Chris Caton

Managing Director, Global Strategy and Analytics

Chris Caton

Managing Director, Global Strategy and Analytics

Melinda McLaughlin

Senior Vice President, Global Head of Research

The bottom line: Following our May 11 webinar on the outlook for logistics real estate, we have continued to field questions about our assumptions for demand. In this piece, Prologis Research re-examines the components of our demand outlook.

Key findings:

A common question involves a partial spending rotation from goods to services, online to in-store. This is temporary and we have been expecting this to occur, which means we’re not changing our stated view on demand. We are watchful on rising levels of consumer stress and modeled -5% real growth in retail goods sales in our Q1 2022 earnings call. We estimate that the market is experiencing more than 800 million square feet (MSF) of pent-up incremental demand even with this pullback. But, in 2022, only 375 MSF will come online to meet this demand. The constraints on capacity remain clear. Given this, our current forecast points to 360 MSF of net absorption resulting in year-end vacancy of 3.3%—less than half the low from the prior cycle. Correspondingly, logistics rents in the U.S. have risen in line with our forecast of 22% for 2022, consistent with an historic low True Months of Supply.™

The future of retail is a further shift to e-commerce. These factors will keep upward pressure on the e-commerce penetration rate:

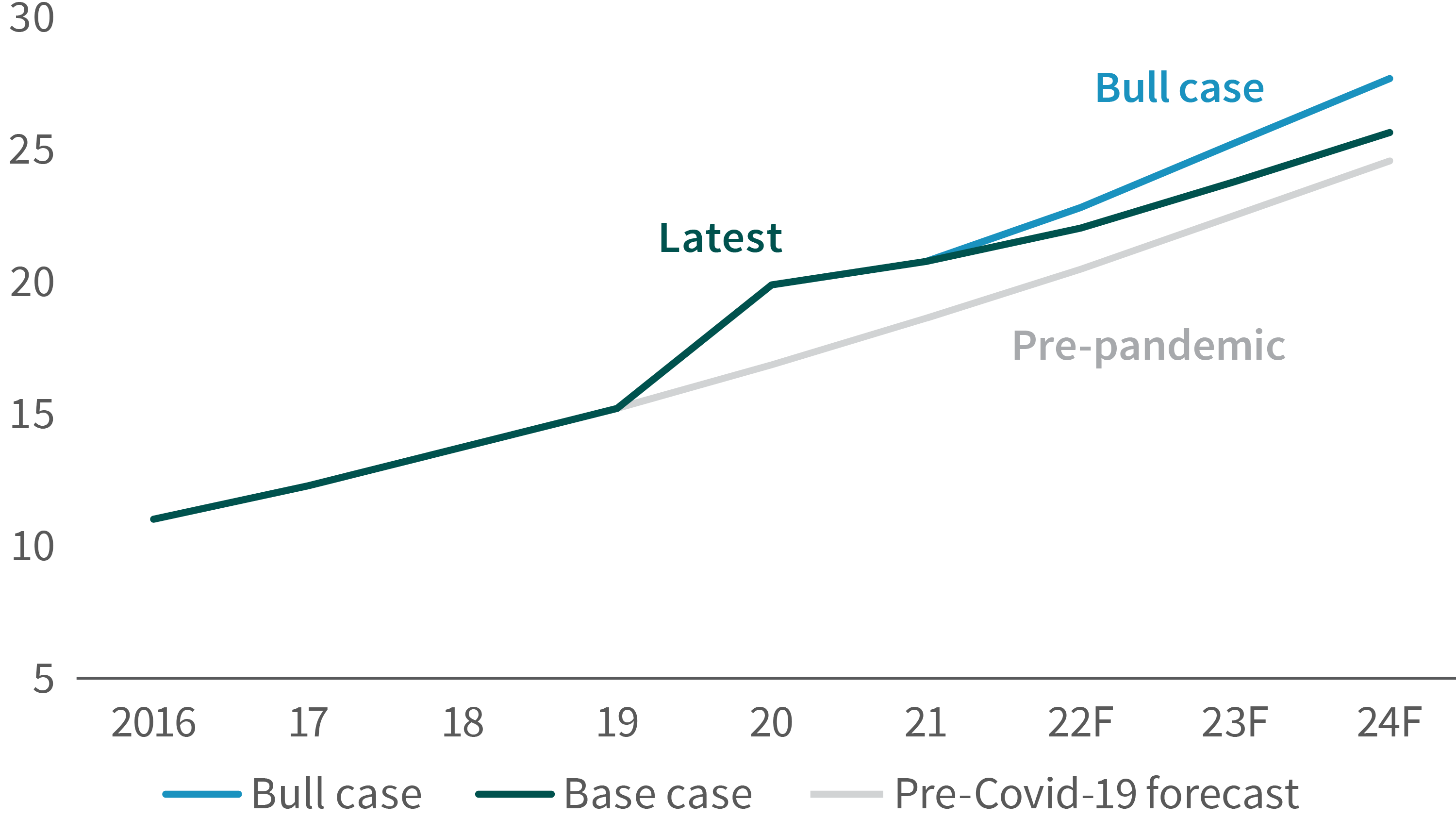

E-commerce as a percent of retail goods sold

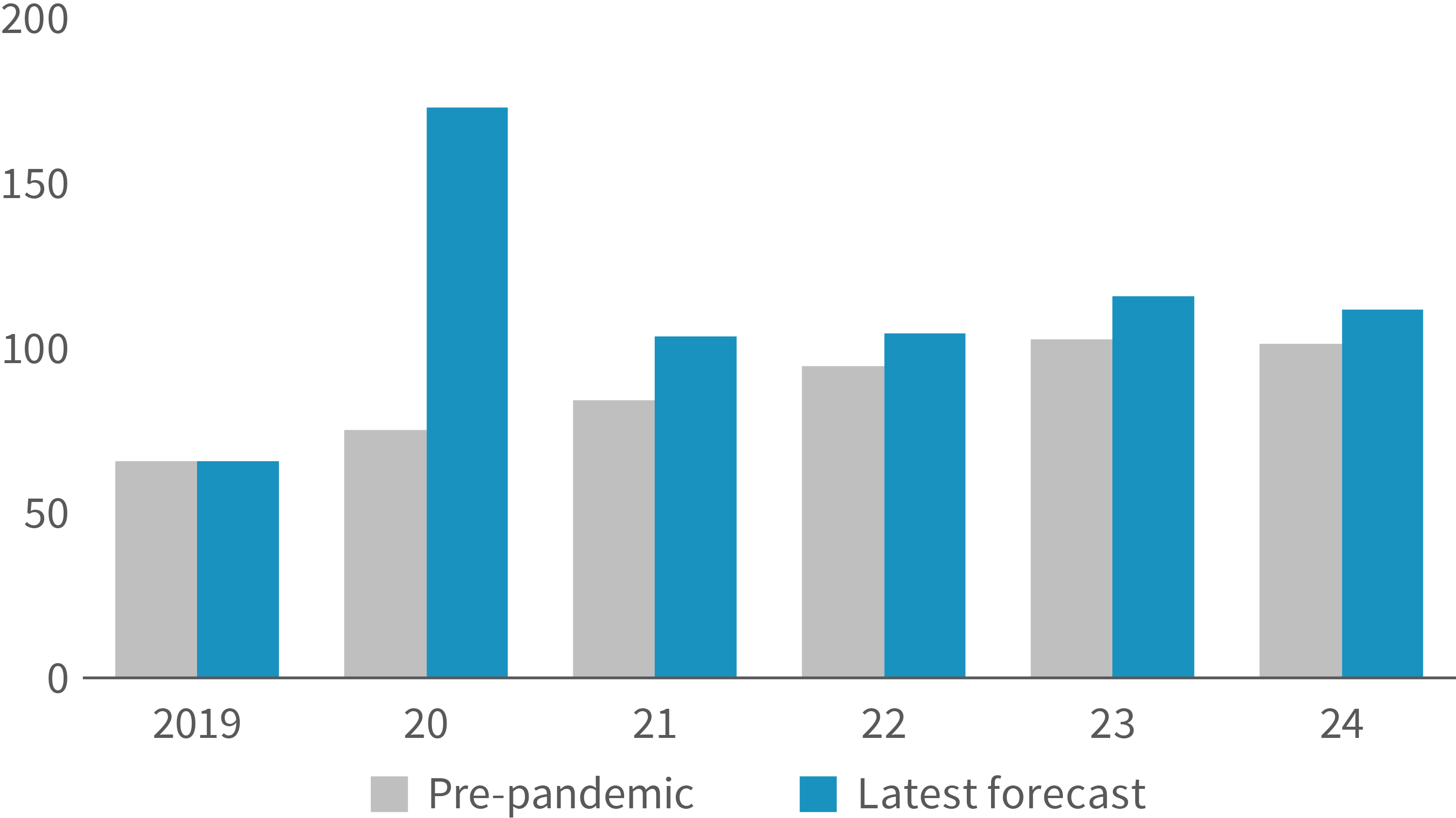

E-commerce revenue growth will exceed its pre-pandemic trajectory; a bull case exists based on expanding capabilities. E-commerce sales volumes are growing off of a higher base because of the pandemic-driven shift. However, real-time data reflects a temporary pause in online sales growth as the consumer begins to venture out and has preference for experiences (dining, travel, etc.) We have long called for this shift in retail sales and have factored it into our forecasts (see Appendix A). As far back as 2020, we called for an eventual “surge and then a lull,” maintained that message through 2021, and recently reiterated “online sales to step back temporarily before it gets back to a growth curve.” Looking ahead, our base case reflects e-commerce reaching 25% of retail goods sold by 2025. In our bull case, e-commerce share climbs higher due to faster deployment of same-day and next-day delivery capabilities, improved online sales technologies (e.g.,augmented reality, metaverse purchasing) and continued capability investments in under-penetrated segments like furniture and groceries.

E-commerce is in a new phase of growth—Amazon is unique because it acted quickly to secure space. Prologis Research estimates 300 MSF of demand generated by the shift from 15% to 21% e-commerce as a proportion of total retail goods sales from 2019 to 2021. Amazon represents approximately 42% of the U.S. online sales market4 and absorbed nearly 200 MSF during 2020 and 2021.5 Even as its largest user, Amazon represents less than 3% of occupied logistics space.6

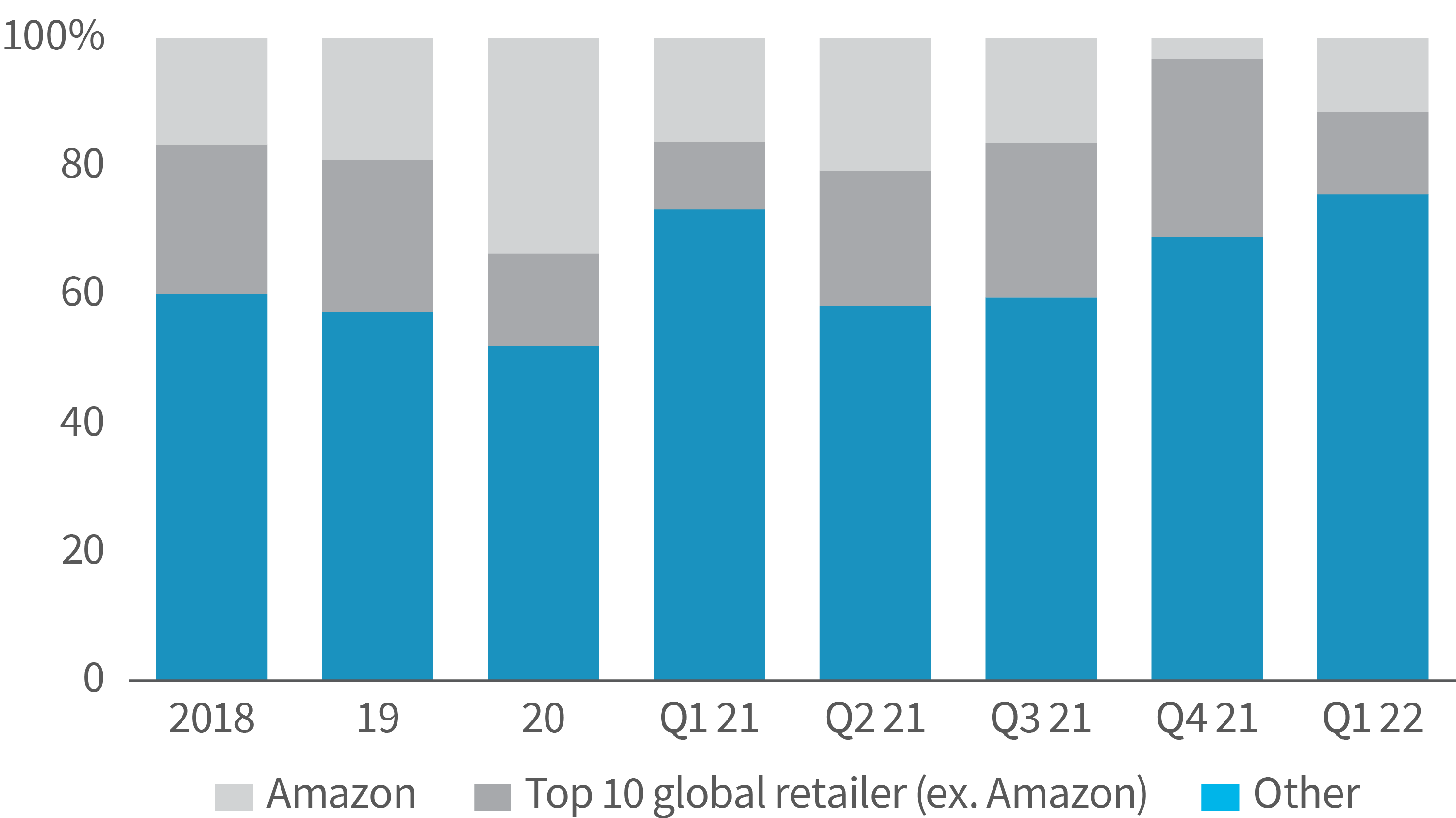

What’s important? E-commerce demand is diversifying. The pandemic’s impact on the growth of e-commerce extends across retailer categories and product lines and has spurred retail business formations.7 Prologis leasing data shows that in the year through Q1 2022, non-Amazon customers accounted for 85% of new e-commerce leases, up from 66% in 2020. Amazon’s proportion of new leasing volume peaked in 2020. Today’s e-commerce customer base is more international in nature and spans a wider range of organizational types, from pure online retailers omni-channel brands, direct-to-consumer initiatives, and innovative new companies. In sum, we are watchful on general economic and retail trends, but logistics market conditions are still defined by historic low vacancy, constraints on new deliveries, and pent-up demand.

Proportion of new e-commerce leasing by customer type, Prologis

by square footage

MARCH 10, 2020 – Covid 19 Special Report – Implications for Logistics Real Estate

“…this opportunity could be short-lived as some customers race to gain lost ground and expand their needs for facilities in support of business continuity and higher service levels.”

APRIL 6, 2020 – Business Update Conference Call

“There is going to be a surge of this stuff and then there’s going to be a lull of this stuff, and then it’s going to stabilize at the higher level, because of the penetration of e-comm and more safety stock.”

SEPTEMBER 10, 2020 – Evercore ISI 2020 Real Estate Conference

“We’ll give some of this e-commerce stuff back temporarily and then we build off of that basis. I don’t expect it to continue surging from these peak levels. But I think it has legs and will continue in a major way.”

JANUARY 6, 2021 – Prologis Q4 2020 Earnings Conference Call

“Initially, obviously, we’ve had a clear market leader, which is Amazon in excess of 40% of the total volume, but we’re seeing breadth in terms of different e-tailers that are now growing their businesses and have found their footing. So, I think we’re in very early stages.”

JULY 19, 2021 – Prologis Q2 2021 Earnings Conference Call

“While Amazon remains steady at 6% of total new leasing, we have seen many more e-commerce players come to the table. For example, we signed 168 new e-commerce leases in the first half of 2021 versus 53 in the first half of last year.”

OCTOBER 27, 2021 – Prologis Breaking New Ground 2021

“I actually think it is going to get worse, because a lot of people already talking about the logjam over Christmas are going to experience it… The short-term problem, I think, is going to be with us through 2023… the world is getting less and less predictable.”

APRIL 19, 2022 – Prologis Q1 2022 Earnings Conference Call

“I expect the percentage of online sales to temporarily step back a bit before it gets back on a growth curve of ever increasing penetration levels. And I also believe that the expenditures are going to shift more to experiences than goods like they have been in the last two, three years.”

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of March 31, 2022, the company owned or had investments in, on a wholly owned basis or through coinvestment ventures, properties and development projects expected to total approximately 1.0 billion square feet (93 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,800 customers principally across two major categories: business-to-business and retail/online fulfillment.

Every connection starts with a conversation. Our team is here to help.