A New Supply Paradigm

Prologis Research details the trends affecting commercial real estate development in the U.S.

Development activity is rising, but more slowly than during past cycles. Building on an improved macroeconomic climate, the recovery of occupancies and rents has invited development across all sectors, not just industrial. Yet, this cyclical upturn obscures important structural shifts. These shifts revolve around the mindset of greater discipline. Prologis Research notes several important drivers for these shifts, including the following:

- Consolidation and institutionalization: Emerging development trends, which are moving toward larger-scale institutions as key players

- A greater degree of risk aversion: Changing attitudes toward risk by institutions—both on the equity side and the debt side—which translates into a measured appetite for risk

- New lending constraints: Changes in the banking industry, including expanded regulations and a preference for relationship lending and institutional borrowers

- Tighter talent pool: A shortage of real estate professionals with neither relevant nor extensive development experience or the willingness or ability to invest significant equity

- Better information: Greater transparency and accessible information about markets and development projects, which makes it possible to approach opportunities and risks proactively and in real time

This evolution has brought more discipline to the industry. Eventually, supply and demand will return to equilibrium, even as some markets experience periods of excess supply. Overall, the industry is more responsive to risk, and watchful for signs of excess. We believe these factors represent a new normal, and that collectively these themes will shape the current and future real estate development cycles.

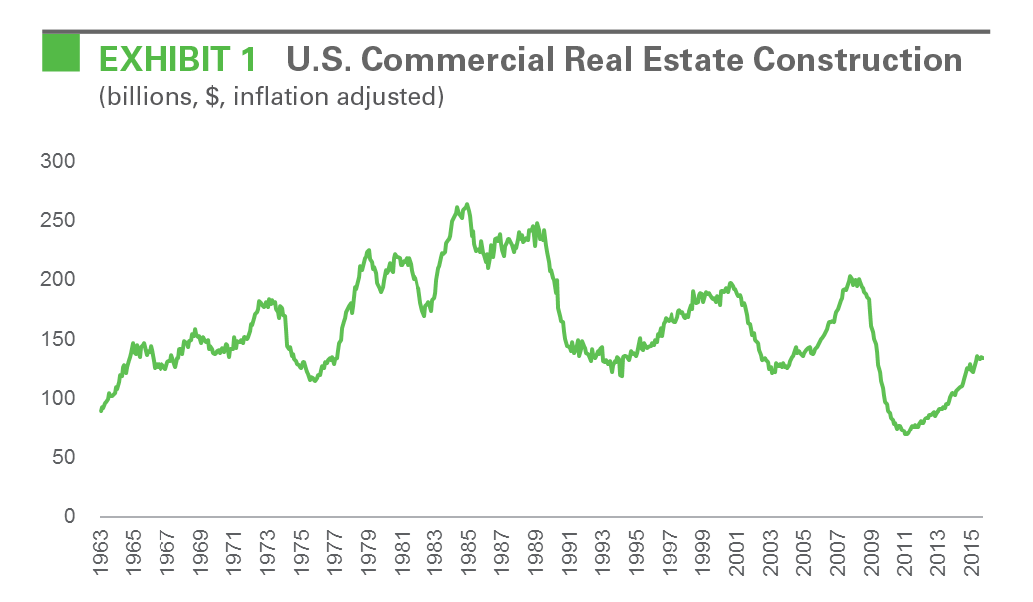

Examining the ongoing stability of the U.S. expansion. Nearly three years ago, Prologis Research identified an expansion was taking hold in the U.S. logistics real estate markets. Shortly thereafter, Prologis Research noted the potential for a sizeable rent expansion, which has largely played out. In a recent study, Prologis Research also noted that obsolescence drives demand for new development. Yet, one of the unique fixtures of the current cycle has been the moderate pace of recovery of supply. Looking back, development starts fell to their lowest point in 50 years, triggered by the Global Financial Crisis and the ensuing recession. Even as fundamentals have firmed, rising replacement costs offset recovering market rents and historically low cap rates. Digging into the details, crosscurrents have masked important structural changes, which are critical to understand development’s slow recovery and are the focus of our paper.

The supply cycle this time around feels different. Banks are generally more cautious given the experience of the last round of overbuilding. They face increased levels of regulation and have a greater focus on larger, more institutional developers.”

- Jeff Horowitz

Global Head of Real Estate, Gaming & Lodging Investment Banking Bank of America Merrill Lynch

Development in the U.S. has become increasingly institutionalized. Real estate is not unlike other industries that have consolidated over time. While real estate historically has been an entrepreneurial business, underlying drivers have shifted in the past decade—indelible marks from the Global Financial Crisis are part of this story—toward consolidation. We have witnessed consolidation and the rise of major real estate companies in the short history of the modern REIT era. We also have noted changes on the ground— for example, industrial development in Chicago. At the peak of the last cycle, many entities were in the process of developing facilities. Today, that figure has been cut in half, with far fewer developers active in the market, according to data from CoStar. Of the developers that are currently active or have recently delivered buildings, the vast majority have a national presence, with a significant number of international players as well. Furthermore, in square footage terms, the top 10 developers comprise a larger share of total deliveries in recent years than during the expansion phase of the last cycle, according to data from CoStar and CBRE. Other markets are experiencing similar trends.

Changes in the marketplace are driven by cyclical and structural trends. Structural changes take time to filter through industries and institutions, suggesting that these trends will continue to shape the development market. These drivers include:

- Bank industry consolidation and restrictive lending practices

- Expanded banking regulations

- Fewer professionals with real estate development expertise

- Transparent and easily accessible data to inform development decisions

Bank industry consolidation and greater aversion to risk have made it harder for entrepreneurs to secure capital. Banks traditionally have been the main source of capital for development. Because of this, changes in the banking industry will ripple through the real estate sphere. In addition to increased regulation, described below, notable themes include:

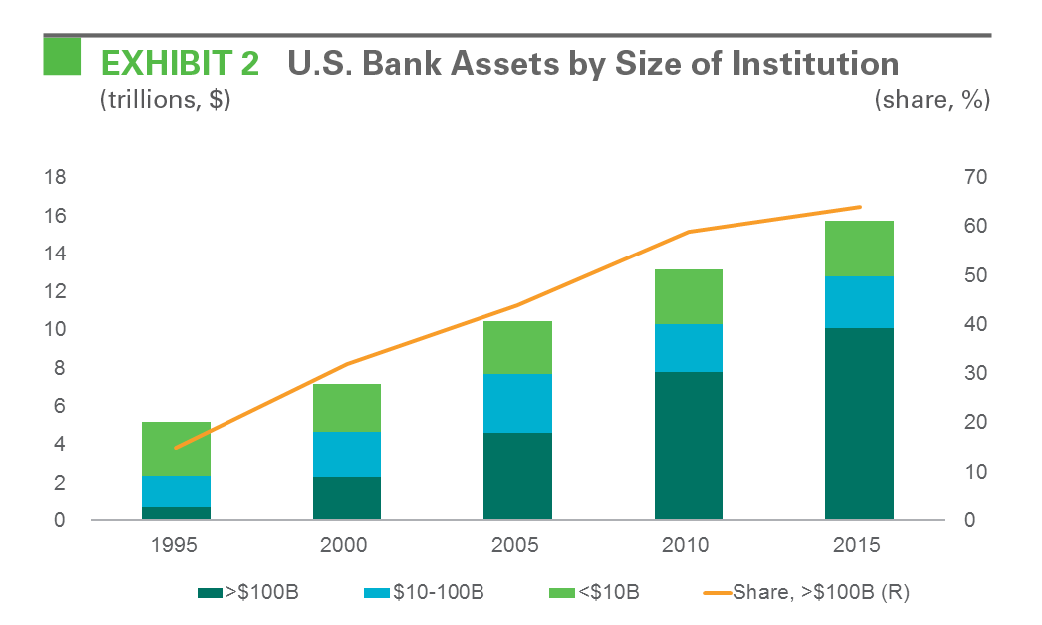

- Consolidation. The top four banks account for more than 40% of all deposits, up from about 10% two decades ago. Banks with assets of more than $100 billion hold 64% of industry assets in 2015, up from 15% two decades ago, according to data from the FDIC.

- Customer selection. As banks scale, they have focused increasingly on relationship lending and customer selection, favoring large and disciplined real estate enterprises.

- Global Financial Crisis. Considerable losses incurred during the recession have led to changes in risk tolerance and the types of loans banks will make.

These themes have driven an institutionalization of development. Many large real estate enterprises borrow on lines of credit, producing increased cost savings and flexibility. In contrast, entrepreneurs price their developments individually by project.

Bank regulations surrounding construction lending have expanded. Basel III and HVCRE (high volatility commercial real estate) rules adjust risk weightings for construction loans. With the HVCRE designation, loans that do not meet certain criteria receive a 150% risk weighting. Because the regulations are new, some fluidity exists in the cost adjustment for HVCRE loans, although this adjustment appears to add approximately 100 basis points to interest rate cost. The most notable HVCRE criteria are a 15% cash equity requirement (borrowers can no longer use the appreciated value of their land) and a reduced ability to release cash flow from projects during the life of the loan. Furthermore, regulators continue to clarify the regulations, bringing uncertainty to the bank finance market. Borrowers now face higher pricing, greater equity commitments and diminished cash flow flexibility.

“Regulations force most banks to hold about three times as much top-quality capital as is required under existing rules… the risk weighting for commercial real estate exposures increase -- particularly for those deemed to be more volatile -- HVCRE. Conversely, multifamily loans are eligible for a reduced risk weight of 50% one year”

- – Real Estate Roundtable

The full effect of these new regulations will take time to manifest. Although the nation’s largest banks have already adopted these regulations, smaller banks are still early in the process. And, while smaller banks have seen a decline in their market share, they can be important lenders to entrepreneurial developers. New bank regulations and HVCRE may further change their landscape. The net effect is delayed access to capital and a more pronounced increase in the cost of capital for smaller real estate developers, who face the following conditions:

- Much higher equity requirements driven by market practice and the rollout of new regulations.

- Increased debt cost tied to higher spreads that follow from new risk weightings for HVCRE loans. The prospective rise in short-term rates will likely further increase pricing.

Recent and multi-decade trends in banking will shape this cycle and those to come. The Global Financial Crisis and losses incurred on construction loans will continue to cast a long shadow. At the largest banks, attitudes toward risk have prompted a shift toward relationship lending and stricter limits for construction loans. Increased regulation has affected all banks. The goal of these regulations is to manage and properly price risk in the system, which in turn increases costs, raises equity requirements and reduces cash flow flexibility.

The shift in the financing markets coincides with and reinforces two other trends driving the institutionalization of development. These trends are (1) fewer professionals with development expertise and (2) more readily accessible information for potential developers.

Shortage of professionals: Rampant development in the 1980s was hit hard by the downturn of the early 1990s, which in turn led to a dearth of construction activity. Real estate development never returned to 1980s-level volume in subsequent periods of expansion. This lack of opportunities culminated in the post-Global Financial Crisis development drought, a time when construction activity plummeted to an historic low. Given the lack of activity, developers were forced to find different jobs within real estate, such as asset or portfolio management, or they simply left the business. This shortage of talent is a critical factor—substantial investments in time and money will be needed to train the next wave of developers. The lack of capital—debt or equity—to fund new projects likely makes this deficit a long-term challenge.

“Past downturns, along with the difficulty of being independent as the sector institutionalizes, have contributed to a reduction in real estate development talent. Companies need to focus on growing talent, and I believe large real estate institutions have many advantages, such as a greater ability to give executives opportunities to move within functional disciplines.”

- Deb Barbanel

Global Head of Real Estate, Russell Reynolds Associates

Readily available data. The past two decades have seen a considerable rise in the quality and quantity of information available to the real estate industry. Investment committees have better access to local comparables, and to information on macro and micro trends. This data reflects historical trends that can extend back to the 1980s, allowing for a more informed analysis. Today, institutions can more carefully measure their risk exposure in order to make sound decisions.

CONCLUSION

Supply is shaping up to be different in the current cycle. Several long-term factors—vigilance among developers and lenders, expanded bank regulations and a shortage of talent—have changed the landscape. Institutions now play a greater role in real estate development. Collectively, the hallmark appears to be discipline. This discipline should make the industry more responsive to cumulative risk at any point in time, and to downturns in demand.

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in industrial real estate. As of September 30, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 671 million square feet (62 million square meters) in 21 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party logistics providers, transportation companies, retailers and manufacturers.

Copyright © 2015 Prologis, Inc. All rights reserved.