The Prologis Logistics Rent Index

The key takeaways from our 2016 rental survey include:

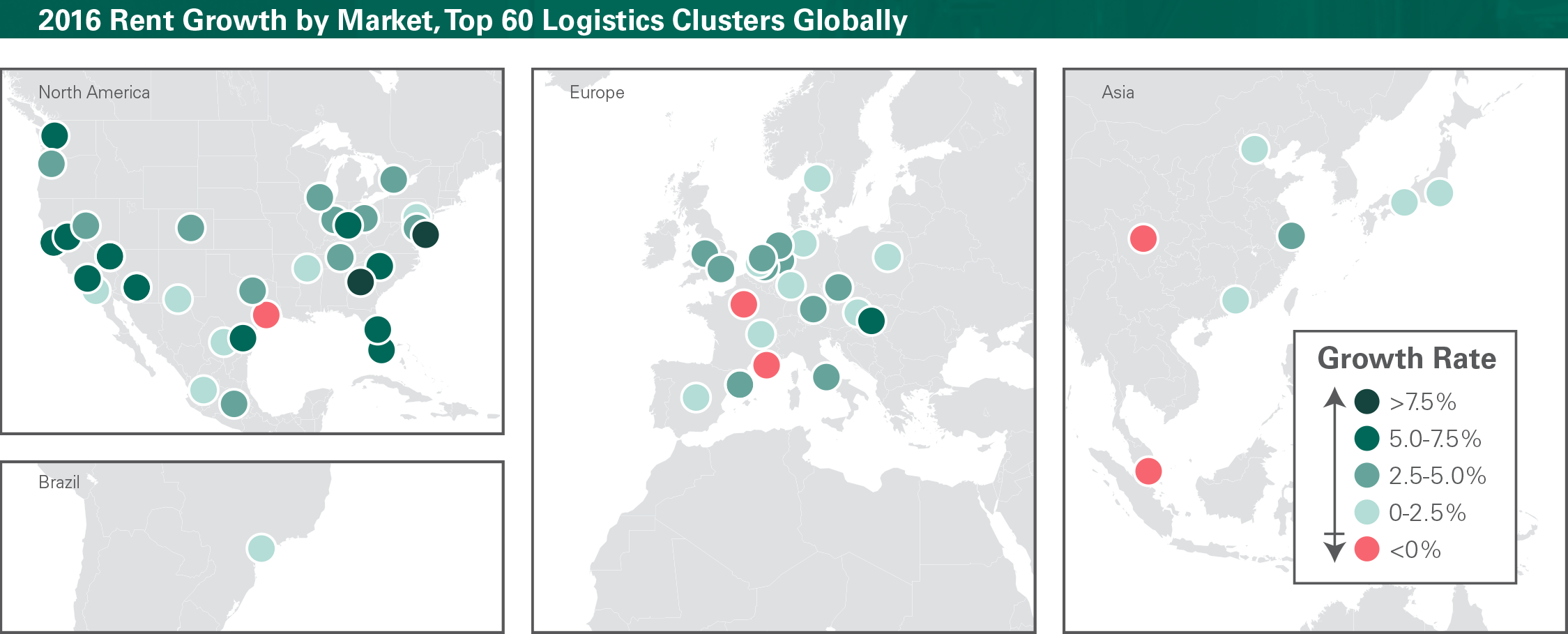

- Global rental rates rose by 4% in 2016

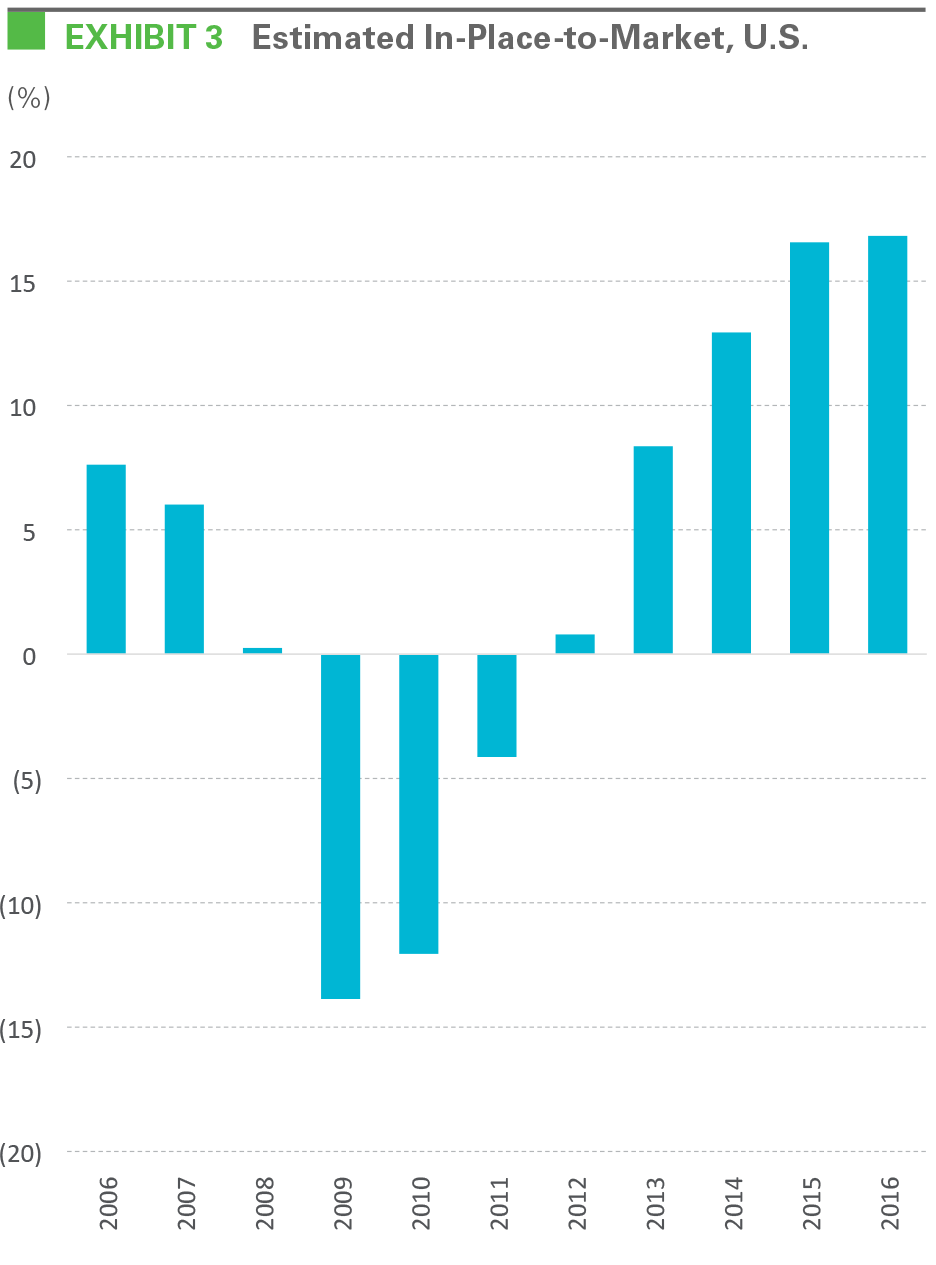

- The gap between in-place lease rates and market rents is at a historically wide level, in our view of Prologis data and estimates

- Outperformance of market rental growth was concentrated in the major population centers

- Rent growth was strongest in the U.S., but momentum is growing in Europe

Global Overview

The Prologis Logistics Rent Index examines trends in net effective rents globally in 60 markets spanning the four major regions of the world. The unique index focuses on market taking rents (net of concessions) for modern-grade logistics real estate, covering pricing for Class-A and well-located Class-B facilities. Data for the Prologis Rent Index comes from our global portfolio and our local knowledge of pricing in the markets in which we operate.1 We embarked on this study because we found that market rental rate trends across the globe either are not readily available, may not deduct for lease concessions or do not accurately reflect the performance of modern logistics facilities. Prologis Research introduced the proprietary Prologis Rent Index in 2015. This 2016 report is our first update. To revisit our 2015 inaugural report, please click here.

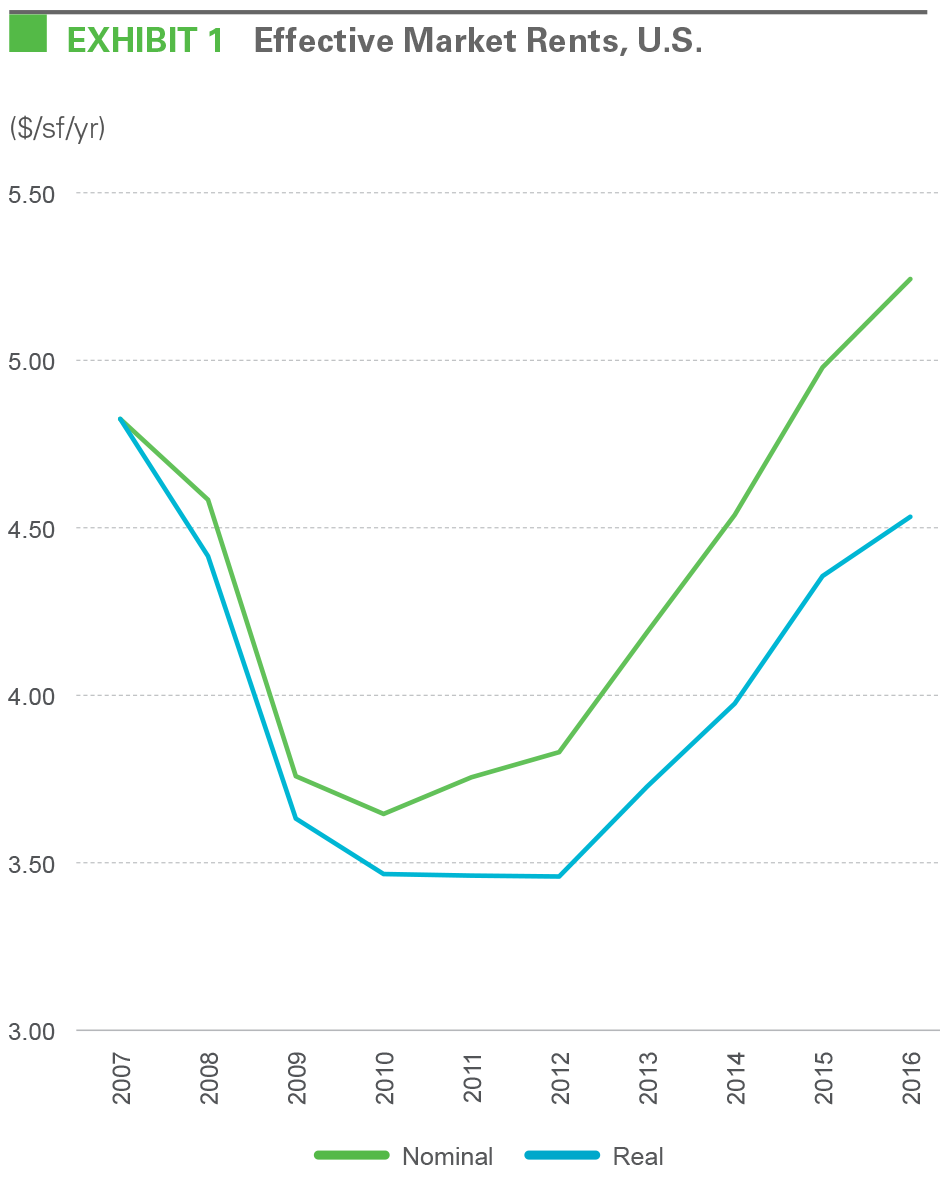

Insights from our 2016 survey. Low inflation has not damped rental growth over the last 12 months. 2015 and 2016 were the two lowest years for inflation globally, based on data dating back more than three decades, yet logistics rent growth was strong, with rents rising more than 10%. The healthy environment can be ascribed in large part to the confluence of consumption and the favorable underlying dynamics of supply and demand. Globally, rents rose by 4%. The United States led market rental growth in 2016, rising 5%. Moderate recovery in Europe continued, with rents up 3% led by the UK, but a broader swath of markets has begun to see increased rates.

Drivers of market rental growth in 2016 played out as we anticipated. Last year, we called for further strengthening of market rental rates globally, underpinned by historically low market vacancy rates and rising replacement costs. In Europe, reduction of leasing concessions proved to be considerable and in sync with the broader economic recovery. On the other end of the spectrum, the markets in which we expected rental growth challenges (Houston, Poland and São Paulo), materialized as well.

Market rental growth is poised to continue. Market vacancies are at or near historic low levels in most markets around the world and customer demand is healthy.2 In many of the leading markets, replacement costs are rising quickly and changing the development cost equation. In turn, rising replacement costs further support market rents. Setting aside the potential for negative economic surprises, scarcity of available space creates the potential for surprisingly strong rent growth as customers continue to compete for space. Development activity remains disciplined, particularly in the U.S., and balanced supply/demand should keep market vacancies low throughout 2017. Submarket selection matters more than ever before and performance has not—and will not—be uniform.

WHAT DOES IT ALL MEAN? OUR STUDY REMINDS US THAT REAL ESTATE IS INHERENTLY LOCAL. KEY THEMES BY STAKEHOLDER:

- For customers, securing quality space remains challenging. In many markets, rent growth in recent years has been materially ahead of local consumer price indices. For customers who only lease space periodically, growth over multiple years means rents may be 20% higher, or more, than the last time they leased space. Moreover, the combination of low vacancies, improving economic growth and rising replacement costs suggests that rents will continue to rise in 2017. Forward-thinking customers with a thorough planning process and the ability to act quickly stand the best chance of meeting their real estate requirements at the most attractive price.

- For investors, valuations in high-growth environments can be difficult. Rapid market rental rate growth means local knowledge is critical. In-place rents are materially below market, principally in the U.S. At the same time, the recovery has expanded; more markets are enjoying positive rent growth. However, performance has not (and will not) be uniform. Markets with higher barriers to supply have very low vacancies, and customers are competing for vacancies and driving up rates.

Market vacancies are at or near historic low levels in most markets around the world and customer demand is healthy. In many of the leading markets, replacement costs are rising quickly and changing the development cost equation.

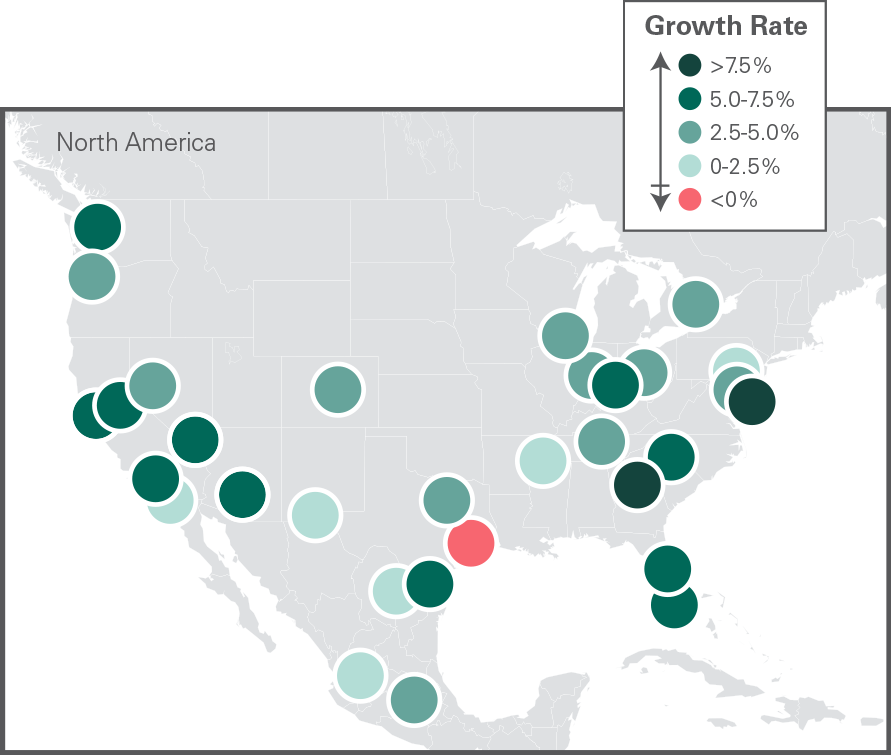

United States

In the U.S., rent growth remains outsized and is growing the fastest globally. The operating environment in the U.S. is the strongest in the world and the best in Prologis’ three-plus-decade history. Vacancy rates fell below 5% for the first time in 2016 and demand remains robust, fueled by the combination of the recovering economy, e-commerce growth and a muted expansion for new development.3 In many instances, scarcity means customers have relatively few alternatives. Such momentum has generated a big change in rents, which are up more than 35% from their lows during the global financial crisis. Strong growth continued in 2016, by 5% nationally. Excluding the softest market (Houston), growth in the U.S. would have been nearly 40 bps higher. More generally, growth was strongest in the major population centers and in markets with higher barriers to entry. In just the major coastal markets, rent growth was more than 150 bps higher than all other U.S. markets.

The gap between in-place and market rents is at a historic wide level based on Prologis data and estimates. The more than 35% rise in market rents over the last several years has put in-place rents farther below market than at any point in recent history, in our view. The gap between in-place versus market rents should narrow as the pace of market rental growth normalizes in the coming years. In the Americas, in-place rents are 15% below market, but there is a wide differential by lease vintage and by market and submarket selection. On average, customers recently had new lease rates that were 20-25% higher than prior rates. Given the low market vacancy and the strong competition for space, customers with a thorough planning process and the ability to act stand the best chance of securing the space they need at the most attractive price.

The rental rate expansion is maturing and its drivers are changing. Early phases of rent growth, which occurred in the U.S. during the 2012-2015 timeframe, were characterized by unwinding discounts from the recession. Each year, a handful of markets saw big increases in rents—more than 10-15% annually. Markets changed from year to year as each experienced its pop back from recession, but in total national growth was healthy in the mid- to high-single digits annually. Market rental performance was fueled by steady increases over a broader swath of markets, while comparatively fewer markets had significant spikes. Instead, market rental growth has been fueled by customer demand to be well-located, the economic dynamism and importance of major consumer markets and isolation from the competition of new supply.

Replacement costs are at their highest on record, signaling further increases in rents. Replacement costs rose faster than inflation again in 2016, up 3-5% yr/yr. Higher replacement costs require higher market rents to warrant new projects. In contrast with the last cycle, the current expansion seems more durable. In the last cycle, a spike in steel caused big increases in replacement costs in 2006 and 2007, which subsequently reversed during the Global Financial Crisis. By contrast, recent growth has been fueled by a return to normal pricing among general contractors, increases in labor rates (unemployment is below 5%), new municipal fees and a rise of certain materials such as concrete.

There are a handful of markets in which customers have been able to drive better pricing. Generally, these markets are not major population centers, nor do they have major barriers to supply (geographic, legal or otherwise). In 2016, these markets included certain submarkets in Central PA, Louisville and Memphis. In the past, these excess supply markets included Indianapolis in 2015 and Phoenix in 2014. In addition, the softening in Houston’s economy from low oil prices has led to rent declines. Importantly, underperforming markets change as the cycle evolves—as an example of pricing sensitivity, developers have paused activity until the market outgrows its excess supply. This is a break with the past. Critically, customers should act quickly if faced with these opportunities, as the disruptions we note are likely self-correcting and temporary.

Europe

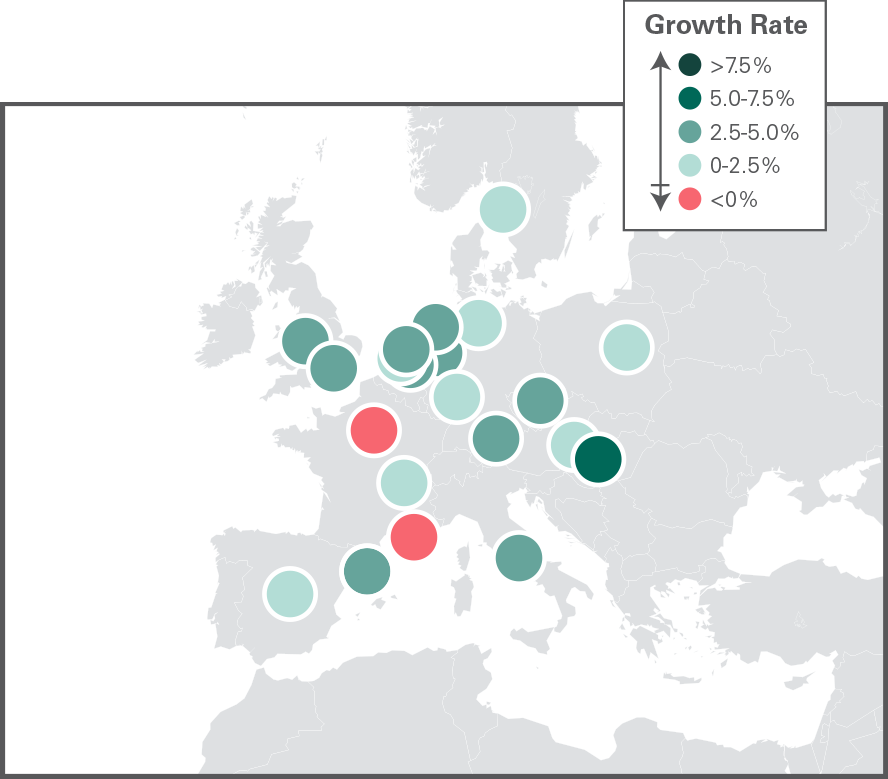

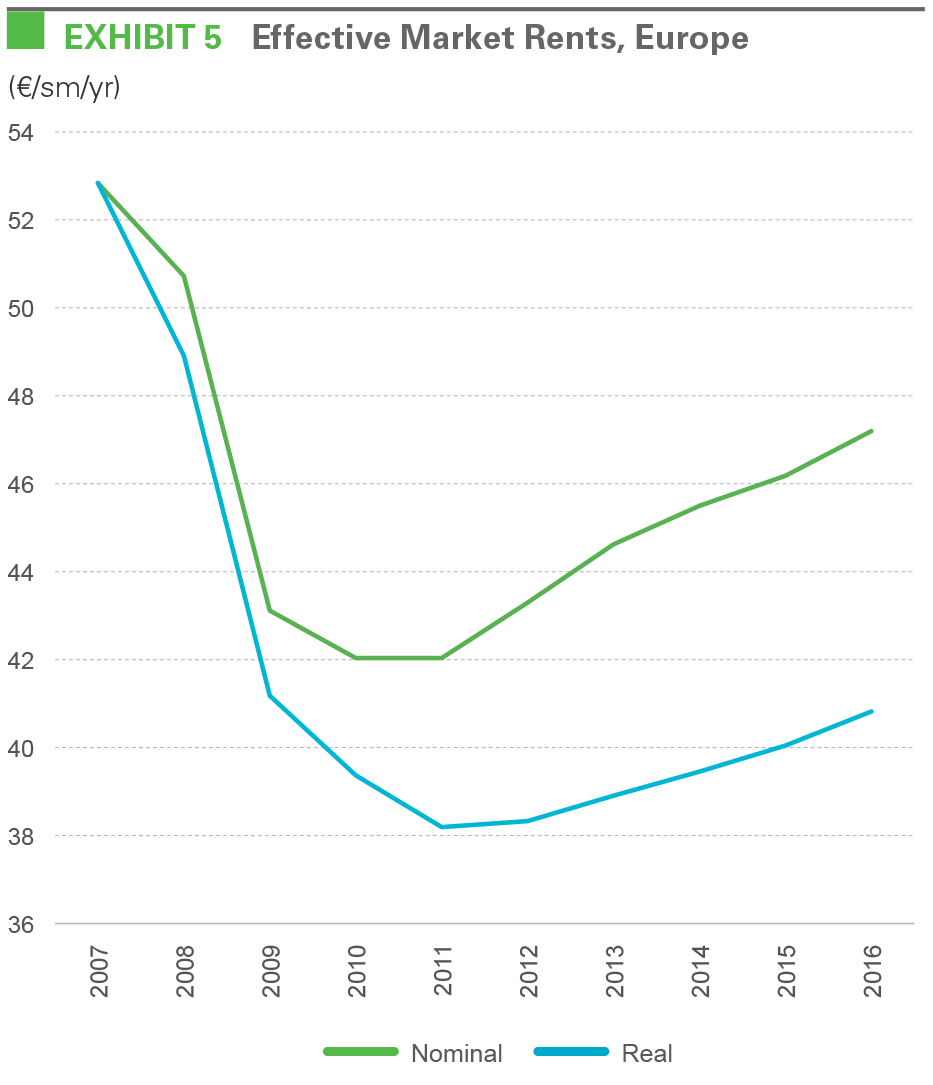

In Europe, market rental growth was steady in 2016, yet the pace of growth might surpass the U.S. in the next few years. Net effective rental growth was 3% last year across Europe, a repeat of the pace from 2015. Rental growth remains moderate compared to the U.S. but is notably ahead of the low inflationary environment. The unwinding of lease concessions has been the principal driver of the market rental recovery. The operating environment for logistics real estate experienced a measured, albeit steady, improvement during the last several years. In turn, the market vacancy rate in Europe is below 6%, the lowest level on record.4 While market demand has been positive, it has been constrained by the measured economic recovery. Lackluster demand from prior years improved considerably in 2016, however, and net absorption reached its strongest level since 2007. Of note, more markets experienced increases in net effective rents in 2016 versus in prior years. Broadly, net effective rents remain below prior cycle peaks and the pace of market rental growth in Europe might surpass the U.S. in the next few years.

Wide differences by country and market present both risks and opportunities for investors and customers alike. While rents rose in more markets in 2016 than at any point in the recovery, performance has varied widely. As has been the case throughout the cycle, growth was strongest in the UK (despite Brexit), signaling that market activity continued despite new uncertainty. Parts of Northern Europe and CEE also experienced notable increases in net economic rents. In leading recovery markets in the UK and Northern Europe, economic growth is better established and customer sentiment is more upbeat. By contrast, rent growth remained muted in other parts of Europe, notably Paris. In these lagging recovery markets, rents remain very low relative to history and on an inflation-adjusted basis.

Broader increases in replacement costs are beginning and will become an added driver of rent growth. In a region with just 0.3% estimated inflation in 2016, discussions of increases in replacement costs are not commonplace. However, the environment is shifting. Replacement costs remain depressed when compared with historical trends—on both an absolute and inflation-adjusted basis. The unemployment rate, although still high, has declined materially in recent years and a limited availability of labor has become acute in several markets. The overall improvement in the economy is leading to more business for general contractors, which in turn has begun to lift pricing.

FOCUS: POLAND REMAINS A NOTABLE OUTLIER IN THE RECOVERY PATH

Lack of transparency and high lease concession levels offered to prospective tenants in Poland led to some of the widest gaps between headline and net effective rental rates globally in recent years. In our inaugural report from last year, we called out the aggressive use of free rent in the Polish logistics market (>25% of total rent), which skewed the market’s perception of rental rates. In turn, pricing dynamics often did not accurately represent an asset’s true economic prospect. In the past few quarters, Prologis Research has noted indications of a change in investor sentiment and an increased awareness of this mismatch in values. While only a nascent trend at this point—capital continues to invest in the Polish market—investors have become more selective. Should this trend continue, concession levels may decrease.

In Asia, market rents moderated in 2016, as the advancing supply cycle constrained growth in some market. In Japan, market rents were flat last year. Notwithstanding big increases in replacement costs over the past several years, development activity is near historic highs. Estimated vacancy rates in the global markets remain low, below 5%, as customers continue to adopt large multi-tenant facilities at a record pace.5 Nonetheless, there is more competition and rent growth has slowed (although it remains ahead of the low inflationary environment). In China, market rental growth was led by the East China region (Greater Shanghai). The pace of rent growth has slowed as the market environment has normalized in recent years. In 2010-2012, vacancy rates fell to ultra-low—and unsustainable—levels. As the supply cycle has normalized, rent growth has softened to a more sustainable pace (still in the low- to mid-single digits). Most Tier One6 cities enjoyed modest growth in 2016. However, a handful of growth submarkets have excess supply and limited growth—for example, West China. In Singapore, market rents declined due to high vacancy and competition.

In Latin America, rent growth was broadly soft on a nominal and inflation-adjusted basis. In Mexico, market vacancies are low and demand in 2016 was its strongest on record. However, uncertainty surrounding changes in trade policy with the United States has led to volatility in the value of the peso, which in turn has hampered market rental growth. In Brazil, rental rates are mostly flat. Economic conditions have been very soft, although the development community has been responsive to the mixed climate. In fact, activity was up incrementally in 2016 versus 2015 and there were a handful of submarkets with some rollback in lease concessions. As rents (and replacement costs) are depressed on an inflation-adjusted basis, increases could be material once the market recovery emerges.

Submarket selection matters more than ever before and performance has not—and will not—be uniform.

We expect rental growth to continue and rise in more markets around the world, notably Europe. The operating environment broadly warrants a positive view in most regions around the world. Key themes that seem likely to shape the year ahead include:

- Improving customer sentiment. Economic forecasts are higher for 2017 than in 2016. Leading indicators, such as consumer and business confidence, support this view. In addition, our conversations with customers and their representatives are more positive than they have been in years.

- Ultra-low vacancies. Market vacancy rates are below 5% in the U.S. and below 6% in Europe. Scarcity has led customers to compete for remaining availabilities, bidding up rental rates.

- Differentiation by market. As the rent expansion matures, we expect greater differentiation to emerge by market. Major population centers with higher barriers to supply appear poised to experience the strongest increases in rents.

- Rising replacement costs. The combination of low unemployment, improving economic growth and customer sentiment and ever busier general contractors has fueled a rise in replacement costs in more places around the world—in fact, replacement costs are reaching new highs. Higher replacement costs require higher market rents to warrant new development.

- Limited numbers of outliers. A handful of markets allow customers to drive preferential pricing. The common thread in these markets is that there is no common thread. Supply is a factor in some markets in the U.S., Asia and Poland. In Mexico, geopolitical factors may limit growth. Around the world, there are relatively few other examples of soft demand conditions, but they include notable markets such as Houston and Paris.

End Notes

- The Prologis Logistics Rent Index is representative of pricing for modern logistics real estate and functional infill facilities. The index comprises rental rates that are net of free rent and considered on a triple net basis (i.e., exclusive of operating expenses). The index covers 60 of the world’s largest logistics real estate markets. The global and regional indices are rent-based weighted averages. Data comes from our local Prologis teams and is the then prevailing pricing for space in the major modern and functional infill submarkets within their respective markets.

The geographic composition of the index is 66% U.S., 20% Europe, 8% Asia and 7% Latin America. Market stock figures are Prologis estimates based upon data from CBRE, JLL, Cushman & Wakefield, Gerald Eve and Colliers. The most notable markets outside our geographic coverage include Hong Kong, Australia and Moscow. Exchange rates as of December 30, 2016 were used to convert foreign currency into U.S. dollars. Growth rate figures are compiled on a local-currency basis (i.e., the Prologis Logistics Rent Index excludes the impact of changes in foreign exchange rates). - Prologis Research analysis of market vacancy rates relative to historical norm by market. Time series data varies by market, and provided by CBRE, JLL, Cushman & Wakefield, Gerald Eve, and Colliers

- CBRE, Prologis Research

- CBRE, JLL, Cushman & Wakefield, Gerald Eve, Prologis Research

- CBRE, Prologis Research

- “Tier One” defined as the largest economic metro areas in China. While metrics used to define tiers may vary, consensus view includes Beijing, Shanghai, and Guangzhou

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2016, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 676 million square feet (63 million square meters) in 20 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment.

Copyright © 2017 Prologis, Inc. All rights reserved.