Logistics Facility User Survey 2013

Introduction

Europe has a larger population and a higher combined Gross Domestic Product (GDP) than the U.S., yet it has 4.5 times less Class-A logistics space. In this context, the reconfiguration of the European supply chain and the rise of e-commerce means there is significant development potential for modern, efficient distribution facilities across the region. The questions facing developers, owners, managers, and their customers, are: “Where are the most strategic logistics locations in Europe, and why?”

The answers to these questions are essential for making well-informed investment and development decisions. Prologis has partnered with Eyefortransport (EFT) to explore industry perceptions on the most desirable logistics locations around Europe, and to quantify the criteria which influence site selection. As well as demand, supply is equally important to investors since markets with tight supply and higher entry barriers generally outperform markets with weaker demand/supply dynamics.

Warehouse users from a range of sectors—from retail to automotive to pharmaceuticals—were asked to share their views by ranking 100 locations against various priority criteria.

Based on the results of the survey, this paper outlines:

- Key logistics location selection criteria;

- The most desirable logistics locations in Europe today and in 2018; and

- Key demand drivers of the future.

Executive Summary

Prologis has identified 13 criteria which affect the desirability of a logistics location and therefore the site selection decision. The three most important are: 1) proximity to economic networks and strategic transportation access; 2) proximity to customers; and, 3) labor availability and flexibility.

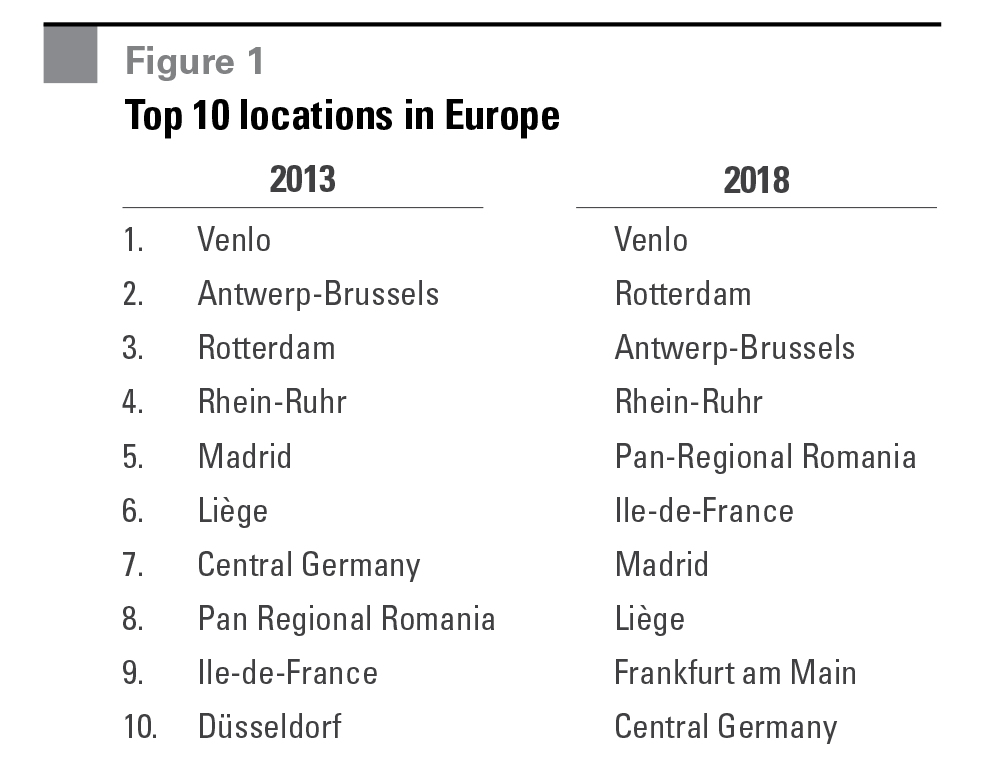

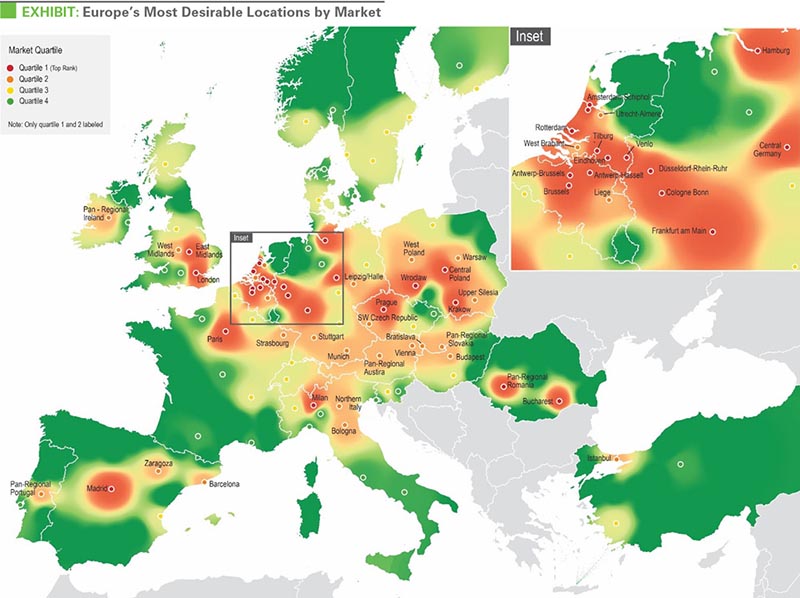

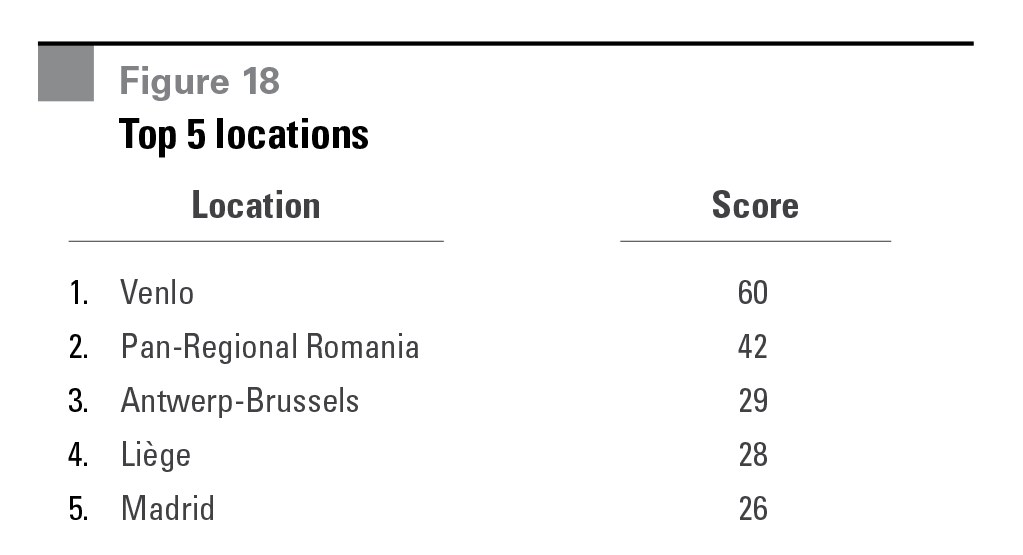

Survey participants were asked to score 100 European distribution locations against these site selection criteria. The top three locations were found to be in the Netherlands and Belgium: Venlo, Antwerp-Brussels and Rotterdam. With the exception of two markets, Madrid and Pan-Regional Romania, the top 10 most desirable locations are in Continental Western Europe.

Looking to 2018, the results show that Venlo will remain the most popular location, although its sizable lead over the other top four locations decreases. The results also show that locations in Central & Eastern Europe will gear up and become more attractive in the European logistics landscape. Logistics facility users continue to consolidate their operations in larger more efficient Class-A distribution centers and plan to operate in larger networks. Almost two-thirds of all respondents expect to operate a Pan-European distribution network by 2018.

Prologis has identified 11 key drivers of change which will affect (European) distribution network strategies over the next five years. Secular drivers such as global trade, outsourcing and globalization will be stronger than cyclical drivers. All but one of the 11 key drivers will lead to further supply chain consolidation. Increasing fuel prices, which will have the greatest impact on distribution network strategies over the next five years, could support decentralization.

MOST DESIRABLE LOCATIONS

Introduction

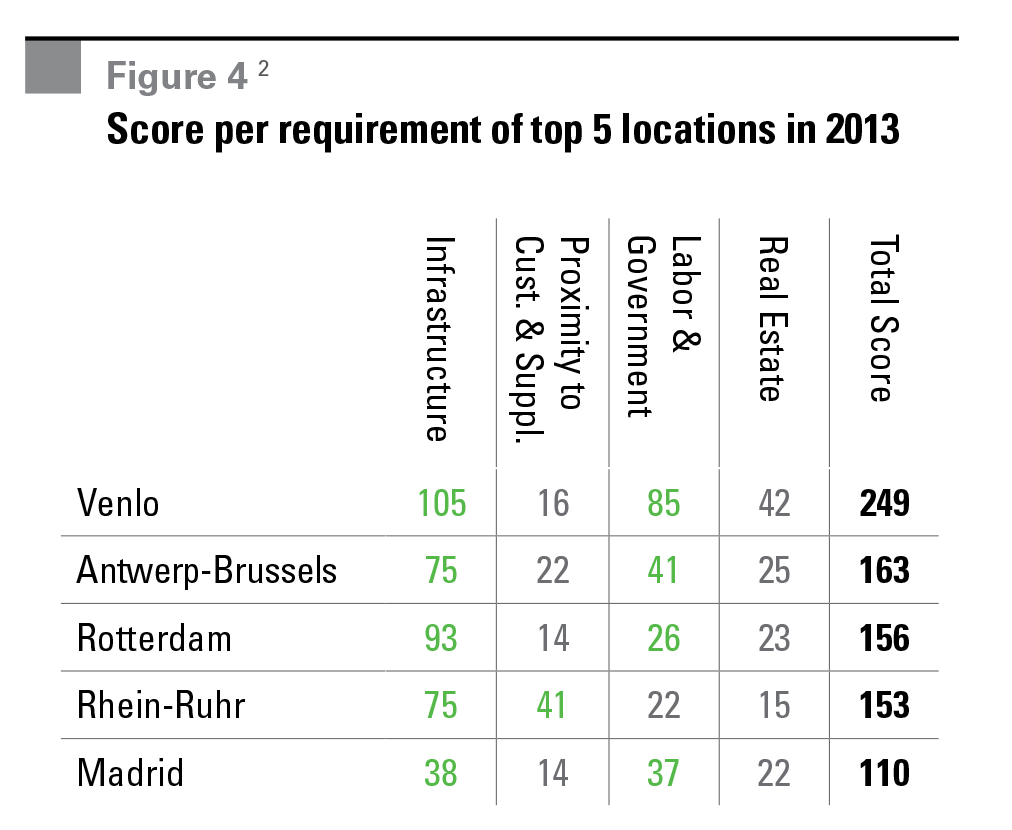

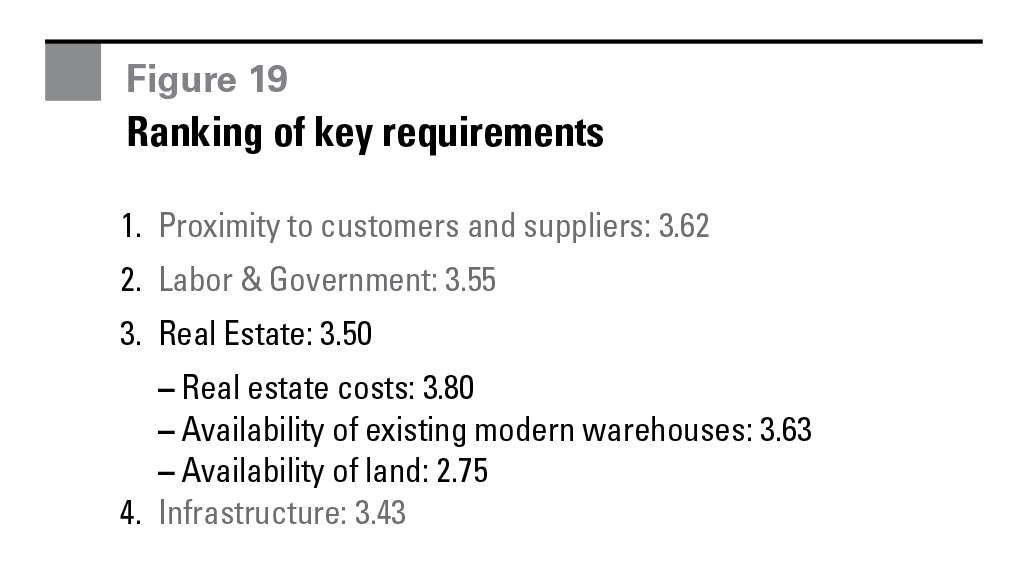

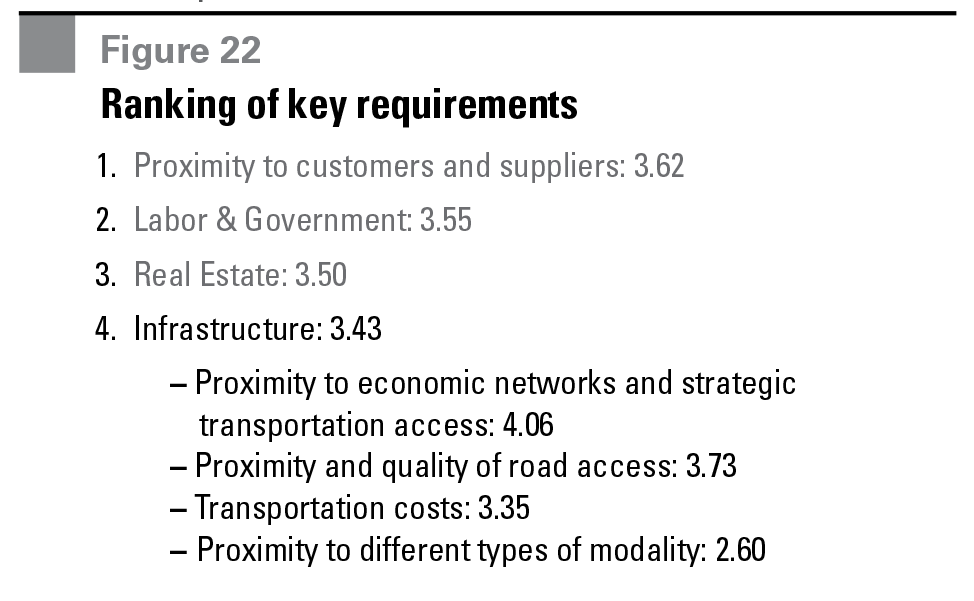

Participants were asked to score 100 logistics locations around Europe against 13 criteria, which were grouped into four categories; 1) Proximity to Customers and Suppliers, 2) Labor & Government, 3) Real Estate, and 4) Infrastructure. The most desirable locations today and in 2018 were determined based on these criteria.

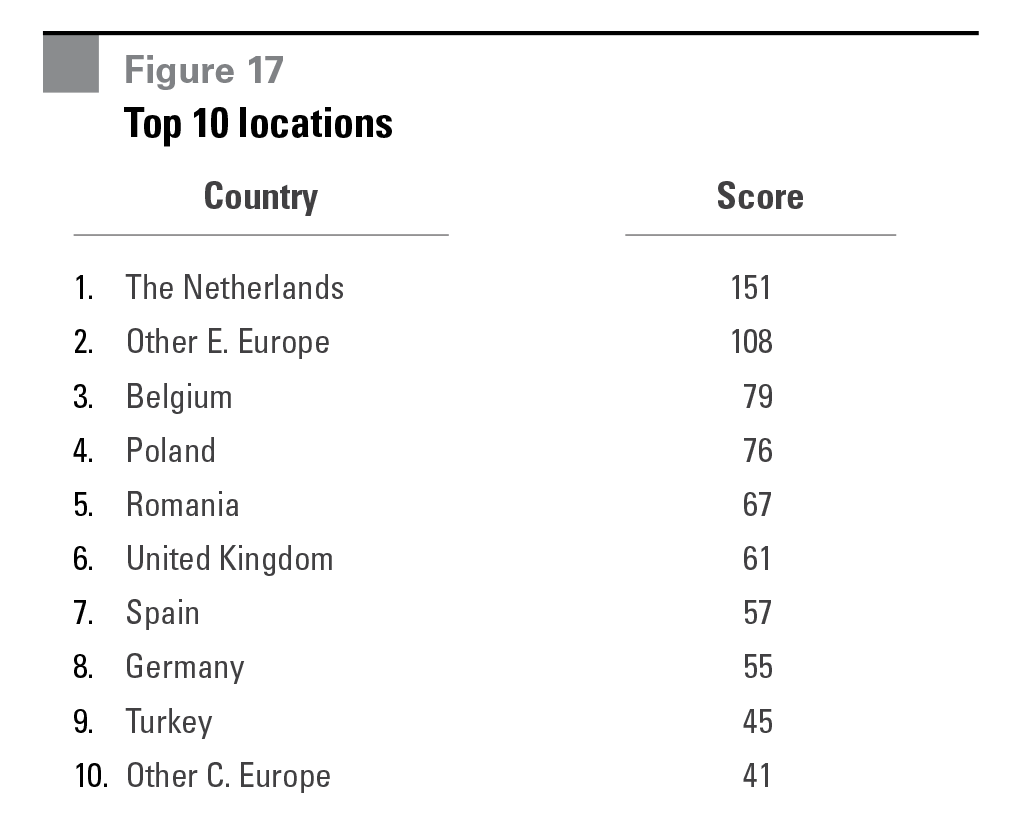

Top 10 Most Desirable Locations in 2013

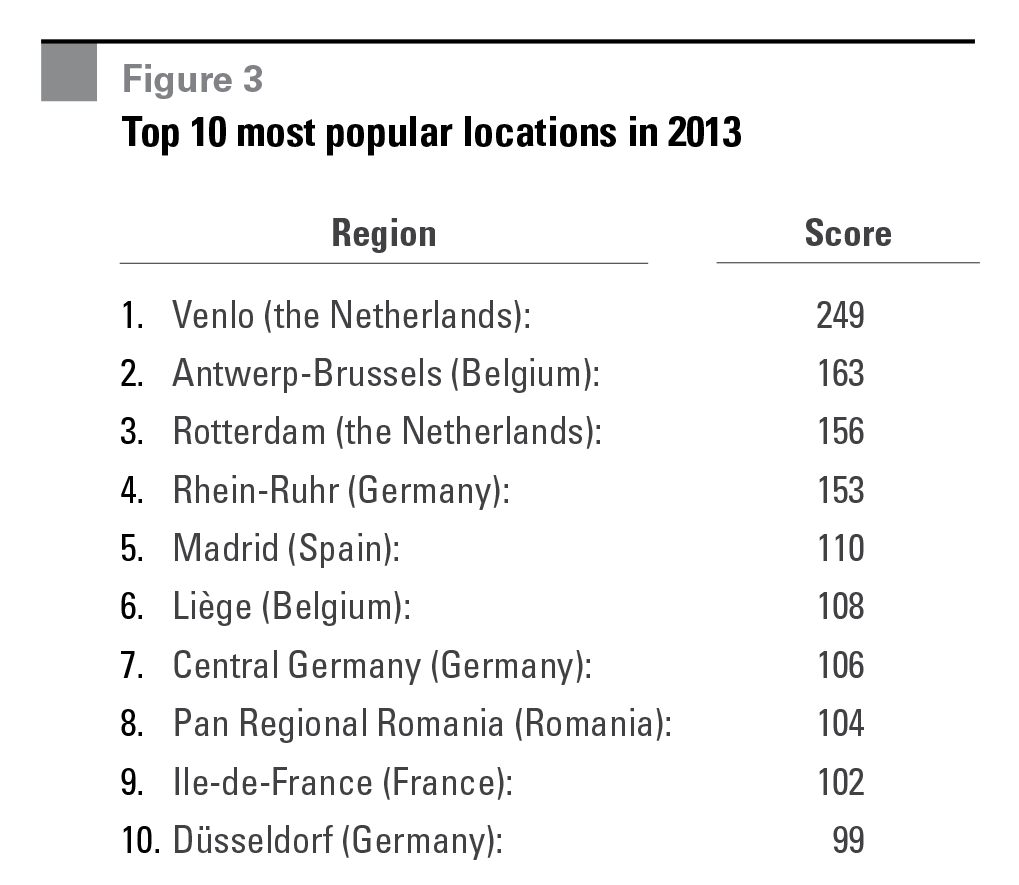

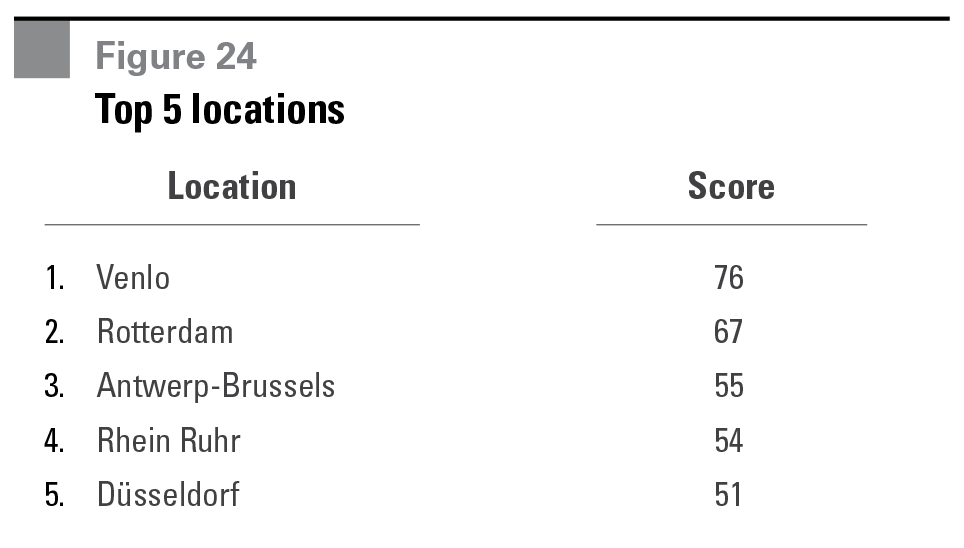

The Benelux is the clear winner with three markets in the top three locations: Venlo, Antwerp-Brussels and Rotterdam. With the exception of two markets, Madrid and Pan-Regional Romania, all markets are in Continental Western Europe (Benelux, Germany and France). The top four markets are among the most attractive for pan-European distribution, and therefore include a larger number of European Distribution Centers (EDCs) as a result.

Eight of the ‘top ten’ locations are in Western Europe

We segmented the top 10 markets into three clusters. The first is one market - Venlo, with a total score almost 1.5 times greater than runner-up, Antwerp- Brussels. The second comprises Antwerp-Brussels, Rotterdam and Rhein-Ruhr (excluding Düsseldorf), which have relatively similar scores. The third includes locations ranked from fifth place (Madrid) to tenth place (Düsseldorf). The spread in terms of scores between these six locations is only 11 points.

Among the broader 100 locations, there are common findings among each quartile1. Outside the top 10, the first quartile includes Frankfurt am Main, Prague, Schiphol Airport and Central Poland. The second includes Munich, Hamburg, West Midlands, Barcelona, Warsaw and Upper Silesia. The third includes Lyon, Stuttgart and West of England & Wales. Locations in the fourth are in the European periphery and don’t play a major role in the European logistics network.

Venlo won three of the four categories (Infrastructure, Labor & Government and Real Estate). It was recognized as the best location for many specific criteria such as proximity to economic networks, strategic transportation access, transportation costs, flexibility of workforce and best location for regulatory issues.

Survey participants ranked Venlo as the most desirable logistics location

Antwerp-Brussels was ranked second or third in each category. Rotterdam’s third place was primarily due to its score as the best location for modality availability, offsetting weaker results for the proximity to customers and suppliers requirement.

Rhein-Ruhr was a close fourth due to its proximity to customers and suppliers. Madrid was a distant fifth (closely followed by Liège), but scored well in the Labor & Government and Real Estate categories. Pan-Regional Romania might come as a surprise, but owes its top 10 rank primarily to very good scores on Real Estate and Labor & Government categories.

Rhein-Ruhr won the category ‘proximity to customers and suppliers’

With regard to the verticals, retailers prefer the United Kingdom, the pharma industry selected Switzerland due to the incentives, and the hi-tech and 3PL customers chose markets in the Netherlands.

Location criteria between the industry groups 3PLs and shippers differ in the level of importance, although both consider overall supply chain costs. Real estate costs and proximity to customers & suppliers are the most important for 3PLs while good quality infrastructure and regulatory issues are the most important criteria for shippers.

One major difference is that 3PLs do not own goods whereas shippers do. As shippers take title of goods, an attractive regulatory framework such as customs regulation and the tax environment are vital requirements.

3PLs are generally confronted with lower margins which explains the importance of real estate costs Additionally, as 3PLs’ strategy is to provide an end-to-end service for shippers they view the proximity to customers and suppliers as more important compared to shippers.

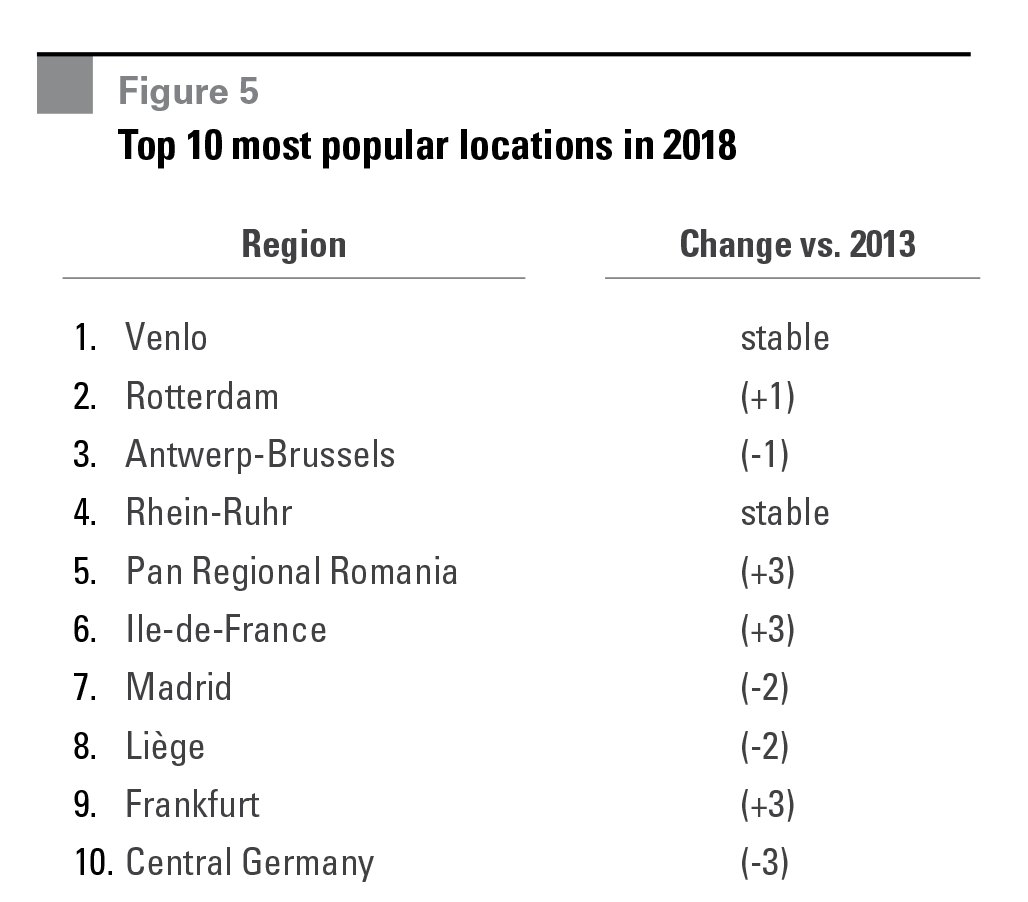

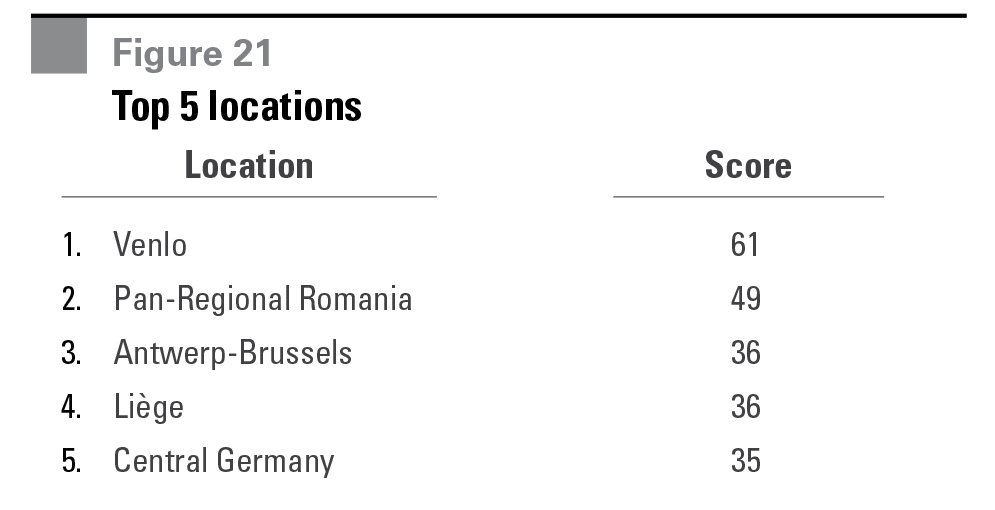

Top 10 Most Desirable Locations in 2018

The survey results show that Venlo will remain the most desirable location in 2018, although the gap narrows slightly between the other top four locations.

Out of the top 4, Pan-Regional Romania, Ile-de- France and Frankfurt (+3) will see the strongest improvements by 2018. Pan-Regional Romania will gain further popularity in the category Labor & Government and Real Estate. Ile-de-France will improve in all four categories by 2018. Frankfurt is expected to improve in all four categories as well and showed the strongest results of all locations in the category proximity to customers and suppliers. Six out of the 10 most improving locations are located in Central (2) & Eastern (4) Europe. For instance, Prague will move up seven places to 14th position, and Istanbul will move up nine places to 15th position in 2018.

Results show that locations in Central & Eastern Europe will gear up and will become more attractive locations in the European logistics landscape

Survey and Characteristics of Respondents

The 13 location drivers were scored by our respondents weighted by importance to their decision when choosing a location. Scores vary from one to five, with five being of greatest importance.

For this survey respondents had the opportunity to choose out of 100 locations, across 22 countries and two aggregated regions in Central Europe (e.g. Balkans) en Eastern Europe (e.g. Baltics).

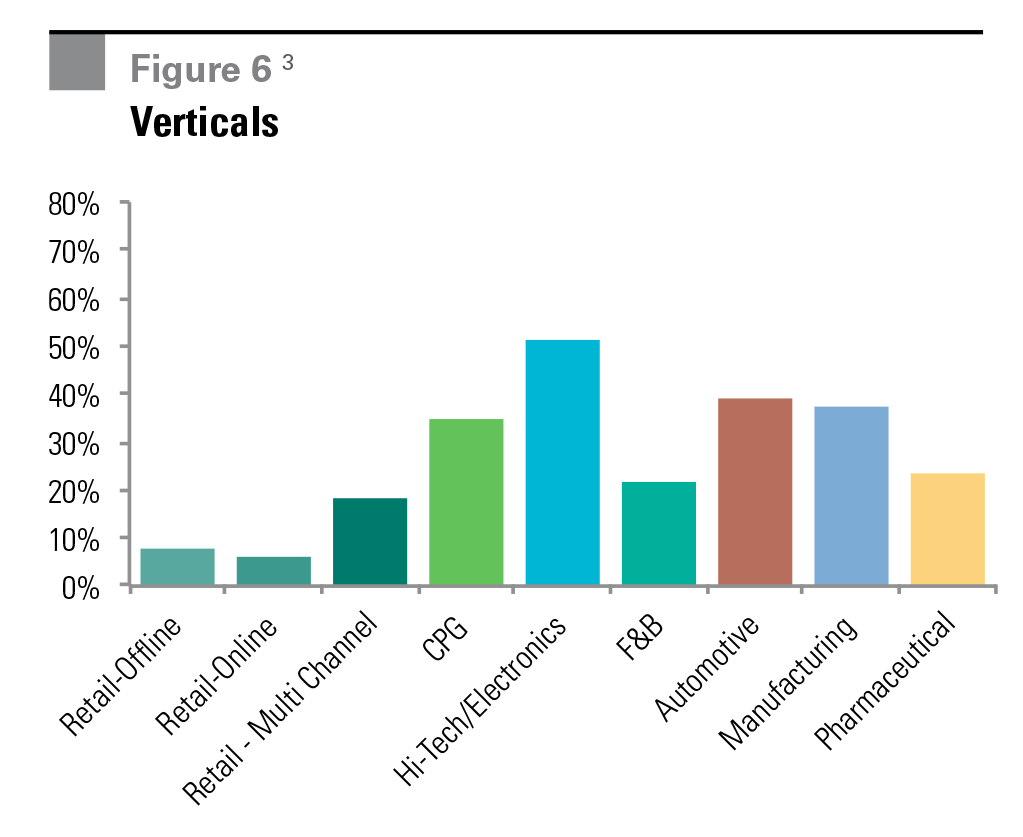

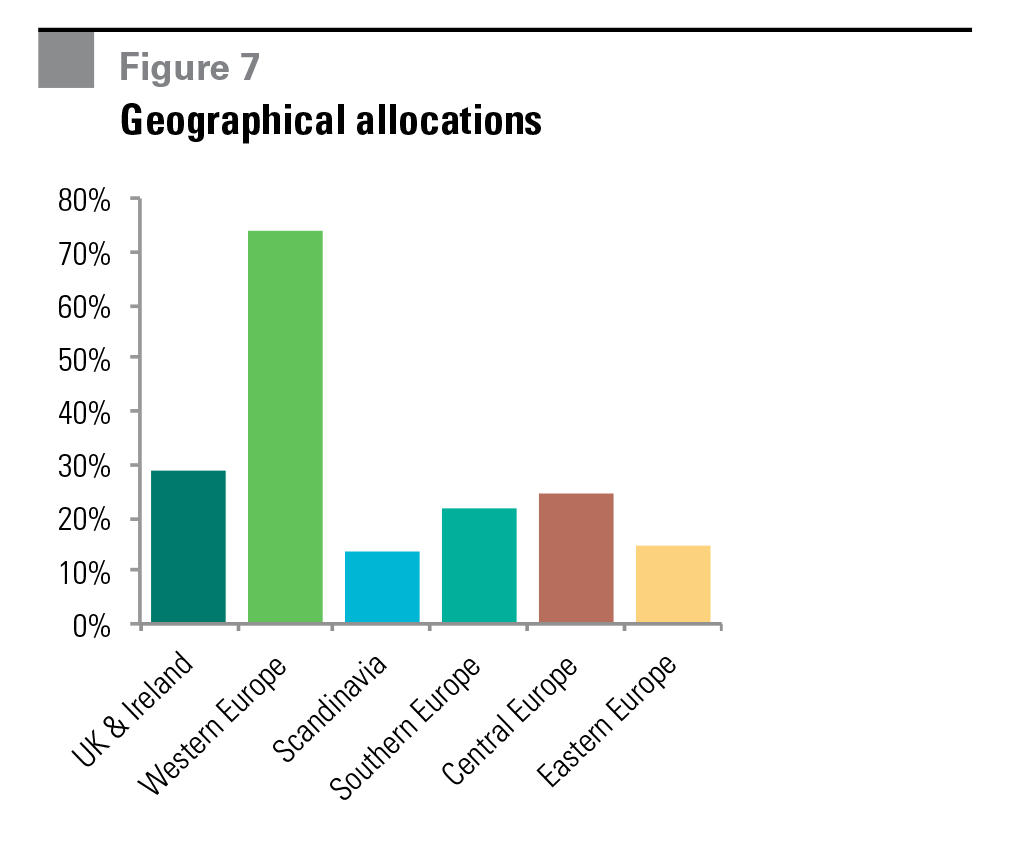

We sent a questionnaire to a large number of distribution center users, such as retailers, 3PLs and shippers in the first quarter of 2013. A total of 160 respondents completed the survey and 120 completed every question. All respondents are solely warehouse users. Our respondents were well diversified across industry sector and geography, as shown in the charts.

Key Demand Drivers of the Future

Introduction

Economic and structural drivers are constantly changing. Companies therefore need to continuously evaluate and optimize distribution strategies to ensure the highest service levels for the lowest costs. The extent to these changes and need for consolidation differ between the different type of logistics operations (e.g. slow movers vs. fast movers) and products (e.g. value of product).

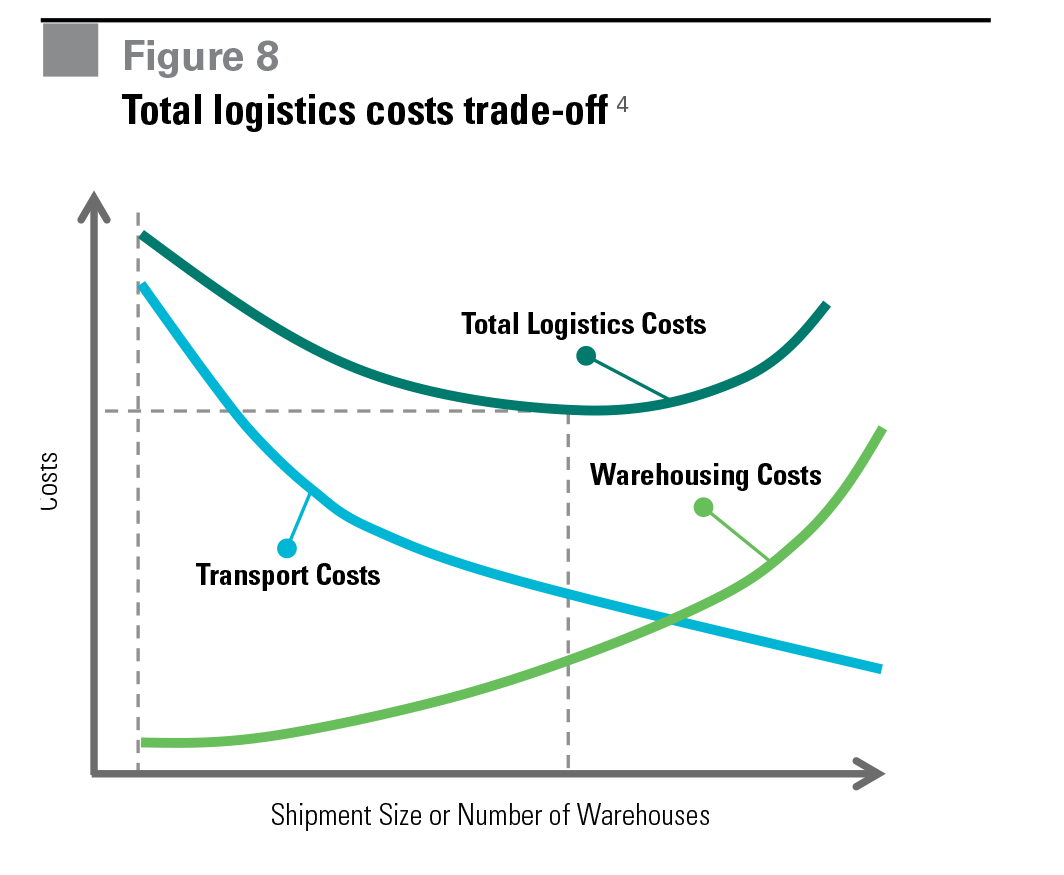

Based on the growth in the shipment size (economies of scale) or the number of warehouses (lower distances) a balancing act takes place between transport costs and warehousing (inventory carrying) costs.

There is a cutting point representing the lowest total logistics costs, implying an optimal shipment size or number of logistics facilities for a specific freight distribution system. Finding such a balance is the common goal in logistics operations. In this section we cover network changes and key drivers that will alter (European) distribution strategies by 2018.

Distribution Networks

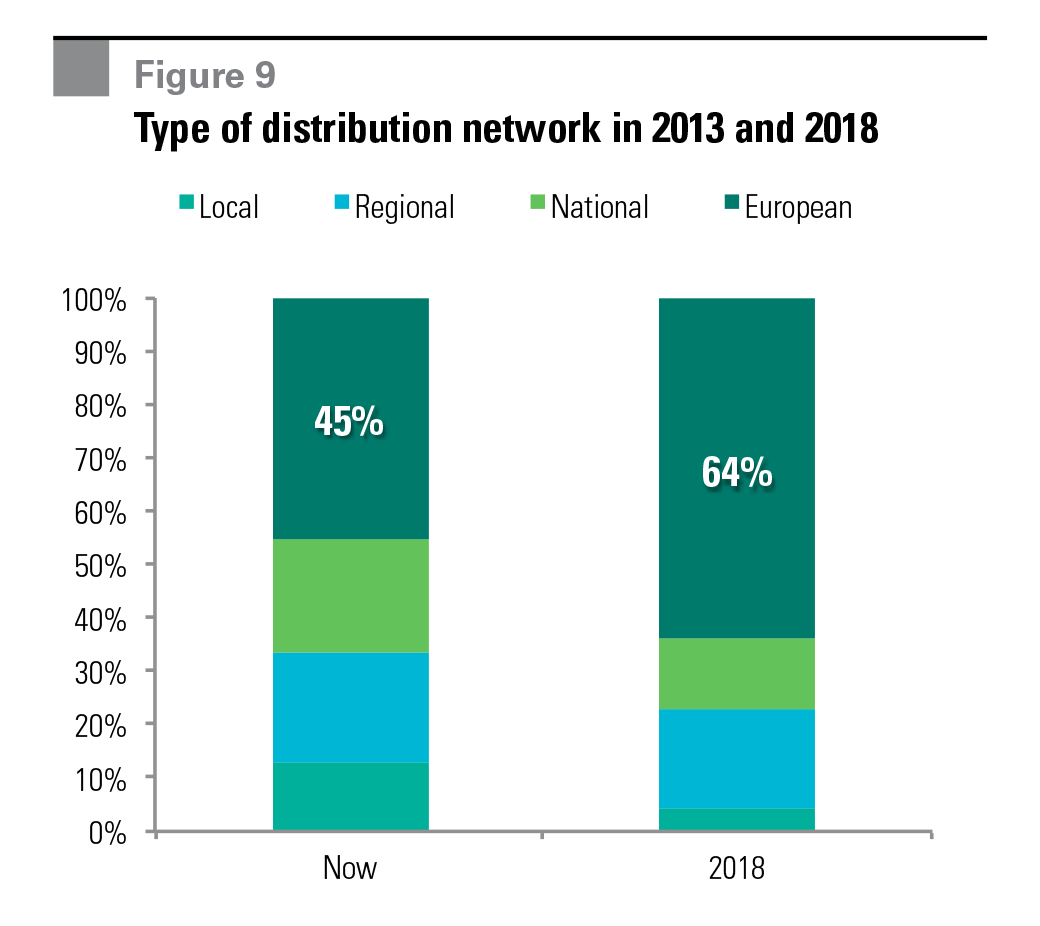

Figure 9 shows that 45% of all respondents run a European distribution network and expect the consolidation trend to modern logistics facilities to continue, leading to more European distribution networks at the expense of National/Local networks.

Almost two-thirds of the respondents, an increase of 19 percentage points, expect to operate in a European distribution network by 2018. For companies with a European distribution network, nearly all will stay as they are.

Consolidation trend will continue, driving strong demand for modern warehouse space

Of those not already running a European distribution network, 61.5% expect a change by 2018. For distribution facilities users running national networks, almost 50% expect go to a European one by 2018 and only 15% expect to decentralize to a regional network. For those running a regional DC network, 51% expect to change, with most of these moving to a European (33%) or national (15%) network.

For those running local networks, only a quarter will still have their local network by 2018. Results show that warehouse users continue to consolidate their operations in larger more efficient DCs and plan to operate in larger networks.

Drivers of Change

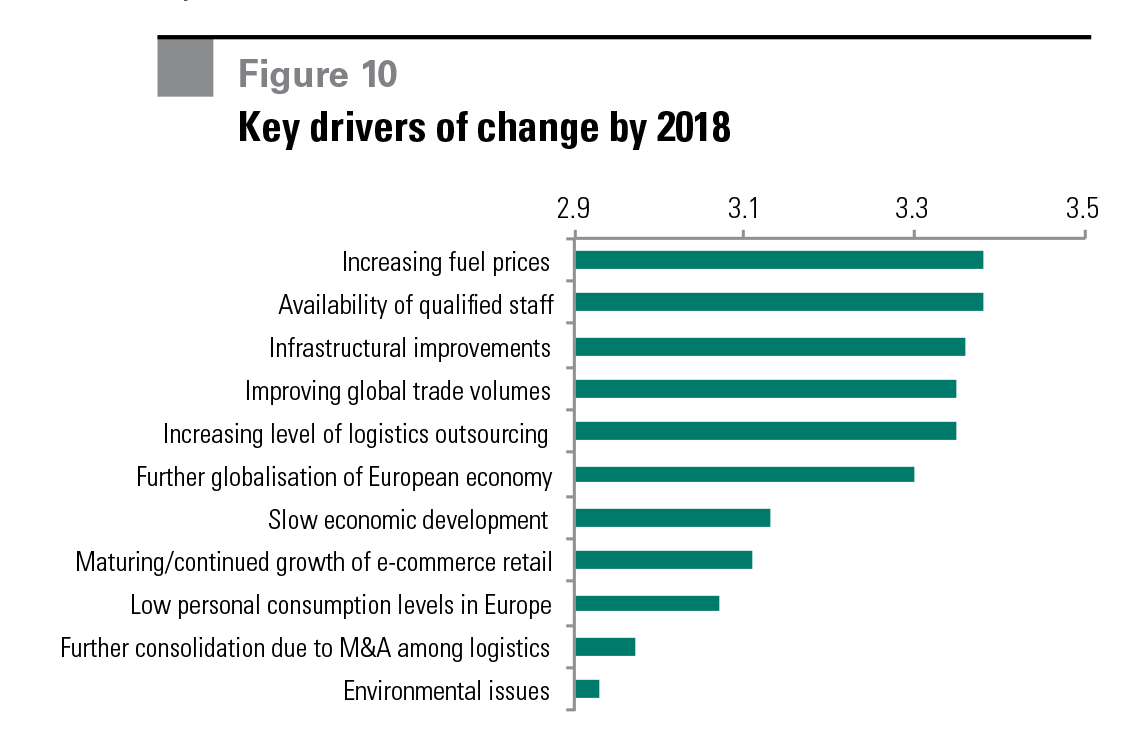

We asked respondents to anticipate the importance of 11 key drivers affecting (European) distribution network strategies during the next five years. As seen on figure 10, secular drivers of change including global trade, outsourcing and globalization will be stronger drivers of change than cyclical drivers such as economic development and consumption. Increasing fuel prices will most impact distribution network strategies in the next five years. Logistics transport costs are the largest cost component for warehouse users (approximately 50-60%). Increasing fuel prices are therefore crucial as the focus shifts from inventory to transport cost optimization.

The second most important driver is the availability of qualified staff, although this differs significantly by country. While there are more staff available due to increasing unemployment in Europe, it is still difficult to find qualified and experienced employees.

This particularly applies for the Northwest of Europe with lower unemployment figures than Southern and Central & Eastern Europe. The third driver of change, infrastructure improvements, is expected to change the market significantly especially in Central & Eastern Europe where infrastructure is developing rapidly.

Structural drivers are expected to be stronger drivers of change than cyclical ones

There are differences between smaller companies (revenues below €50 million) and larger companies (revenues above €250 million) regarding drivers of change through 2018. Smaller companies see rising fuel prices as a bigger influencer/driver than larger ones, and care more about the availability of future development land when looking for a distribution center.

Larger companies care more about access to seaports and transportation infrastructure. Additionally, larger firms rank environmental issues higher than smaller companies.

The importance of structural drivers leading to further supply chain configuration in Europe underscores that the European logistics property market is less mature compared to a market like the U.S. and therefore principally driven by trade and supply chain reconfiguration.

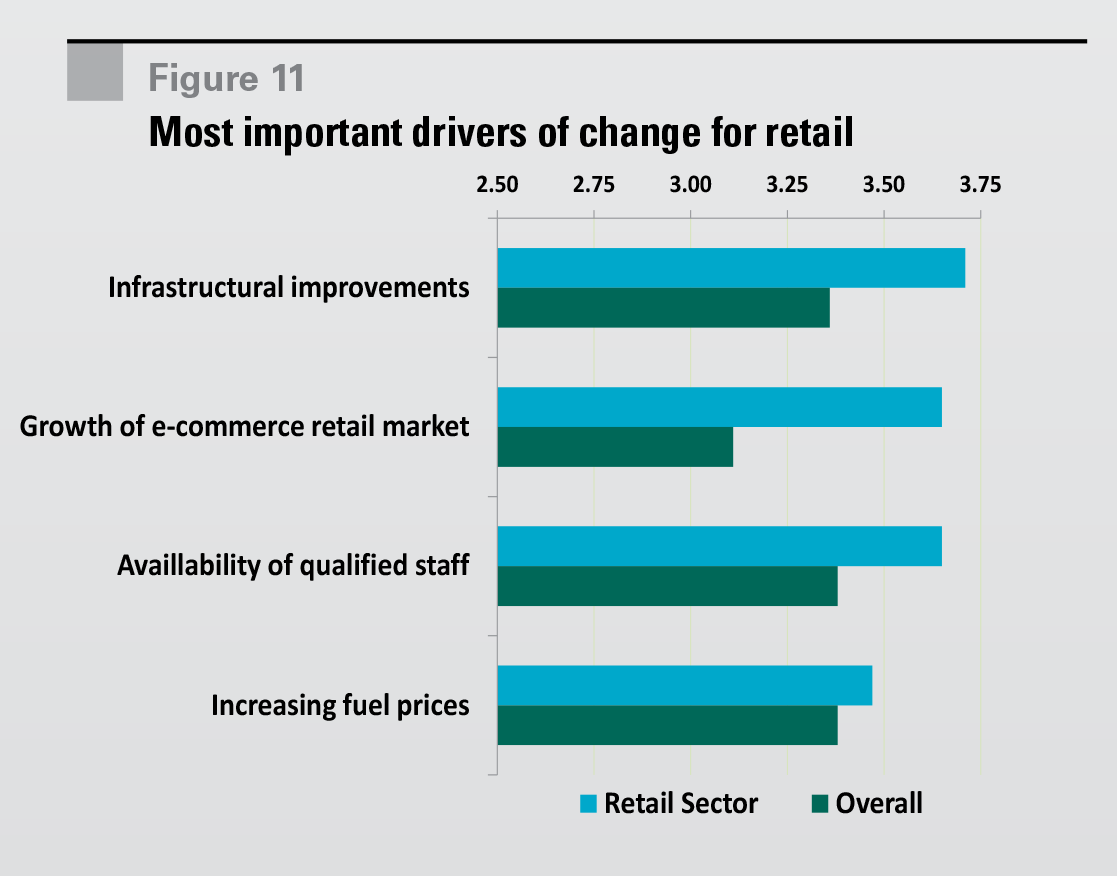

E-commerce

E-commerce is a rapidly growing driver of demand, although growth varies by sector. The vertical retailers expect that the maturing and continued growth of the e-commerce market is the second most important driver of change in the coming five years. Retailers view infrastructure improvement and availability of staff as the other critical key drivers for supporting growth in the e-commerce market. Infrastructure improvements enable retailers to increase their service level, potentially providing customers a same day delivery service.

E-fulfilment centers have a greater employee density to pick and process orders. To gain easy access to local labor pools, regional distribution centers and mail centers must be located near population centers. This also helps e-commerce players minimize transportation costs when handling outbound and return deliveries, and provide a better service to customers. “Bricks and clicks,” or omnichannel retailers, offer consumers the option to collect or return the goods at their shops. There is no “one size fits all” e-commerce distribution model, but there is an increasing trend toward core submarkets closer to consumption centers.

Effects on Consolidation-Decentralization

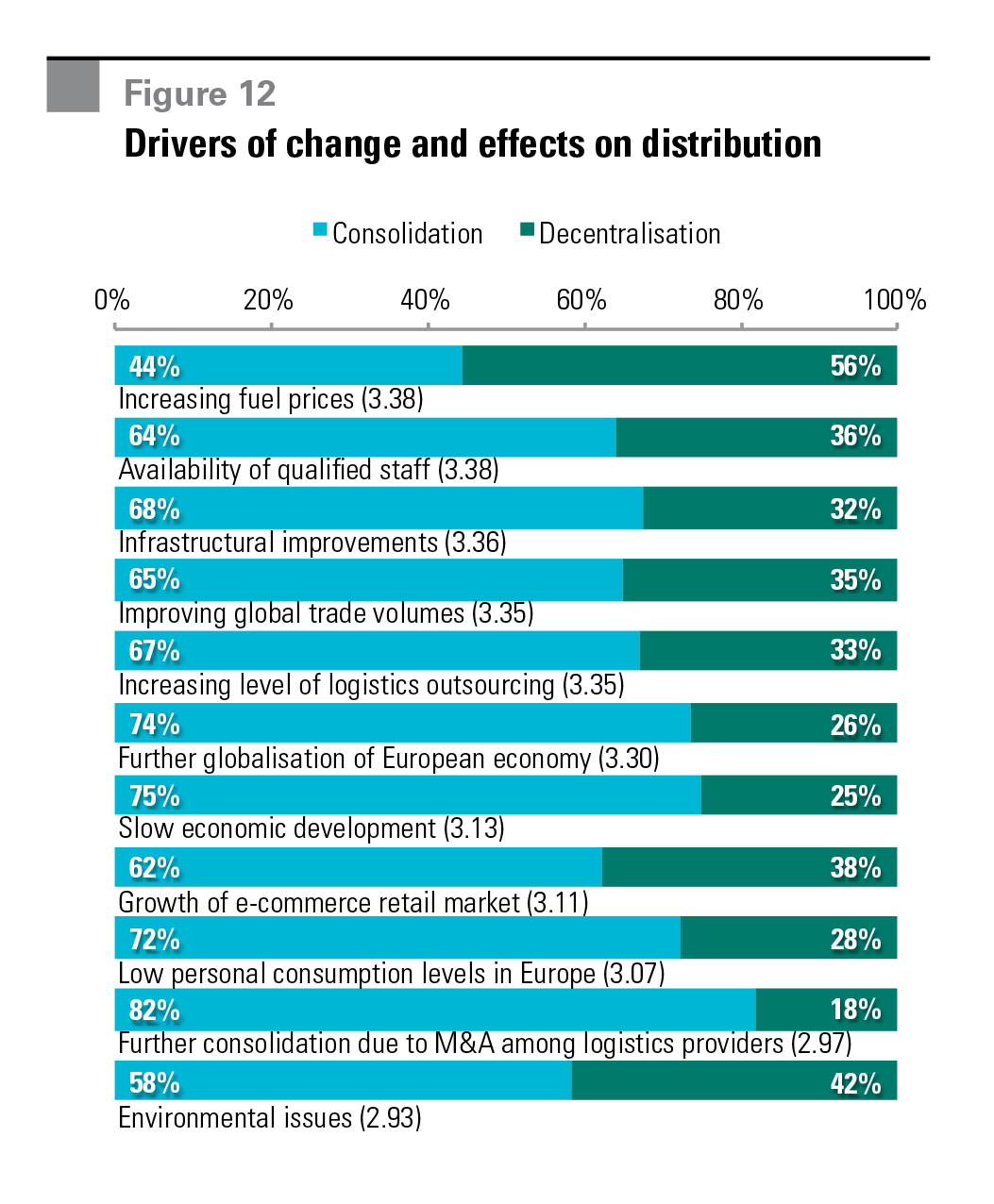

We asked respondents if these change drivers would lead to more or less consolidation in their distribution network strategy over the next five years. Ten out of the eleven drivers of change will lead to more consolidation (see figure 12). The structural drivers are consolidation among logistics providers (82% expect consolidation), globalization of the European economy (74%) and infrastructure improvements (68%). The cyclical drivers are slow economic development (75%) and low consumption levels (72%). Increasing fuel costs, which is the most important driver for shaping distribution networks in the next five years, is also the strongest contributor to decentralization.

10 out of 11 drivers of change will lead to more consolidation (see figure 12)

CONCLUSIONS

There is an undersupply of Class-A logistics space in Europe. The reconfiguration of the European supply chain and the rise of e-commerce means there is significant development potential for modern, efficient distribution facilities across the region. Logistics companies are constantly optimizing their distribution strategies to ensure high service levels for minimal costs.

Logistics facility users continue to consolidate their operations in larger more efficient facilities and generally plan to operate in larger networks. Almost two-thirds of all respondents expect to operate in a European network by 2018. This is at the expense of local and regional networks. Locations in the Benelux are the clear winners in terms of ideal locations to for distribution centers.

Looking forward to 2018, Venlo will remain the most desirable location for logistics facility users, although its lead will narrow slightly. Locations in Central & Eastern Europe will gear up and become more attractive in the European landscape.

SITE SELECTION CRITERIA FACTS & FIGURES

Proximity to customers and Suppliers

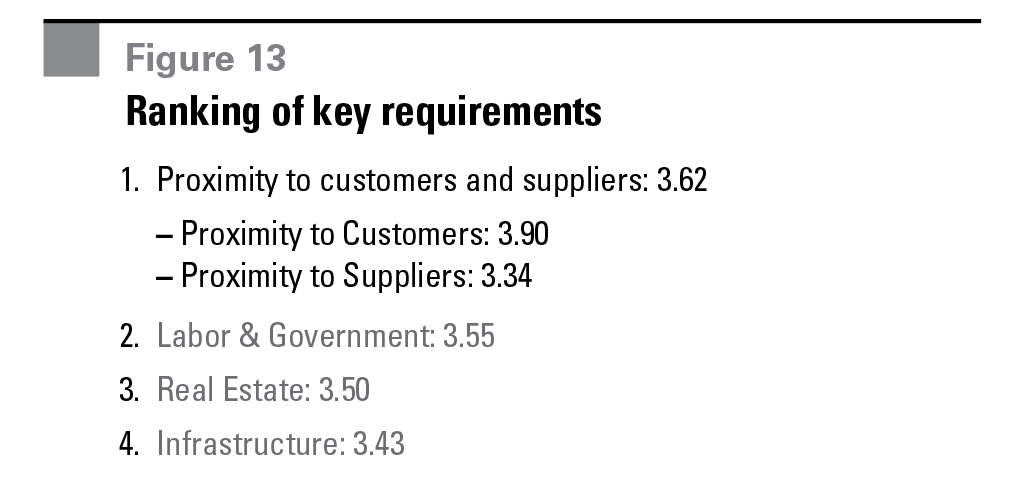

Importance as a requirement

Proximity to Customers and Suppliers scored an average of 3.62. This was the highest score as an overall category.

Scores within Proximity requirement

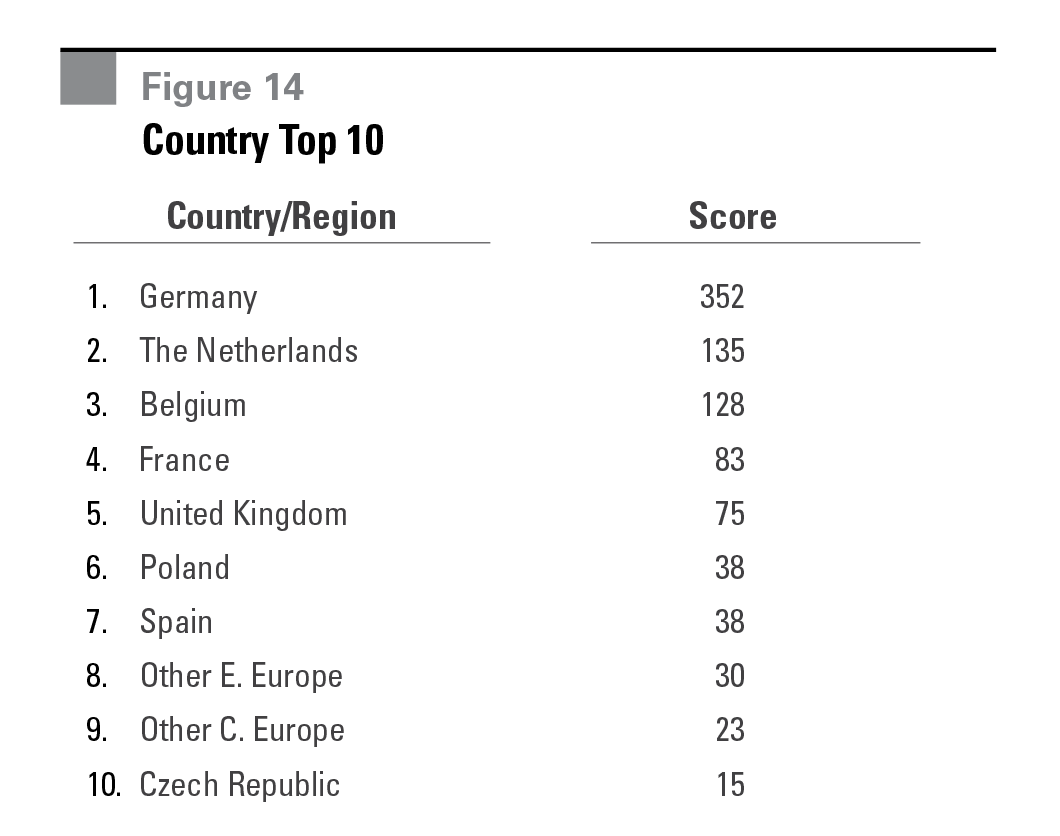

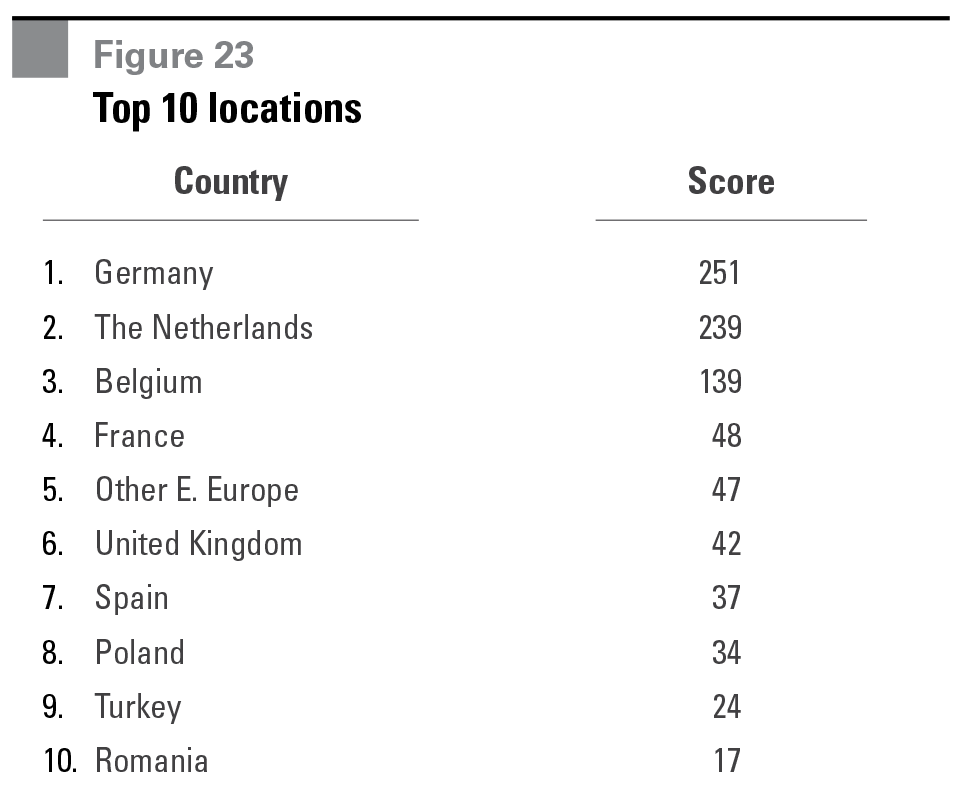

Looking at the preferred locations on a national level, Germany ranks highest given its central location within Europe and proximity to customers and suppliers.

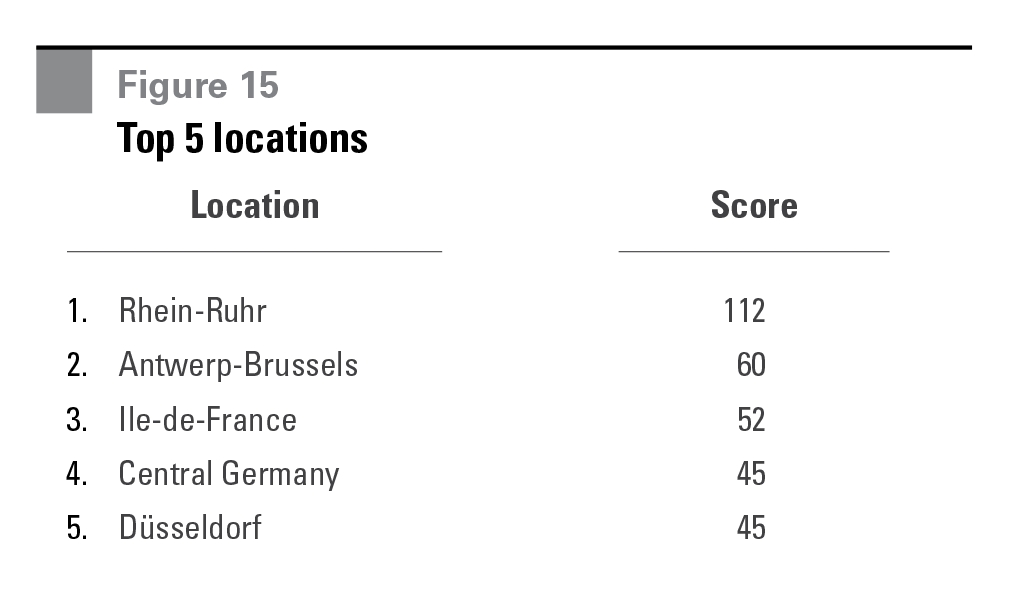

Rhein-Ruhr was the absolute winner with a score nearly twice that of the second region, Antwerp- Brussels. All attractive locations are concentrated in the economic heart (“Blue Banana”) in northwest Europe.

For 2018, respondents expect that Venlo and Frankfurt will make significant gains, while Düsseldorf and Antwerp-Brussels will decline slightly. Rhein-Ruhr is expected to remain the most attractive location in terms of proximity to customers and suppliers. Its score will remain twice as high as the runner-up (Venlo).

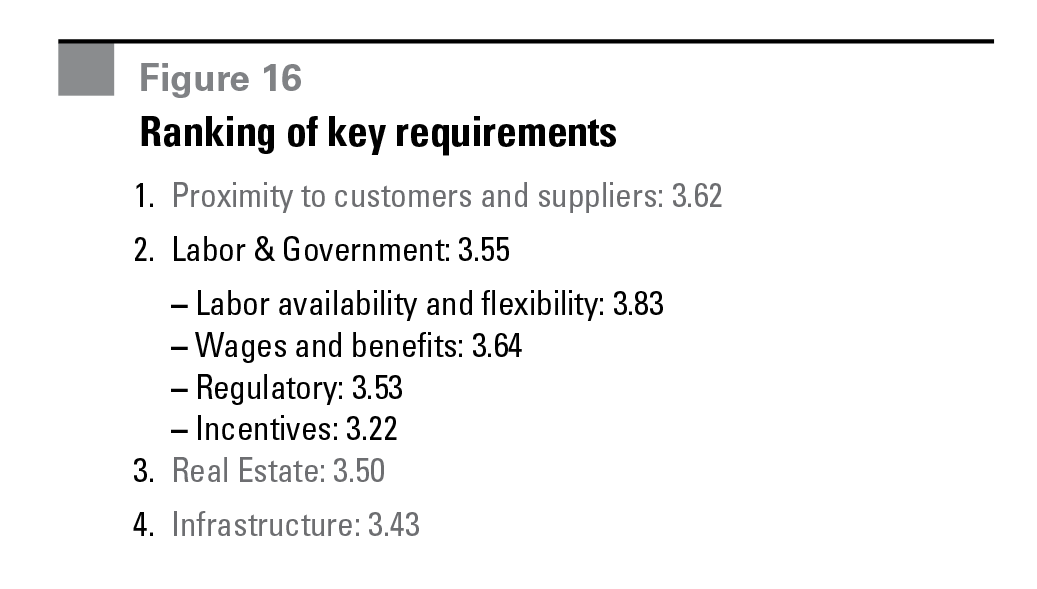

Labor & Government

Importance as a requirement

Labor & Government criteria scored an average of 3.55. Labor availability and flexibility is the most important location criteria scoring a 3.83. The two most important drivers have to do with labor, the least are associated with government.

Scores within Labor & Government requirement

On a national level, the Netherlands scored highest for labor availability and flexibility, regulatory and incentives. The Netherlands also scored fairly high for the requirement regulatory.

The Netherlands is seen as the gateway to Europe and has low regulation barriers. This is critical for its role as an EDC hub.

Spain’s and the United Kingdom’s positions are due to being placed relatively highly across all four Labor & Government requirements, the United Kingdom gaining from the positive impression of its incentives. The top four attractive countries for cost of labor are in Central & Eastern Europe where Romania scored the highest. There are significant differences between EU Member States, with hourly labor costs (incl. wages & salaries and other costs) ranging from €3.70 and €4.40 in Bulgaria and Romania respectively to €37.20 in Denmark and €38.10 in Sweden. Spain scored highest (5th) for the ‘cost of labor’ driver outside Central & Eastern Europe.

Spain’s relative low scores for government specific drivers pushed it down to the 7th position. The runner-up for the driver labor availability and flexibility is Poland, just behind the Netherlands.

This makes Poland an attractive country in labor terms because it scores highly for availability and flexibility and it is the third regarding cost of labor.

Venlo was top in three out of the four labor & government criteria, with only the cost of labor letting it down. In the regulatory section it scored twice as highly as the next region. The top five regions for both 2013 and 2018 are all in Belgium or the Netherlands. Within these scores, Central & Eastern Europe dominated the cost of labor criteria with the top four spots going to regions in Romania and Hungary, although two Western European markets followed next i.e. Madrid and Northern England. For incentives, regions in Switzerland and Ireland are in the top three in 2013, although they are not there by 2018, with Bucharest being the biggest gainer as joint #1 with Venlo.

For incentives the regions in Switzerland and Ireland are in the top 3 in 2013, although they will not be in 2018

By 2018, respondents expect Venlo to remain the most attractive location for the labor & government criteria. However, regions in Turkey jump up the rankings mainly due to it being a favorable place for cost of labor and Bucharest rises in 2018 due to high incentive scores.

Real Estate

Importance as a requirement

Real estate criteria scored 3.50. There are three drivers within this category; availability of land, availability of existing modern warehouses and real estate costs. Real estate costs had the highest score: 3.80.

Scores within Real Estate requirement

Surprisingly, the Netherlands was the location chosen most for availability of land and modern warehouses, but it rated 3rd for real estate costs behind Poland. Warehouse users consider total operational costs and although real estate costs in the Netherlands are above the European average, companies evaluate the total benefits and efficiency of a location.

Within Central & Eastern Europe, Poland and Romania achieved the highest score within the real estate requirement. Poland is first for both real estate costs and availability of modern land and warehouses. Romania has a particular high score for the requirement real estate costs but ranked fifth out of eight for availability of modern land and warehouses. Venlo led the way overall in 2013, due to high scores for the availability of land and modern warehouses. Interestingly, the vacancy rate in Venlo has plummeted since reaching its cyclical high in 2010 and dropped by 800BPS to 9.2% by the end of June 2013, which is currently below the Pan-European average of 9.7%4.

Central Germany and Antwerp-Brussels scored both high in the location driver availability of land and modern warehouses. They are middle ranking for real estate costs. Locations in Poland, like Warsaw and Krakow, scored relatively high for both requirements. Within Poland favorable locations are more spread and so no Polish location made it in the top 5.

Central Germany and Antwerp-Brussels both scored highly for the availability of land and modern warehouses but were middle ranking for real estate costs

Pan-Regional Romania and Bucharest in 2018 owe their score to the high marks for the location driver real estate costs; this is where Venlo lost popularity as a location in 2018, which implies that the respondents foresee that rents will increase and the availability of land will shrink in Venlo.

Infrastructure

Importance as a requirement

Infrastructure criteria scored 3.43. There are four segments within this category. The category proximity to economic networks and strategic transportation access is the most important of all 13 surveyed requirements. The criteria transportation costs is the ninth out of 13 most important location drivers. Respondents view other criteria like proximity to customers and closeness to economic networks and strategic transportation access as more important requirements for their location decision than transportation costs.

Scores within Infrastructure requirement

Germany is the preferred country in terms of infrastructure, ahead of the Netherlands, Belgium and France.

Germany scored the highest in three out of four infrastructure requirements. It was ranked second for proximity to different types of modality behind the Netherlands. Interestingly, when looking at the 15 most favored countries, a large number of Central & Eastern European countries like Poland (8th), Romania (10th), Hungary (11th) and Czech Republic (12th) are ahead of countries such as Italy and Austria. Not surprisingly, Central & Eastern European countries scored specifically high in terms of transportation costs.

Venlo scored the highest in three of the four criteria: road access, proximity to economic networks and transportation costs. This underwrites its function as an EDC location. These locations rely on excellent infrastructure conditions, good access to a major hinterland and a good proximity to major gateways like seaports.

Rotterdam polled outside the top five in the location driver transportation costs and proximity and quality of road access, but was such a clear winner in modality availability, scoring more than twice as many votes Antwerp-Brussels making it number two overall.

Venlo scored the highest marks in 3 of the 4 requirements but Rhein-Ruhr is the most favorable location for proximity to economic networks and strategic transportation access

Footnotes

- Ranked set of data which is divided into four equal groups

- Figure 4: Green numbers indicate highest two scores per market

- Figure 6: CPG: Consumer Packaged Goods; F&B: Food & Beverage

- Source: Prologis Research based on Herriot-Watt University

Forward-Looking Statements

Copyright © 2013 by Prologis, Inc. All rights reserved.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis

Prologis Inc. is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of December 31, 2012, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 554 million square feet (51.5 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

White Paper Contributors

Dirk Sosef, Director Research & Strategy Europe

Ali Nassiri, VP Head of Research & Strategy Europe