Prologis Industrial Business Indicator™

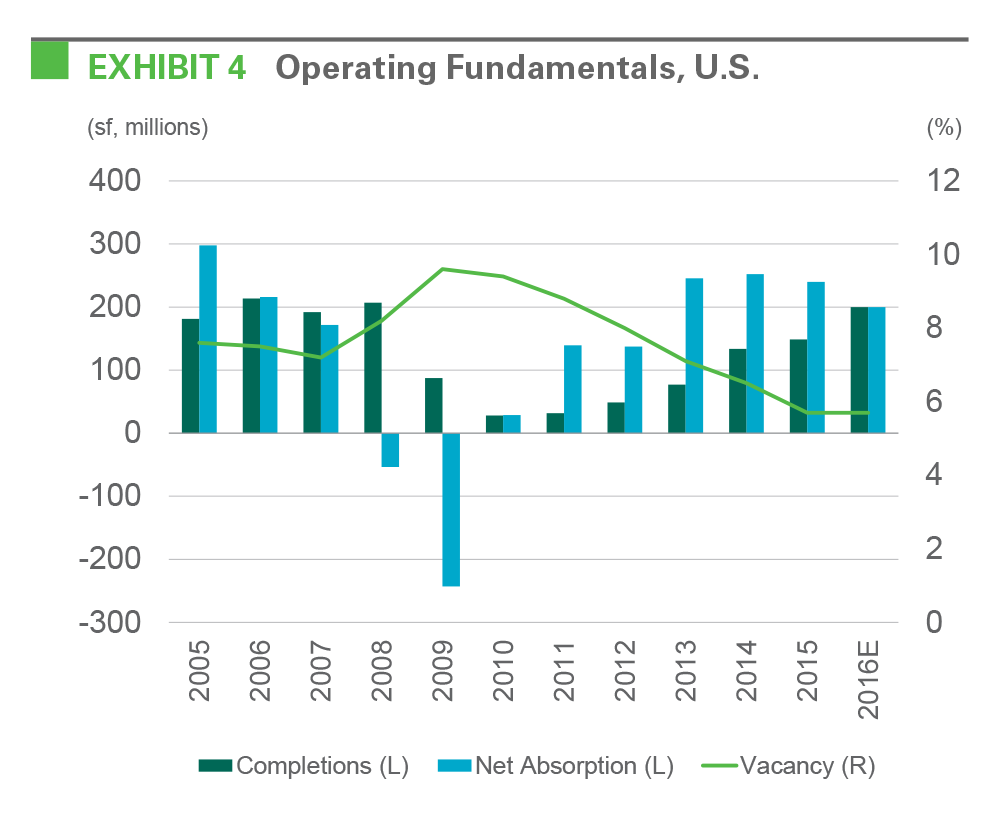

Amid highly fluid market conditions, the most recent indicators for the logistics real estate markets illustrate stability. Net absorption amounted to 240 million square feet in 2015, the third year of net absorption in excess of 200 million square feet, a very strong result. More recently, net absorption in the fourth quarter was 64 million square feet, amounting to approximately 220 million square feet on a seasonally adjusted annual basis.1On a forward-looking basis, logistics real estate customers remain in growth mode. Results from Prologis’ proprietary survey of customer activity, the U.S. Industrial Business Indicator™ (IBI), remain in the high-50s, a level consistent with normal growth for the industry.

This relative stability is in marked contrast with the recent apparent moderation of economic activity. The combination of extensive diversity across the industry’s customer base, its focus on activities that serve basic daily consumption needs (e.g., non-discretionary goods like food), and the ongoing sizable expansion of e-commerce supply chains, all serve to lift demand despite macroeconomic crosscurrents. At the same time, while leading indicators mostly remain healthy, risks to the global economy have clearly mounted. Consequently, Prologis anticipates a more normal year of net absorption in 2016, amounting 200 million square feet, in line with forecasted completions. This supply-demand equilibrium should hold the vacancy rate steady at 5.7%, remaining at multi-cycle lows and supporting further rent growth.

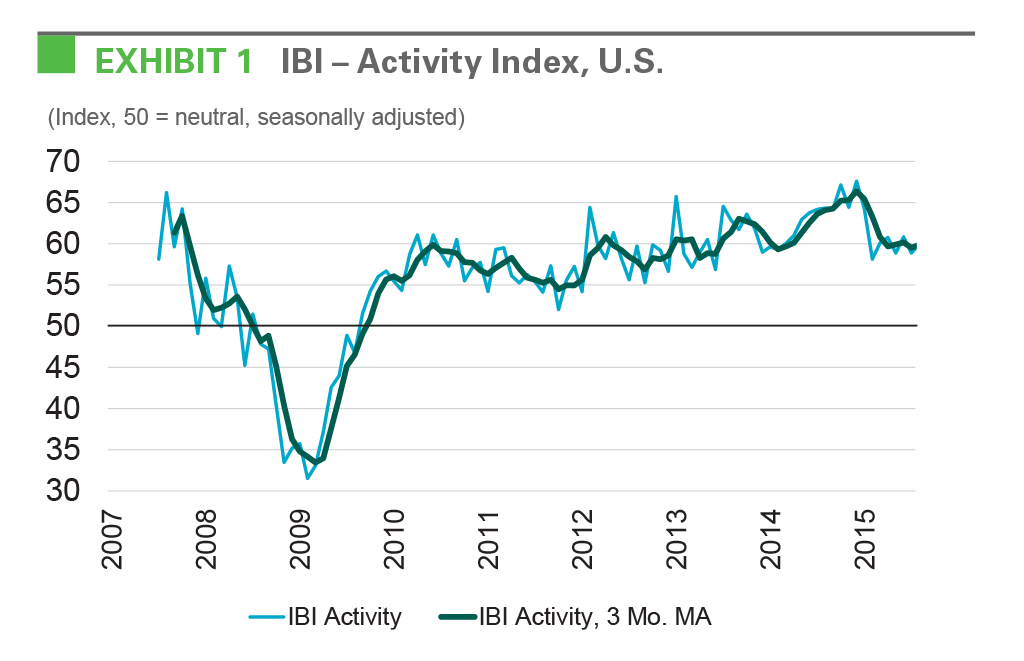

Customers remain in expansion mode. The IBI activity index improved to 58.7 in January and has averaged 57.9 during the last three months. IBI activity readings in the high-50s reflect logistics real estate demand growth at a level requiring significant new supply. While the IBI has had its own share of recent volatility and modest slowing, as shown in Exhibit 1, it remains notably healthier than recent softness in GDP and other economic indicators. While this difference could be the lead/lag between the economy and industrial real estate decision making, likely more important are characteristics of the industry, such as its diverse customer base, its focus on activities that serve basic daily consumption needs (e.g., non-discretionary goods like food), and the ongoing sizable expansion of e-commerce supply chains.

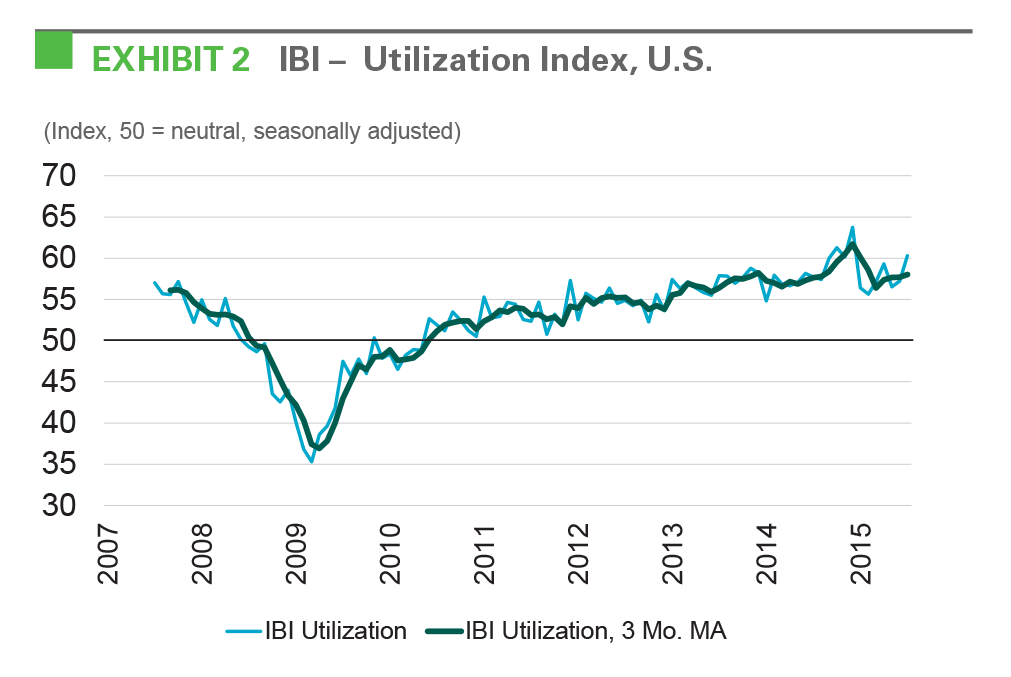

Utilization rates continue to rise and are elevated, creating the potential for additional demand. Customers utilized 85.8% of logistics real estate space in January 2016, up slightly from a year ago and remaining near record highs. Growth in customer activity and high utilization should drive new leasing activity, as customers will need to augment their existing real estate footprints to accommodate business growth. The combination of new leasing and draw-down of existing inventories could put downward pressure on the utilization rate in the future, a net positive for the industry.

Beneath the surface, activity is led by a few industries. Given headwinds from the strong dollar, slowdown in emerging markets, and inventory build-up in early 2015, customers in the wholesale trade and manufacturing industries recorded weaker activity readings in recent months. By contrast, the strongest activity readings came from customers in the retail segment in January. As the headwinds from the strong dollar and inventory correction dissipate going forward, customers in some of the lagging industries could post a recovery in activity levels.

Cyclical macroeconomic indicators illustrate greater stability than financial markets. Segments directly related to logistics real estate demand enjoy a relatively stable economic backdrop. Consumption continues to grow at a moderate pace, household balance sheets are healthy, and job creation is elevated. While there has been month-to-month volatility in business sentiment and trade-related indicators, the data still illustrate expansion rather than contraction. Looking forward, tight labor market conditions should boost wage growth and consumer confidence, fueling growth in consumption and import volumes and in turn drive logistics real estate demand. Structural shifts, such as investment in dedicated e-commerce supply chains, continue to augment these cyclical forces.

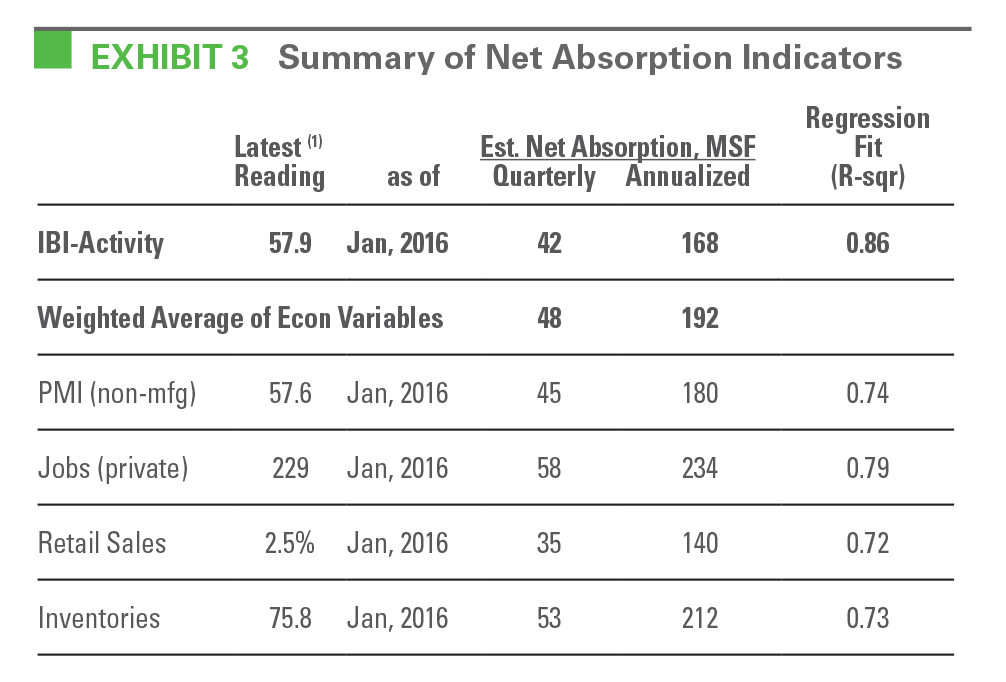

Anticipating a steady 2016 for logistics real estate. Looking backward, absorption of real estate logistics space has outperformed expectations for demand based on economic fundamentals. The adoption of e-commerce and other structural shifts have been factors. Our econometric analysis of the most relevant and real-time indicators illustrates annual net absorption of nearly 200 million square feet (see Exhibit 3). These leading indicators are mostly healthy, but reflect some of the recent weakness in the overall macroeconomic climate, which economists currently anticipate will improve. Looking forward, Prologis anticipates a normal year of net absorption in 2016, amounting to 200 million square feet, in line with forecasted completions. This supply-demand equilibrium should hold the vacancy rate steady at 5.7%, remaining at multi-cycle lows. Rent growth should accordingly continue at a pace that exceeds core inflation.

FOOTNOTES

(1) Based on CBRE-EA data

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of December 31, 2015, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 669 million square feet (62.2 million square meters) in 20 countries. The company leases modern distribution facilities to approximately 5,200 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

Copyright © 2016 Prologis, Inc. All rights reserved.