Introduction

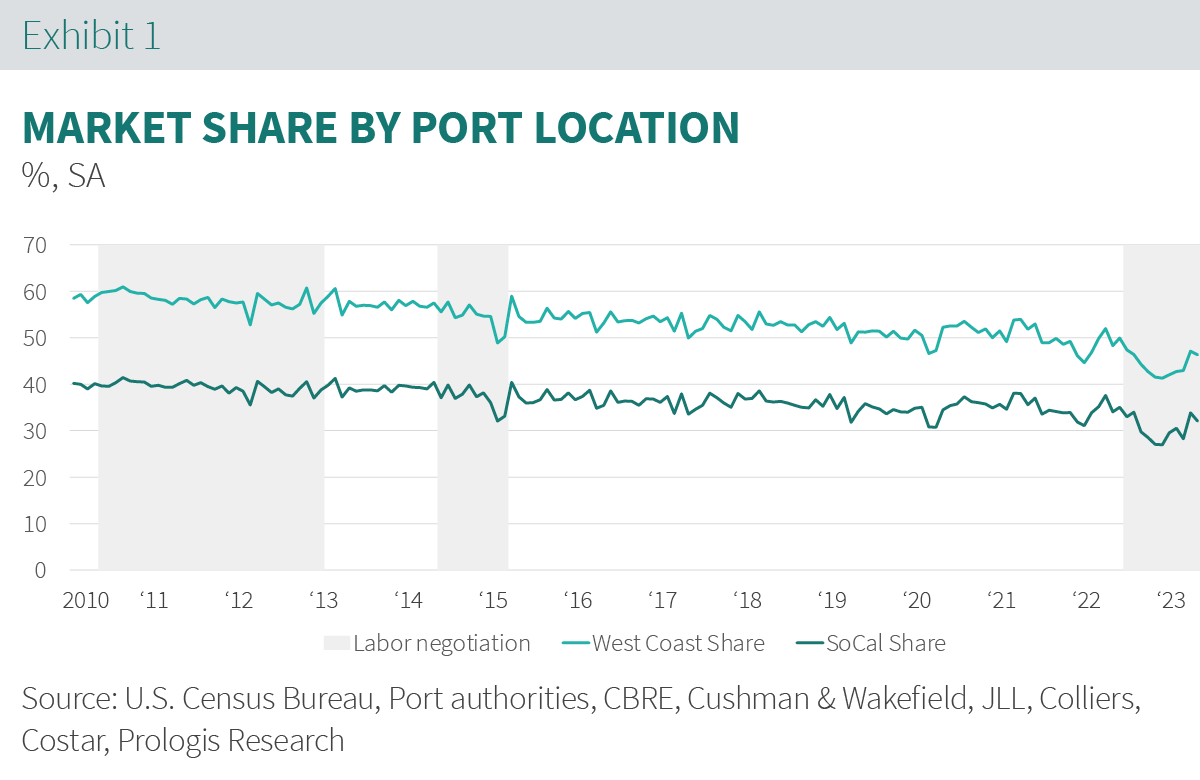

The Southern California ports of Los Angeles and Long Beach received 8 million loaded TEUs (twenty-foot equivalent unit shipping containers) over the last 12 months, down nearly 27% from the prior 12 months and 11% below the pre-COVID-19 pace. Southern California port activity has been adversely impacted by two factors: a decline in overall global activity and diversions to other U.S. ports. In turn, demand for logistics real estate has seen a downtick from prior years of unprecedented strength. But with the prospective recovery of global trade activity and seaborne cargo—alongside the soon-to-be ratified International Longshore & Warehouse Union (ILWU) contract—it’s time to look at the future impact of these factors on the markets of Southern California.

Key takeaways:

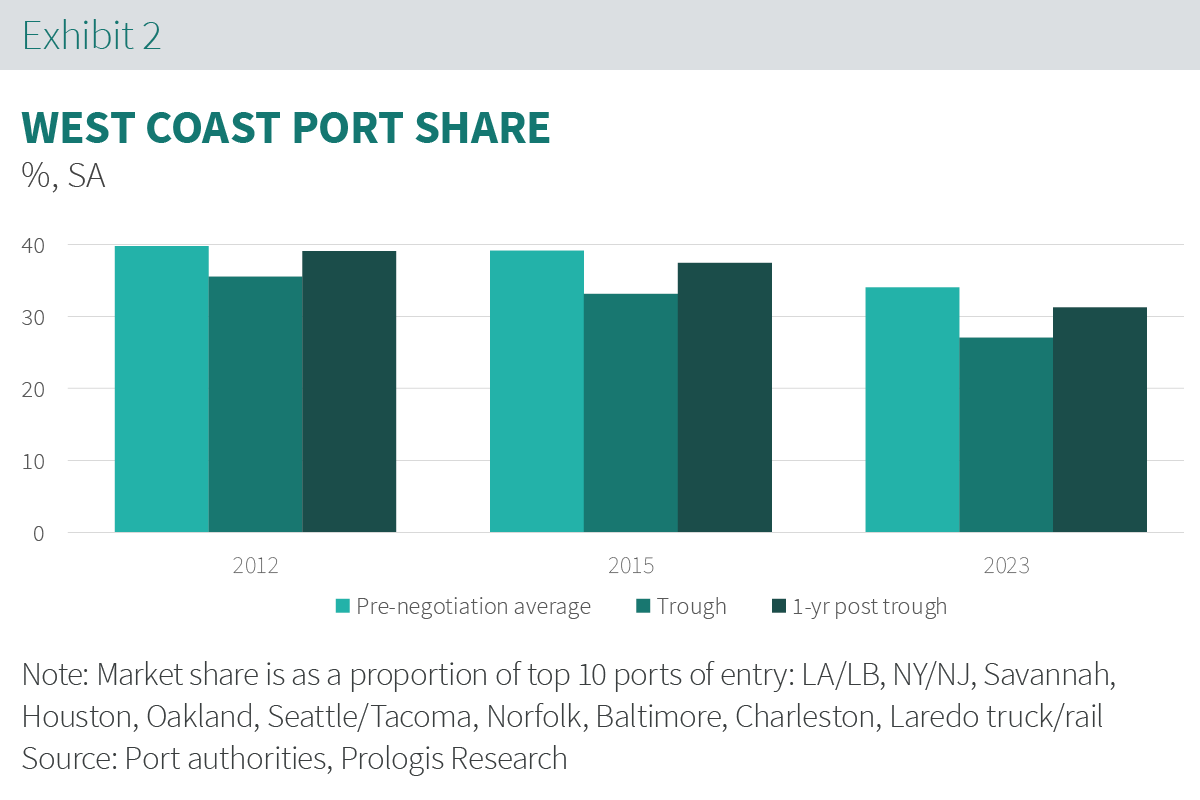

- Because of the ILWU contract resolution, the ports of Los Angeles and Long Beach (LA/LB) are poised to regain about half the market share lost in 2022/2023. Based on our analysis of global trade routes, population centers and temporary port share shifts, we project a stabilized market share to occur 6-12 months after contract ratification of approximately 33% of U.S. container imports will pass through the LA/LB port complex, up from a recent low of 27%.1

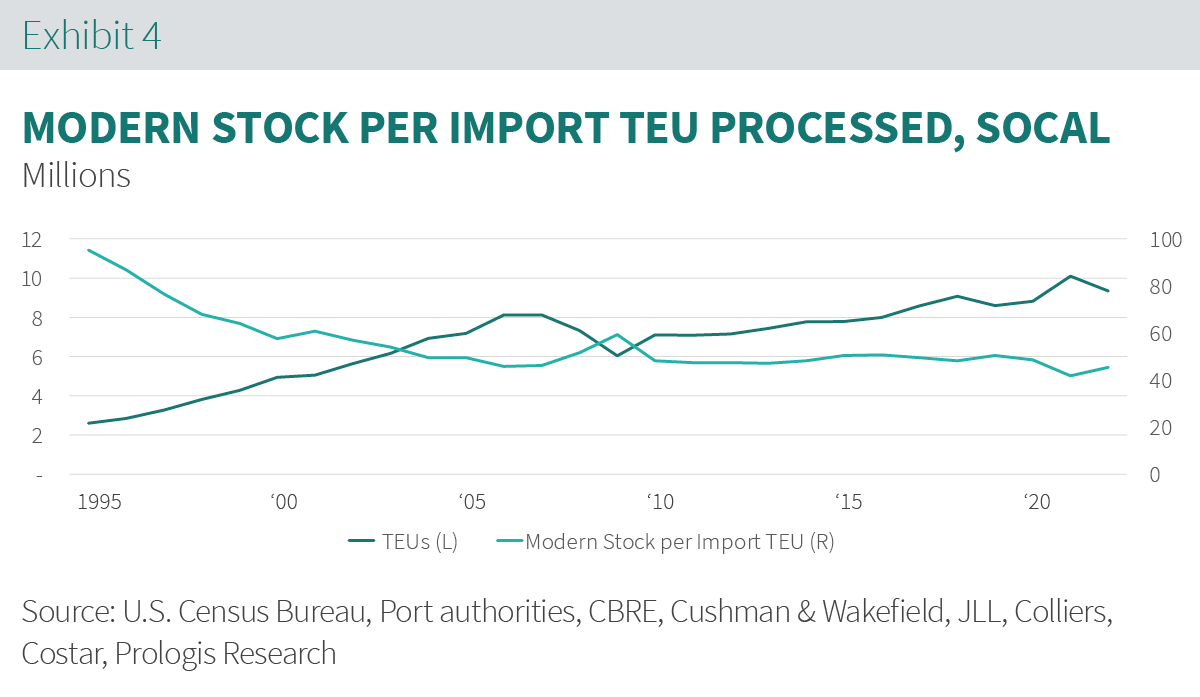

- Southern California demand is not contingent on short-term movement in port flows. Logistics space serves multiple supply chain functions in these markets—most importantly, making city life possible and handling the daily needs of the 24 million people who reside across Southern California. Southern California container import volumes reached new peaks while the amount of modern stock per container processed fell to a 15-year low. High and rising barriers to development mean logistics real estate supply will likely fall short of demand over the medium to long term, yielding rent growth and investment outperformance.2

The LA/LB ports are poised to regain half or more of the market share lost in 2022.

Recent shifts in the flow of goods through Southern California are a result of an unusual confluence of four major forces:

- Fear of disruption resulting from labor negotiations in Southern California. Approximately 40% of customers occupying logistics space in Southern California are in the transportation and logistics sector (compared to 30% in the rest of the U.S.), illustrating the role of trade in the logistics market. When the new contract for ILWU dockworkers is ratified, providing stability through the medium term, we expect Southern California’s share of U.S. maritime imports to stabilize at about 33% of U.S. imports from a trough of 27%.3

- Temporary bullwhip effect from pandemic-era shortages. Rapid changes in consumption patterns and the easing of supply chain disruptions left many retailers struggling to calibrate product mix and inventory levels with consumer needs.

- Lower expectations for growth. Economic uncertainty produced caution in future demand planning. Before past recessions, inventories tended to decline approximately 2% before retail sales began slowing.4

- Long-term structural shift toward resiliency. Network expansion along the East Coast diversifies supply chain entry points and positions goods closer to end consumers. Production shifts to Mexico will also add resilience to global operations, boosting import traffic through Texas.

Southern California logistics space serves multiple supply chain functions, and demand is not contingent on short-term movements in port flows.

Customers occupy logistics space in Southern California for three main purposes:

- Serving the consumption needs of Southern California’s 24 million residents. Consumers in this area spend $64,000 per household on average, 9% above the national average.5

- Distributing to the greater Southwest region. Within 500 miles of the LA/LB ports, there are 10 metro areas, which combined equal approximately 15% of U.S. consumption.6

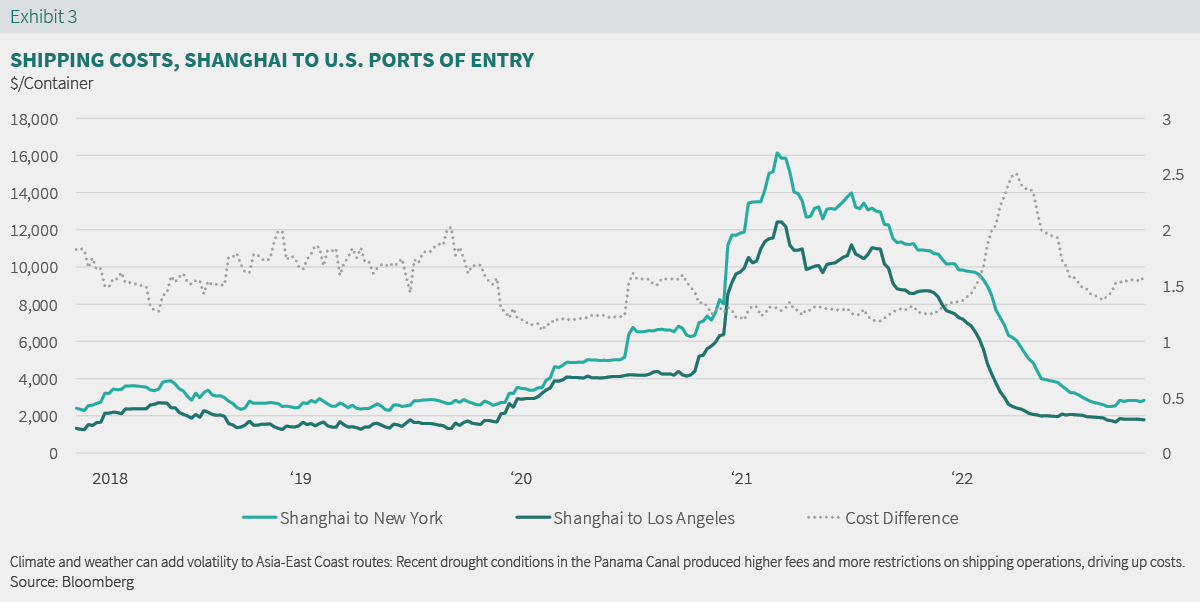

- Processing national import/export for U.S.-Asia trade efficiently. Shipping a container from China to LA/LB costs approximately 30% less and shortens the travel time by about 15 days, compared to shipping to the East Coast.7

Prologis Research modeled drivers of U.S. logistics real estate demand growth and found greatest significance with retail/wholesale inventory growth, retail sales growth and e-commerce penetration. Trade and industrial production had a limited and weakening relationship with near-term net absorption patterns over history. But positioning along global trade routes and sustained growth in TEU volumes is a major factor in the evolution of logistics clusters.

Southern California remains the largest and most concentrated logistics cluster in the world.

But supply has not kept up with growth in TEU processing volumes, showcased by a decline in the ratio of modern stock to TEUs over time.

Supply will not be able to keep pace with demand in Southern California.

The region’s substantial barriers to development create low supply elasticity, price shocks, pent-up demand and make existing properties more valuable. These barriers to supply have increased significantly over time as open land is developed and regulatory resistance increases. (See a map of enacted or proposed moratoriums.)

The Bottom Line

Demand for Southern California logistics real estate will outstrip supply over the medium to long term due to its multifunctional value to national, regional and local supply chains, laying the foundation for outperformance.