Prologis’ Latest IBI and Why it’s Important

The Broad View

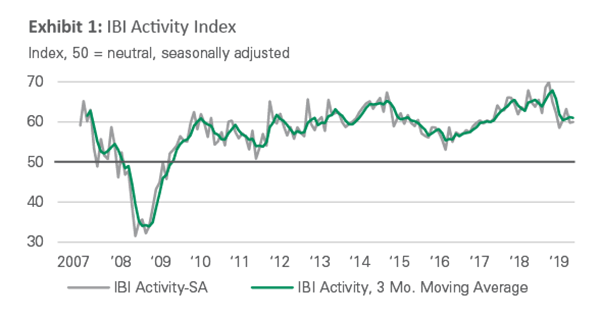

- Prologis’ proprietary Industrial Business IndicatorTM (IBI), a quarterly survey of customer sentiment, came in at about 60 in the second quarter of 2019—a healthy and sustainable level after 2018’s exceptionally strong (yet ultimately unsustainable) activity (see Exhibit 1).

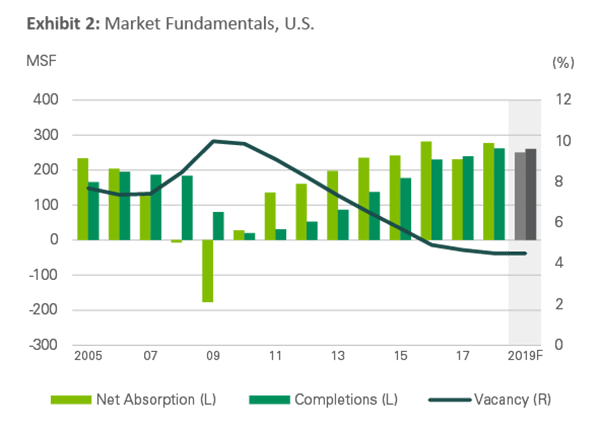

- The U.S. logistics real estate market is poised for a broader array of outcomes that correspond to barriers to new supply. The length of the expansion—10 years and counting—has been a boon to developers, who have used that time to bring new supply online in markets with lower barriers to entry. Even so, supply is behind demand in aggregate, with vacancies holding at 4.5 percent.1

- Prologis Research forecasts 250 million square feet of net absorption and 260 million square feet of new supply in 2019—which in turn should keep vacancies at or near their historic lows (see Exhibit 2).

- Any disconnects between demand and supply should continue to be concentrated in submarkets with high big-box activity, making market conditions challenging for customers looking to expand in all other areas.

The Details

U.S. logistics real estate demand is built on consumption.

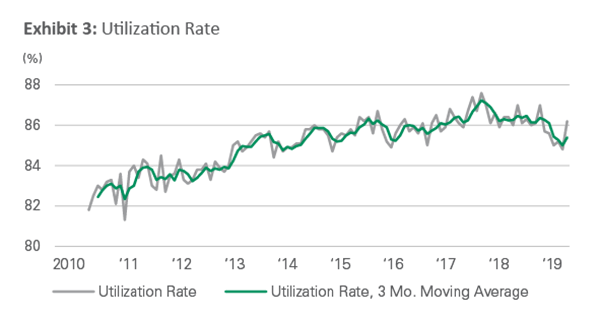

Yet, shifts in the flow of imports, which form the basis of consumption, can affect the timing of demand. Looking back, volatile trade policies pulled forward some demand into 2018, causing the IBI activity index and utilization rate to surge. In the first half of 2019, the data suggest a return to normal demand growth, with the IBI activity index at around 60 and the utilization rate steadying in the 85 to 86 percent range (see Exhibit 3).

Some large logistics real estate users have recently announced significant investments in their distribution networks; this is consistent with structural trends that have been bolstering demand through the expansion. The primary driver behind these mission-critical buildouts is the need to meet higher service level expectations with a decentralized distribution network.

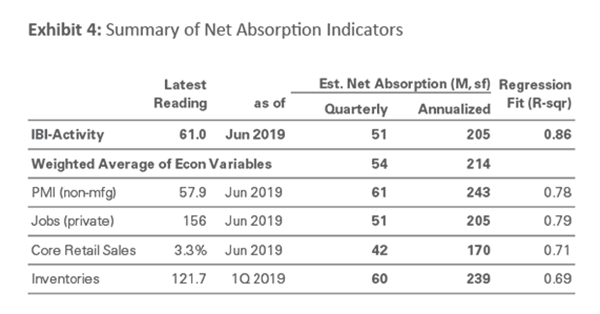

Current economic readings point to a demand run rate of 200 to 250 million square feet (see Exhibit 4). A continued boost from structural trends underlies the Prologis Research forecast for demand at the high end of this range, with 250 million square feet of net absorption expected for full-year 2019.

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau

of Labor Statistics, Prologis Research

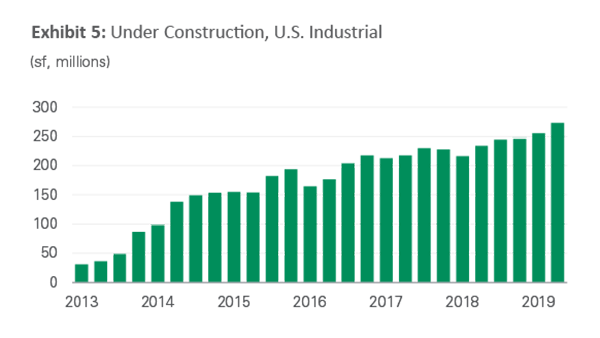

In this cycle, supply trends have evolved from chronic undersupply post-GFC to majority built-to-suit and pre-leased big box to a few isolated pockets of oversupply. Strong demand for both high throughput and localized distribution coupled with the slow ramp-up in new supply explains why the market remains undersupplied in aggregate, even as the pipeline of space under construction reached a new cyclical peak of more than 270 million square feet (see Exhibit 5).2

Across the U.S., rising barriers to logistics real estate supply include a lack of land suitable for today’s modern product; intensified scrutiny from communities (resulting in higher fees and longer entitlement timelines); and consolidation of the industry into institutional hands, which tend to have a more conservative approach to risk.3 These barriers vary substantially from market to market.

The result of these forces? More than half of the total amount of space under construction is concentrated in six markets: Pennsylvania, Atlanta, Chicago, California’s Inland Empire, Dallas and Houston.4 Even within these markets, new supply is focused on big-box product in outlying submarkets. Beyond these locales, new supply remains at or behind demand. Prologis Research anticipates completions of 260 million square feet in 2019, with the 10 million-square-foot disconnect with demand isolated to the aforementioned submarkets.

Quick Wrap

A combination of broad-based demand and concentrated supply has widened the range of rent growth outcomes by market.

U.S. market rents are poised to grow by roughly 6% in 2019, after increasing by 8% in 2018 and by more than 9% in 2017.5 With rents at new peaks after several consecutive years of rapid rent growth, customers with expiring leases continue to face sticker shock across most markets. Yet, the pace of growth is slowing in locations with a high level of spec, as the list of available options has expanded. In markets with little new supply, potential users continue to bid up rents to secure the best space. With the vacancy rate set to remain near its historic low of 4.5%, logistics customers will be wise to plan for their needs as far in advance as possible even as expansion is becoming somewhat easier in a few select locations.

Endnotes

- CBRE, Cushman & Wakefield, Jones Lang Lasalle, Colliers, CBRE-EA, Prologis Research

- CBRE, Cushman & Wakefield, Jones Lang Lasalle, Colliers, CBRE-EA, Prologis Research

- Prologis Research, Five Trends Shaping Real Estate Development

- CBRE, Cushman & Wakefield, Jones Lang Lasalle, Colliers, CBRE-EA, Prologis Research

- Prologis Research

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 786 million square feet (72 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers across two major categories: business-to-business and retail/online fulfillment.