Source: Prologis Research.

Q1 IBI Activity Index Deeper Dive:

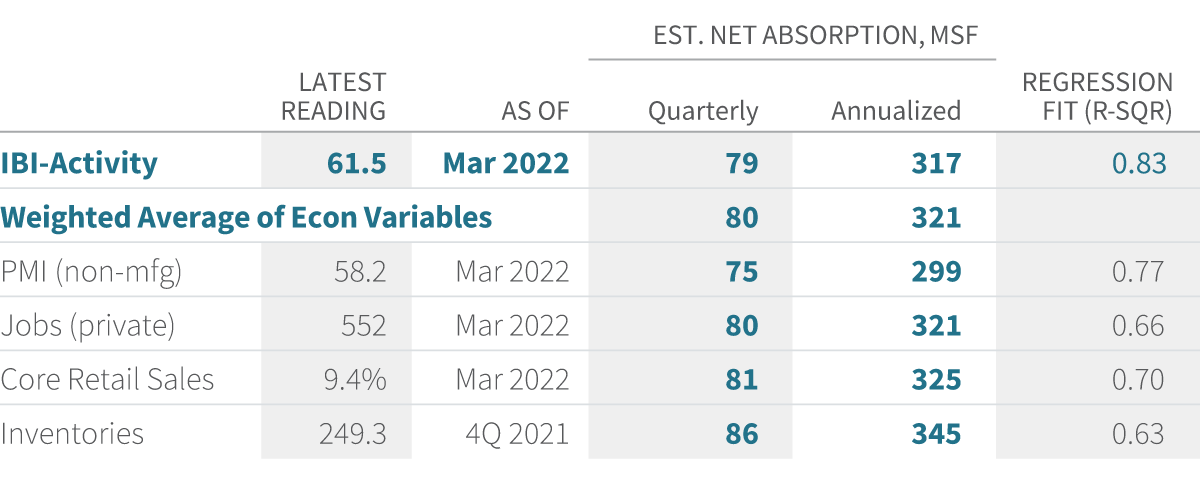

Consumer spending and the rebuilding of inventories supported another quarter of solid demand for logistics real estate. The Q1 IBI reading of 65 is consistent with an annual demand run-rate of 320 MSF. Core retail sales were flat month-over-month and up 4 percent year-over-year as of March.iv

The flow of goods has opened as supply chain bottlenecks ease. The IBI utilization rate increased steadily to 85.5 percent in March from less than 85 percent in the previous quarter. However, retailers still do not have enough stock on hand: Inventory-to-sales ratios were 1.11 in February, nearly 10 percent below pre-pandemic levels.v Prologis Research modeled a 5 percent decrease in the sales of goods and concluded that an incremental 800 MSF of logistics space would be needed to correct the current shortage and build inventory growth of 10 percent.

Source: Prologis Research.

Exhibit 3

Summary of Net Absorption Indicators

Note: Values are a 3-month trailing average, except inventories. Stock, absorption, completions, under construction and vacancy fundamentals now represent a narrowed 30 markets to reflect where Prologis has a presence.

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau of Labor Statistics, Prologis Research

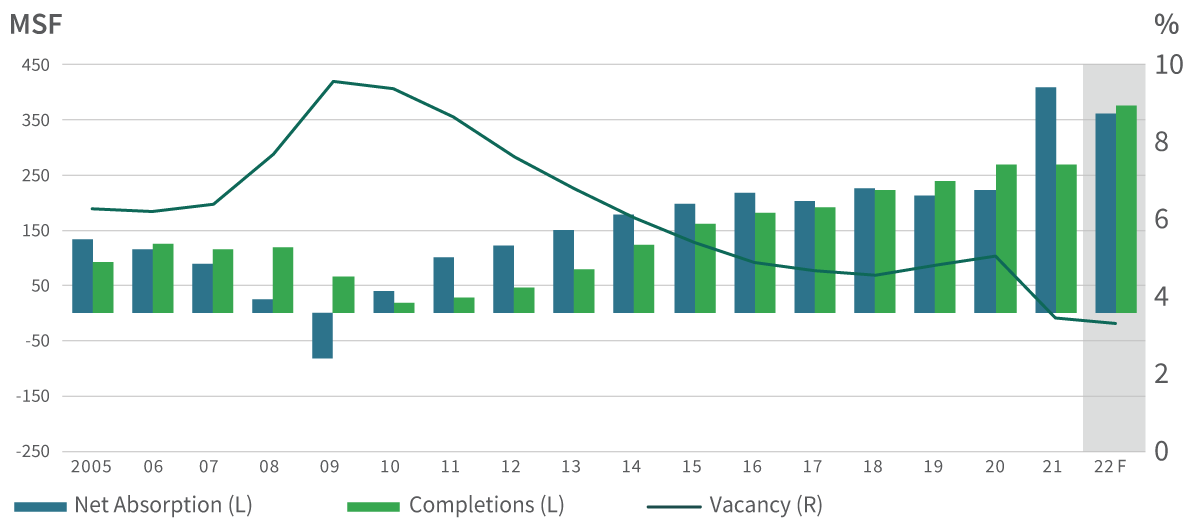

Exhibit 4

Market Fundamentals, U.S.

Source: CBRE, JLL, Cushman & Wakefield, Colliers, CBRE-EA, Prologis Research.

Source: Prologis Research.

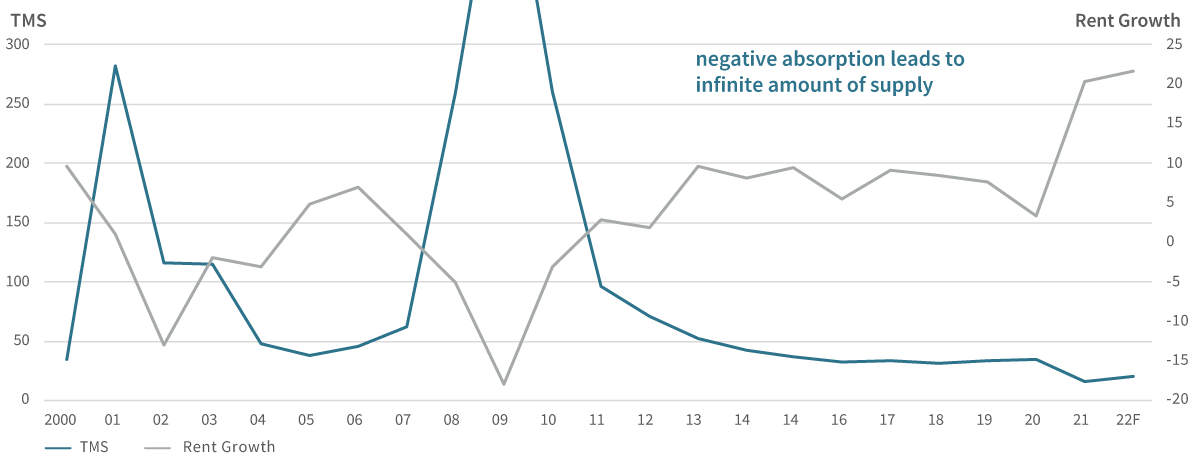

Prologis True Months of Supply (TMS) correlates to real estate leasing conditions. (see Exhibit 6) This proprietary measurement accurately captures supply/demand dynamics by comparing all vacant spaces (existing + unleased development pipeline) to trailing net absorption. Traditionally, months of supply for logistics real estate is calculated as the total development pipeline vs. net absorption. However, this can send inaccurate signals in markets with very low vacancy (and low trailing net absorption). TMS corrects for this disparity.

Note: correlation spans 2015 to 2021 in U.S. and 2007-2021 in EU

Source: U.S. data from CBRE, C&W, JLL, Colliers, CBRE-EA, CoStar, Prologis Research; Europe data from CBRE, C&W, JLL, Colliers, Fraunhofer, Gerald Eve, Prologis Research

At the current rate, available logistics space in the U.S. would dry up in 16 months. (see Exhibit 7) The expansionary average is 36 months, and anything less than 50 months is consistent with positive real rent growth. Why so high? The U.S. is a mature logistics real estate market and tracked inventory contains more obsolete vacant space than less mature markets such as Europe, China and Latin America. U.S. TMS is at an all-time low, reflecting challenges for all customers who need to expand in a constrained market.

Exhibit 7

U.S. TMS

Source: CBRE, JLL, Cushman & Wakefield, Colliers, CoStar, CBRE-EA, Prologis Research

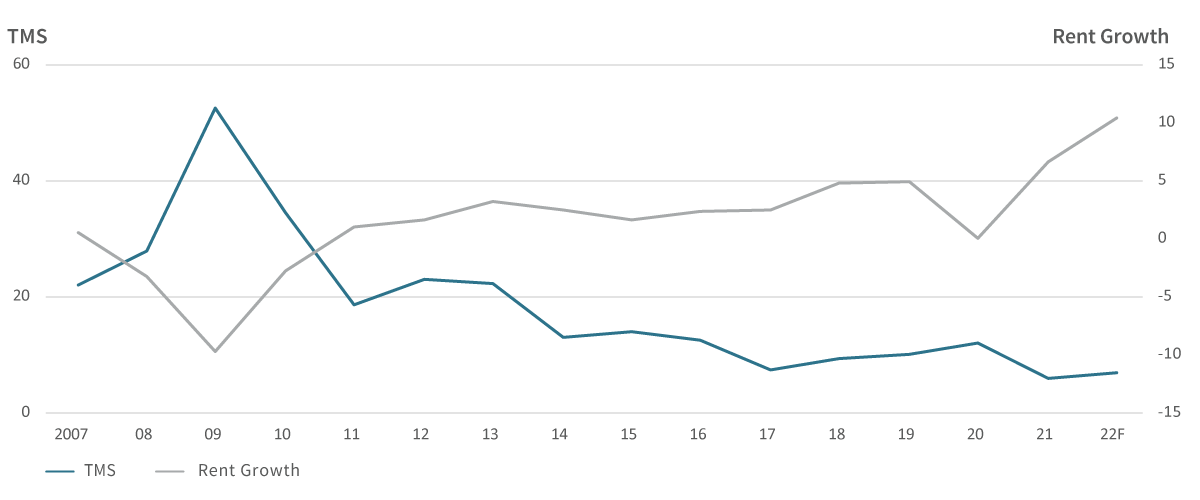

TMS in Europe is at a record low of six months. (see Exhibit 8) Europe tends to have a lower TMS than the U.S. due to a higher proportion of build-to-suit developments in the pipeline and newer logistics inventory with fewer obsolete vacancies. TMS has a high correlation (-0.9) with market rent growth since 2007.

Exhibit 8

EU TMS

Source: CBRE, C&W, JLL, Colliers, Fraunhofer, Gerald Eve, Prologis Research

Ongoing supply chain disruptions will put downward pressure on logistics real estate deliveries. Inflation will hike up replacement costs and developers will have no choice but to charge higher rents to justify the financial outlay for new developments. These forces, coupled with rapid growth in Q1, prompted Prologis Research to increase our 2022 rent growth forecast to 22 percent.

Vacancies will remain at record lows through year end. We forecast 375 MSF of completions in 2022, down from our prior forecast of 400 MSF due to the increased likelihood of extended supply chain-related delivery delays. At 360 MSF of net absorption, demand will keep pace with new supply in most locations, and leasing conditions will remain challenging for customers looking to expand. Planning and acting swiftly is key to maintaining a competitive advantage.

Prologis Research will include TMS in its recurring quarterly IBI paper. These proprietary indictors collectively summarize the current state and future direction of the logistics real estate market.