Automation has the power to revolutionize logistics operations. As capabilities expand alongside declining costs, faster returns on investment (ROIs) are fueling adoption. Three trends are aligning to drive higher levels of automation within our facilities. First, COVID has led to greater absenteeism, further stressing labor availability. Second, technology continues to improve, expanding capabilities and reducing costs. Third, labor-intensive operations, specifically e-commerce, are growing quickly. These users benefit greatly from this technology and are leading adopters.

This dramatic transformation cannot be overstated: What was expected to take years to gain traction is occurring in mere months. As a result, some logistics customers are making significant investments in automation. In this report, the first in a series, we examine the current state of warehouse automation, how it is changing, and impacts on desired building features. Highlights include:

- Automation adoption is currently limited in logistics facilities due to high cost, low flexibility and slow ROIs. Move-in costs for fully automated facilities are 4-5x higher than no-to-low automation move-in costs.1 Additional factors include difficulties in planning and the need for operational flexibility, as well as realities around downtime and integration during implementation.

- Automation is concentrated in e-fulfilment. E-commerce is 3x more labor intensive versus traditional logistics operations,2 with twice the volatility in sales versus brick-and-mortar retail,3 and fast-growing, making it a desirable target for investments that can improve labor productivity and smooth out peaks.

- Automation can open up high-quality locations near end consumers, facilitating expanded direct-to-home delivery. In many cases, site selection today is a trade-off between availability of labor and proximity to the end consumer. In a world of automation, the second factor can take priority, allowing customers to offer faster delivery times and optimize transportation costs.

This report addresses the three top questions surrounding the current state of automation and its future prospects:

- What is automation?

- What is the adoption rate of automation and how is it changing?

- How is automation changing logistics real estate requirements?

What is automation?

Automation aims to improve efficiency. When done well, automated sites are more productive, run more smoothly, have faster processing times, improve worker safety and are more efficient from a total cost standpoint (operating and capital expenses). Key logistics operations typically comprise the following:

- Unloading/receiving

- Put-away

- Storage

- Picking

- Packing

- Loading/shipping

All logistics operations must assess their requirements and capabilities across these functions and invest accordingly. For quite some time, the logistics industry has leveraged a wide range of productivity-enhancing equipment to accomplish these functions, such as racks and forklifts.

To define and segment automation technologies from other types of equipment the key differentiator is autonomy from human control. Here again, some of these productivity-enhancing technologies, including complex conveyance systems, pneumatic rollers and automated guided vehicles, are not new to logistics operations.

Automation technologies can be grouped into two categories:

- Fixed automation. These types of automation tend to be large, bespoke or semi-bespoke, fixed capacity with limited flexibility, and high-priced installations. Common types include:

- Conveyor belts

- Automatic sorters

- Palletizers

- Pallet shuttles

- Automated Storage and Retrieval Systems (AS/RS).

Full fixed automation: Automated Storage & Retrieval System (AS/RS), automated sortation

Partial fixed automation: Conveyors, palletizers, pallet shuttles, vertical lifts

- Mobile and semi-mobile automation. These types of automation tend to be discrete robotics solutions that work in a range of environments and offer greater flexibility for scaling up/down as needed. Common types include:

- Automated Guided Vehicles (AGV) such as autonomous forklifts

- Autonomous Mobile Robots (AMR) such as some co-bots

- Specialized/niche automation such as automated boxing and trailer unloaders

Mobile automation: Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs)

No one solution exists. Many automation solutions aim to address one or two of the six core warehouse functions. Each step engenders substantially different actions, movements, variability and levels of complexity; further, each requires specialized equipment. Integrations between core functions and across automation technologies are especially complex and expensive. For example, pneumatic rollers will accomplish only put-away and picking with dedicated lanes for each. Mobile technologies and co-bots aim at the simplest functions to automate, offering the fastest ROIs and easier integrations while allowing users to build on human talent at the core of operations.

What is the adoption rate of automation and how is it changing?

Logistics users invest in automation primarily to improve labor productivity and through-put, not to reduce square footage. Consequently, adoption rates of automation are linked to labor. E-commerce operations will routinely employ more than three employees per 1,000 square feet.4 The majority of these customers, which represented ~15% of logistics space as of mid-2020,5 have adopted one or several forms of automation. By contrast, traditional fulfillment operations employ one employee per 1,000 square feet on average. Automation adoption by these users is very low. Taken together, adoption of one or more types of automation technologies is between 20-25% across logistics real estate facilities. While operational density can be a by-product of automation, it is not the main goal nor it is common. In fact, reduced congestion in the facility is an important benefit of many types of automation.

Current automation adoption rates vary widely by technology. A 2019 survey of U.S. logistics customers indicated that about 30% of respondents worked in facilities that included conveyor or vertical lift storage – the most common technologies in use. Approximately 8-10% of respondents’ workplaces included AGVs/AMRs, with around the same percentage deploying pick-to-light or pick-to-voice technologies. Fixed automation systems (AS/RS, automated sortation) were relatively uncommon, at 3-5% of respondents. Across these technologies, adoption is concentrated in larger units: For example, those with robotics were 33% larger than average and units with AS/RS or automated sortation systems were three times larger than the average unit.

Today, end-to-end automation is rare and overall adoption rates, particularly for fixed automation, are low for a variety of reasons, including:

- High costs and long payback periods. Many traditional forms of automation are heavily customized for specific uses, which both drives up initial costs and limits secondary use. In addition, the low number of workers in many logistics facilities limits the economic benefits of task/process automation via labor savings.

- Process complexity and planning challenges. Automation is the most prevalent where the following three characteristics overlap: (i) repeated processes; (ii) high volume; and (iii) low day-to-day and month-to-month variability. The greater volatility inherent in e-commerce businesses further compounds the challenges of long-term investments in automation. However, the benefits are especially clear during the holidays and other peak times when labor needs are drastically pronounced.

- Implementation limitations. Supply chains have historically been built for efficiency. There is very little downtime for system upgrades, and interruptions to existing processes bring added cost and risk to operational stability.

- IT considerations and poor data quality. The complexity of automation systems requires the integration of multiple existing systems (e.g., ordering, warehouse management). This means that the traditional barriers to IT modernization apply for automation, as well. A Q1’20 survey by DC Velocity/ARC Advisory Group indicated that the highest-priority technology investment remains Warehouse Management Systems, at 36% of respondents.

- Labor constraints. Historically low unemployment, increasingly complex jobs (e.g. technicians) and remote locations are barriers to implementation.

Newer technologies are solving traditional barriers to adoption. Integration is becoming easier, fixed technologies are increasingly designed for modularity, and mobile automation is being introduced alongside humans. Automation can be an incremental technology that enhances existing processes rather than a fundamental replacement – again, the focus is on labor productivity enhancement and not “dark”, fully-autonomous operations and/or dramatic changes to real estate use. And the consensus is that automation will have financial benefits: according to the DC Velocity survey, 96 percent of respondents (prior to the onset of COVID-19) said they expected the warehouse automation value proposition to increase over the next three years.

How is automation changing logistics real estate requirements?

Automation enables greater choice in location, and most types can be incorporated into any modern facility. We examined two areas of potential change for logistics real estate: functional requirements and locational requirements.

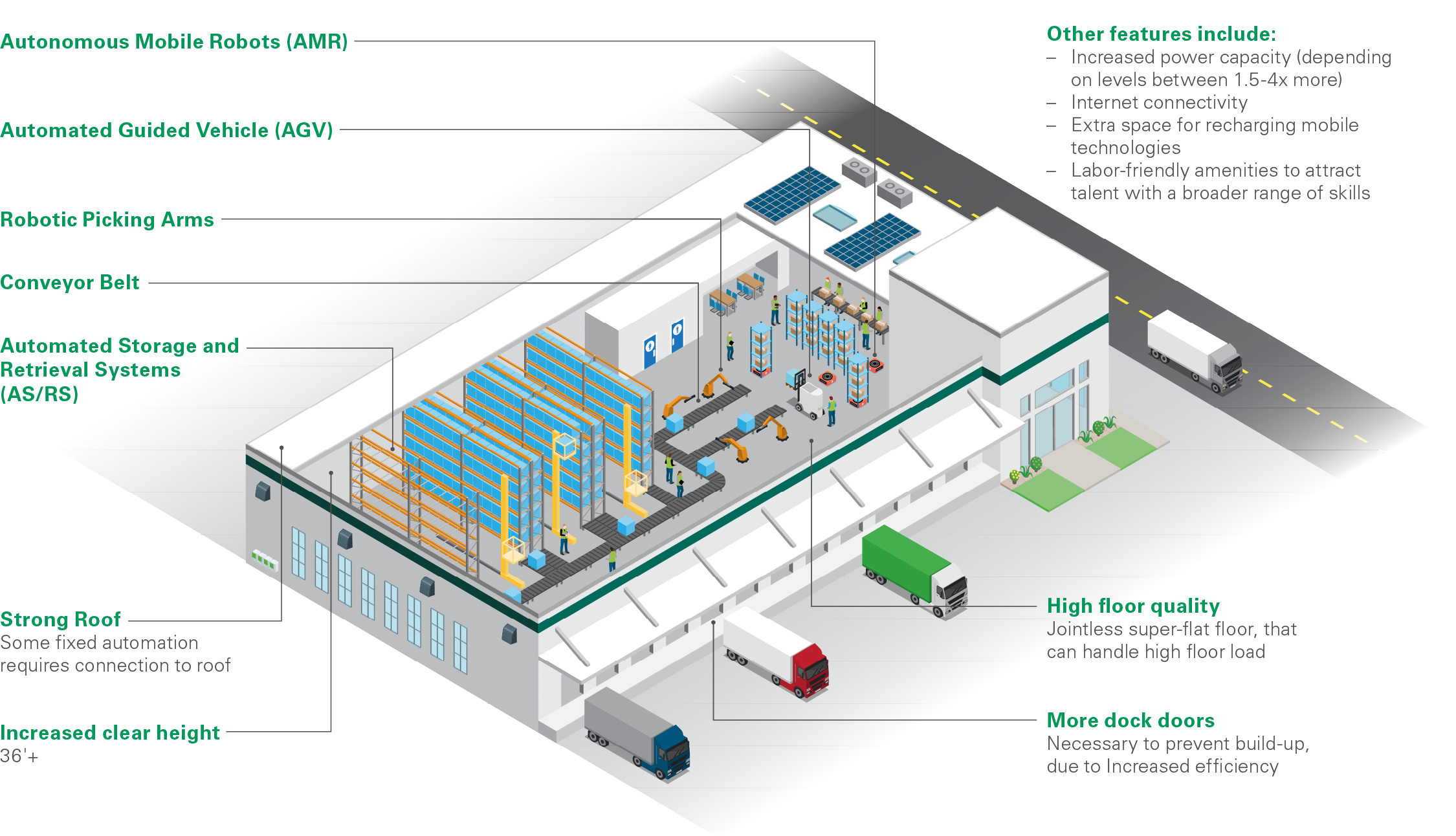

Physical requirements for automation are not changing the rate of functional obsolescence. The shift toward mobile automation and modular fixed automation means that the physical characteristics of buildings matter less as technologies become more flexible. Most necessary features can be retrofitted (e.g., enhanced power requirements). See Exhibit 1 for more details on desired building characteristics.

Automation opens up new and more productive locations. Specifically, automation spurs opportunities for expansions into markets with limited labor pools. On the surface, the disconnect between logistics operations and labor needs may seem like a case for remotely located facilities. However, reducing transportation costs and shortening the distance to consumers is mission-critical to most logistics users. Consequently, they are showing more interest in how automation can help unlock infill and urban locations where labor costs and availability have traditionally been hurdles.

In Summary: Automation is an opportunity for logistics users to optimize their facilities

Automation allows customers to optimize their supply chains via proximity to better locations.

Currently, adoption is low but rising, with pockets of higher adoption and growth in fast-changing segments such as e-fulfilment. On the technology side, the fastest-growing automation solutions are more flexible, more mobile and less tied to physical building characteristics than they were in the past. Of note, automation is not affecting the functional obsolescence of logistics facilities, but rather by decreasing the need to locate close to labor, is opening up newer and more productive locations close to end consumers. In this way, automation is helping supply chains move more quickly into the future – a future where dynamic, productive and well-located logistics facilities help customers literally deliver the goods.

Exhibit 1

AUTOMATION AND LOGISTICS REAL ESTATE REQUIREMENTS

Endnotes

1. Prologis Research2. Prologis Research U.S. customer survey on labor, 20193. Public company filings, Prologis Research4. Prologis Research U.S. customer survey on labor, 2019; Prologis Research European

customer survey on labor, 20185. Prologis ResearchForward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 976 million square feet (91 million square meters) in 19 countries.

Prologis leases modern distribution facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.