The Broad View

- Prologis’ IBI, the company’s proprietary survey of logistics real estate customer activity, reflected a sentiment of growth in the third quarter of 2020 after a period of historic volatility in the second quarter. Activity levels reached 59 in September – in line with strong growth. Utilization recovered during the same period, hovering in the 84-85% range – near capacity - after having fallen to ~83% in April.

- Demand for logistics real estate strengthened and diversified, with leasing momentum across a broader range of industries and size categories.1 Net absorption surged to nearly 65 million square feet (MSF), led by key locations along supply chains and near large populations, including Southern California, New Jersey/New York, Dallas and Atlanta.2 Given low vacancy, leasing was propelled by incoming new supply, which tallied 89 MSF in the quarter. As demand kept up with new supply, the vacancy rate remained low, at 5.0%. Rent concessions that had been put into place due to heightened uncertainty around COVID-19 were rolled back; as a result, market rents reaccelerated, growing 2% in the third quarter.

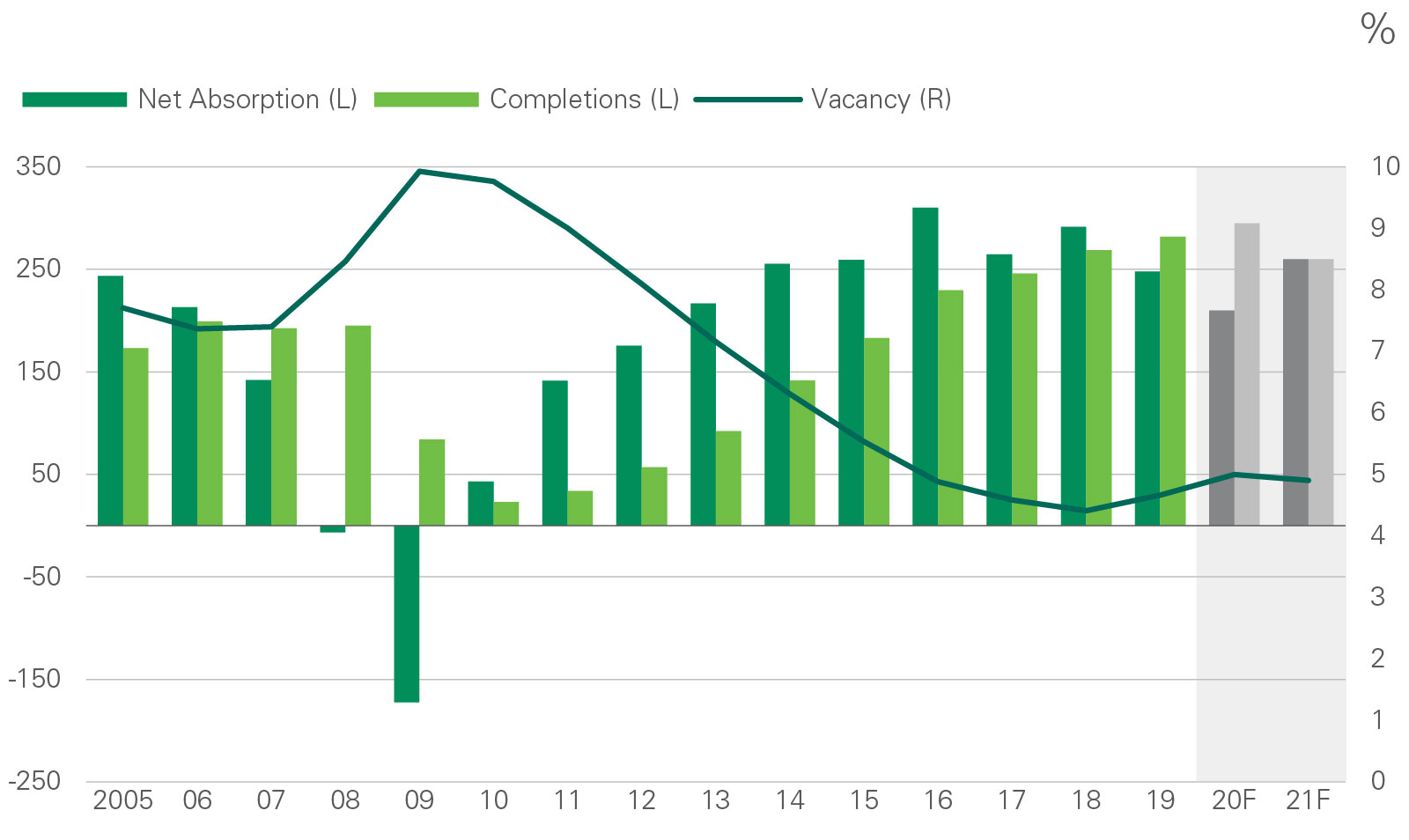

- Operating conditions improved measurably over the past 90 days and, as a result, Prologis Research upgraded our forecast for 2020 net absorption to 210 MSF from 160 MSF in Q2’20 and 100 MSF in Q1’20. The forecast for completions was also revised up, to 295 MSF from 250 MSF in the second quarter of 2020. At year-end, we expect vacancy of 5.0% and full-year 2020 rent growth of 2.5%, which reflects a much faster return to growth than anticipated; this growth is driven by strong demand for space.

The Details

Prologis’ IBITM stabilized in line with future growth in logistics demand. As of September, the IBI had recorded four consecutive months over 50, a number that shows demand growth over month over month. Space utilization, another leading indicator of logistics demand, climbed to a third-quarter average of 84.5% – near pre-pandemic levels. Improvement was broad-based by industry, but retail reported the highest readings in recent months (reflecting strong growth in both activity and space utilization). Services businesses, however, lagged.

The demand recovery broadened as net absorption surged. While a greater range of industries expanded their operations in the third quarter, both e-commerce-driven leasing and 3PL activity remained above pre-pandemic averages.3 Leasing for e-fulfilment purposes reached nearly 37% of new leasing in Q3’20 compared against an historic average of 21%, and that leasing activity spanned a wider range of businesses: pure-play e-commerce users of all sizes, brick-and-mortar retailers and 3PL firms all were active. 3PLs were also leasing space to help solve inventory challenges. In Q3’20 during the quarter, logistics users gained a better grasp of supply chain volatility as it pertains to the source of goods, their cost and their availability relative to the situation in the early days of the pandemic. Disruptions in these areas are requiring shippers and buyers to explore different network designs, particularly within major bulk submarkets. Logistics users with the resources to do so are pivoting quickly and generating reconfiguration demand. With both locations well-positioned upstream of supply chains and having proximity to large consumer populations for direct-to-home delivery, key gateway markets led in net absorption during the third quarter, although demand was spread throughout the U.S. Net absorption came in above expectations, with 65 MSF for the quarter, pushing our 2020 demand forecast to 210 MSF.4 Rents were stable or up in the third quarter as occupancy remained high in most markets, causing us to revise up our expectations for rent growth in Q4’20 and 2021.

Logistics operations continue to trend toward normal. By September, just 2% of respondents reported suspended operations as a result of the pandemic (about one-third of peak shutdown levels), with the remainder nearly equally split between companies that have made operational changes such as staggered shifts (previously ~60% of respondents) and those that reported no changes to operations as a result of COVID-19 (previously ~35%).

Speculative development activity is still lower than 2019 but is trending upward. In total, construction starts declined by 17% y/y and increased 23% q/q in the third quarter. Year-to-date, speculative starts are 10% below 2019 levels while build-to-suit activity is up 24% over 2019. Constrained in aggregate, speculative development starts were highest in Dallas, Atlanta and Pennsylvania in Q3’20. A brisk pace of deliveries and falling starts caused the total pipeline of space under construction to contract by 6% y/y from a cyclical peak of 316 MSF in Q3’19. Yet, because the supply pipeline expanded in early 2020, deliveries should remain heightened through year-end: Prologis Research anticipates 295 MSF of deliveries in 2020. Looking further ahead, new supply is poised to slow in early 2021.

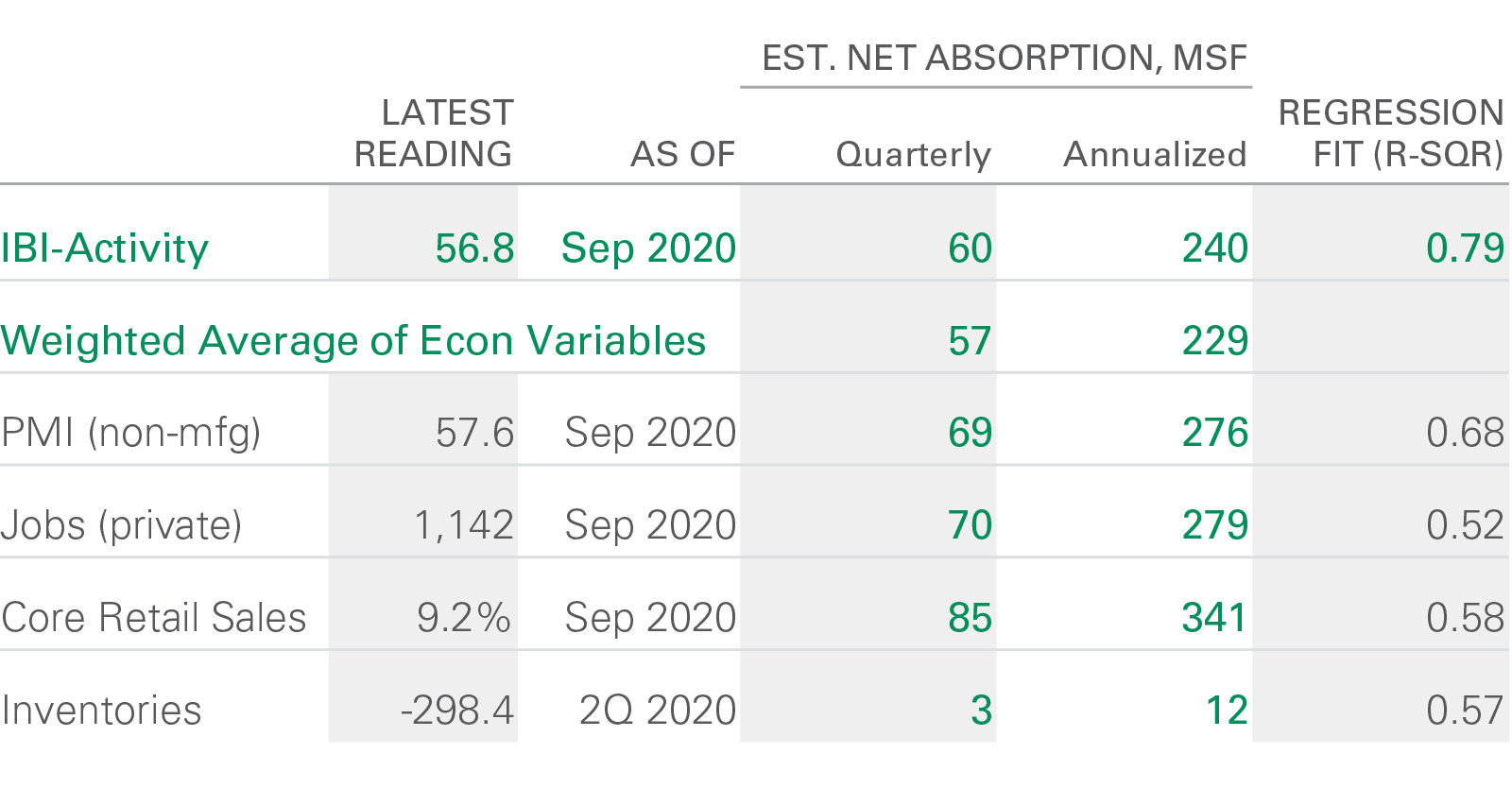

Exhibit 3

SUMMARY OF NET ABSORPTION INDICATORS

Note: Values are a 3-month trailing average, except Inventories.

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census Bureau of Labor Statistics, Prologis Research

Exhibit 4

MARKET FUNDAMENTALS, U.S.

MSF

Source: CBRE, JLL, Cushman & Wakefield, Colliers, CBRE-EA, Prologis Research

Quick Wrap

Rebounding activity and a falling supply pipeline could lead to a critical shortage of space in early 2021. Throughout the third quarter, customer activity levels were in line with growth in demand for logistics space. We point to three drivers: (1) uncertainty—while still high—is lower than it was during the early stages of the pandemic, which has boosted confidence around leasing; (2) macroeconomic data suggest that COVID-19 and consumption coexist; and (3) clarity around long-term supply chain reconfiguration needs, particularly elevated e-commerce volumes and the need for resilient supply chains and higher inventory levels, has both improved and increased urgency. As a result of robust demand and still-low vacancies, market rental growth reversed course and eradicated discounts put into place in the second quarter. The contraction in the development pipeline means that available options for customers looking to expand could narrow quickly, particularly in locations with high barriers to new supply. Perhaps, more than ever, planning well in advance for logistics needs could become a source of competitive advantage.

Endnotes

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 976 million square feet (91 million square meters) in 19 countries.

Prologis leases modern distribution facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.