Broad-Based Demand Drives Logistics Real Estate

Demand for logistics real estate is increasingly global and broad-based, the result of which has been a remarkable period of strength in recent years. This has occurred in spite of modest economic growth overall. The changing nature of consumption is the primary underpinning of this outperformance and the most prominent force shaping future demand.

This demand phenomenon has been covered in recent Prologis Research white papers, specifically (i) consumption and the growth of e-commerce and (ii) supply chain reconfiguration, undersupply and the importance of logistics clusters. Market vacancy rates are among their lowest in history in many markets around the world, alongside considerable recoveries of rental rates. Low supply also has played a key role; we covered this topic in a previous white paper.

- Consumption is the main driver of logistics real estate and it outperforms overall economic growth. E-commerce—with its rapid growth, high intensity of real estate use and space demand, and increasing need to locate within and adjacent to major population centers—is causing a shift in how goods are distributed and augments this demand trend.

- Supply chain modernization is an important driver in mature economies, especially in Europe and Japan.

- New supply chains, driven by the emergence of the middle class, are an important driver in emerging markets.

- Trade growth for the types of goods that flow through logistics real estate buildings still outperforms economic growth, adding to demand in some of the largest and most supply-constrained markets in the world.

INTRODUCTION

Our analysis is organized into three sections: (i) introducing a new framework for classifying customers and their use of space; (ii) identifying the demand drivers of logistics real estate and how they are changing; and (iii) implications for the future.

I. INTRODUCING A NEW FRAMEWORK FOR LOGISTICS REAL ESTATE DEMAND

Logistics real estate facilities are versatile and can provide for a wide range of uses if located and constructed at the outset with an eye to the future. Global supply chains are complex and do not fit neatly into a simple framework. With such high variety, a complete picture of market trends, along with specific opportunities and risks, is not possible. Traditional analyses of customers have focused solely on their industries and do not truly capture the complexity or variety of logistics real estate demand. In order to understand the true nature of changes in the industry and their drivers, a more complete framework would address the multiple rationales for customer requirements, specifically:

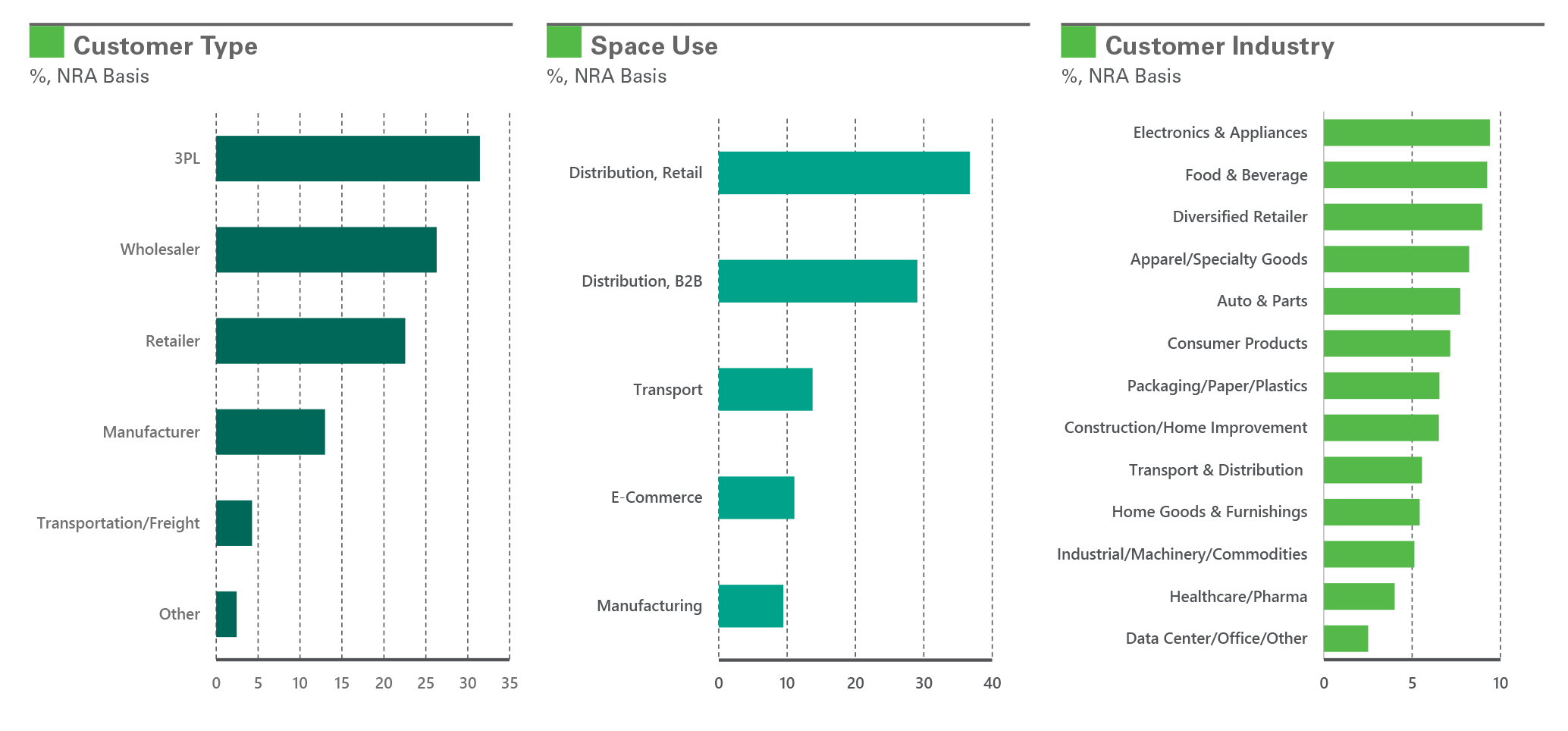

- Who. What type of customer leases logistics real estate? Users participate in all stages of the supply chain and we have identified five distinct categories. They may be an end retailer, a wholesaler, a transportation company, a manufacturer or a third-party logistics provider (3PL) working on behalf of other customer types.

- What. How do customers use the facility? Logistics real estate facilities can serve many functions, but they typically fit into five primary uses: business to business distribution, retail store distribution, business to consumer/e-commerce fulfillment and manufacturing. Often, multiple uses occur within a facility.

- Why. Which industry propels the activity? This is the conventional categorization of customers. We have identified 14 key customer industry groups, detailed in the exhibit below.

This enhanced framework offers more insights into industry growth. Expanding the framework from just industry, which classifies requirements 10-15 ways, to this more complete framework results in thousands of classifications. For example, customers generally fall into one of three principal customer type categories–3PL, wholesaler or retailer–each representing 25-35% of Prologis square footage without an outsized concentration in any category. Similarly, customer industries span more than a dozen categories with more than 5% of square footage, yet without a high concentration in any category (all have less than 10% of square footage). Putting these classifications together, clusters of customer requirements emerge that are more illustrative of their true economic nature and the associated opportunities and risks. Such detail better reveals how the industry is evolving, and can allow for better positioning of logistics real estate facilities that align with areas of demand growth.

II. IDENTIFYING LOGISTICS REAL ESTATE DEMAND DRIVERS AND THEIR EVOLUTION

Demand for logistics real estate is healthy, matching or exceeding past rates of growth. The U.S. is on pace to grow by 250 million square feet or more in 2016 for the fourth year in a row. Yet, headline economic figures have been soft and below averages. Nowhere is this trend clearer than within global trade, a traditional demand driver of logistics real estate. Our analysis of the global footprint of logistics real estate customers highlights the changing nature of the relationship between logistics real estate demand and its drivers. In this section, we examine the trend in trade and the performance of port-related submarkets. To fully connect economic drivers with market performance, we also briefly revisit the other fundamental drivers of logistics real estate, consumption and supply chain reconfiguration.

Individually, these trends are idiosyncratic and can be variable at times. Yet, they have unified to drive robust demand, one where the logistics expansion is well ahead of, and outperforming, the economic recovery, a trend that seems likely to continue.

Outperformance of trade growth continues, although it has become less pronounced than in the past. For the past several decades, the expansion and modernization of supply chains globally has increased the need for logistics real estate facilities near key trade hubs. The growth of trade has been considerable over the decades, with annual growth averaging 9% in the 1990s and 8% in the 2000s (before the recession), according to the International Monetary Fund (IMF). More recently, growth has averaged just 3% in the last five years, barely keeping pace with overall economic growth.

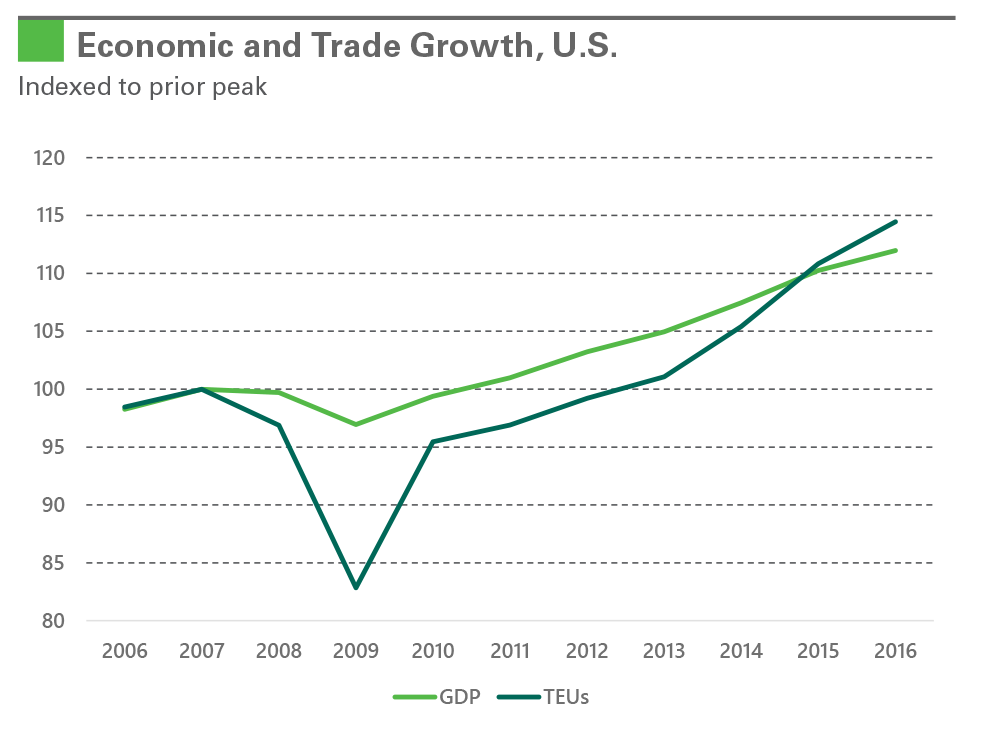

There is an important difference between the reported dollar volume, which are the commonly referenced statistics, and the volume of containerized

trade, which drives demand for logistics real estate. Growth in containerized trade in the U.S. continues to have a steeper trajectory than overall economic growth; TEUs are up more than 15% over the last five years, well ahead of economic growth. The slowdown in trade is in industries that do not impact demand for logistics real estate, like commodities. Oil makes up a big part of global goods trade, reaching a peak of more than 20% of merchandise trade value in the U.S. in 2008, based on data from the World Trade Organization. The growth of alternative energy sources, such as natural gas exploration and fracking in the U.S., has reduced the need for imported energy. Separately, there have also been short-term factors limiting trade growth. The slow economic recovery in key trade oriented economies, specifically Europe, depressed global trade growth in recent years. Europe accounts for 15% of world GDP, but nearly 35% of global merchandise imports, according to the IMF and World Trade Organization (WTO).

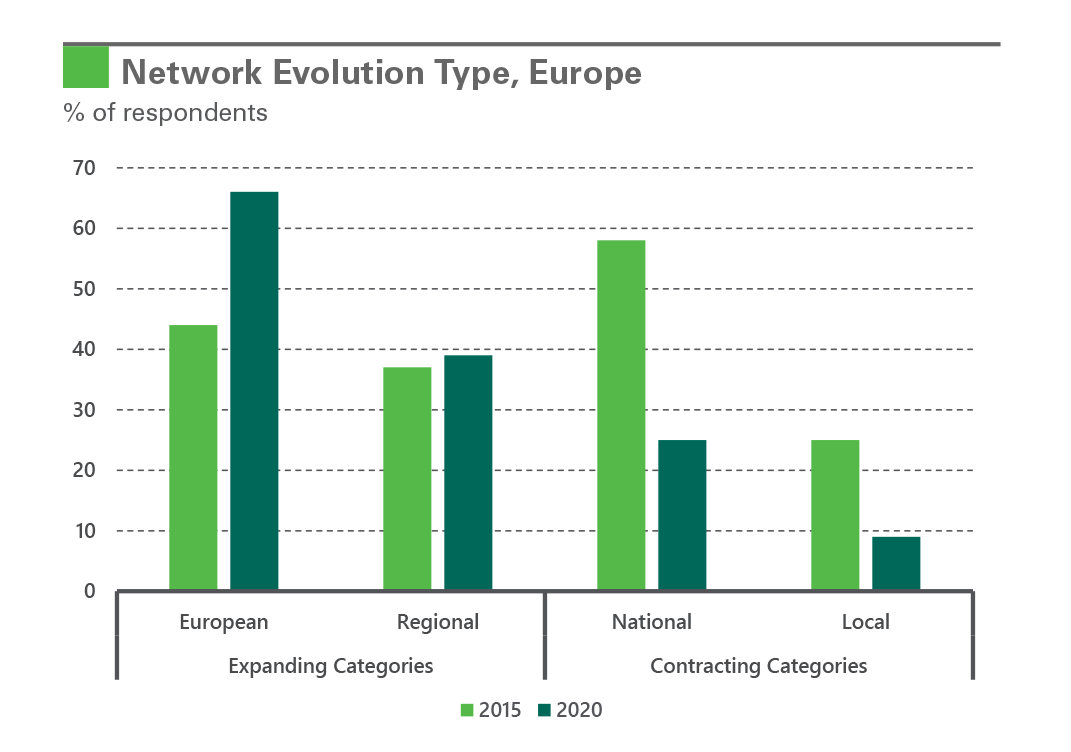

Logistics real estate demand is above historical averages, including in markets adjacent to major ports such as Southern California and Northern Europe. Demand has fully recovered in these markets despite slowing trade growth. As a result, the vacancy rate is less than 2% in Los Angeles and less than 4% in Northern Europe, according to data from CBRE, Jones Lang LaSalle, and Gerald Eve. The variability and slow pace of trade growth has had a limited impact on the logistics real estate industry. How is this possible with just moderate growth in trade? At their core, these are major population centers where local economic and consumption activity is the principal demand driver. In addition, supply chains are still catching up with past growth – they still need to be reconfigured and optimized for the globalization that occurred in the 1990s and 2000s. This catch-up creates demand in excess of what might be indicated by current economic and trade trends alone. This trend is not yet exhausted, either. In Europe, for example, supply chains remain mostly local or nationally focused, but are intended to be European or regionally focused in time, as revealed by a survey of customers conducted in early 2016.

Economists still expect trade growth to outperform, although that may have only a muted impact on logistics real estate. Trade growth is expected to be 3.8% in 2017 and 4.2% in 2018, each ahead of economic growth, according to the International Monetary Fund. To be sure, the current political climate has created uncertainty in the outlook. However, looking backwards, past weak trade growth did not translate to weak logistics market demand. Looking forward, there are multiple other (more important) demand drivers for logistics real estate, specifically consumption and supply chain reconfiguration, which together will continue to propel the logistics real estate markets.

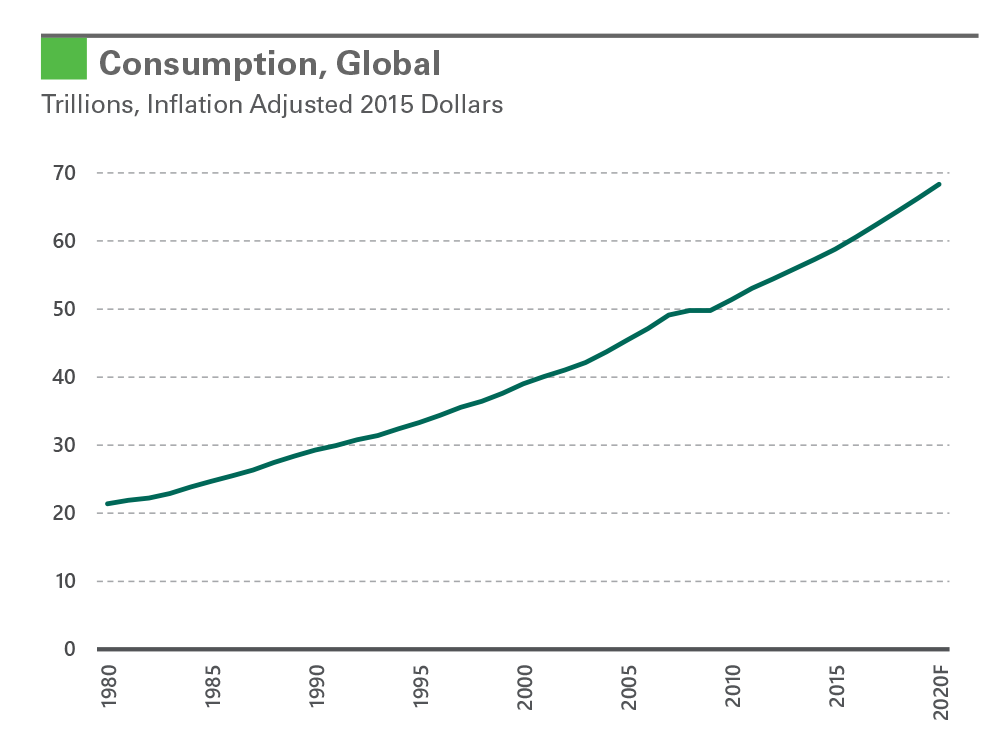

Consumption is the main driver of logistics real estate demand. Among the principal demand drivers, the relative size of markets is most closely correlated with the amount of consumption within each respective market. This relationship is natural; consumption accounts for the majority of economic activity. Global consumption has expanded by 15% from 2010 to 2015, after adjusting for inflation, according to IMF data. However, consumption models are evolving, and so too have demand drivers for logistics real estate.

E-commerce has contributed to the outperformance of logistics real estate, a trend that seems likely to continue. Within the Prologis portfolio, e-commerce leasing accounts for approximately 20% of new leasing, up from less than 5% five years ago. This growth has been driven by a combination of growth in the e-commerce industry and the intensity of use of the activity. Global e-commerce sales are forecast to grow by more than 150% over the next five years, due to a greater propensity to spend online, driven by growth in new geographies (like Asia), new technologies (virtual reality) and demographics (like Millennials entering their peak spending years). In addition, e-commerce-driven occupiers are very intensive users of logistics real estate. Prologis Research estimates that these users require between 2.5-3.0x the logistics space compared to typical distribution activities. For more information, please see this white paper regarding e-commerce and logistics real estate.

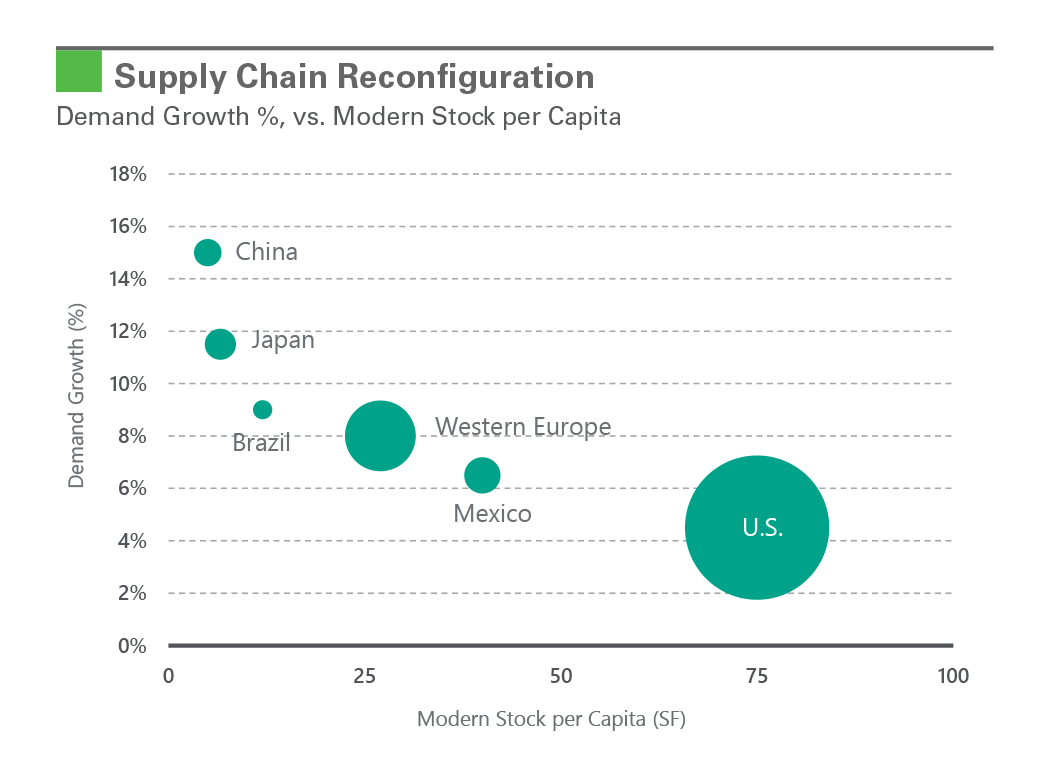

Supply chain reconfiguration and modernization add to the global demand for new facilities. The adoption rate of modern logistics real estate is still low in many parts of the world. In Europe, we estimate that less than 20% of logistics stock is modern. In Japan, the share is less than 5%, and it is even lower in emerging markets, including China and Brazil. A close review of market dynamics reveals the rate of demand growth for logistics real estate has an inverse relationship to the existing amount of modern stock per capita. Many markets around the world are still being established and enjoy a rate of demand growth that far exceeds economic and demographic growth.

Reconfiguration creates demand in many markets of the world. This trend, along with positive consumption and trade growth, is driving the need for modern stock in markets such as China, Japan, Brazil and Europe. Customers in these markets, particularly, are upgrading from outdated, often small and owner-occupied facilities to newer facilities in premium locations. Simultaneously, consolidation of operations into more modern facilities is improving efficiency and adding to the demand for modern stock. The formation and growth of logistics real estate clusters is detailed further in this white paper.

III. CONNECTING INSIGHTS WITH LOGISTICS REAL ESTATE RISKS AND OPPORTUNITIES

Consumption will continue to propel growth. In line with the global economy, space occupied by industries aimed at serving consumer households represents more than 80% of the Prologis global customer footprint. In general, this proportion is slightly higher in developed economies such as Japan, the U.S. and the UK. As the consumer classes continue to expand in emerging economies such as China and Mexico, demand for logistics real estate should follow suit.

Additionally, the nature of consumption is changing rapidly, a fact that is reflected in leasing activity by building function. While space oriented toward distribution to retail stores and other businesses represents approximately two-thirds of the customer footprint, the amount of space dedicated to e-commerce fulfilment has grown most rapidly in recent years, and is poised to continue.

The customer base exhibits broad diversity. No industry represents more than 10% of the Prologis global customer footprint. Furthermore, retail, wholesale and 3PL customer types each account for about one-quarter to one-third of the customer base, further illustrating the diversity of the customer footprint. Customers with more specialized space requirements, such as manufacturers and transportation/freight specialists comprise a much smaller proportion of demand. This diversity supports the stability of logistics real estate demand even as individual industries undergo phases of expansion or contraction.

Flexibility is critical. One of the most prominent insights from this advanced framework is that while common practices exist, there is a range of potential ways that customers in a particular industry, stage of the supply chain or geography use logistics real estate. More than half of the Prologis global customer footprint is in space being used for two or more functions. Buildings that are well-located and well-designed for multiple uses should therefore have access to a deeper pool of potential users.

CONCLUSION

Logistics real estate remains a growth industry due to its multiple structural demand drivers rooted in serving the consumption needs of the global economy. Our research reveals new findings. The industry’s exposure to the entire supply chain creates a high level of diversity by industry and customer type. In turn, there are multiple fundamental economic drivers that propel the industry forward, specifically consumption, trade and supply chain reconfiguration. As it pertains to trade as an industry driver, it still has created some demand despite headlines to the contrary. Global trade continues to grow and keep pace with overall economic activity. More importantly, there is a distinction between the reported dollar volume of trade and the growth of containerized goods that flow through logistics facilities (which outperform).

The industry’s outlook is positive. Whatever the direction global trade takes in the coming years, it is important to recognize the health of port-oriented submarkets despite the deceleration of trade growth. These markets have diverse demand drivers - local consumption and supply chain reconfiguration have more than picked up the slack left by less pronounced trade growth. Indeed, these other trends have accelerated in recent years in all types of markets around the world. They are structural trends, such as the growth of consumer classes in emerging economies and the rapid expansion of e-commerce sales, which together emphasize the distribution of goods to major population centers. They are likely to dovetail with ongoing economic growth, especially for categories helpful to logistics real estate demand, such as the recovery in U.S. homebuilding and household formation generally.

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2016, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 665 million square feet (61.8 million square meters) in 20 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment.