As expected, customer activity and utilization moderated in the first quarter of 2019 after reaching unsustainable peaks in late 2018, according to Prologis’ proprietary survey of customers, the Industrial Business Index (IBITM). Contributing factors include normalization of inventory stocking activities and operationalization of newly-leased facilities after a very strong year of net absorption.

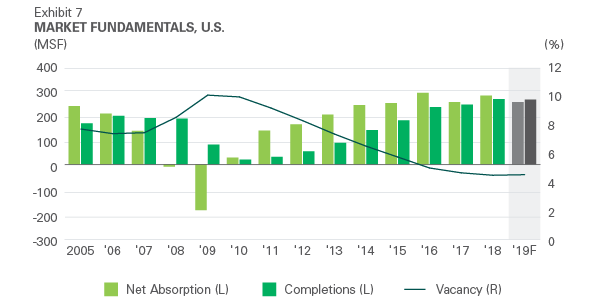

As of Q1’19, most logistics real estate markets remain capacity-constrained, meaning that customers are waiting for new supply to come online in order to expand their distribution networks. Prologis Research sees this pent-up demand reflected in a high proportion of built-to-suit projects and strong pre-leasing in the construction pipeline. As a result, demand and supply should remain roughly in line through 2019, keeping the vacancy rate near its historic low of 4.5% and putting further upward pressure on rental rates.

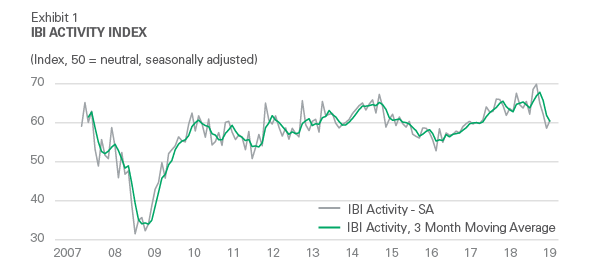

Customer activity and utilization has moderated but is consistent with growth. The IBITM activity index decelerated to an average of 60.4 in Q1’19 from a recent peak of 67.8 in Q4’18 (see Exhibit 1). The combination of stronger economic growth and advance stocking of inventory ahead of tariffs combined to boost activity in late 2018.

In early 2019, the combination of slower economic growth1 and a pause in inventory stocking contributed to a slowdown in activity levels. These trends were also reflected in the utilization rate, which decreased to 85.4% in Q1’19 from 86.4% in Q4’18 – near the record high (see Exhibit 2). Still, at 60.5 in March 2019, the IBITM activity index was consistent with strong growth in the flow of goods through U.S. logistics facilities (readings above 50 signify growth).

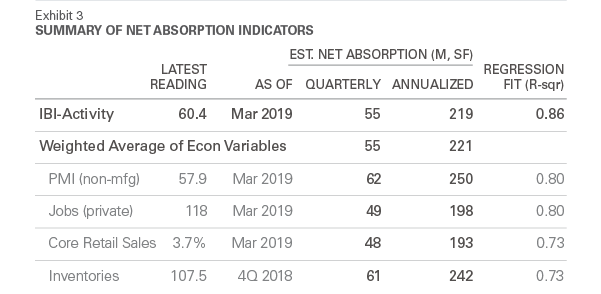

2019’s slow start to economic and demand growth was affected by a number of one-time factors. Logistics real estate demand and supply were balanced in Q1‘19, with 40.4 MSF of net absorption and 46.8 MSF of completions, holding the vacancy rate steady at an all-time low of 4.5%.2 In terms of economic data, the government shutdown, extreme winter conditions, and shifted seasonality in supply chain patterns may have skewed data downward. Accordingly, our regression model of leading indicators, including the IBITM, suggests a current demand run rate of about 220 to 250 MSF (see Exhibit 3) annually, down from nearly 300 MSF in late 2018.

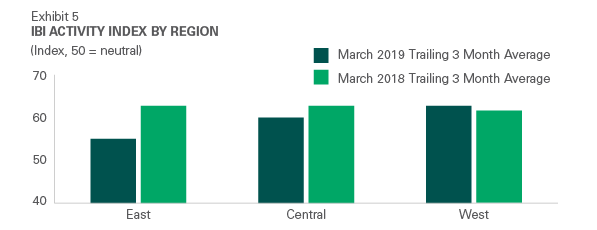

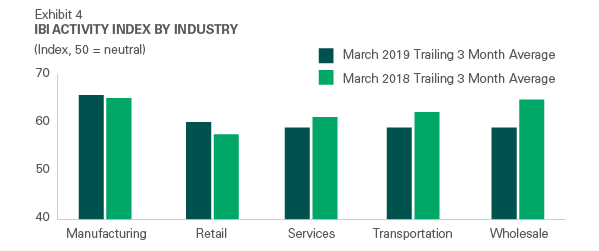

Momentum is strongest for retail and manufacturing customers. This latest survey suggests an acceleration in activity for retail customers over the past year (see Exhibit 4). The activity index for manufacturing customers also improved in Q1’19 relative to the year prior, while wholesale, transportation and services customers reported lower activity levels. On a regional level, activity accelerated in the West region and decelerated in the East and Central regions (see Exhibit 5). Prologis Research had expected some volatility in these metrics, as inventory stocking patterns and the flow of goods through domestic supply chains were disrupted by new international trade policies.

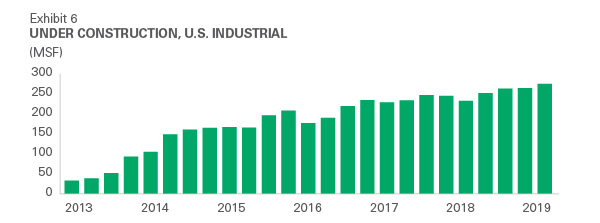

Development is highly concentrated in a few pockets. Market rents continued to climb upward in Q1’19, incentivizing more development.

The pipeline of space under construction inched up to 255 MSF in the first quarter, up from 246 MSF in Q4’18.3 Starts rose 15% year-over-year in Q1’19, driven primarily by an increase in build-to-suit activity, which comprised 30% of projects started.4 On the contrary, speculative starts declined by 5% during the same period. On a submarket level, the outlying regions of Atlanta, Pennsylvania, Chicago, Dallas, and Houston are at greatest risk of a mismatch between supply and demand. Indeed, some 50% of spec starts were in these five markets in Q1’19.

The outlook in most markets for continued low vacancy and upward pressure on rents. With the exception of the aforementioned pockets of spec development, new supply is unlikely to outpace demand in the near term. Given current capacity constraints, demand should approximately match new supply in the coming year, keeping the vacancy rate at its historic low of 4.5% through 2019. Prologis Research forecasts 250 MSF of demand and 260 MSF of supply in 2019. The combination of sustained healthy demand, low availability and rising rents should continue to make planning for upcoming requirements a priority for forward-thinking users of logistics real estate.

Endnotes

2. CBRE, JLL, Colliers, Cushman & Wakefield, CBRE-EA, Prologis Research

3. CBRE, JLL, Colliers, Cushman & Wakefield, CBRE-EA, Prologis Research

4. Prologis Research

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2018, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 768 million square feet (71 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers across two major categories: business-to-business and retail/online fulfillment.