The Broad View

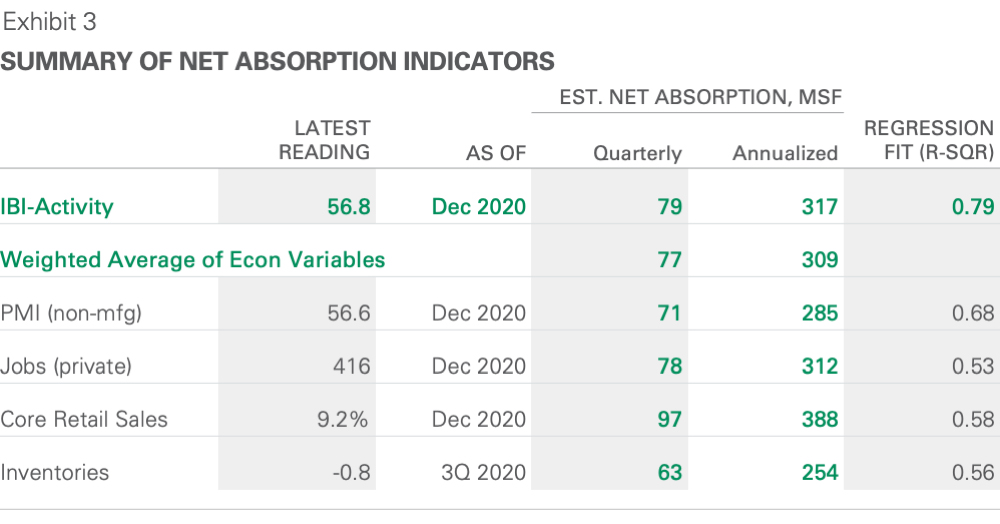

- Prologis’ IBITM, the company’s proprietary survey of logistics real estate customer activity, remained in the growth range through Q4 and into early 2021. Activity levels steadied around 55 during this period, in line with moderate growth in the flow of goods. Utilization remained around 83% in Q4 2020 as sales outpaced inventory growth. Re-stocking began to take hold in January, and utilization ticked up to 84%.

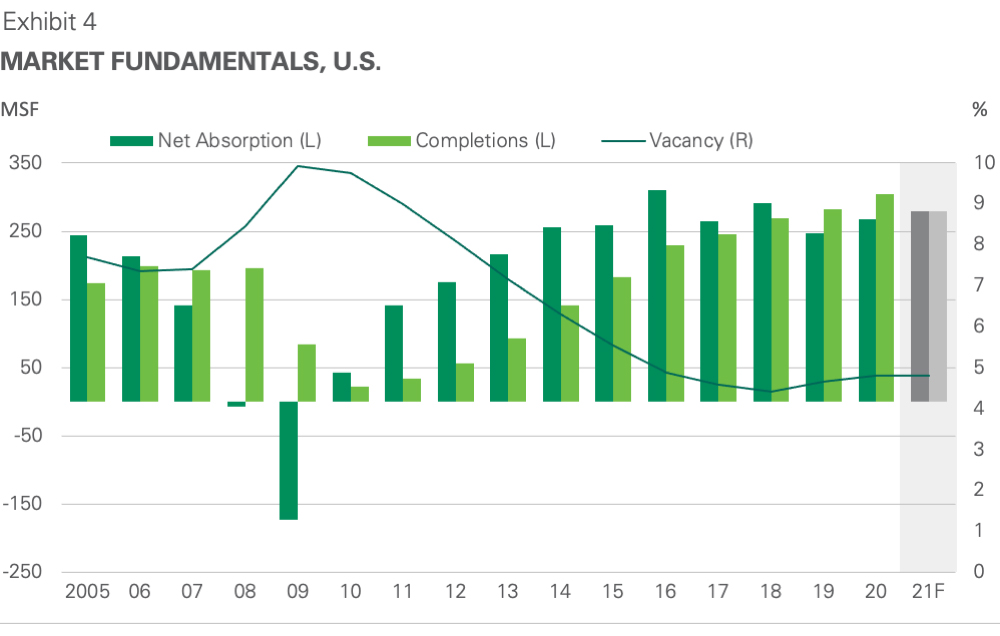

- Logistics real estate demand surged to more than 100 million square feet (MSF) in the fourth quarter.1 Expansion activity spanned industries, markets and size categories.2 Demand exceeded new supply for the first quarter since mid-2019, and the vacancy rate fell 10 bps to 4.8%. Market rents (in the U.S.) increased at a faster pace and in more locations, posting an increase of 3.2% for the year in aggregate.

- We expect continued structural demand tailwinds and an improved cyclical outlook for 2021. Prologis Research upgraded its forecast for 2021 net absorption to 280 MSF from 260 MSF in Q3 2020. Completions are forecast to match this pace, with vacancy holding steady through year-end. Rent growth should accelerate further to approximately 5% in 2021, driven by a combination of strong demand, limited availabilities and rising replacement costs.

The Details

Prologis’ IBI reflects both continued growth in the flow of goods and a lag in space utilization. The IBI Activity Index steadied at 55 in December 2020 and January 2021, marking eight consecutive months of growth. Space utilization rose from 83% in December to 84% in January 2021. Customer feedback and macro data point to a lack of inventory as an underlying factor: While sales were strong, order delays and congestion at U.S. ports resulted in an all-time low in the inventory-to-sales ratio at year-end.3

Demand for space accelerated and broadened through year-end. Showing no signs of impact from the second wave of the pandemic, leasing activity gained momentum through year-end, bringing vacancy rates down across most regions. Structural trends – such as the rising adoption of e-commerce and the need for safety stock to accommodate supply chain volatility – drove this demand alongside customer confidence to commit to long-term leases. Strong sales of retail goods4 and improved prospects for cyclical growth in 2021 underscored this shift, reflected in a broadening group of logistics occupiers in growth mode and signing new leases. Retailers and transportation companies reported the strongest activity levels in late 2020 and January 2021, while services firms continued to post the weakest growth. Active segments included food and beverage, consumer products, electronics and healthcare.5 At 100 MSF, demand exceeded new supply in Q4 2020 and the vacancy rate fell 10 bps to 4.8%, just 10 bps above its pre-pandemic level.6

Demand flowed into the future, elevating build-to-suit starts and pre-leasing of the construction pipeline. In total, construction starts increased by 10% year-over-year. Beneath the surface, strong demand for modern product and few availabilities drove build-to-suit activity up 66% over 2019, while spec starts posted a -4% decline. Faced with dwindling available space, customers actively pre-leased new space under construction; in fact, in several markets, half or more of logistics space under construction is already spoken for. Houston is the company’s only market on its supply watchlist, as deliveries there outpaced demand by 2x in 2020.

Market conditions could lead to a critical shortage of space in 2021. After more than 300 MSF of completions in 2020, Prologis Research anticipates 280 MSF of deliveries in 2021, with the bulk coming in the second half of the year. Demand will remain strong but, with vacancy rates remaining near historic lows, realized net absorption will be limited by the quantity of new supply. We forecast 280 MSF of net absorption and stable vacancy at 4.8% in 2021. Through 2020, market rents increased at a faster pace and in more locations, posting an increase of 3.2% for the year in aggregate. Prologis Research expects that this momentum will extend through 2021, with 5% growth projected for the full year.

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau of

Labor Statistics, Prologis Research

Quick Wrap

Structural and cyclical demand could intensify competition for available logistics real estate. Demand is poised to remain strong for three reasons: (1) improved cyclical growth prospects built on stimulus, vaccination rollouts and consumer savings/pent-up demand; (2) continued build-out of e-fulfilment capabilities; and (3) investment in supply chain resilience via inventory rebuilding and expansion. Rising barriers to logistics real estate development have both extended the time it takes to construct a facility and increased costs. Both demand and supply trends should be magnified in major consumption centers. A mid-2020 pause in construction activity will likely result in a lower level of deliveries in early-to-mid 2021. Availabilities are likely to remain low through the near term, boosting competition for space and market rental rates. To stay ahead of this competition, customers are advised to plan far in advance for their supply chain needs.

Endnotes

2. CBRE, Cushman & Wakefield, JLL, Colliers, CBRE-EA, Prologis Research

3. U.S. Census Bureau, retailers’ inventories to sales ratio data as of November 2020

4. U.S. Census Bureau Advance Retail Sales report as of December 2020

5. Prologis portfolio data

6. CBRE, Cushman & Wakefield, JLL, Colliers, CBRE-EA, Prologis Research

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 984 million square feet (91 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.