The Broad View

- Strong retail sales were key to lifting the IBITM Activity Index across our 29 U.S. markets. The index rose to 67 in Q4 2021 across regions and industries. A number above 50 indicates growth.

- Extreme competition for logistics space pushed rents higher than ever. Rents grew by 6.5 percent quarter-over-quarter and 20.4 percent annually.i [Prologis Research will delve deeper into rents in its upcoming annual Logistics Rent Index].

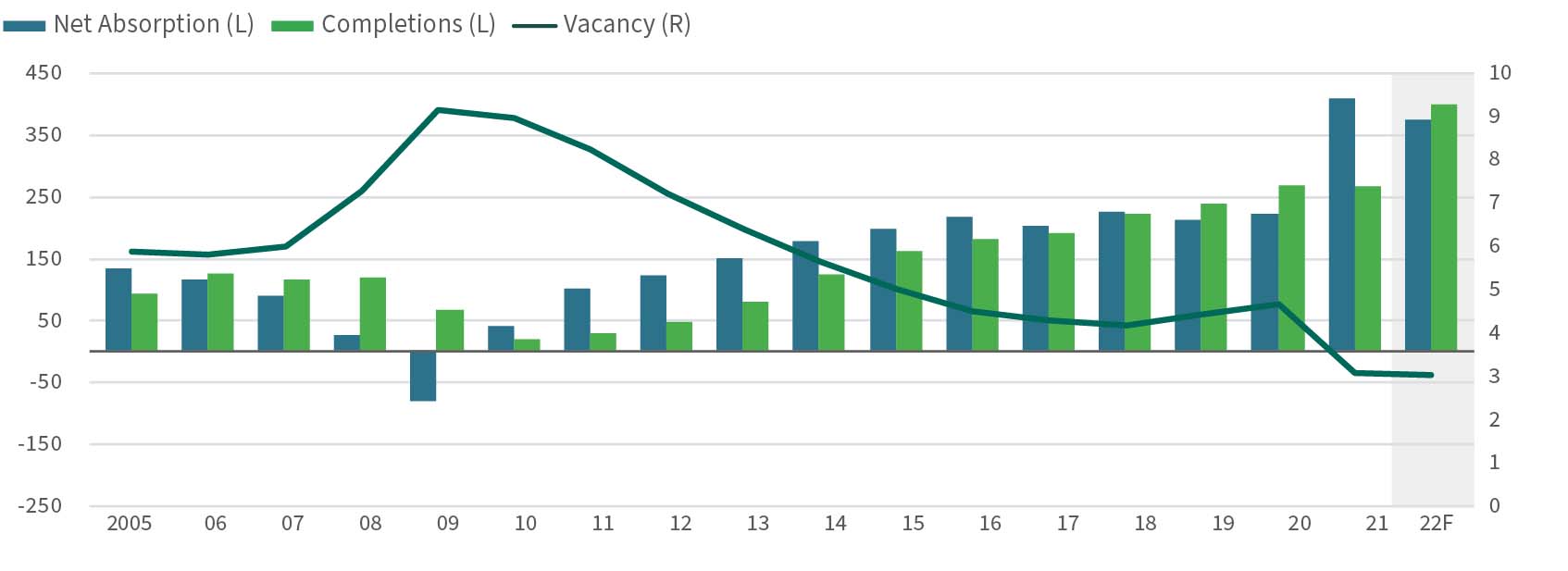

- Robust consumer spending coupled with supply chain disruptions drove intense demand. Logistics customers absorbed some 120 million square feet (MSF) of logistics space in Q4. For the year, they snapped up a record-setting 410 MSF, up 85 percent compared to 2020.ii iii

- Available logistics space doesn’t meet demand. Even with 270 MSF of new supply, vacancies fell 160 basis points in 2021 to an all-time low of 3.4 percent.

Source: Prologis Research.

Source: Prologis Research.

- Low supply will continue to drive competition for space. Of the 390 MSF of construction now in the pipeline, most will be spoken for upon delivery given current pre-leasing volumes. Some 70 percent of new supply is pre-leased.iv

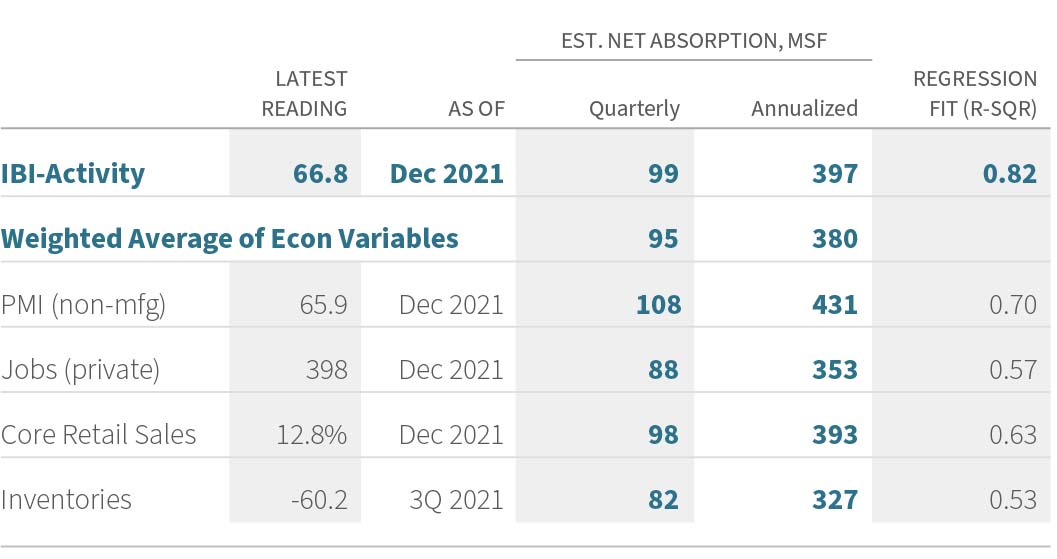

- Increased consumption lifted warehouse demand. Despite backlogs, supply chains remained active through the holidays. The Q4 IBITM activity index was 66.8, up 120 basis points quarter-over-quarter. This level of activity is estimated to create approximately 400 MSF of demand for logistics space over the coming year. During the holidays, e-commerce sales – which require three times the logistics real estate of traditional brick-and-mortar stores - rose 11 percent year-over-year vs 8.1 percent in-store.v

- Space utilization points to ongoing logjams in the supply chain. The utilization rate edged up into the mid-85 percent range in November and December. While utilization is below its historic high of 87 percent, the inventory-to-sales ratio is more than 10 percent below pre-pandemic levels and there is no “shadow space” to absorb inventory right-sizing. Prologis believes supply chains will have to expand by 15 percent or more to accommodate normal inventory levels and foster resilience against future disruptions.

- Vacancies will remain at historic lows through 2022. Prologis Research forecasts net absorption of 375 MSF and completions of 400 MSF, which will keep vacancy at its historic low. U.S. market rents should increase by another 10 percent in our base case. We expect that supply chain disruptions will persist into 2023, which could amplify competition for even fewer vacant space. As we’ve noted before, logistics customers who move quickly to secure prime space in this tight market will reap the competitive advantage.

Exhibit 3

SUMMARY OF NET ABSORPTION INDICATORS

Note: Values are a 3-month trailing average, except inventories. Stock, absorption, completions, under construction and vacancy fundamentals now represent a narrowed 30 markets to reflect where Prologis has a presence.

Source: Institute of Supply Chain Management, Bureau of Economic Analysis, U.S. Census, Bureau of Labor Statistics, Prologis Research.

Exhibit 4

MARKET FUNDAMENTALS, U.S.

MSF

Source: CBRE, JLL, Cushman & Wakefield, Colliers, CBRE-EA, Prologis Research.

Source: CBRE, JLL, Cushman & Wakefield, Colliers, CBRE-EA, Prologis Research

Endnotes

ii CBRE, JLL, Cushman & Wakefield, Colliers, CoStar, CBRE-EA, Prologis Research.

iii Our historical and forecasted stock, net absorption, completions, under construction, and vacancy fundamentals now represent a narrowed 30 markets to reflect where Prologis has a presence.

iv JLL

v Mastercard SpendingPulseTM

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As ofDecember 31, 2021, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.0 billion square feet (93 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,800 customers principally across two major categories: business-to-business and retail/online fulfillment.