Sizing the opportunity

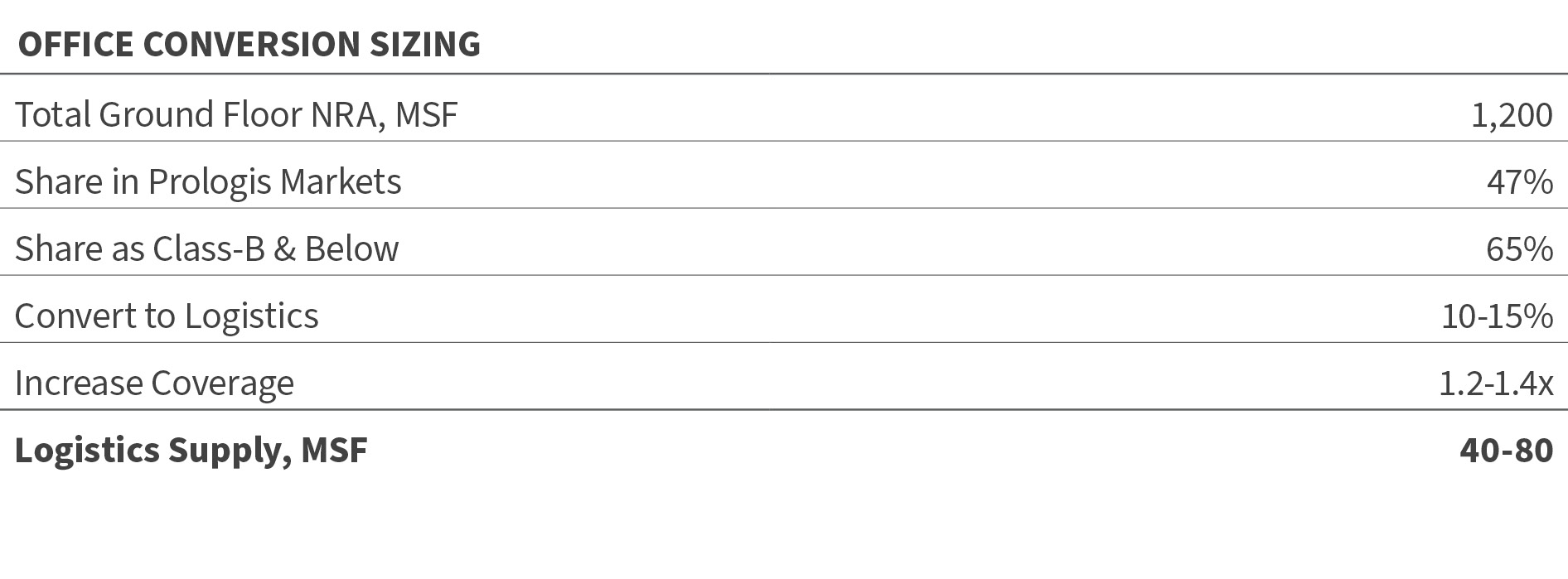

Logistics uses require larger land parcels, typically 8 acres or larger. In the U.S., approximately 27,000 office buildings, or 2.2 billion square feet in total office stock and 1.2 billion square feet in ground floor real estate, meets this criterion, according to Costar data.3 This analysis focuses only on Prologis’ top 25 U.S. markets. Given the wide spread between rents and values for Class-A office and logistics space, we narrow the opportunity set to Class-B and below office buildings, which encompass roughly 65% of square footage in Prologis’ markets. Ultimately, Prologis Research estimates that about 40-80 MSF will be converted to logistics over the next decade.

Economics limit the conversion rate

The above estimate is filtered primarily on functionality: large enough land sites, increased obsolescence as office product, and the ability to convert surface-level parking to expand site coverage. Prologis Research detailed the challenges facing retail-to-industrial conversions in depth, and while office conversions face many of the same challenges, some distinctions underscore our 10-15% estimated conversion rate for eligible properties.

- Office conversion creates an even bigger basis reset than retail. Unlike certain types of retail, office properties cannot physically accommodate logistics uses. They would need to be demolished to convert to a usable logistics site, adding to an extended carry period, de-tenanting costs, and a higher required return to compensate for rezoning risks, relative to a typical greenfield project. Office campuses with a single tenant or large anchor are more attractive targets, due to a simpler de-tenanting process.

- Only locations that can achieve premium rental rates justify the high cost to convert. Large, coastal markets with high land values and limited logistics supply are likely targets, and include the suburbs of New York, Southern California, San Francisco and Washington, D.C. Even though Class-B/C office rents generally exceed logistics rents in these locations, lower cap rates and tenant improvement costs for logistics properties add to the conversion rationale.

- Logistics-specific requirements further limit what constitutes a feasible site. Logistics users focus on proximity to transportation infrastructure while typical office use prioritizes access to a skilled workforce.

- Regulatory resistance is an obstacle. Office conversions may not generate the same community resistance as retail conversions. Offices are often set back from residential areas, may exist in an industrial overlay zone and loss of sales tax revenue is not a concern. However, the implied loss of whitecollar jobs associated with office conversions can complicate the already-lengthy rezoning/permitting/approval process in these high-cost areas, adding cost and time.

In summary

Despite potential opportunities, the office-to-logistics conversion trend is likely to be minimal. Successful redevelopments will be concentrated in areas with high land costs and limited competition from nearby logistics properties. New supply from this source will take time to come online because resolving existing agreements, demolition, rezoning, entitlement, permitting and approvals take much longer than a typical greenfield logistics development.

ENDNOTES

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2021, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.0 billion square feet (93 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,800 customers principally across two major categories: business-to-business and retail/online fulfillment.