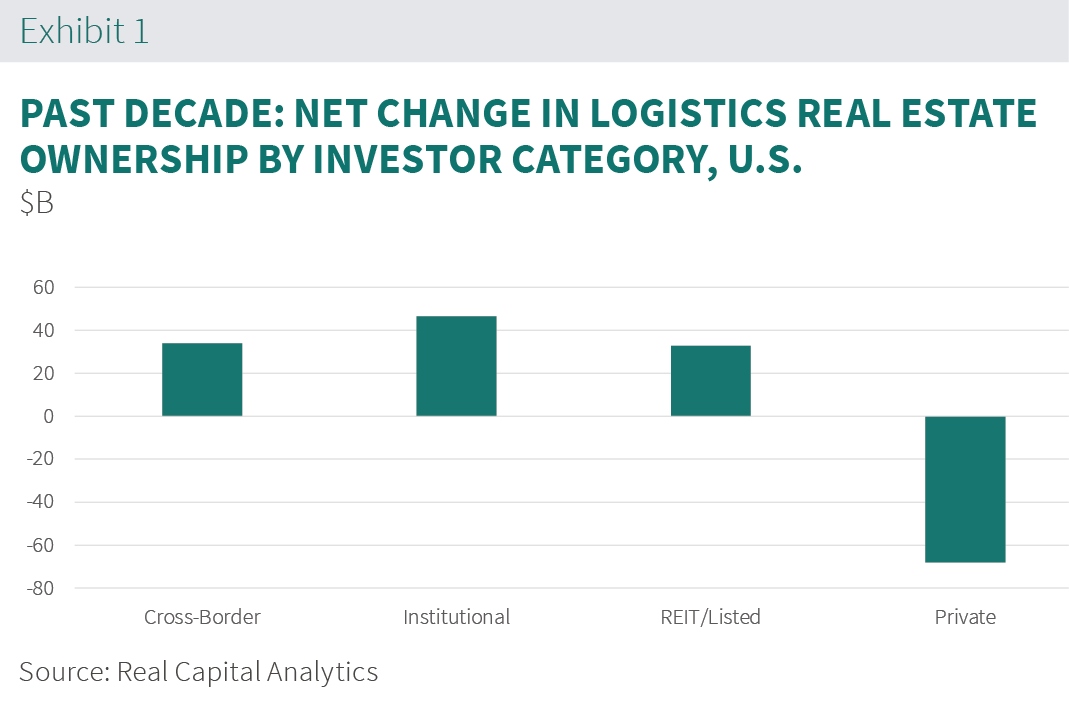

An institutionalized developer and investor base creates limits. Over the past 10 years, private owners and owner-users have been net sellers of logistics real estate while domestic and foreign institutions have increased their allocations to the sector.4

Barriers to supply are high and rising. The amount of developed land within 20 miles of U.S. major city centers increased by 32%5 during the past 20 years as cities increasingly built outward. At the same time, regulatory barriers to new industrial buildings have increased, lengthening construction timelines, increasing costs and limiting the amount of new products brought online each year.

The future of retail is driving demand.

With greater predictability in supply chains sans pandemic-era disruptions, companies are again turning to improved service to win consumer dollars.

E-commerce is gaining share. Prologis Research expects over 100 bps growth in U.S. e-commerce share of goods sales in 2023 year-over-year, equal to more than 50 MSF of demand. Around the world, delivery timelines are falling again as the ability to consistently deliver goods in one day or less produces a competitive advantage. Investments in larger, decentralized distribution networks facilitate fast delivery and reduce transportation costs. As a result, we expect increased demand for logistics real estate concentrated near centers of consumption.

Product variety is on the rise. Another avenue to revenue growth is expanding choice to stay on top of rapidly evolving preferences and a desire for customized offerings. The top global consumer goods companies increased product mix by 16% between 2018 and the first half of 2023. A broadened product mix requires additional storage space, adding to logistics real estate demand.2

The future of the supply chain is resilience.

Customers are evolving their global supply chains to manage persistent disruption.

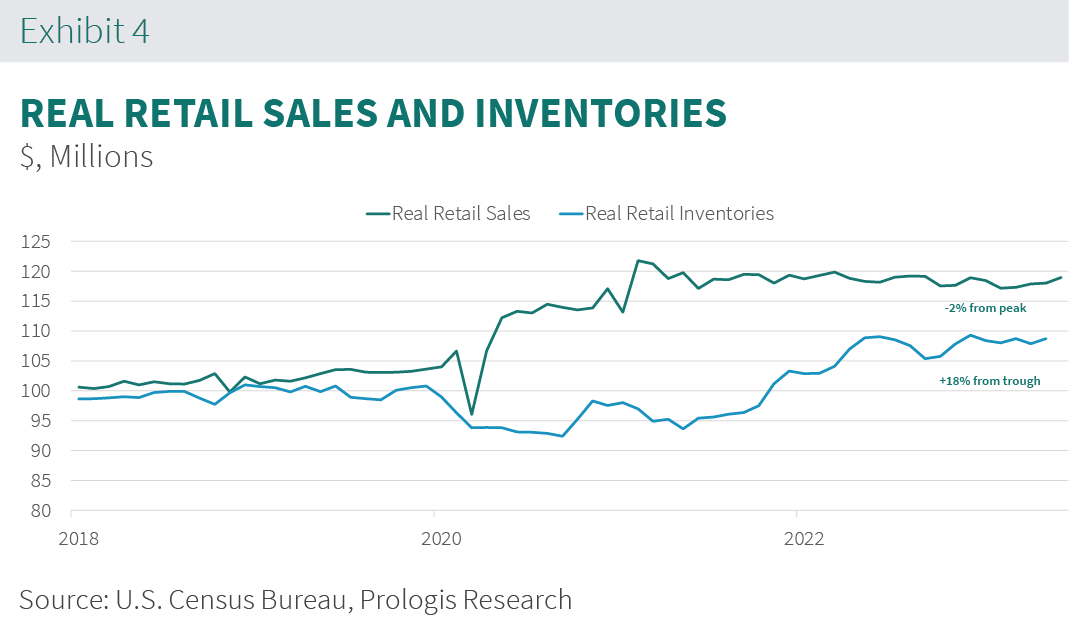

The shift from just-in-time to just-in-case is on-going and will be reflected in future demand. When the U.S. inventory to sales (I/S) ratio fell to 10% below pre-pandemic levels, we called for cumulative inventory growth of 15-20%, driving a surge of demand. Subsequently, real inventories increased by 15% and both the I/S ratio and inflation-adjusted inventories per household recovered to 3% above pre-pandemic levels.6 From 2020 to 1H 2023, logistics real estate demand total 1.2 billion square feet or 330 MSF per year vs. historical expansionary average of 175 to 200 MSF in the top 30 U.S. markets, showcasing this incremental demand.

More growth is needed to reach “just-in-case” inventory levels that are 5% or more above pre-pandemic, although economic uncertainty may push some demand into 2024. Historical patterns suggest inventories decline by approximately 2% before sales slow, a quantification of the uncertainty. Going forward, resilient inventories are part of the 20% higher demand

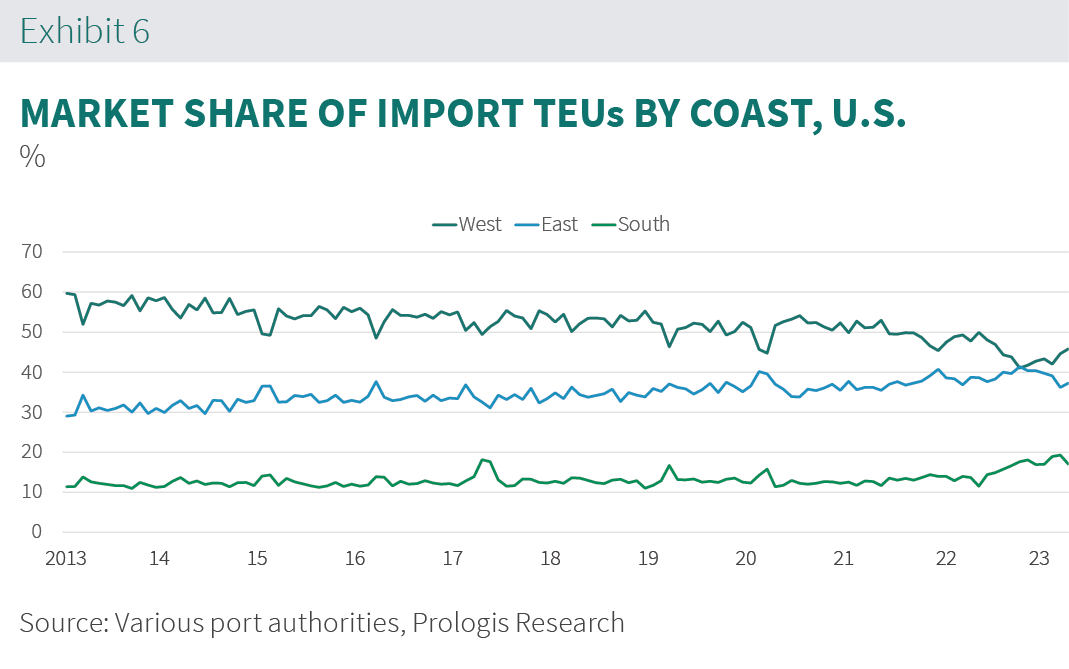

Diversified sourcing and ports of entry will drive the need for duplicative facilities. Supply chains are now past the pandemic bullwhip. Normal seasonality is slowly returning but still subject to geopolitical tensions and disruptions from labor, weather and climate-driven events.

In the near term, in Southern California, the International Longshore and Warehouse Union (ILWU) negotiation-driven share shift will partially reverse. The structural portion of this market share shift will remain in expanded footprints near seaports along the east and south coasts that offer import gateway diversification. In Texas, demand driven by nearshoring has amplified the need for facilities between Laredo (the top U.S.-Mexico freight border crossing) and Dallas (the largest intermodal hub in proximity to Mexico.7

New building deliveries will contract by 35% or more in the U.S. and Europe in 2024.

This creates a window for positive demand to take market vacancies further below historical norms in late 2024 and into 2025. Preliminary 3Q 2023 data shows a further deceleration in starts, revealing the ongoing impact of the price of debt and changes in bank and regulator behavior in the wake of the Silicon Valley Bank and Credit Suisse failures.

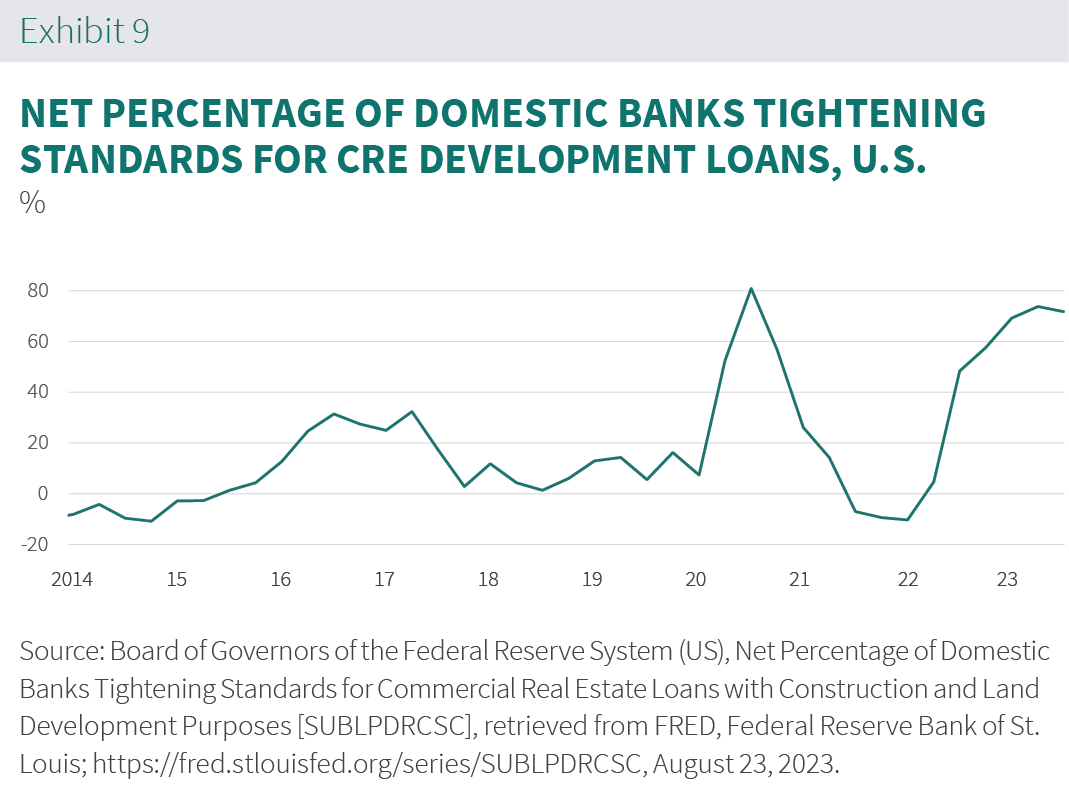

Replacement costs remain elevated, driven by higher financing costs and competition for labor and materials from infrastructure, manufacturing and housing. Construction loans are expensive and difficult to secure. With most banks tightening lending standards and interest rates doubling during the past 18 months, the era of ample, low-cost financing ended abruptly in 2022.8

The outlook for decreasing vacancy adds upside to market rental growth in 2025 and beyond. Taken together, positive demand drivers and a rapid fall in starts could push the U.S. vacancy rate from a peak in the mid-4% range at the beginning of 2024 back to the mid-3% range by the end of 2024, with a similar pattern in Europe. For users of mission-critical logistics facilities, structural shifts in demand, like evolving consumer preferences and the need for supply chain flexibility in an increasingly uncertain world, are more likely to be met with chronic undersupply and higher barriers to new development in the future.