The Broad View

- Prologis’ IBI, the company’s proprietary survey of logistics real estate customer activity, recorded historic volatility in the second quarter—with both the sharpest monthly fall followed by the fastest rise. Activity levels improved in recent months, reaching 57.9 in July after April posted the lowest reading (below 30) in the history of the index.

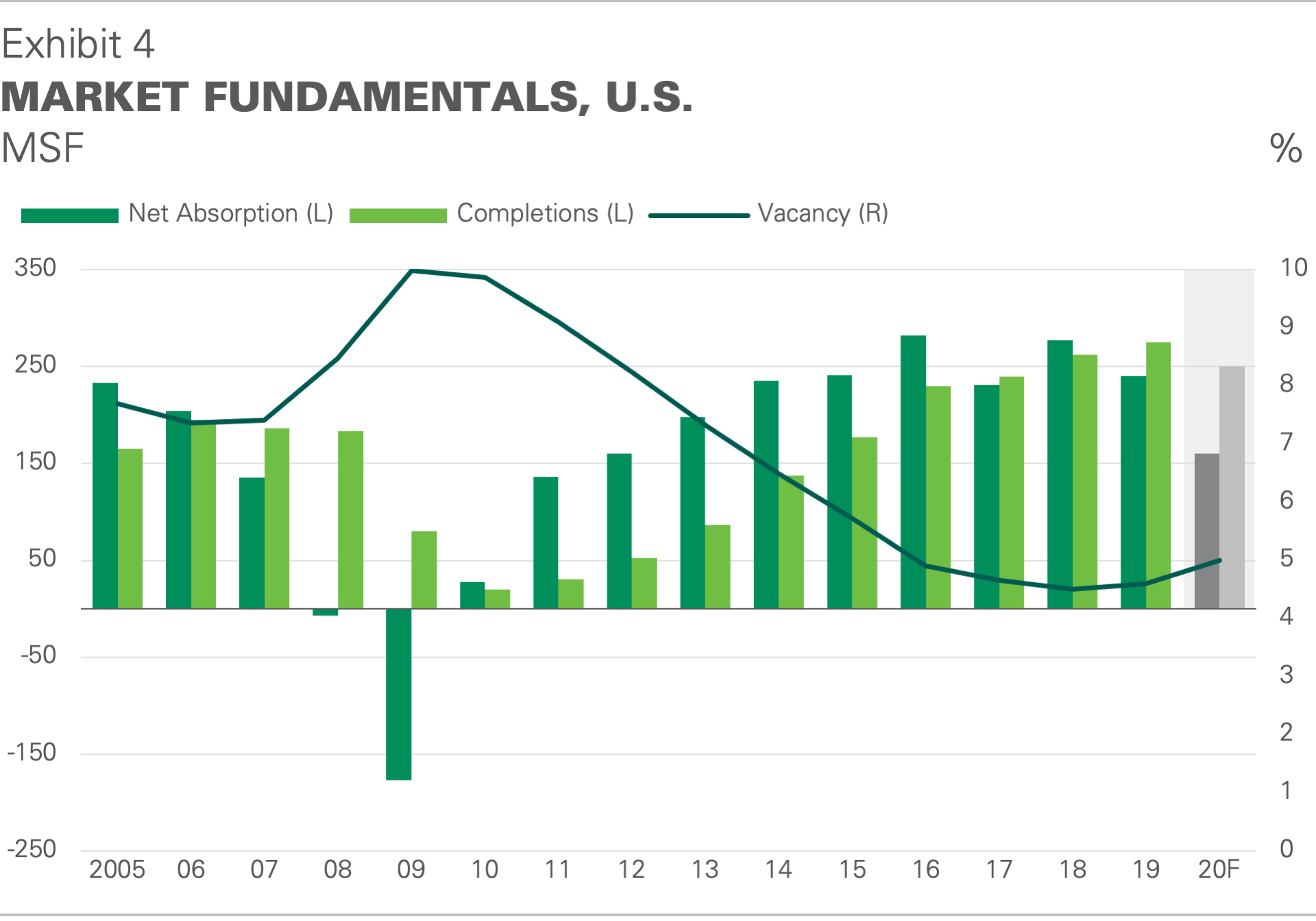

- Re-openings coincided with a diversification of logistics real estate demand. Coming in at 37 MSF for Q21, net absorption was above expectations. Beneath the surface, a wider range of industries and size categories experienced improved leasing momentum through June relative to March and April.2 New supply continued to come online, with 73 MSF of completions. The combination pushed the vacancy rate up 10 bps to 4.8%—still a historically low level.

- Prologis Research revised up our forecast of 2020 net absorption to 160 MSF from 100 MSF in Q1’20. Anticipated completions were also revised up to 250 MSF from 225 MSF, bringing the year-end vacancy forecast to 5.0%. Market rents fell by ~1.5% (q/q) in Q2, effectively giving back the first quarter’s rent growth. An increase in rent concessions, particularly in smaller box infill spaces, drove lower net effective rents, while headline rates were stable.

The Details

Prologis’ leading indicator of logistics real estate demand showed significant volatility in the second quarter. The April report came amidst the early stages of COVID-19 shutdowns with a reading below the prior low of the Global Financial Crisis. An index reading below 50 signals a contraction in demand compared to the month prior. In our view, the index readings in May and June of up to 50.1 suggest relative stability in business activity, while July’s reading of 57.9 indicates moderate growth in activity. Space utilization, another leading indicator of logistics demand, fell to 83% in April (its lowest level since 2012) before climbing to 84.3% in July—still below the pre-pandemic average.

Logistics operations are gradually getting back to normal. Anticipating an impact based on extraordinary measures to prevent the spread of the virus, we added a question to assess the impact of coronavirus on operations beginning in March. By July, less than 3% of respondents reported that they had suspended operations as a result of the pandemic (about half of peak shutdown levels), with more than 60% reporting operational changes such as staggered work shifts. More than 34% responded that operations were “business as usual.”

A wider range of customer industries and size categories underscored growth in the second quarter. Relative to overall consumption, the logistics real estate customer base skews toward basic daily needs and structural trends such as e-commerce.3 These essential goods and operations continued to function – and in some cases thrive – even during the height of the Stay-at-Home phase of the pandemic. In Q2, leasing activity evolved alongside re-openings to incorporate a broader group of participants, which is reflected in diversity by industry and size category. Elevated short-term leasing activity restored supply-demand balance to several big box submarkets in recent months as larger spaces were taken down. In addition, customers may have a window in which to act opportunistically in supply-constrained infill submarkets, given an environment of rising sublease space, a high proportion of small- to medium-sized customers, and heightened uncertainty that paused activity, especially along the West Coast. In aggregate, net absorption came in above expectations with 37 MSF for the quarter, leading to an upward revision to our 2020 demand forecast to 160 MSF.

Speculative development activity fell but a handful of markets remain active. Speculative development starts fell by 30% (y/y) in the second quarter. Capital appetite for the asset class remains high and continues to gravitate toward build-to-core strategies in lower-barrier markets. Speculative development in Houston, Dallas and Pennsylvania remained active. Build-to-suit (BTS) activity also accelerated, with e-commerce driving growth for large box space. Higher-than-expected BTS activity coupled with stubbornly high speculative starts by merchant developers in a handful of markets drove our 2020 supply forecast to 250 MSF.

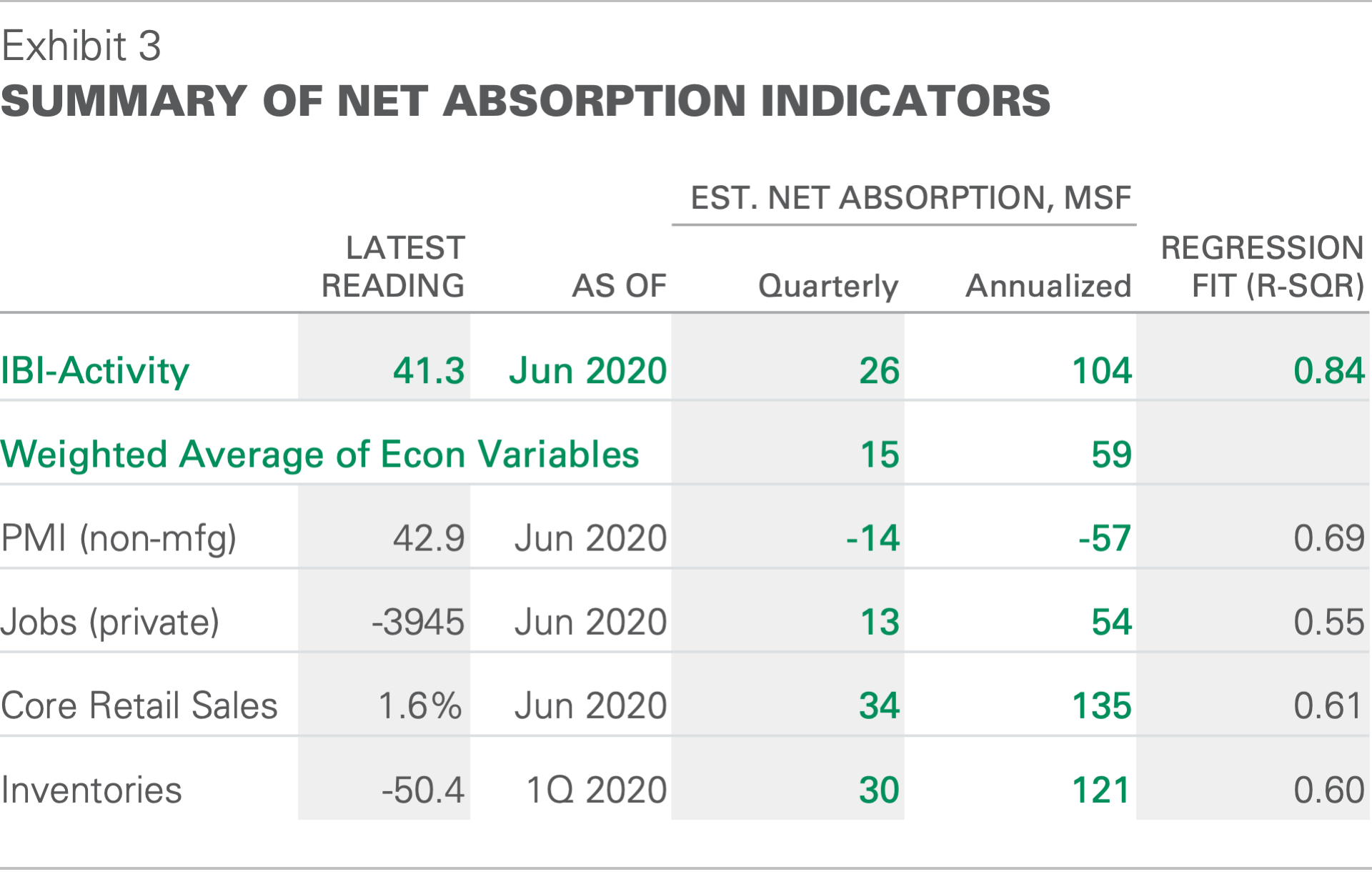

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau of Labor Statistics, Prologis Research

Quick Wrap

Logistics real estate customer activity fluctuated alongside COVID-19 uncertainty. Customer leasing activity improved substantially in the second half of the quarter, as by then customers had more clarity and time to digest how the pandemic might affect their business. Demand and supply cycles shifted quickly, with bulk distribution outperforming smaller infill locations (a reversal of recent trends). Market rental growth contracted by ~1.5% (q/q), which equates to approximately one additional month of free rent on a five-year lease. Still-low vacancies in most markets, together with structural trends that could drive a brisk recovery, mean the window for customers to act on favorable conditions could be short even as uncertainty remains high.

Endnotes

2. Prologis portfolio data

3. https://www.prologis.com/logistics-industry-research/customer-resilience-amid-higheconomic-

volatility

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 963 million square feet (89 million square meters) in 19 countries.

Prologis leases modern distribution facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.