Summary: What’s next for logistics real estate?

That question has been central to our three-part series on supply chains, which launched in April. In this final installment, we study how the following mega trends across the broader logistics ecosystem could affect logistics real estate in the next decade.

- The future of retail relies on convenience, immediacy, and product variety—what we call “Synchronized Commerce”—as retailers and brands respond to Millennial shopping habits and new technologies, such as augmented and virtual reality.

- The future of supply chains requires a focus on greater efficiency driven by technology, including alternative fuels, autonomous vehicles, robotics/automation, and predictive analytics.

- The future of cities can be characterized by increased urbanization with more congestion and a built environment that reflects the further clustering of knowledge centers, shifting demographic trends (greater affluence), and increasingly strained infrastructure.

Logistics real estate will play an integral part in addressing these trends, particularly the following:

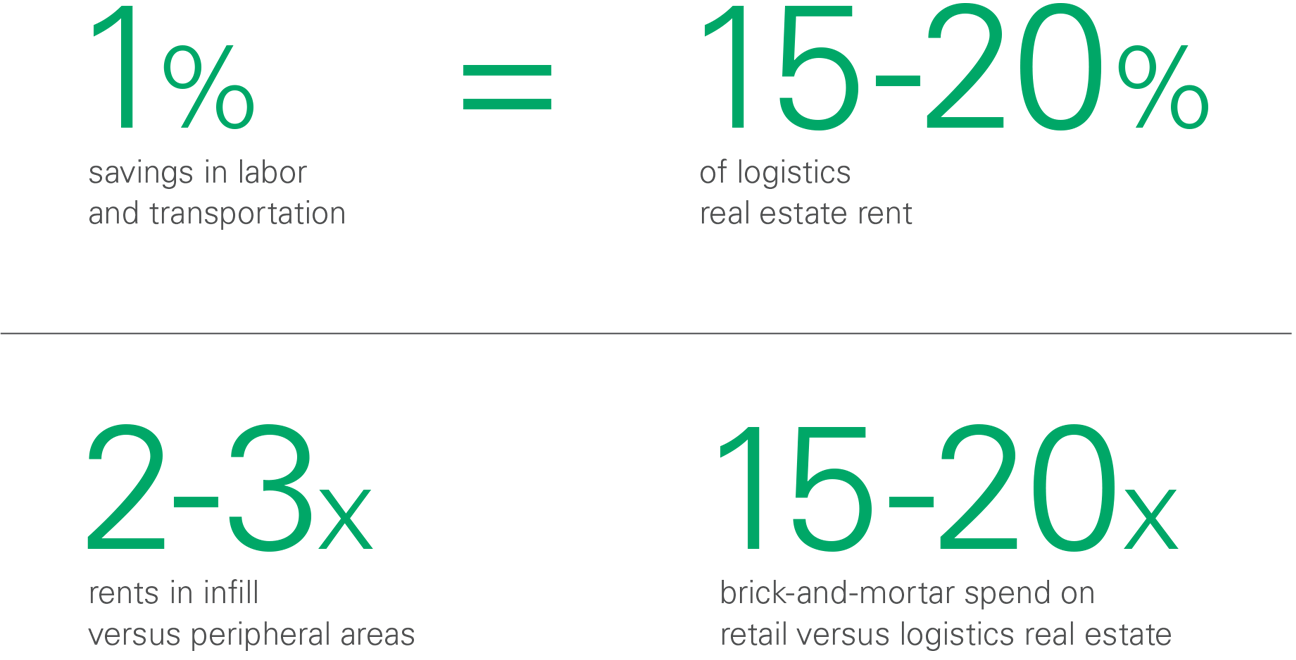

- Supply chain efficiencies from technological developments and changing network configurations will create savings and margin that can flow to retailers, brands, consumers and logistics real estate. Each 1% savings in transportation and labor costs equates to a considerable 15-20% of logistics real estate rent.1

- Logistics real estate that helps retailers execute Synchronized Commerce is positioned for considerable momentum in demand and rent growth. Retailers will have to compete harder on convenience, immediacy, and product variety in executing Synchronized Commerce. This will bring more complexity to supply chains while emphasizing time-to-market and proximity to consumers.

- Rents in the world’s leading infill submarkets have nearly doubled in the last 5 years; we believe this outsized growth will continue.

What is the future of logistics real estate?

Our outlook considers future trends affecting the broader logistics ecosystem, including the future for retailers, cities, and supply chains.

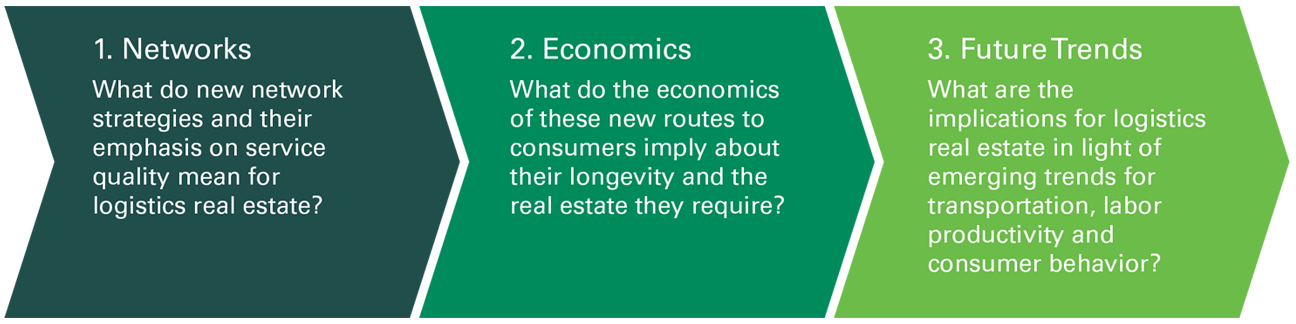

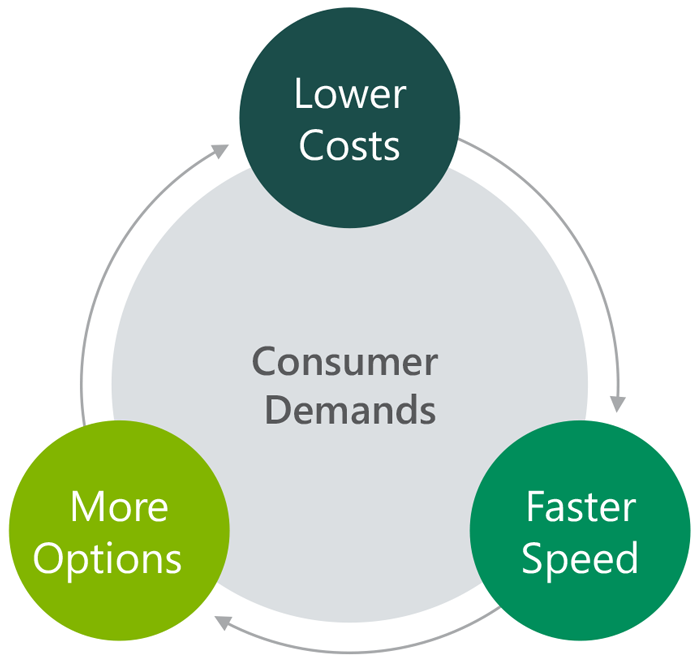

Our first paper in this series looked at the intersection between the trends affecting logistics real estate (globalization, data/automation and transportation innovations) and consumer expectations (demand for lower cost, broader variety and faster delivery). We arrived at three crucial questions for supply chains and logistics real estate:

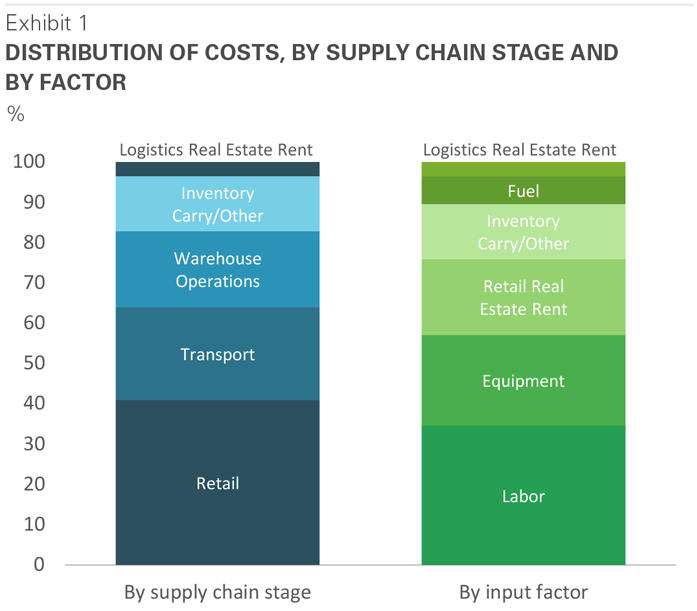

Our previous two papers addressed the first two questions. Importantly, in our second supply chain paper, we outlined the cost structure of supply chains (as shown in the following exhibit). The detail is important not only to showcase the durability of new network strategies but also to lay the groundwork for addressing our third question: what do future trends hold?

This paper is about how the components (input factors) of supply chain costs are expected to change and the impact of these changes on logistics real estate.

In the first section, we analyze the supply chain implications of emerging technologies, such as alternative fuels, autonomous vehicles, robotics/automation and predictive analytics. In the second section, we conclude that securing urban and infill logistics real estate will remain central for revenue generation, even as retailers, cities and supply chains evolve.

Transport innovation. Transportation is the biggest cost in supply chains and consists of fuel, equipment and driver time. Most new technologies in this field can be categorized as alternative fuels and autonomous vehicles. Taken together, these technologies will help alleviate price volatility and could lead to meaningful cost reductions over the medium- and long-term (i.e., >20 years).

- Alternative Fuels. With energy production (e.g., solar panels) and the cost to manufacture storage (e.g., batteries) declining quickly, the trucking industry is on the cusp of substantial change. These technologies are already being adopted and will grow quickly in the next 5-10 years. The economics are most compelling for short-haul city distribution, as alternative fuels also help compliance with increasingly stringent emission standards. The case for regional and long-haul trucking will take time to develop. For logistics real estate, a reduction in transportation costs for city distribution makes e-commerce more sustainable and economically viable. Buildings will need to provide the ability to recharge/refuel vehicles, thus necessitating site improvements.

- Autonomous Vehicles. This technology has the potential to change city landscapes. However, there are numerous challenges such as the viability of the technology, its cost, regulation and popular acceptance. In the near-term, application of this technology will likely be limited to adaptive cruise control (including the ability to follow closely and form convoys) and lane keeping. These technologies increase safety and reduce fuel consumption and could improve driver retention via enhanced working conditions. More material changes will take longer to develop. As a result, these technologies in the short- and medium-term will moderately change the economics of the trucking industry. Such changes imply only a small impact on supply chain strategy, and in turn, may translate to limited implications for logistics real estate.

Robotics/Automation. Labor represents a large cost. Supply chains have a long history of deploying equipment to enhance productivity. Today, that equipment encompasses several levels of complexity and investment and includes (i) racking and forklifts, (ii) sortation equipment, (iii) picking assistance via co-bots, and (iv) highly mechanized installations encompassing all aspects of moving goods through logistics facilities. Currently, supply chain complexity hampers ROIs for higher levels of investment. Complicating factors include seasonality, product variety, and picking frequency. As such, adoption levels are moderate and rising at a gradual pace. Yet, innovation will doubtlessly expand capabilities and reduce cost.

Automation will change the economics of logistics real estate strategies. Labor costs have escalated rapidly due to strong competition for a limited number of workers and labor-intensity arising from e-commerce. Looking forward, automation will shift the nature of human work in logistics facilities, requiring higher skill levels. It will also translate to supply chain savings in the medium- and long-term. Those savings will open up locations—specifically infill—that may not have been viable options due to high wages. At the same time, the risk that robotics and automation will reduce the need for logistics real estate is low. These technologies are space-intensive, and users are introducing them to aid in productivity and labor cost management regardless of how they may or may not affect real estate costs.

Predictive Analytics. Inventory carry cost is a big expense for supply chains. Several factors point to an upward trend, including rising interest rates and the expansion of mass customization and product variety. The Internet of Things (IoT), Big Data, and modern mathematical techniques give retailers and distributors a path to more efficiently allocate inventory and meet consumer needs. Consequently, Predictive Analytics helps retailers cope with rising supply chain volumes, complexity and costs. Digitization of supply chains is asking more of all the constituent pieces in terms of data availability and visibility, logistics real estate included. At the same time, rising consumer demands, such as large product variety and fast time to market, will counteract efficiency gains in inventory allocation. Therefore, the impact on logistics real estate demand seems limited.

Retail Models. As we discussed in detail in our second supply chain paper, retailer models are changing. Traditional brick-and-mortar retailers spend 15-20x on their retail real estate footprint compared with logistics real estate. Yet, this ratio has begun to fall quickly in the age of e-commerce as supply chains grow and retail footprints shrink. Retailers increasingly see their supply chains as a competitive asset rather than a cost center and are prioritizing this capability. Looking forward, retailers will continue to compete with Synchronized Commerce: low cost, more variety, and faster speed. While physical retail real estate will continue to have its place, the shift toward e-commerce is still in the early phase. For supply chains, this means less will be spent on retail and more will be spent on logistics real estate—in particular, facilities in major population centers.

Taken together, service levels (measured by time, not cost) will be the key variable upon which supply chains are optimized. Technology trends will create efficiency in supply chains, with related cost savings. Investments in alternative fuel sources and autonomous vehicles should push transportation costs down considerably over the long-term. Similarly, automation/robotics investments will dramatically decrease labor expenditures. Given the current distribution of supply chain costs, these efficiency gains have significant implications. For example, each 1% savings on transportation and labor equates to 15- 20% of rent for logistics real estate.3

Where will these savings accrue and what are the implications for logistics real estate?

There are three categories of stakeholders with opportunities: (1) retailers, along with the brands that produce retail products; (2) consumers; and (3) logistics real estate. Naturally, retailers and brands would like to keep the margin for themselves, but some will choose to compete on cost, transferring the benefit to consumers. However, the shift toward Synchronized Commerce and its emphasis on convenience, immediacy and product variety should lead to increased complexity in retail and supply chain operations. Well-positioned logistics real estate can help manage that complexity and deliver on the service-level needs of tomorrow’s consumer. Given this over-arching trend, there is a distinct likelihood that real estate will capture a portion of the margin.

Rents in logistics real estate are both a function of customer demand and barriers to supply. Demand for space depends on the value that the real estate creates for supply chains, while barriers to supply limit the ability of customers to secure alternatives. Clearly, rental rates differ between adjacent markets (where distances can span 200-500 miles). They are a function of the size of the consumer market, the affluence of the consumer base, barriers to supply and replacement cost. Rents within major markets are around 1.5-2x higher (and sometimes more) than near-adjacent supply chain markets—such as New York and Central Pennsylvania.

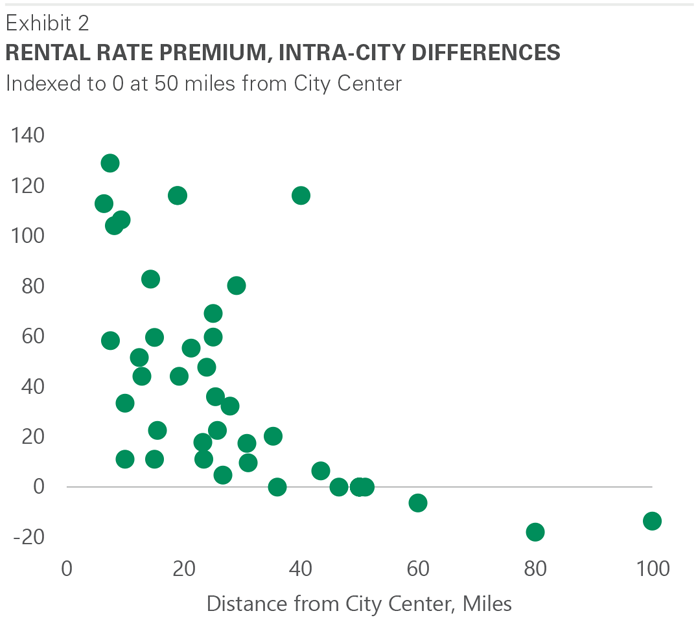

The impact of rising consumer demands is illustrated by rental rate differences within cities. Rental rate differences within markets over distances spanning 75 miles (1-2-hour drive times) illustrate stark differences as shown in the chart below. Prologis Research organized rental rates by submarket and distance to city center for the world’s top seven logistics real estate and consumption markets.4 We found that rents in infill and urban locations are 2-3x those in peripheral locations. This multiplier has risen over time, as consumer demands have increased, congestion has grown, and little new product has come online in urban locations.

The rent gradient should steepen, with higher growth for closer- in submarkets, as urbanization and technology trends coalesce. Already, the combination of retailer priorities, supply chain capabilities and urbanization/congestion has caused increased competition for properties closest to population centers, steepening the rental rate gradient. There are several compounding trends:

- Technology. As it removes barriers to operating in urban environments (e.g., automation can help supply chains cope with high wages in infill and urban environments while electric vehicles can help with emission regulations) and creates a margin opportunity, time will emerge as the inevitable constraint.

- Diverse demand. Requirements are not just confined to the Last Touch® parcel network. The demand profile is highly diversified and includes food and beverage customers, construction materials, furniture companies, municipal uses, and vehicle fleet management.

- Increased congestion. The underlying trend is a lengthening in transit times; what was once proximate will become distant.

- No alternatives to accommodate growth. All this will occur in an increasingly land-constrained, urban environment with few opportunities to supply logistics stock.

As a result, we expect the rent gradient to steepen as customers have the business case, capability and willingness to pay for infill and urban locations. The case for multi-story warehousing and urban redevelopment will strengthen alongside rents, as it addresses both the aging of existing urban product and the scarcity and high cost of land.

Obsolescence risk could rise alongside rapid technological change. Rapid technological changes and the structural supply chain shifts that accompany them could accelerate obsolescence in certain product categories—or create new patterns of obsolescence. Clearer differentiations in asset quality are likely to emerge as some technologies, such as advanced automation/robotics, require certain building specifications such as power, floor flatness or ceiling heights. At the same time, these technologies have not yet fully emerged and judging change is difficult. Risks seem greatest to locations and facilities that benefit from low labor costs or which are removed from major population centers.

Conclusion

Adoption of new technologies is expected to cause aggregate supply chain costs to flatten or fall in the medium-term. Users of logistics real estate may find these technologies unfeasible today; yet, adoption will accelerate with technological maturation and the growing need to overcome logistics challenges. Future-proofed portfolios must account for the following trends:

- More “unknowns”: these include regulation or the pace of technological progress/adoption—as well as “unknown-unknowns.”

- The rise in consumer expectations and the value of time. The growth of cities will drive this trend. Land shortages in urban locations will intensify, widening the disconnect between supply and demand. Labor will likely be in short supply, spurring automation. Hence the ability to handle transportation innovations and automated equipment should be built into current design.

A stringent focus on consumers should lead to outperformance across a range of scenarios. Technological innovations cater to higher service-level requirements. More than before, retailers will emphasize the locations that can optimize savings and capabilities enabled by new technologies.

End Notes

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward- looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forwardlooking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports.

Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries.

Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2018, the company owned or had investments in, on a wholly owned basis or through

co-investment ventures, properties and development projects expected to total approximately 685 million square feet (64 million square meters) in 19 countries.

Prologis leases modern distribution facilities to a diverse base of approximately 5,000 customers across two major categories: business-to-business and retail/online fulfilment.