Product name: Prologis European Logistics Fund (the "Fund")

Legal entity identifier: 213800UUB8VTV263F198

Does this financial product have a sustainable investment objective?

| ☐ Yes | ☒ No |

| ☐ It will make a minimum of sustainable investments with an environmental objective: ___%

☐ in economic activities that qualify as environmentally sustainable under the EU Taxonomy ☐ in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy |

☐ It promotes Environmental/Social (E/S) characteristics and while it does not have as its objective a sustainable investment, it had a proportion of __% of sustainable investments

☐ with an environmental objective in economic activities that qualify as environmentally sustainable under the EU Taxonomy ☐ with an environmental objective in economic activities that do not qualify as environmentally sustainable under the EU Taxonomy ☐ with a social objective |

| ☐ It will make a minimum of sustainable investments with a social objective: __% | ☒ It promotes E/S characteristics, but will not make any sustainable investments |

A. Summary

Prologis European Logistics Fund (the “Fund”) promotes sustainable practices in the acquisition and management of real estate investments. Prologis Management II S.à r.l., a Prologis affiliate (the “Management Company”) incorporates the Environmental Characteristics (as defined below) through its sourcing and investment approach by, among other things, identifying real estate assets to acquire where there is opportunity to mitigate negative environmental impacts by integrating LED lighting and solar power generation capacity into such assets.

The binding elements of the investment strategy are:

- The mitigation of negative environmental impacts of the Fund’s real estate assets by installing LED lighting and increasing solar power generation capacity; and

- The exclusion of real estate assets that are involved in the extraction, storage, transport, or manufacture of fossil fuels.

B. No sustainable investment objective

This financial product promotes environmental or social characteristics, but does not have as its objective a sustainable investment.

C. Environmental or social characteristics of the financial product

The Fund promotes sustainable practices in the acquisition and management of real estate investments. The Fund has and will continue to increase the amount of LED lighting installed in its real estate assets and increase the solar power generation capacity of its real estate assets in order to reduce the environmental impacts of such assets (the “Environmental Characteristics”).<

A reference benchmark has not been designated for the purpose of attaining the Environmental Characteristics promoted by the Fund.

D. Investment Strategy

What investment strategy does this financial product follow and how is the strategy implemented in the investment process on a continuous basis?

The Management Company incorporates the Environmental Characteristics through its sourcing and investment approach by, among other things, identifying real estate assets to acquire where there is opportunity to mitigate negative environmental impacts by integrating LED lighting and solar power generation capacity into such assets.

New investments

The Prologis development pipeline allows opportunities for the Fund to invest in assets that are designed to sustainable building certification standards.

All assets developed by Prologis and which are acquired by the Fund are designed to sustainable building certification standards (including BREEAM, LEED and DGNB) relevant to the asset’s geography.

When the Fund acquires newly built assets from other third parties, the Management Company will review the buildings’ performance and impact in an effort to select buildings that already meet sustainable building certification standards.

The Fund also acquires assets that are not newly built. For all acquisitions, the Fund assesses energy use and environmental impacts, and assesses opportunities to incorporate Environmental Characteristics into the investment.

Existing investments

The Management Company will also update and retrofit some of the existing assets owned by the Fund to reduce environmental impacts. The Fund’s investment strategy considers opportunities to improve the environmental performance potential of its existing assets, such as by installing LED lighting and increasing solar power generation capacity.

What are the binding elements of the investment strategy used to select the investments to attain each of the environmental or social characteristics promoted by this financial product?

The binding elements of the investment strategy are:

- The mitigation of negative environmental impacts of the Fund’s real estate assets by installing LED lighting and increasing solar power generation capacity; and

- The exclusion of real estate assets that are involved in the extraction, storage, transport, or manufacture of fossil fuels.

What is the policy to assess good governance practices of the investee companies?

As the Fund invests in real estate assets, the assessment of good governance practices in relation to investee companies is not directly applicable.

Nonetheless, Prologis and the Management Company ensure that good governance practices are followed by setting clear expectations with respect to transparency and accountability around sustainability aspects of the Fund’s portfolio towards the Fund’s investors. Prologis and the Management Company promote high standards of ethics and governance as key elements of success. All Prologis personnel are subject to the Prologis Code of Ethics and Business conduct, published on the Prologis website. Furthermore, all of the Fund’s suppliers are subject to the Prologis Supplier Code of Conduct. Each year, Prologis employees and board members are required to complete ethics training. Prologis also provides training on its Code of Ethics and Business Conduct, Foreign Corrupt Practices Act, harassment, and insider trading.

Does this financial product consider principal adverse impacts on sustainability factors?

☒ Yes

The Management Company considers the potential principal adverse impacts (PAI) of its investment decisions by assessing potential PAI during the due diligence process before investment decisions are made. This includes the two mandatory adverse sustainability indicators applicable to investments in real estate assets and to the Fund, as available under Annex I of the Commission Delegated Regulation (2022/1288):

- Exposure to energy inefficient real estate assets; and

- Exposure to fossil fuels through real estate assets (the Fund does not invest in real estate assets that are involved in the extraction, storage, transport or manufacture of fossil fuels).

As of financial year 2023, information on such potential PAI will be reported on in the periodic report of the Fund, which will be made available to investors on an annual basis.

☐ No

E. Proportion of investments

What is the planned asset allocation for this financial product?

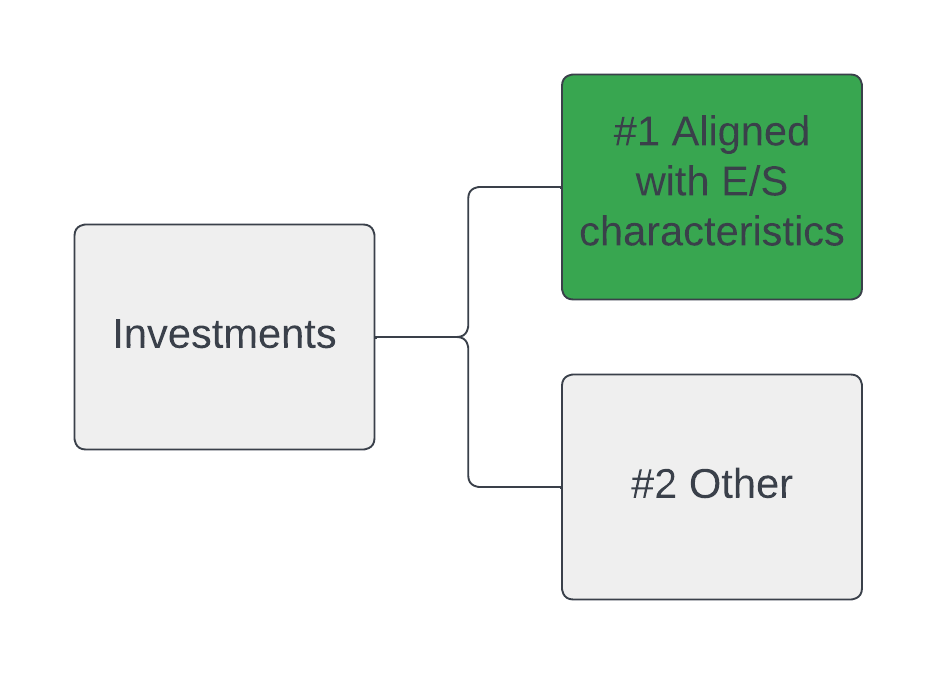

The Management Company will invest a minimum proportion of 90% of the Fund’s total assets in real estate investments used to attain any of the Environmental Characteristics.

In relation to "#2 Other" investments, Article 4.1 of the Fund’s Investment Guidelines permit up to 10% of the Fund’s net assets (and therefore less than 10% of the Fund’s total assets, taking into account any leverage) to be made in temporary liquid investments, including derivatives for hedging purposes.

#1 Aligned with the E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

What is the minimum share of investments with an environmental objective aligned with the EU Taxonomy? (including what methodology is used for the calculation of the alignment with the EU Taxonomy and why; and what the minimum share of transitional and enabling activities)

The Fund does not currently commit to invest in any “sustainable investment” within the meaning of the EU Taxonomy. However, this position will be kept under review as the underlying rules are finalised and the availability of reliable data increases over time. As the Fund does not commit to invest in any “sustainable investment” within the meaning of the EU Taxonomy, the minimum share of investments in transitional and enabling activities within the meaning of the Taxonomy Regulation is therefore also set at 0%.

The EU Taxonomy sets out a "do no significant harm" principle by which Taxonomy-aligned investments should not significantly harm EU Taxonomy objectives and is accompanied by specific EU criteria.

The "do no significant harm" principle applies only to those investments underlying the financial product that take into account the EU criteria for environmentally sustainable economic activities. The investments underlying the remaining portion of this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Any other sustainable investments must also not significantly harm any environmental or social objectives.

What is the minimum share of sustainable investments with an environmental objective that are not aligned with the EU Taxonomy?

The Fund promotes the Environmental Characteristics but does not commit to making any “sustainable investments” within the meaning of the EU Taxonomy. As a consequence, the Fund does not commit to a minimum share of sustainable investments with an environmental objective that are not aligned with the EU Taxonomy.

What investments are included under “#2 Other”, what is their purpose and are there any minimum environmental or social safeguards?

In relation to "#2 Other" investments, Article 4.1 of the Fund’s Investment Guidelines permit up to 10% of the Fund’s net assets (and therefore less than 10% of the Fund’s total assets, taking into account any leverage) to be made in temporary liquid investments, including derivatives for hedging purposes. Regarding derivatives, the Fund is subject to fluctuations in interest rates and in foreign currency exchange rates as a consequence of the revenues of some of its properties being denominated in currencies other than the euro. As such, the Fund enters into derivative transactions on a temporary basis for hedging purposes to mitigate risks resulting from fluctuations in foreign currency exchange rates (as necessary). In addition, the Fund enters into interest rate derivative transactions on a temporary basis for hedging purposes to mitigate risks resulting from fluctuations in interest rates (as necessary).

As such, the “Other” investments include investments in liquid assets (ancillary liquid assets, bank deposits and money market instruments) held for the purposes of servicing the day-to-day requirements of the Fund. Due to the neutral nature of the asset, no minimum safeguards have been put in place.

F. Monitoring of environmental or social characteristics

What sustainability indicators are used to measure the attainment of the environmental or social characteristics promoted by this financial product?

To assess, measure and monitor the attainment of the Environmental Characteristics promoted by the Fund, the Management Company will use the following core sustainability indicators:

- Percentage of total portfolio coverage of investee properties (based on sqm) with LED lighting installed; and

- Solar capacity installed on investee properties in megawatt-peak.

How are the environmental or social characteristics and the sustainability indicators monitored throughout the lifecycle of the financial product and the related internal/external control mechanism?

In 2016, Prologis set public goals related to LED & solar. Prologis globally tracks these characteristics and projects their trajectory, both at the global level and by Fund. The Fund sets annual KPI’s for its LED/solar goals which are included in its Annual Business Plan which it reports to investors. These are measured and reported periodically.

G. Methodologies

What is the methodology to measure the attainment of the environmental or social characteristics promoted by the financial product using the sustainability indicators?

There are two different metrics utilized, pertinent to each of the promoted characteristics:

Regarding LED coverage : % of floor area of the warehouse and office areas of the portfolio.

Regarding solar : Installed solar capacity, measured in megawatt-peak

H. Data sources and processing

What are the data sources used to attain each of the environmental or social characteristics including the measures taken to ensure data quality, how data is processed and the proportion of data that is estimated?

Regarding LED, Prologis tracks the coverage achieved with LED lighting in the office and warehouse spaces in its global portfolio within property and unit characteristics through the use of a global database utilizing the actual numbers available.

For solar coverage, the relevant data is manually tracked in the Prologis energy team’s Global Solar Tracker (GST). When a property is acquired, any solar data is recorded in GST both by the Fund management and energy teams. If the solar project is initiated after the acquisition, this data is first recorded by the energy team and the GST is updated. The GST reports the numbers following an approval process.

I. Limitations to methodologies and data

What are the limitations to the methodologies and data sources? (Including how such limitations do not affect the attainment of the environmental or social characteristics and the actions taken to address such limitations)

LED : measuring only office/warehouse space does exclude a small part of the floor area (for example mezzanine space) but since this relates to a small part of the total floor area, the impact would be minor. In addition, the LED tracking process is dependent on the local teams’ operational efficiency/procedures and there could be a possibility of underreporting the numbers for a particular quarter if an LED conversion is not entered into our systems timely. Periodical checks on the installed LED lighting are carried out, so any increase/decrease would be evaluated, reducing any chances of error.

Solar : the data provided for solar is manually made available by the Prologis energy team and is not yet part of an automated global database, thus is reliant on the energy team’s efficient operational procedures. Periodical checks on the installed solar capacity are carried out, so any increase/decrease would be evaluated, reducing any chances of error.

J. Due diligence

What is the due diligence carried out on the underlying assets and what are the internal and external controls in place?

Data is gathered considering building energy efficiency, green building certifications (if any), and the existence of LED lighting and/or solar installations.

K. Engagement policies

Is engagement part of the environmental or social investment strategy?

☐ Yes

☒ No

L. Reference benchmark

Has a reference benchmark been designated for the purpose of attaining these characteristics promoted by the financial product?

☐ Yes

☒ No