Inside the Global Supply Chain

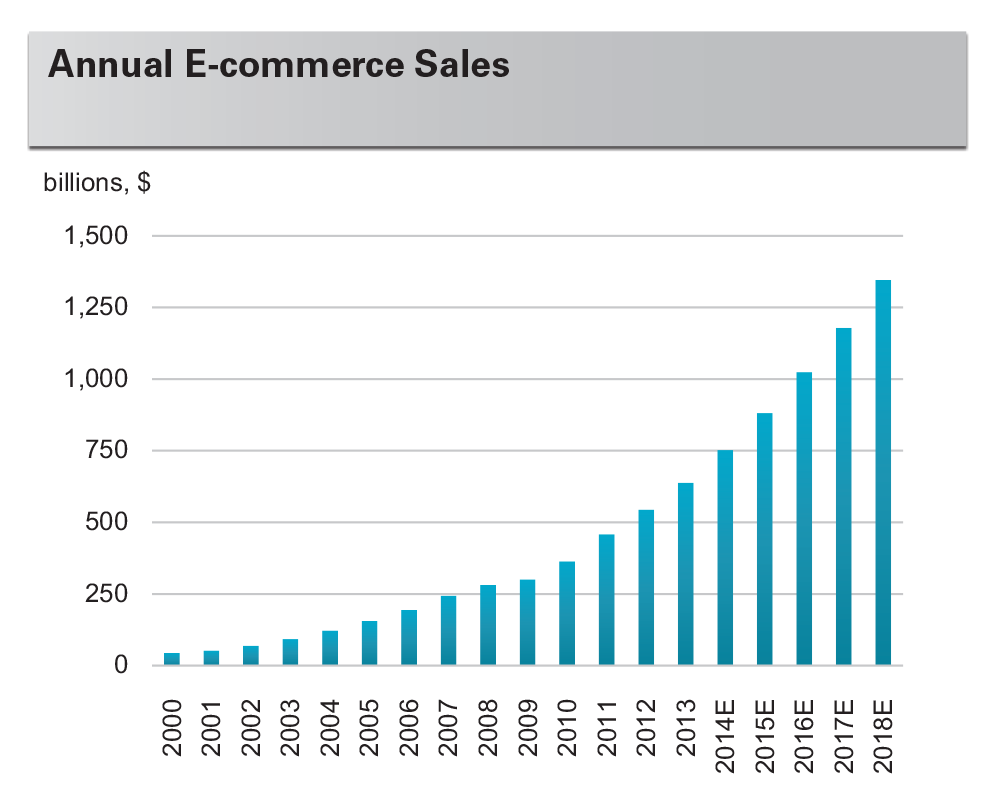

The global shift toward e-commerce is changing how the retail and logistics industries operate. This trend affects all aspects of the retail industry, including the strategic location of fulfillment centers and total real estate footprint. E-commerce sales are growing 20% annually and are expected to reach $750B globally this year. This growth is an important new driver of demand for logistics real estate as traditional distribution activities (to store) transition to fulfillment centers (direct to customer). As e-commerce retailers seek to drive profitability, to differentiate their offerings and to improve time to market, logistics facilities are increasingly viewed as revenue drivers.

Our analysis focuses on answering the key questions about how e-commerce is changing retailers’ needs for logistics real estate and how logistics facilities are adapting. We explore the evolution of supply chain organization, focusing on the arc of an individual customer’s logistics fulfillment footprint over time. We also examine overall retail industry growth, with an eye toward addressing the risk of cannibalization and implication for the long-term demand growth of logistics real estate. Finally, we consider what activities within the facility are unique to e-commerce and their implications for asset selection and obsolescence of existing distribution centers. While e-commerce fulfillment is in its infancy, we anticipate e-commerce will continue to create significant new demand for logistics real estate; proximity to consumers will be critical; and that facilities that meet today’s standards for ceiling height and coverage ratios can continue to attract e-commerce requirements.

INTRODUCTION

E-commerce has become a sizable tail wind for logistics real estate. Annual sales amount to $750B globally; retailers are successfully delivering on their omnichannel and mobile concepts.1 Consumer habits are changing and retailers recognize e-commerce as an established business. They are investing to compete, increasingly with a focus on their supply chain and logistics facilities.

Yet order fulfillment is still in its infancy. While e-commerce only represents 10% of all new leasing around the world, this percentage has doubled during the past three years. Consumer behavior is evolving faster than supply chains can adapt. As such, we see retailers and distributors experimenting with order fulfillment models. Such rapid growth and quickly changing requirements make for a difficult decision-making environment for those organizing supply chains.

Substantial growth remains ahead for e-commerce and logistics real estate. Forecasters, such as Goldman Sachs, anticipate that online sales will continue to rise at double-digit rates for the foreseeable future. Analysts, including McKinsey and Forrester Research, have estimated that the online share will rise to the mid-teens during the coming decade, up from less than 10% today. We see several themes emerging that will shape e-commerce and logistics real estate for the foreseeable future.

- Organization. As aggregate e-commerce demand comprises the constituent e-commerce companies, considering decision-making of individual customers provides a roadmap for the future. High industry growth suggests to us that distributors will increasingly favor facilities proximate to their end customers.

- Industry growth and cannibalization. High top-line industry growth is a positive, but we also observe that e-commerce customers use the space differently and more intensively; they need more space as traditional retail activities are consolidated into logistics facilities.

- Obsolescence. In our view, most e-commerce customers adapt to traditional logistics facilities, rather than require extensive specialized configurations and improvements. On the margin, we see a greater emphasis on high-quality space, including superior infill locations, higher ceiling heights and lower coverage ratios (in Europe and the U.S.)—collectively themes we also see among our non-e-commerce customers.

We review each of these themes in detail.

EVOLUTION OF SUPPLY CHAIN ORGANIZATION

The demand profile for logistics facilities is highly variable. On the surface, e-commerce demand for logistics facilities appears dominated by large build-to-suit requirements. In fact, demand is much more diverse. There is a broad range of e-commerce business models, varying in ways such as the size of the operation, product focus, product value and retailer model (e.g., pure e-tailing or omnichannel). These business dimensions affect the types and locations of the logistics facilities that are needed.

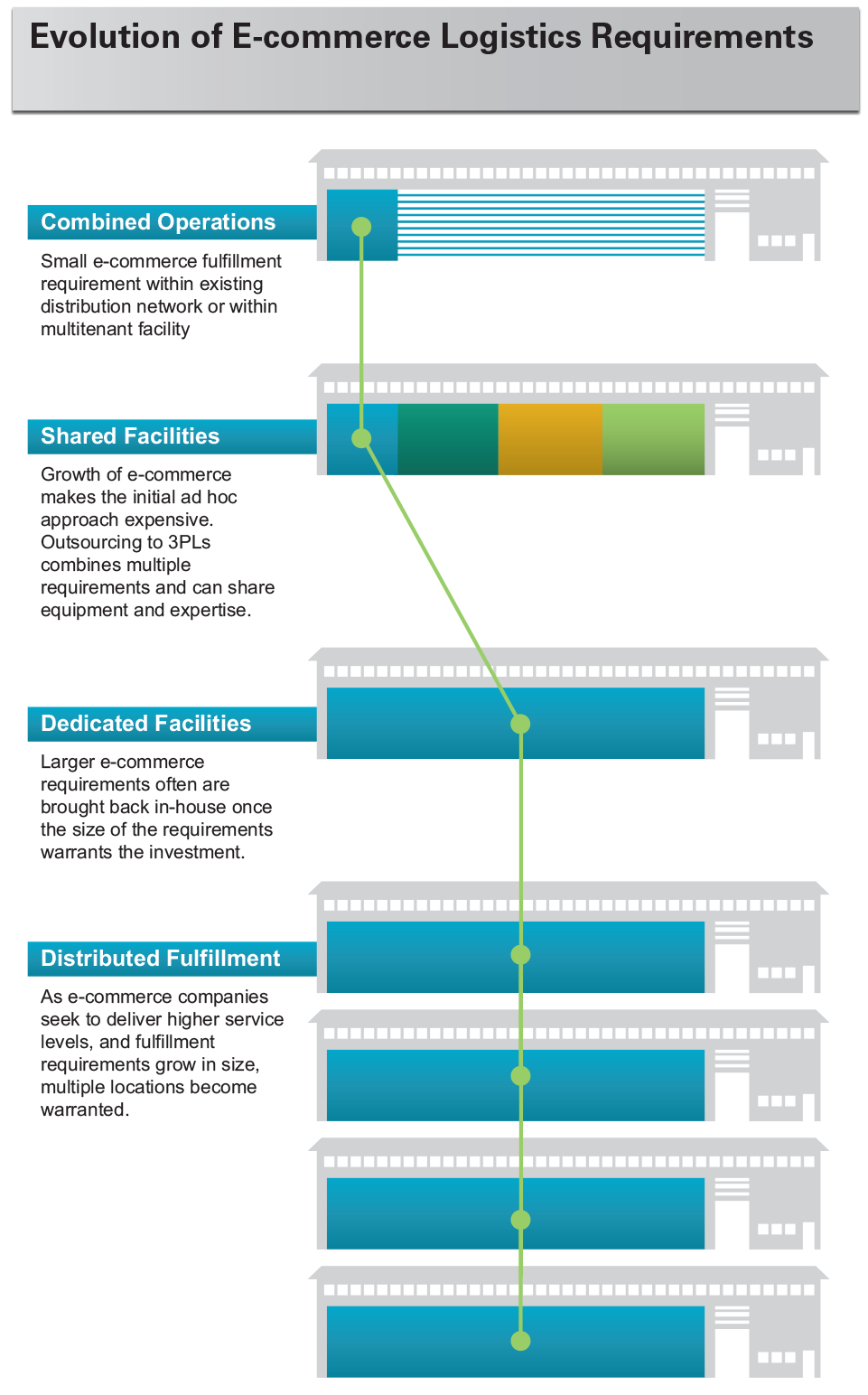

As individual customer requirements evolve, consistent patterns are emerging. We see a natural arc in the organization of e-commerce fulfillment within our own customer footprint. Requirements generally fall into one of four buckets, including:

- Combined operations. At the outset, e-commerce fulfillment is a modest operation. The size and growth of the concept is only in its early stages. The requirement can reside alongside in-store distribution within a single logistics facility, leveraging existing supply chain investments. However, combined operations are an ad hoc approach that typically does not scale well as the e-commerce fulfillment requirement expands. For pure-play online retailers, the early-stage requirement typically takes the form of leased space within multitenant facilities.

- Shared facilities. As demand grows, e-commerce fulfillment can become cumbersome and expensive within small and shared facilities. Growing the logistics real estate footprint is the next step, either on a direct basis (leasing a portion of a multitenant facility, for example) or via an outsourced model (with a third-party logistics provider). Many 3PLs bring existing physical infrastructure and have the specialized capabilities to grow the e-commerce fulfillment requirement.

- Dedicated facilities. Once the e-commerce requirement reaches scale, fulfillment may require one or multiple dedicated facilities. Initially, a single fulfillment center may suffice, often in centralized locations (which consolidate inventory). Retailers using this model recognize that online fulfillment and distribution to stores have distinct needs and challenges. This strategy is particularly relevant for midsize and larger retailers, who have the scale to separate stand-alone in-store distribution and online fulfillment.

- Distributed fulfillment. As the e-commerce concept grows, and fulfillment requirements increase, multiple facilities are needed. At this scale, retailers pursue a disseminated fulfillment strategy, using multiple facilities and locating closer to their customers, such as we see today with larger retailers. The benefits of this approach are faster delivery times, more responsive service and lower transportation costs.

How e-commerce customers use logistics space will shape future demand in two important ways:

E-commerce is global, but real estate is local. Consumer preferences are rapidly changing across the globe, requiring logistics facilities to locate closer to end-consumers as they demand faster delivery times. However, geographic barriers can be a limiting factor. In continental markets, including in the U.S. and Europe, logistics users must balance choosing centralized site locations that consolidate inventories with a distributed fulfillment model that reduces delivery times, but that requires a sizable investment in facilities and inventories given the breadth of these geographic regions. Larger retailers typically pursue a distributed model given their scale, which we expect to become increasingly commonplace as the industry grows. In contrast, countries including Japan (Tokyo), the U.K. (Midlands) and Brazil (São Paulo) allow for centralized fulfillment while delivering high service levels. E-commerce retailers in these regions are proximate to their customers and can ship to the broader area, often within one day.

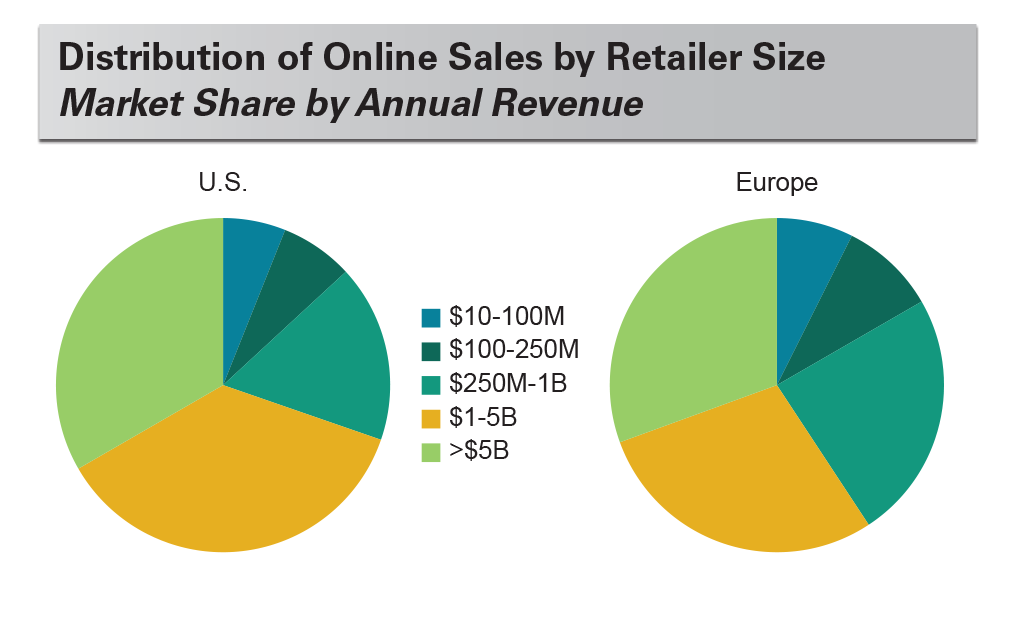

There are substantially more customers in the e-commerce space than is commonly understood. In the U.S. and Europe, 30 retailers accounted for half of all online sales in 2013, each with more than roughly $2B in annual online sales. These are national and international retailers that require multiple stand-alone e-commerce fulfillment centers and are an important demand driver for the logistics real estate industry. The second half of online sales is diffuse among smaller retailers. Many of these retailers use earlier stages of e-commerce organization, including combined operations; use shared facilities; or are beginning to grow into a supply chain with dedicated facilities.

These retailers will continue to propel the industry forward in several ways. First, “smaller” is a misnomer; they are significant businesses and require substantial logistics real estate footprints. There are approximately 600 companies across the U.S. and Europe with online revenues of $50M to $2.5B, data from Internet Retailer show. At this size, average daily sales are roughly $1M, with spikes during peak seasons that must be accommodated, creating sizable fulfillment requirements. In addition, as these retailers grow, they will achieve a scale that will allow for multiple dedicated facilities with greater proximity to their customers (with attendant higher service levels and shorter delivery times).

INDUSTRY GROWTH & THE RISK OF CANNIBALIZATION

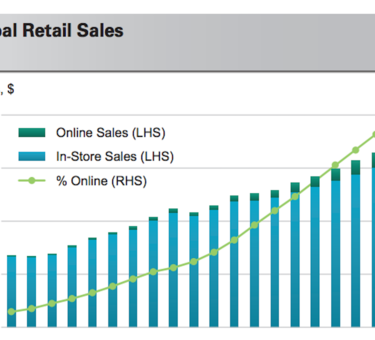

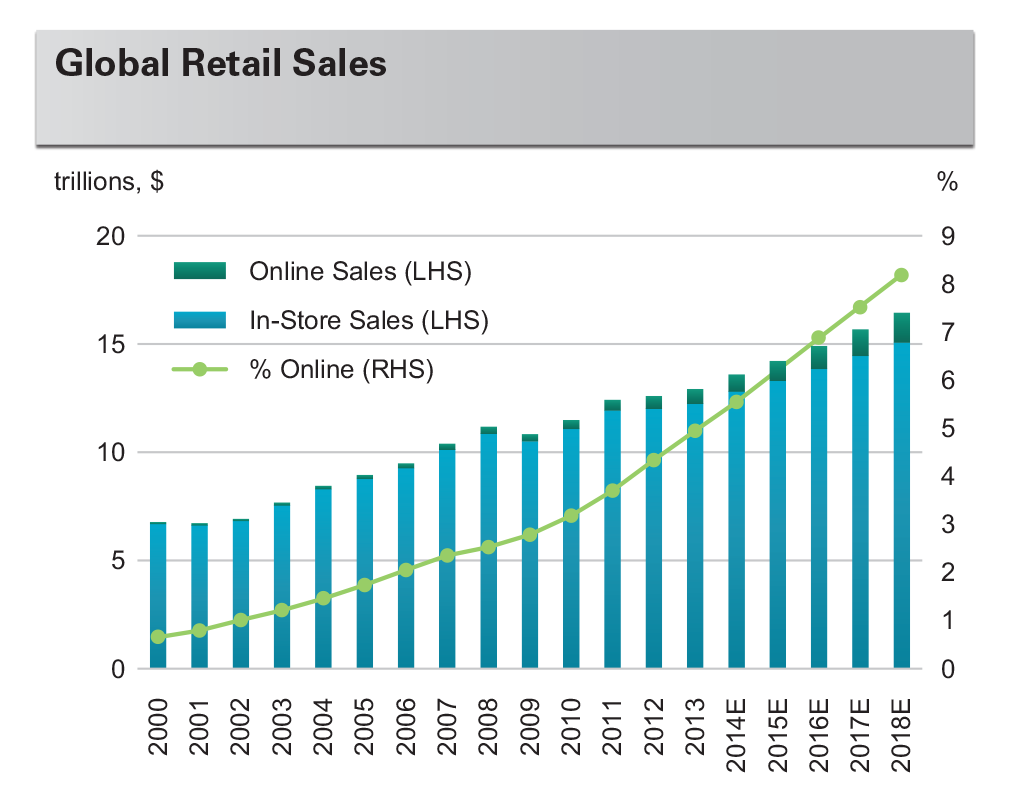

Traditional retail customers continue to grow despite the risk of cannibalization from e-commerce sales. In aggregate, retail sales grow 4% per year. The growth rate for e-commerce is significantly higher, nearly 20% per year, amid a share shift toward online consumption. However, this share shift is sufficiently gradual that traditional in-store retail sales also grow, rising 3-4% per year.1 And while the Global Retail Sales chart illustrates the global trend, this also holds true in the U.S. and Europe.

The utilization of e-commerce space is contributing to outsized growth for logistics real estate. While e-commerce is contributing to shrinking retail footprints for certain formats, we find it has increased the demand for logistics real estate. E-commerce retailers use logistics real estate in ways that require more space. Many activities that were typically carried out within stores are now consolidated into logistics facilities. As a consequence, e-commerce customers require more logistics space than traditional distribution activities. There are four main drivers.

- Product variety. Online retailers have significantly greater product variety (stock keeping units) on average, requiring a broader set of goods carried within logistics facilities.

- Inventory levels. As the point of sale shifts from in-store to the logistics facility, greater levels of buffer stocks must be carried within logistics facilities, requiring larger buildings.

- B2C shipping. Individual order picking, packing and shipping direct to consumers requires more space than store distribution. Instead of efficient palletizing for store distribution, B2C requires an individual box for each order.

- Reverse logistics. Many e-commerce logistics facilities accept returns, and floor space must be allocated to returns processing and restocking activities.

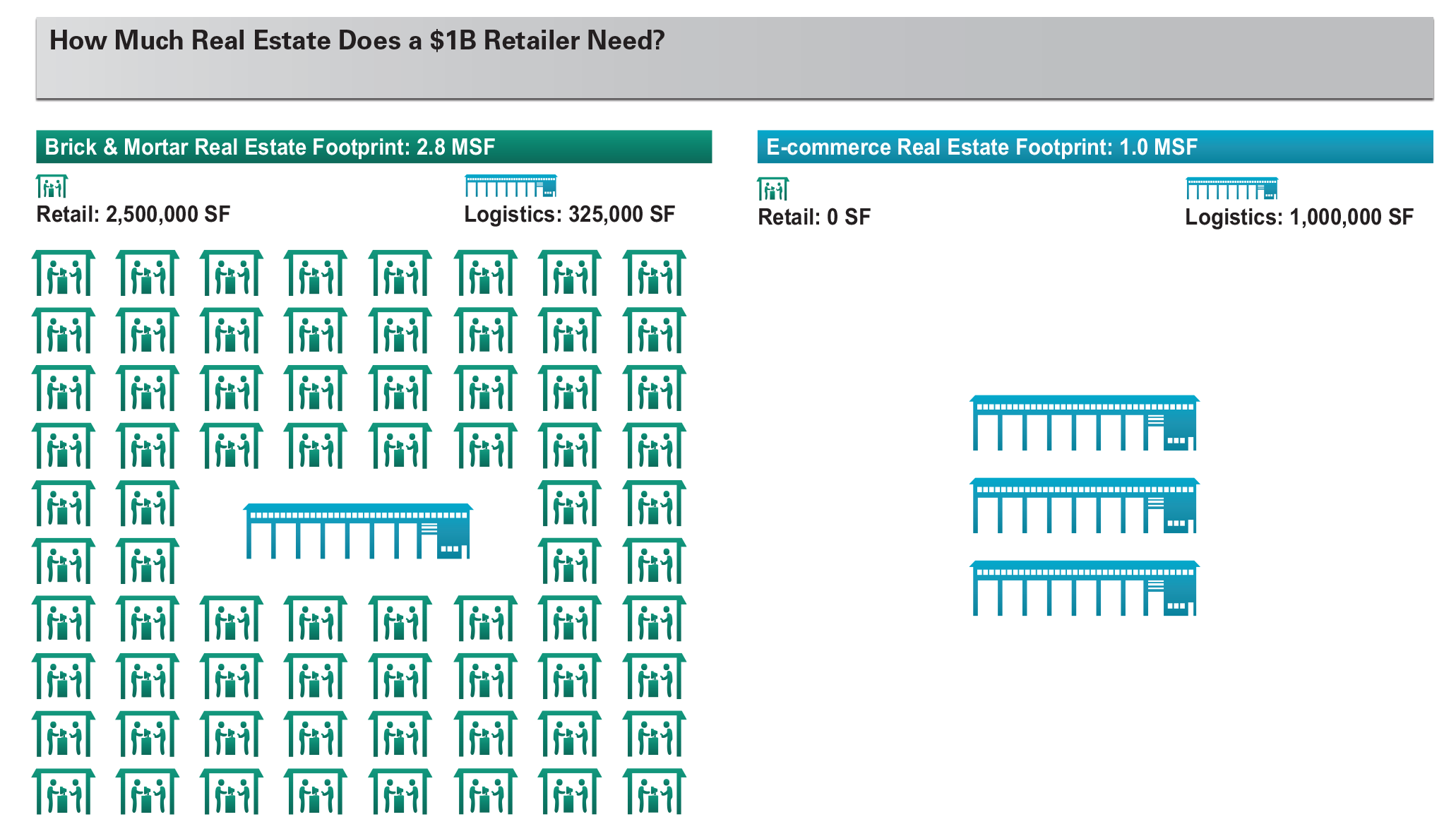

We quantified the difference. To study the impact of e-commerce on demand for real estate, we analyzed the total real estate footprint, both retail and logistics, of leading retailers. We compared pure e-commerce retailers with traditional brick-and-mortar retailers around the world.

E-commerce users require 3x the logistics space, or more, as compared with brick-and-mortar.2 The productivity of retail real estate is well understood; retailers generate an average of $400-450 of annual sales per square foot of retail, but with substantial variance around this mean. Using this assumption, a retailer with $1B of sales would need ~2.5 million square feet of retail space. Our research indicates that distribution centers for brick-and-mortar retailers each support about $2,500-3,500 of annual sales per square foot on average. This means that a retailer with $1B of in-store sales requires approximately 300,000-350,000 square feet of logistics space. By comparison, e-commerce requires more space. Our research reveals the logistics facilities used by e-commerce retailers each support about $1,000 of annual sales per square foot on average. Hence, the same $1B retailer would need approximately 1 million square feet of logistics space, or 3x the space as compared with the supply chain for a traditional brick-and-mortar retailer.

These different supply chains are depicted in the figure below. The shift from in-store to online creates a favorable mix shift in how retailers use real estate, substituting logistics space for retail storefronts; they may need less retail real estate in aggregate, but more logistics space—3x or more—amid the mix shift. A retailer’s decision to shift from in-store to online is driven by a customer service perspective, but significant real estate cost savings can be an incidental benefit. Logistics rents range between $3-10 per foot per year, while traditional retail rents can be $20-50, with high street retail much more expensive.

E-COMMERCE AND IMPLICATIONS FOR ASSET SELECTION AND OBSOLESCENCE

E-commerce is not significantly shifting the types of properties demanded within the industry. Despite strong growth, e-commerce remains a relatively modest share of total demand and cannot shift industry practices alone. While e-commerce represents more than 10% of new leasing, traditional customers are a significantly greater share, representing 80-90% of demand. Their requirements have not changed due to e-commerce. In addition, many e-commerce customers find existing facilities meet their needs. For example, over 40% of our e-commerce customers are within buildings 10 years old or older.

There continues to be a gradual evolution in the types of properties that will be most successful, and e-commerce customers are contributing to these changes. There have been many well-publicized build-to-suit announcements during the past few years. While it has been due mostly to the lack of large available facilities, large e-commerce tenants have sought build-to-suit projects for specific building features and site characteristics. Few of these needs require substantially different construction or layout changes. And many of these facilities have been designed to accommodate a generic second-generation use. At the same time, these customers demand what is considered a modern requirement today. To highlight these differences, we first review how the use of the facility is different; second, we focus on the key drivers of change.

- Location. Many factors are considered in location selection, such as access to labor and shipping nodes. As retailers increasingly pursue disseminated fulfillment models, proximity to their end-customers is becoming more important. The economics of proximity are enhanced as tax laws evolve toward treating online sales and in-store sales the same.

- Mezzanines. As e-commerce remains predominantly hand-picked on foot, shelf heights rarely rise above 6 feet. Consequently, modern e-commerce fulfillment—particularly larger requirements—leverages mezzanine floors to house these shelving installations. Smaller requirements do not typically have mezzanine floors, as they have neither the volume nor complexity to require an investment in mezzanine floors.

- Employees. E-commerce fulfillment requires a substantial amount of labor compared with traditional distribution. E-commerce facilities must therefore accommodate higher employee counts with employee-oriented spaces such as locker areas, break areas and restrooms.

- Power. E-commerce centers have additional equipment, such as more intensive HVAC for employees or automation equipment.

- Dock doors. Many e-commerce users only use dock doors on one side. These sites hold inventory and package goods for shipping, rather than for cross-docking distribution.

- Additional space. Security is higher at e-commerce facilities, which requires incremental space needs both inside the facility and around the site.

Among these different uses, three areas pose obsolescence considerations:

- Proximity. Due to service-level requirements (e.g., time to market) and the intensive use of labor, the strongest demand for e-commerce facilities has been within and adjacent to major population centers. Proximity to shipper distribution nodes has also been important, although the trend toward disseminated fulfillment centers creates a greater focus on population centers. This is particularly true in Asia, where same-day shipping is increasingly commonplace in markets like Tokyo and Shanghai.

- Ceiling height. The world’s largest e-commerce retailers install mezzanine flooring to support product picking, generally using the maximum vertical space available. New construction is following conventional maximum ceiling height by market, which is at least 30 feet in most markets, and 36 feet in a handful of markets. However, maximum ceiling heights are not a requirement for all of the e-commerce industry, including many small and midsize retailers as well as in Asia generally, where mezzanine floors are not commonplace.

- Site coverage. Higher employee counts, and the associated required parking, leads users to prefer sites with significant additional potential parking. This is most true in markets where employees commute by car, including in the U.S. and Europe. However, coverage ratios have already been declining for new construction unrelated to e-commerce to accommodate truck parking; often, some of this truck parking can be repurposed for employee parking. In Asia, there is greater emphasis on access to mass transit.

CONCLUSION

E-commerce fulfillment is in its infancy, but clear themes are emerging. Omnichannel concepts, which require products to be where customers want them when they want them, ask more of supply chains. E-commerce is a big positive for the logistics industry. It is lifting long-term demand growth as it consolidates traditional in-store activities into fulfillment centers. While there have been many high-profile dedicated build-to-suit facilities, they are designed with an eye toward second-generation uses. We see demand for new construction and existing facilities alike.

While the organization of fulfillment models has been fluid, the future is taking shape. Retailers will continue to proceed along the arc of e-commerce fulfillment requirements, initially growing within existing distribution networks, then leveraging multitenant facilities and 3PLs to scale and ultimately requiring dedicated facilities. As online retailers reach sufficient size and scale, fulfillment models will emphasize proximity to major population centers, allowing for faster delivery times, higher service levels and greater flexibility in the supply chain.

We find substantial differences around the world. Geographic differences are a driver. In regions of the world where distribution from a single market can cover the majority of customers, such as in Japan and the U.K., e-commerce models are more developed. In emerging markets, customer habits are migrating rapidly toward e-commerce, resulting in substantially higher growth rates. In China, growth was in the triple digits as recently as 2011 and is expected to be 35% this year, according to Goldman Sachs. In Brazil, growth of nearly 25% is expected in 2014. Supply chains are evolving rapidly in these markets to meet changing consumer preferences. In the U.S. and Europe, e-commerce growth is lower (10-20% annually), but online share is highest in these markets and the industry is already sizeable. Ongoing elevated growth will continue to allow more retailers to rollout distributed fulfillment strategies as the industry scales.

The answers to important questions will mature during the coming years as fulfillment models grow and become more refined. While there remains a degree of fluidity in the shape of future demand, it will likely have several hallmarks: (i) significantly more demand, particularly as demand within shared facilities grows into dedicated facilities; (ii) well-located properties with proximity to employees and customers; and (iii) facilities that meet today’s standards regarding ceiling height and parking availability.

- Goldman Sachs

- Our estimates are based upon figures from financial filings and interviews with those in the industry.

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be copied, photocopied, or duplicated in any form by any means or redistributed without the prior written consent of Prologis.

Prologis Research

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of March 31, 2014, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 574 million square feet (53.3 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,700 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

Copyright © 2014 Prologis, Inc. All rights reserved.