The Broad View

- Strong retail sales and supply chain challenges are driving urgency in leasing. U.S. net absorption reached a record high of 115 million square feet (MSF) in Q3 and 280 MSF year-to-date— more than double the same period last year.1,2

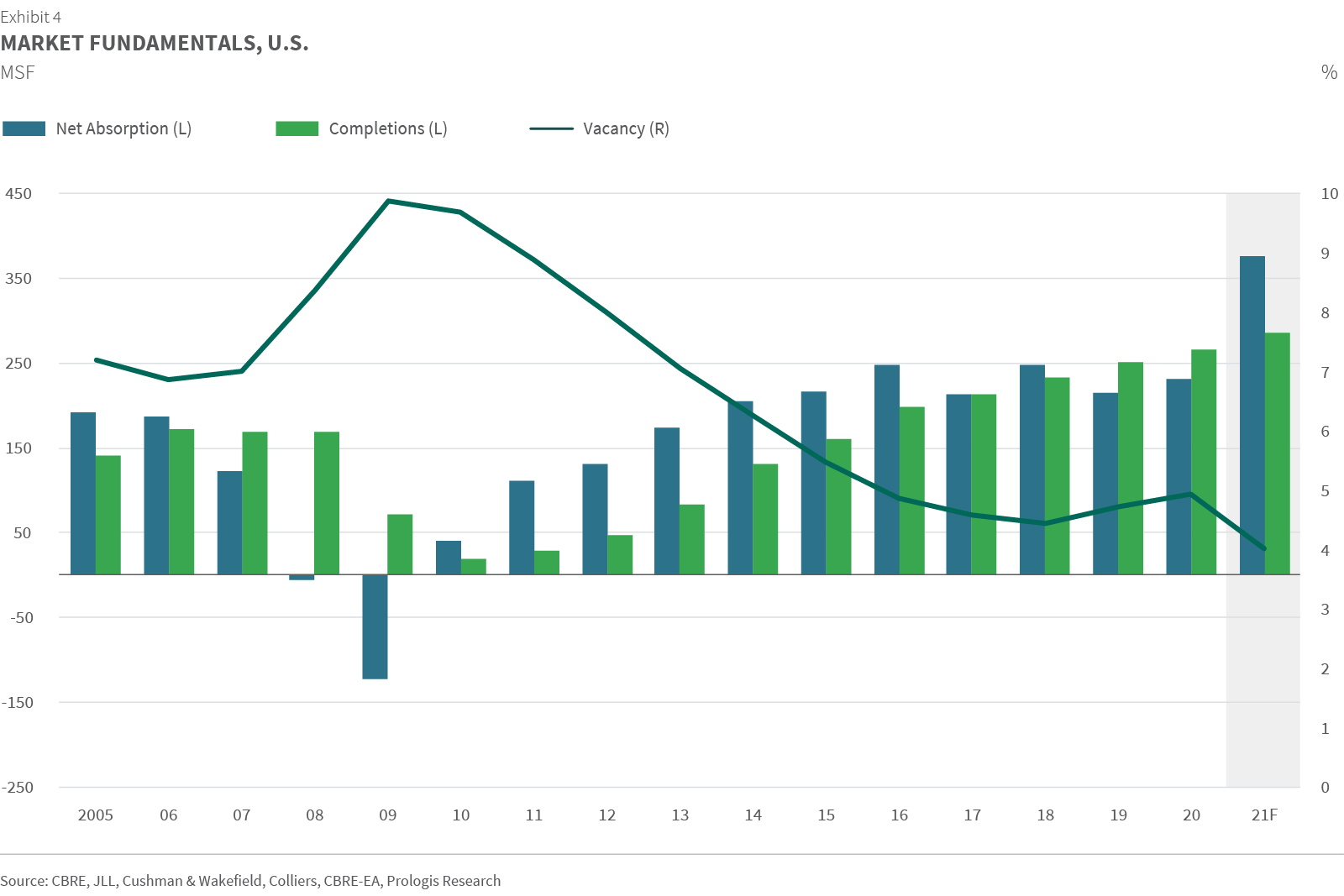

- Space is effectively sold out. Demand has pushed the vacancy rate to a new low of 3.9 percent. What is available is increasingly more expensive. Logistics customers must move fast to lock down space.

- Extreme competition for modern product has pushed rent growth to a new record of 7.1 percent quarter-over-quarter. Even though construction pipelines are at all-time highs, construction delays and record pre-leasing point to persistent shortages of space.

The Details

- Demand reached another record high, driven by structural and cyclical trends. Structural forces are supporting demand and will for years to come as e-commerce penetration rises and companies build resilience into their supply chains. Retail sales are robust, and trillions of dollars in pent-up savings and record-high consumer net worth should support future spending growth.3,4

- Supply chain bottlenecks slowed the flow of goods in Q3 2021, and the utilization rate plateaued. In Q3, Prologis’ IBI™ activity index declined to 66 from 71 in Q2, in line with a 350 MSF+ annual run rate of logistics real estate demand. The utilization rate stayed in the 84-85 percent range, in line with the long-term average. Retailer inventory-to-sales ratios were still at historically low levels, showing that inventories have a long runway for growth.5

- Rents increased by a record 7.1 percent in the third quarter. Rent growth was the highest in markets with large consumption bases and/or near integral ports of entry, where vacancy rates are lowest. The combination of intense competition for few availabilities and construction cost growth in the 15 percent+ range is driving rents higher.

- The construction pipeline increased even as replacement costs rose. Construction starts rose to an all time high of 120 MSF.6 Speculative construction drove most of that increase, representing roughly 88 percent of all starts in Q3. However, the risk of oversupply is low, with pre-leasing reaching a record high of 70 percent in Q3.7 Construction delays are also spreading out deliveries. We do not anticipate significant supply relief in most key locations; new supply is concentrated in low-barrier secondary and tertiary markets and the outlying submarkets of inland markets.

- Demand is set to outpace new supply through the near term. Prologis Research forecasts net absorption of 375 MSF and deliveries of 285 MSF for the full year. The vacancy rate is expected to stay near its historic low through 2022. Elevated demand, rising replacement costs and low supply are likely to produce rent growth of nearly 19 percent in 2021. Looking ahead, we expect that market conditions will remain exceptionally competitive for customers looking to expand, making it essential to plan early and move quickly.

Endnotes

2. Our historical and forecasted net absorption, completions and vacancy fundamentals now represent a narrowed 28 markets to reflect where Prologis has a presence.

3. https://www.bloomberg.com/news/articles/2021-10-17/-2-7-trillion-in-crisis-savings-stayhoarded- by-wary-consumers.

4. https://www.federalreserve.gov/releases/z1/20210923/html/recent_developments.htm.

5. U.S. Census Bureau.

6. Prologis Research.

7. JLL.

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2021, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 995 million square feet (92 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers principally across two major categories: business-to-business and retail/online fulfillment.