The Broad View

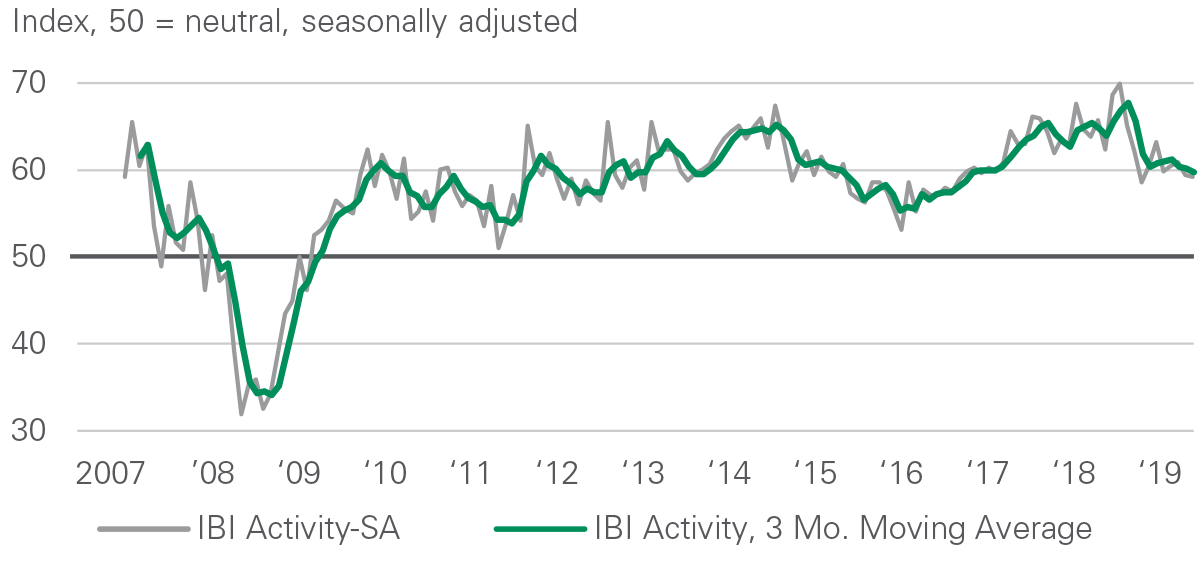

- Prologis’ latest IBI™, a quarterly survey of customer sentiment, was stable throughout the third quarter, registering at a level of about 60. This indicates an environment of normalization away from the unsustainably high levels of activity recorded in 2018.

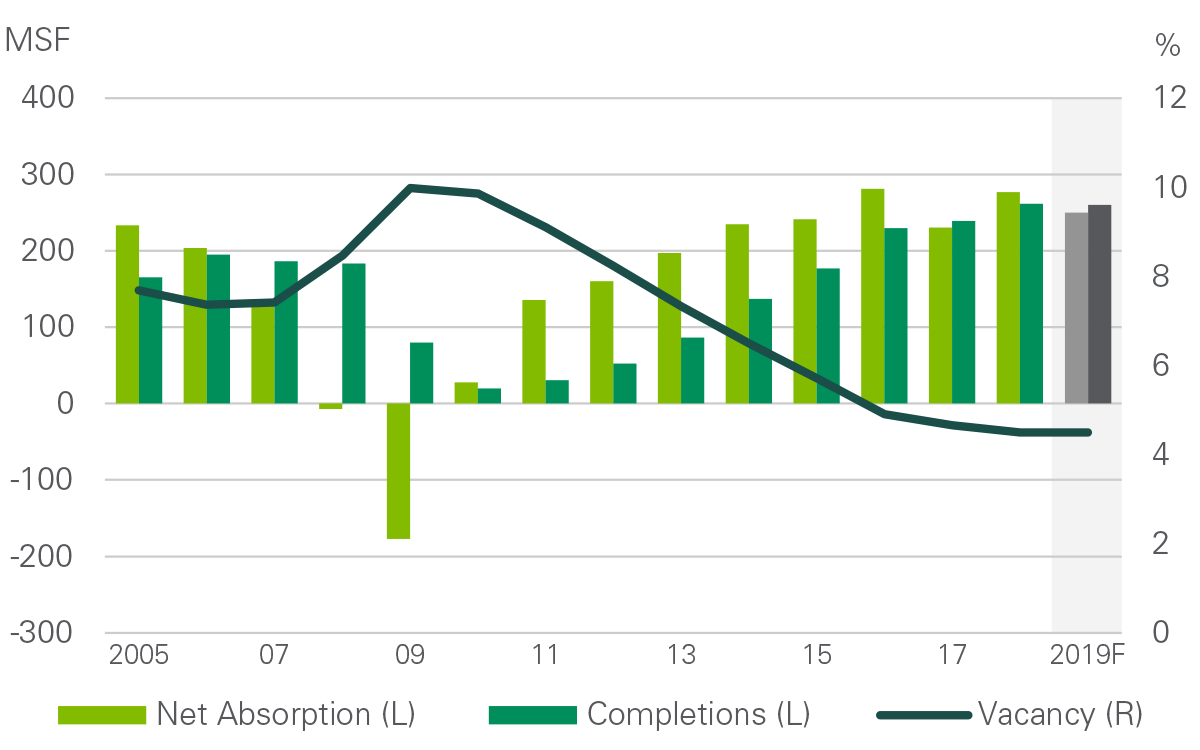

- Operating conditions remain healthy, with market vacancy near 4.5%.

- Prologis Research anticipates net absorption of 225 MSF and 240 MSF of completions in 2019 with market vacancy near the current historic low of 4.5%.

- About half of U.S. development activity begun over the last four quarters was concentrated in six low-barrier markets, further reducing supply risk. That said, supply is rising in smaller multi- market distribution hubs.

Exhibit 1

IBI ACTIVITY INDEX

Exhibit 2

MARKET FUNDAMENTALS

The Details

Underlying demand drivers remain healthy as logistics activity normalizes. As expected, macroeconomic conditions are generally downshifting. However, the big picture remains favorable, with leading indicators still pointing to a continuation of steady growth in the U.S. Unemployment is at a 50-year low and consumer confidence is high—even as it experiences a controlled descent in recent months. Indeed, consumption remains in a position of strength, both as a driver of broader economic growth and as a structural driver of logistics real estate demand.

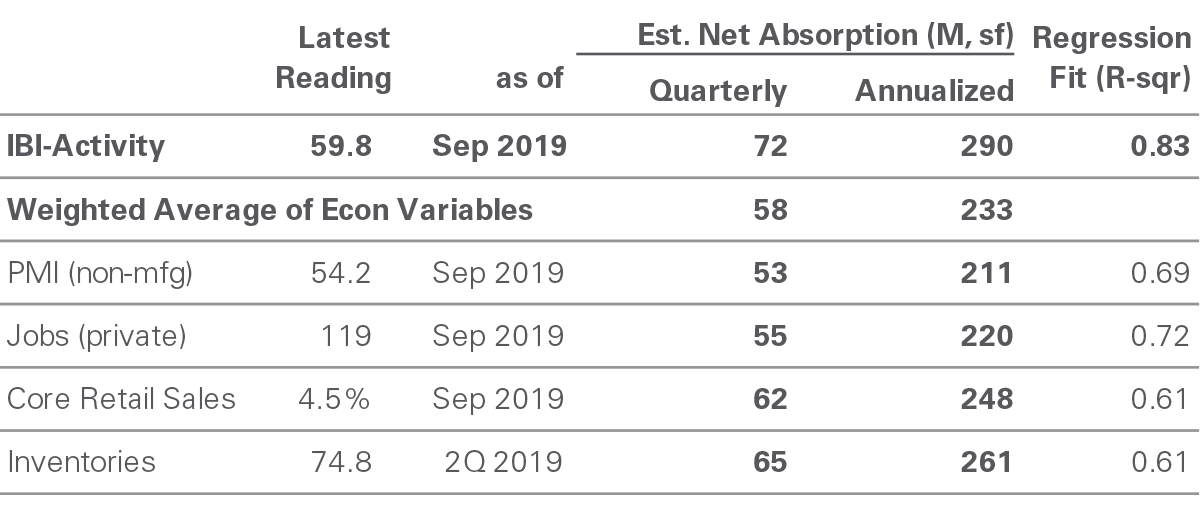

Exhibit 3

UTILIZATION RATE

Logistics real estate demand is solid. Despite uncertainty surrounding trade policy, overall logistics real estate demand is strong. Net absorption exceeded 75 MSF and is in synch with supply deliveries in the third quarter. Market vacancy is close to its historic low of 4.5%. Prologis Research anticipates net absorption at year-end of 225 MSF and 240 MSF of completions in 2019. Utilization of logistics space, a leading indicator of logistics demand, remains at its historical average of 85%.

Exhibit 4

SUMMARY OF NET ABSORPTION INDICATORS

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau of Labor Statistics, Prologis Research

Challenging operating conditions for logistics customers are underpinned by a competitive landscape. Scarcity of available modern product is a challenge, with market vacancy at or near historically low levels in most markets across the U.S. Competition on existing available product remains high in most markets, particularly in coastal metropolises. Lack of available product is posing a challenge for customers looking to expand their supply chains. In many markets, available modern product remains concentrated on new development and, coupled with tight economic fundamentals, presents unique obstacles. For example, with historically low unemployment in nearly every market, labor attraction and retention is a key challenge for logistics customers. Development patterns continue to push further away from city centers and potential warehouse labor, making exurban new sites less appealing and more costly than closer-in submarkets when factoring in higher labor turnover costs.

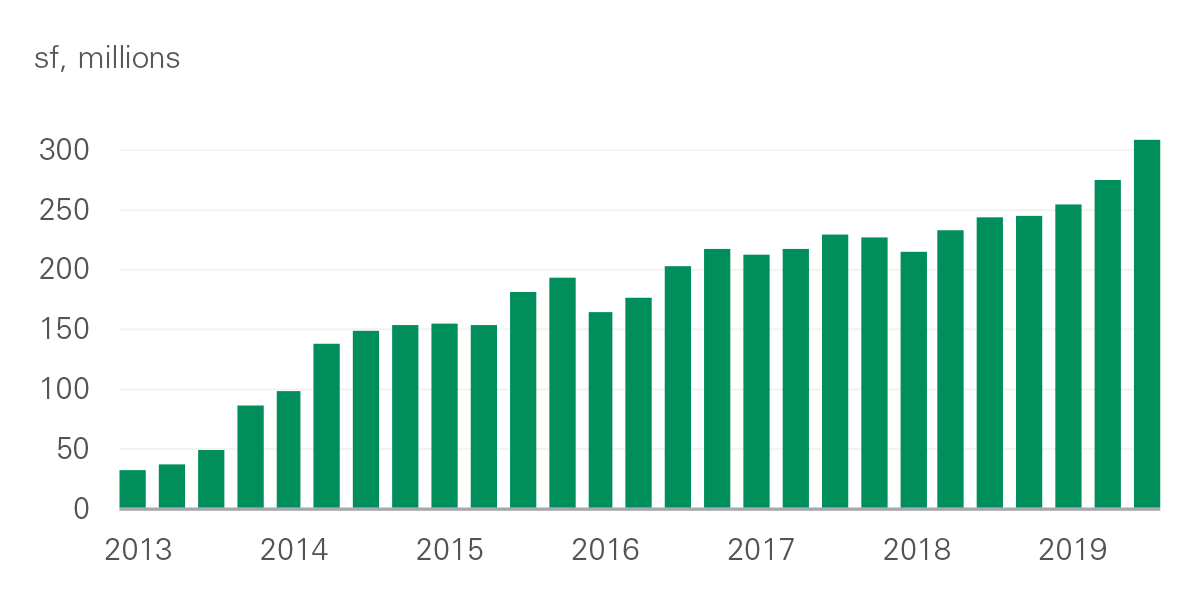

Development activity is rising. Despite low market vacancy and customer focus on delivery time and preference for infill locations closer to consumers, ~50% of the development started over the last four quarters was concentrated in six markets: Dallas, Houston, Chicago, Atlanta, Pennsylvania and the Inland Empire (East). Large-box assets accounted for a significant share of overall development over the last year. However, in recent months smaller- box developments below 300,000 square feet gained momentum, especially in lower-barrier markets such as Phoenix, Reno and Ohio. Indeed, ongoing development activity represents lower risk, but increasingly does not alleviate the obstacles for customers operating in challenging environments.

Exhibit 5

UNDER CONSTRUCTION, U.S. INDUSTRIAL

Quick Wrap

Rental growth is outperforming in the coastal metropolises. Given scarce availability, market rental growth expended by >10% in major coastal metropolis markets such as New York-New Jersey, Southern California and Seattle. As a result, Prologis Research anticipates market rental growth in the U.S. to expand by 7% year-over-year.

Endnotes

- Prologis Research

- CBRE, Cushman & Wakefield, Jones Lang Lasalle, Colliers, CBRE-EA, Prologis Research

- Prologis Research

- Prologis Research

- CBRE, Cushman & Wakefield, Jones Lang Lasalle, Colliers, CBRE-EA, Prologis Research

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 797 million square feet (74 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers principally across two major categories: business-to-business and retail/online fulfillment.