Summary

Growth in the Mexican logistics real estate industry is underpinned by multiple structural drivers. This paper examines three of the trends shaping operating conditions across the country:

- Changing demographics, particularly rising affluence and a young urban population that together are affecting how customers choose and use logistics space

- A vast undersupply of modern-grade facilities that meet a combination of superior locations and building features which are suitable for consumer-oriented distribution space

- Rapid growth of e-commerce

What does it all mean?

For investors, demand is expanding to more customers whose core business activity is driven by durable structural demand drivers, reducing dependency on cyclical economic growth.

For customers, competition for modern-grade buildings is intensifying. Forward-thinking strategies include locking in long-term leases, migrating to build-to-suit, and pre-leasing speculative properties.

I. Introduction

Logistics real estate in Mexico has evolved considerably as customers have grown and their affinity for modern product has become more prevalent. Since the birth of the institutional-grade asset class in the early 2000s, logistics real estate investment strategies have migrated from predominantly production-oriented market exposure in northern Mexico to current hybrid investment strategies. Consumption-oriented regional distribution servicing Mexico City and, to a lesser degree, Monterrey and Guadalajara is playing an increasingly important role.

II. Logistics Real Estate in Mexico is a Growth Industry

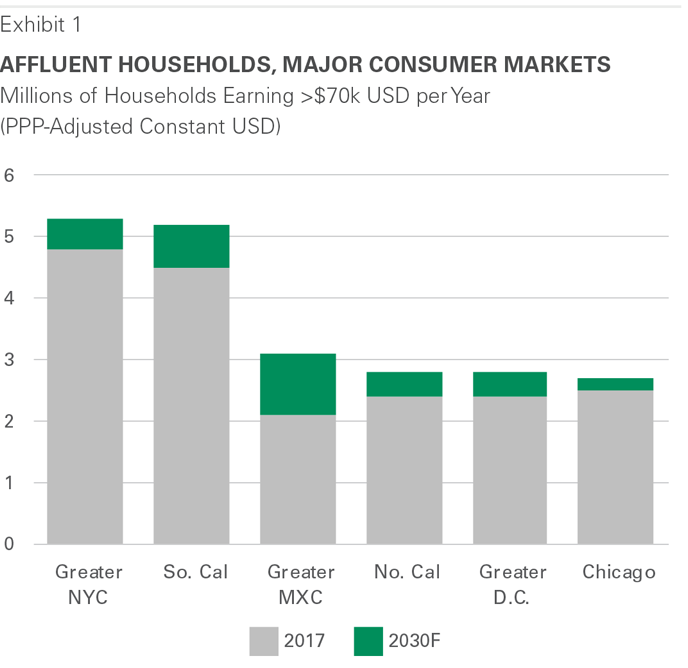

The broader Mexico City region is among the largest established urban consumer markets in the world. Logistics real estate demand in Mexico City is shaped by the adoption of modern logistics facilities and demographics that are unfolding over time. Although not completely decoupled from the cyclical macro environment, these structural drivers have been increasingly visible in recent years as demand for logistics real estate in Mexico City has outperformed the slower economic growth in the macroeconomy. Rising affluence and a young population entering the workforce underpin this outperformance. Of note, the broader Mexico City metropolis includes 2.1 million households earning more than the equivalent of $70,000 USD per annum (PPP-adjusted), representing the potential market depth of frequent and high volume online shoppers.1 By comparison, this is notably larger than other well-established logistics markets in North America, such as Dallas, Atlanta and Miami. In the next decade, another one million households should rise above the $70,000 threshold and the Greater Mexico City region will become the third-largest consumer market in North America.2 This affluence is driving customer demand for logistics real estate, especially from multinational retailers and e-commerce players entering and expanding in the market.

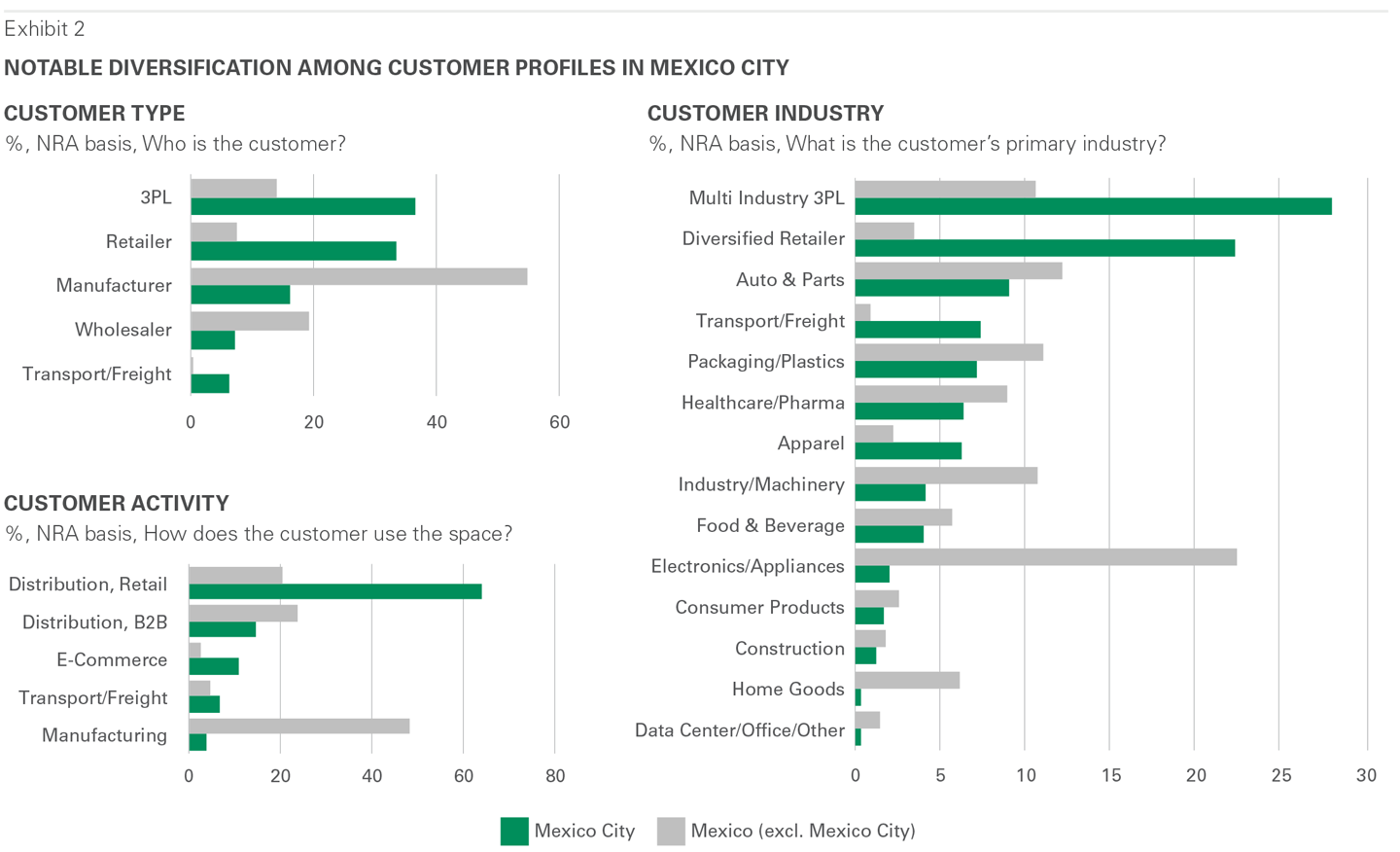

Growing consumption-end demand in Mexico City is driven by the need to service everyday needs. We see broad diversity in how consumption-end customers use their logistics space. To better understand customer activity, Prologis Research created a proprietary analysis, which tracks customer trends globally through three discrete lenses:

-

Who is the customer?

-

How does the customer use the space?

-

What is the customer’s primary industry?

Industry exposure in Mexico City is well- diversified, with about half of these customers within retail or multi-industry 3PL that service the everday needs of consumers. In addition, 75% of customer operations in Mexico City goes toward distribution to retail stores or e-commerce. The inherent diversity of industry and space utilization found in consumption-end logistics markets reduces risk to any one industry trend or operation. (For more on customer trends in the U.S., please click here.)

Note: Industry classifications do not sum to 100%. The balance is ascribable to units where 3PL customers have more than one industry type present. Customer profiles include assets own by FIBRA Prologis, and Prologis balance sheet assets.

Mexico City is vastly undersupplied of modern logistics stock. Unique to operating environments in consumption-oriented emerging markets is a supply-side structural driver, chiefly the adoption rate of modern logistics facilities. For example, the Greater Mexico City region includes some 90 million square feet3 of modern logistics stock. These are facilities that a multinational customer might lease and product built for High-Through-Put DistributionTM with modern building specs, such as elevated ceiling heights and low land coverage ratio in areas near key highways. Modern stock per consumer household in the region is some 15 square feet. By comparision, the same ratio in the United States is around 80 square feet per household.4

-

Mexico City’s undersupply is the result of the following:

-

Supply chain modernization that only began less than

25 years ago with limited competitor expertise on modern logistics development -

Scarcity of well-located sites and access to key roadways in the CTT along I-57 south of the tollboth

-

Lengthy entitlement processes for ejido land

-

Security

-

Topography

Scarcity of modern stock leads to higher demand growth as the adoption rate rises. Market vacancies have improved substantially in recent years in Mexico City, which now is among the lowest market vacancies in the world, and comparable to the most supply constrained real estate markets in the world, such as Los Angeles County, New Jersey/NYC, Germany, and Beijing. Of note, current vacancy risk (vacant stock plus supply currently under construction) represented in months of normalized demand is approximately seven months in Mexico City. This vacancy risk is among the lowest relative to supply constrained emerging market peers and undersuppled/reconfiguring markets in Europe and Japan.

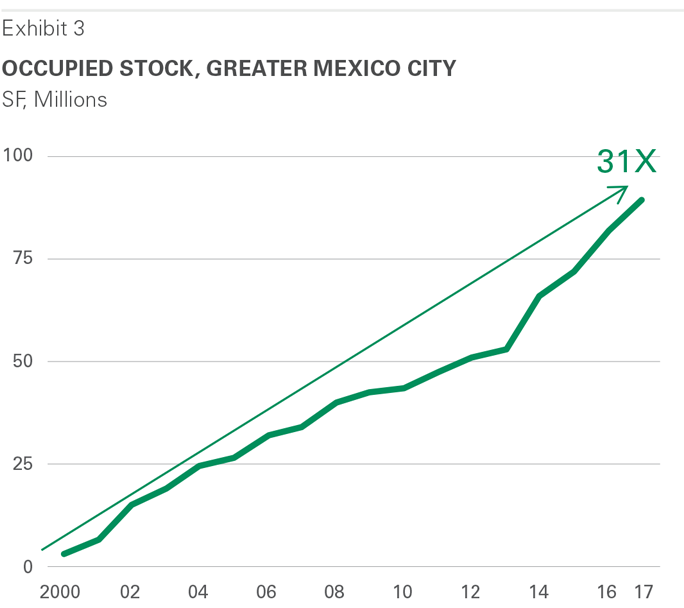

Supply-side structural drivers proved durable throughout macro headwinds. The adoption of modern stock increased 31x since 2000, and importantly, growth continued despite the global financial crisis and recent years of considerable geopolitical uncertainty. Prologis Research estimates the Mexico City market to grow by ~6% in 2018. Preleasing and build-to-suit activity has risen in the last year, as customers attempt to lock-in to leases amid the challenging conditions. Of note, market rental growth in Mexico City was among the strongest in the world in 2017. Low vacancy allowed landlords to price modern available facilities in USD, and MXN market rental growth was considerable in USD-terms, too, trading at a premium to USD rates. Supply contraints and favorable operating conditions for landlords is a key risk catalyst for currency-denomination trends in Mexico City in the near-term.

Note: Greater Mexico City includes Toluca

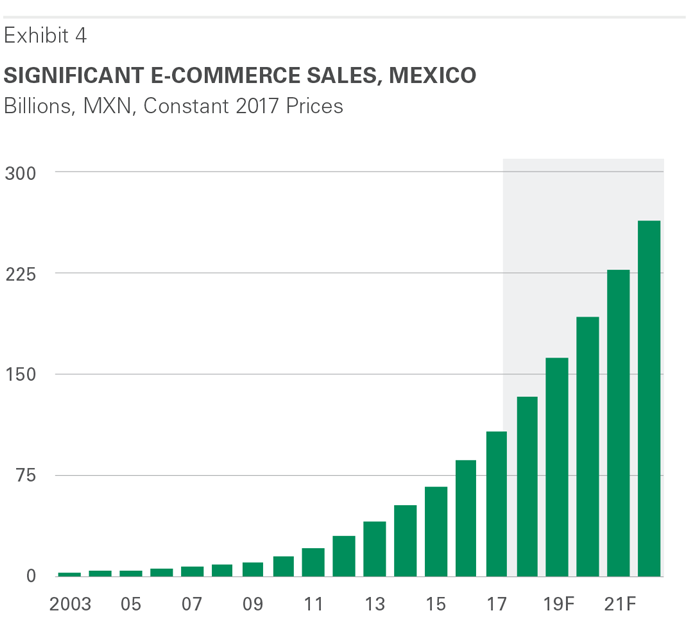

III. E-Commerce is an Added Tailwind for Logistics Real Estate Demand

Note: Excludes sales tax and travel spending

E-commerce operations are growing rapidly in Mexico. Pure play multinational e-commerce users and a handful of domestic e-tailers found success, with certain e-tailer revenues growing by >100% per annum.5 Strategies replicated from other emerging markets and tailored to the Mexican shopper address the realities of providing e-commerce services in Mexico and include:

-

Low banking population: Gift cards and other fintech payment systems help to reach the broader population base

-

Trust in online shopping: A rising tide lifts all ships. Concerns around fraud are seemingly diminished with the success and brands from major multinational e-commerce players. In fact, e-commerce sales among smaller e-commerce firms increased after the entrance of the global e-commerce brands to Mexico

-

Infrastructure: Sweeping telecommunications reform in 2013 helped to lower prices for consumers. Going forward, improving delivery times to a global standard ought to drive demand for infill Last TouchTM facilities

E-commerce users are more intensive users of logistics space. Our prior research found that U.S. e-commerce users require 3X the amount the logistics real estate space than traditional brick-and-mortar retailers (see here for more). Put another way, every $1 billion USD of retail sales translates to 1.0-1.5M sf of new logistics real estate demand. Factors shaping this trend include:

-

Picking-and-packing: brick-and-mortar distribution operations can more efficiently stack goods on pallets versus e-commerce operations which require packaging of individual goods with higher labor use

-

Broader product variety and higher inventories

-

Dedicated B2C shipping areas also add to space requirements

-

Reverse logistics: e-commerce fulfillment centers must dedicate space to handle returns

In Mexico, this intensity use rate is higher than the U.S. average, as rapidly growing e-commerce operations are planning for future sales. This rate should decline over time, but the lack of automation technology in Mexico due to lower labor costs might settle at a rate different than developed economies. For example, experiences in China also suggest the intensity use of space is higher given the preference to substitute labor for capital.

Note: Excludes sales tax and travel spending; China e-commerce sales excludes C2C sales

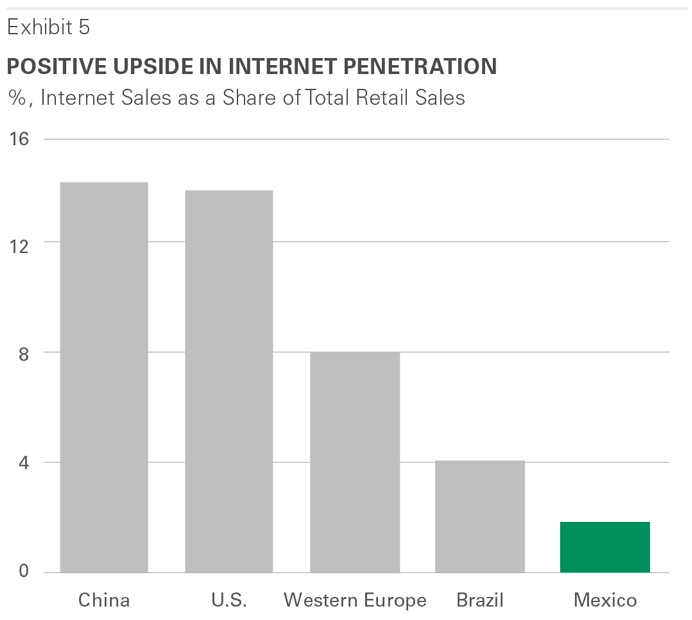

E-commerce supply chain development still in early stages with a lot of upside. Internet penetration in Mexico remains notably below Latin American and major global peers (Exhibit 5). To date, e-commerce supply chain operations have focused on servicing consumers in Mexico City. Operations has been primarily focused on better understanding buyer preferences and merchandising. SKUs should expand rapidly in the coming years, as a result. E-commerce penetration in Mexico could ramp up more quickly than in earlier and more affluent adopters (e.g., U.S., Japan, and Western Europe), as e-commerce leapfrogs traditional retail models. Looking ahead, demand upside seems present in the following areas:

-

E-commerce demand is expected to broaden to regional consumer markets, such as Monterrey and Guadalajara as the large national players build out hub-and-spoke supply chains

-

Improving delivery times will require closer proximity to consumers, driving demand for infill space in Mexico City

-

A handful of mid-tier omnichannel and pure-play e-commerce operations are reaching the scale to begin breaking out their shared e-commerce and brick-and-mortar supply chains with dedicated facilities

IV. Conclusion

Operating conditions in Mexico are fueled by mutliple structural catalysts. These positive catalysts—demographics, undersupply of modern stock, and e-commerce—shape a positive outlook for the asset class. Favorable dynamics for investors include (i) diversity of customer trends to service everyday needs; (ii) strong NOI potential for markets with an undersupply of modern stock; and (iii) higher intensity of logistics real estate demand from e-commerce players. For customers, competition for modern-grade assets is intensifying. Locking into long-term leases, migrating to build-to-suit projects, and preleasing of speculative development are forward-thinking customer strategies.

End Notes

- PPP-adjusted

- Oxford Economics, Prologis Research

- CBRE, Prologis Research estimate of modern stock

- CBRE, JLL, Cushman & Wakefield, Colliers, Oxford Economics, Prologis Research

- Euromonitor, Prologis Research

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forwardlooking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About FIBRA Prologis

FIBRA Prologis is a leading owner and operator of Class-A industrial real estate in Mexico. As of June 30, 2018, FIBRA Prologis was comprised of 196 logistics and manufacturing facilities in six industrial markets in Mexico totaling 34.6 million square feet (3.2 million square meters) of gross leaseable area.

Copyright © 2018 Prologis, Inc. All rights reserved.