SEVEN Supply Chain Predictions for 2023 – E-commerce, growth markets, green building and more

Prologis Research leveraged decades of industry experience and proprietary data, as well as unique insights from our approximately 1.2 billion square feet global portfolio and 6,200 customers, to predict the following seven non-pandemic trends for 2023. (And check out how we did with our 2022 predictions at the end of this report.)

Prediction #1

U.S. warehouse development starts will drop to a seven-year low, even as rent growth exceeds 10%.

Prediction #2

California’s barriers to development will permanently constrain logistics demand, allowing Texas to become the #1 state for net absorption.

Prediction #3

Mexico demand will hit a new annual record as nearshoring drives expansion along the border.

Prediction #4

India will rise from fourth to the third-most-active country for development starts, behind the U.S. and China.

Prediction #5

Build-to-suit rents will reach new levels in the U.S. and EU as market rents are capitalized at 5%, despite falling land and construction costs.

Prediction #6

E-commerce leasing will bounce back to become the second-most-active year on record (after 2021).

Prediction #7

Demand for sustainable warehouses will grow rapidly. Installed rooftop solar capacity will double, and EV truck charging capacity will exceed 10 megawatts.

Prediction #1

U.S. warehouse development starts will drop to a 7-year low, even as rent growth exceeds 10%.

Supporting facts:

-

Driven by a rapid rise in the cost of capital, development starts will decline by 60% to less than 175 million square feet in 2023. We’ve already seen quarterly starts fall 30% from their peak in Europe and expect a similar pattern in the U.S.

-

A pullback of this magnitude would create a shortage of space in 2024. The pipeline will drop from over 500 million square feet in Q3 2022 to 275 by year-end 2023.

-

Low vacancy will produce another year of double-digit rent growth. Even if new demand fell to zero, the national vacancy rate would increase by just 260 bps to 5.9%, well below the long-term average.

Prediction #2

After leading for 25-plus years, California’s barriers to development will permanently constrain logistics demand, allowing Texas to become the #1 state for net absorption.

Supporting facts:

-

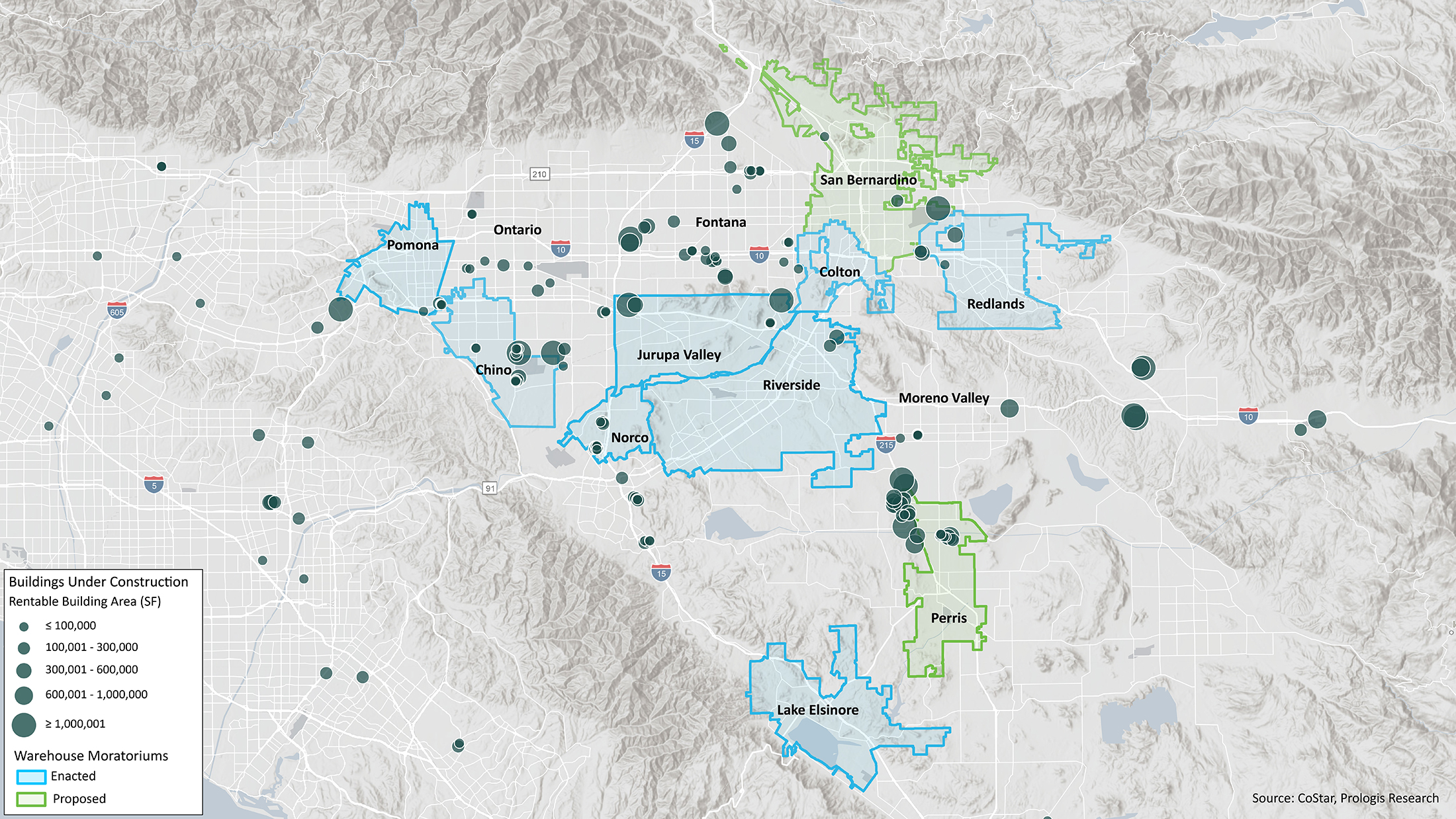

California is short on developable land, and barriers to supply are rising. By November 2022, for example, one-third of the buildings under construction in the Inland Empire were in municipalities that had proposed or enacted local moratoriums on industrial development. Limits on future development in these areas would increase the value of existing properties and creates challenges for customers looking to grow.

-

Texas demand drivers are accelerating. Population growth is expected to continue, and regionalizing supply chains will send more goods through Mexico and Texas.

Prediction #3

Mexico demand will hit a new annual record as nearshoring drives expansion along the border.

Supporting facts:

-

Nearshoring-related expansions made up half of new leasing in 2022. Monterrey, Juarez and Tijuana were the primary beneficiaries.1

-

Increased deliveries in 2023 will allow for more absorption because the vacancy rate is at an all-time low. The under-construction pipeline rose to a record 25 million square feet in Q3, while vacancy fell to 1.4%.2

Prediction #4

India will rise to the third-most-active country for development starts, behind the U.S. and China.

Supporting facts:

-

India is becoming more investable as demand drivers evolve. The combination of strong demographics, increasing exports, favorable regulatory and tax policy changes, and improving infrastructure have attracted capital to India, producing dry powder for logistics development.

-

India was fourth in 2022, more than doubling the volume of development starts in only five years and overtaking Europe’s most active development markets.3

Source: Prologis Research

Prediction #5

Build-to-suit rents will reach new levels in the U.S. and EU as market rents are capitalized at 5%, despite falling land and construction costs.

Supporting facts:

-

Financial market volatility has led to markedly higher costs of capital. Lending costs have risen substantially as central banks increased rates, with the 10-year T-bond hovering between 3.7 to 4.1% in November 2022.

-

Construction cost softness lags economic cycles. Costs may respond eventually to the overall economic landscape, but they haven’t yet. We estimate 10-15% decline in construction costs by year-end 2023, back-loaded in the second half of the year.

Prediction #6

E-commerce leasing will bounce back to become the second-most-active year on record (after 2021).

Supporting facts:

-

E-commerce sales are re-accelerating as the outsized desire for in-person experiences diminishes and the e-commerce value proposition for consumers remains intact. We maintain our prediction that >25% of retail goods will be sold through online channels by 2025, up from 15% in 2019.

-

Leasing activity is re-accelerating. Prologis’s proportion of new leases signed by e-commerce customers rose to more than 17% in Q3 from a trough of 13% in Q1 2022, lifted by a record diversity of customers as parcel networks expand, mid-size retailers improve service levels and new concepts emerge.

-

Parcel delivery costs remain high. Online retailers will look to network design to achieve both cost savings and sustainability goals. Specifically, adding an urban hub to the end of e-fulfillment supply chains can yield cost and environmental efficiencies of 50% on average by shortening the final mile.

Prediction #7

Demand for sustainable warehouses will grow rapidly. Installed warehouse rooftop solar capacity will double, and EV truck charging capacity will exceed 10 megawatts.

Supporting facts:

-

Building future-proof facilities can shield logistics companies from future operational risks, including changing regulations, community resistance and volatile fossil fuel-based energy pricing. Costs for sustainable building and operations are dropping. Government incentive programs and the European energy crisis have the power to turbocharge these longer-term trends.

-

In California, a commission found that 157,000 rapid chargers will be needed by 2030 to support fleet electrification and achieve the state’s carbon reduction goals. (Prologis, which already invests in commercial EV infrastructure, has committed to installing 1 gigawatt of solar by 2025.)

-

In Europe, cities with low-emission transportation zones comprise more than 60% of logistics markets as of 2022, up from less than 25% in 2015.4

End Notes

1. CBRE, Prologis Research

2. Note: Top six major markets. Source: CBRE, Prologis Research

3. Savills, Prologis Research

4. Note: Prologis EU markets only. Source: European Commission, Urban Access Regulations, Prologis Research