Overview

Our research on logistics real estate has recently focused on the importance of consumption, including e-commerce, how location strategy has become a critical differentiator, and the reduced importance of trade as an industry driver. Tariffs and trade sanctions are a negative for economies and a tax on consumers. To-date, threatened sanctions have been small, and logistics real estate remains insulated. Much of the industry’s growth in the last decade has been driven by e-commerce, supply chain modernization and economic expansion. However, an escalation of protectionist trade policies increases the likelihood and potential depth of a global economic downturn, which would have a negative impact on users of logistics real estate.

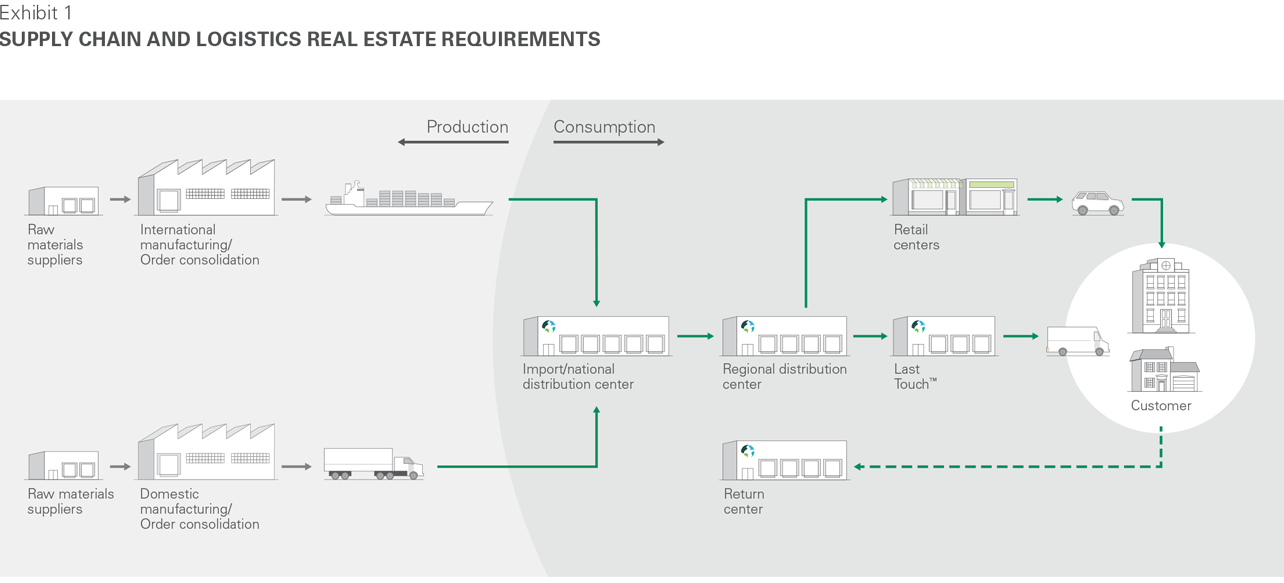

Trade sanctions are aimed at the production end of supply chains. The illustration below shows how goods travel from production to consumption. Along this path, we note five types of location requirements: (1) raw goods distribution; (2) order consolidation; (3) import and national distribution centers; (4) regional distribution centers; and (5) Last Touch® and city distribution centers. The tariffs announced thus far pose a concentrated risk at the production end of supply chains, potentially decreasing demand for goods or acting as prompts for manufacturers to cut costs. By contrast, logistics real estate positioned at the consumption end of the supply chain (regional and city distribution, including Last Touch®) focuses on proximity to major population and consumption centers. That said, slower economic growth due to escalated trade sanctions would negatively impact consumption and, in turn, demand for logistics real estate.

The Prologis portfolio primarily comprises distribution facilities on the consumption end of the supply chain. A review of Prologis’ U.S. customers reveals that more than 75% are focused on city and regional distribution and Last Touch®.1 Much logistics real estate demand growth in the past decade is attributable to e-commerce, supply chain modernization and economic expansion. By contrast, trade growth played a smaller role. For example, Prologis’ strategy in China is almost exclusively focused on Last Touch® and city distribution, limiting the risk posed by current trade policies in that market (China assets represent <1% of the Prologis portfolio by NOI).2

Trade exposure is concentrated in a few markets, which are also important consumption centers. Port markets have the biggest exposure to global trade; however, import centers are still only a fraction of total occupied space in these markets. Among Prologis’ U.S. markets, Southern California and New Jersey contain the highest proportion of space used as import centers, with 25% or less. Major intermodal markets also have links to global trade—specifically Chicago and, to a lesser extent, Dallas—as most imported containers move immediately out of the port via a combination of rail and truck without pausing at a local logistics facility. While these markets are positioned along global trade routes, they are also major consumption centers, with a combined population of nearly 60 million. Accordingly, the majority of space is used to serve local and regional consumption rather than acting as waypoints along global trade routes.

Trade policies as currently announced do not seem to pose a substantial threat to the logistics real estate expansion. Announced trade policies remain small relative to total trade relations, consumption and the overall economy.

- $50B of tariffs on Chinese imports are planned, amounting to less than 10% of trade from China and representing less than 0.5% of the U.S. economy. These tariffs are focused on manufacturing-oriented users and not on the primary customers of logistics real estate and pose little risk to U.S. consumers.

- NAFTA negotiations have not generated new policies. However, logistics real estate markets in both Canada and Mexico have recorded healthy demand and low vacancies despite the uncertainty surrounding trade. Mexico City, for example, has one of the lowest vacancy rates in the world after years of solid demand growth.

Thus far, tariffs have only paused or slowed trade growth, not eliminated it. Demand for trade-related logistics real estate should continue, even as the U.S. negotiates trade on a bilateral basis. Trade and imports could potentially shift from one production market to another, requiring similar logistics real estate to distribute to end-consumers.

A material escalation of protectionist trade policies poses a threat to the economic expansion and, therefore, to logistics real estate demand. Tariffs are a tax on consumption and place upward pressure on prices and inflation. Higher prices could reduce consumption and lead to slower economic growth. Estimates vary, but an expansion of protectionist trade policies could reduce economic growth by 50 bps or more. While logistics real estate demand is buoyed by the structural shift toward e-commerce sales and reconfiguration of supply chains for higher service levels, demand is ultimately built on a foundation of consumption. Lower consumption, lower business confidence and rising uncertainty could produce an economic slowdown or spark a recession that could impact a broad range of U.S. businesses, including users of logistics real estate.

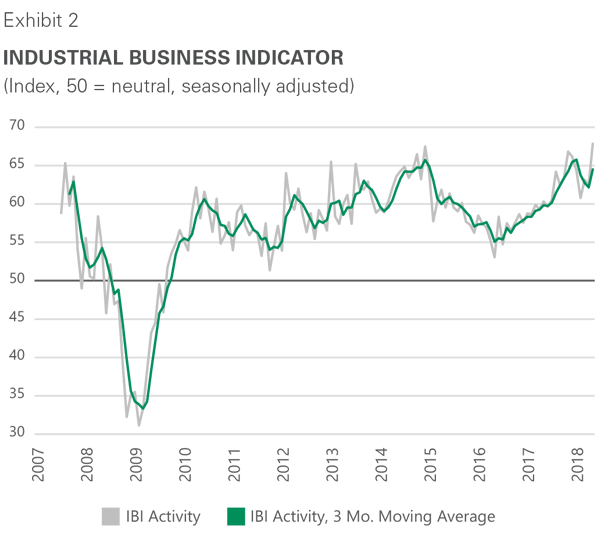

U.S. economic growth and low market vacancy rates are more essential to logistics real estate than trade relations. Customers remain firmly in expansion mode, as reflected by our Industrial Business IndicatorTM (IBI), which remains near peak levels. Consumer confidence is strong. Combined with disciplined supply, the U.S. vacancy rate in the first quarter of 2018 was near the historically low level of 4.6%.3 Low vacancies and strong demand have been a catalyst for considerable rent growth in recent years, producing today’s wide spread between market and in-place rents. This embedded NOI growth should continue to produce positive returns through the near term; however, macroeconomic risk looms on the horizon as future protectionist trade policies are considered.