What’s new in our 2017 rent survey?

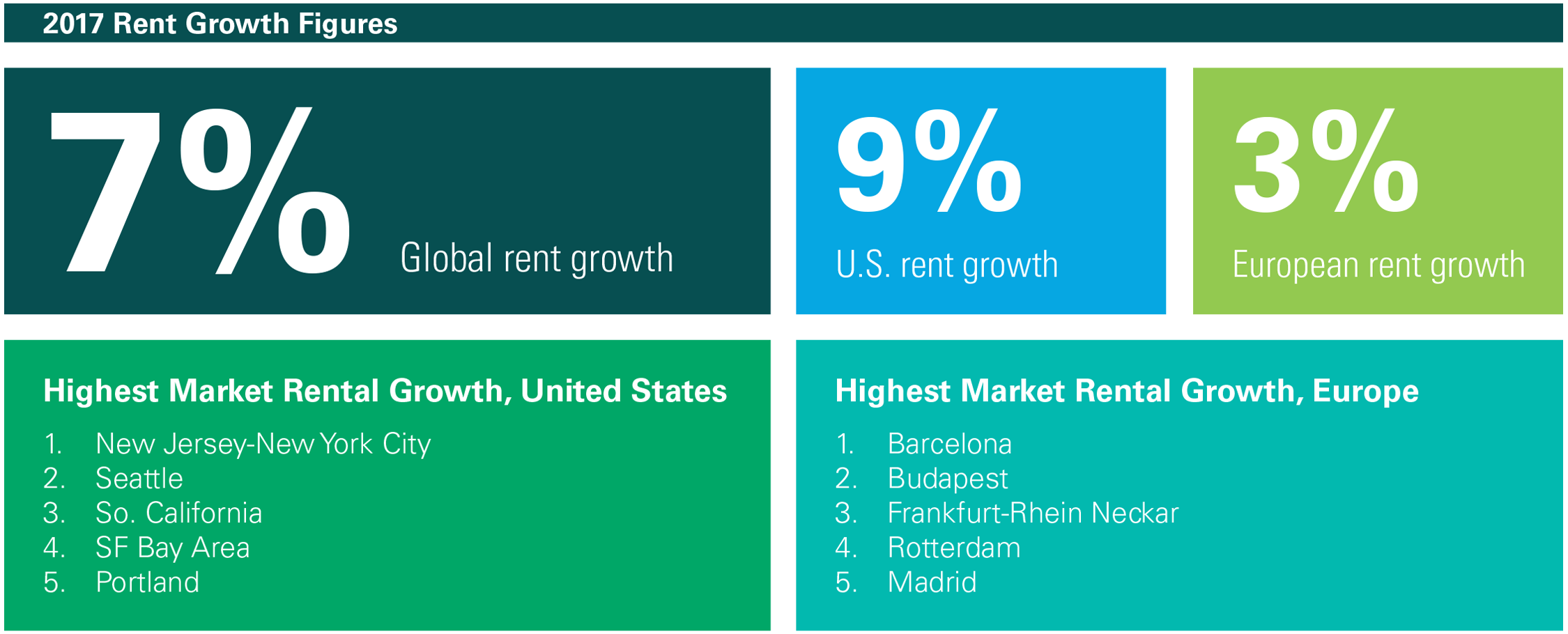

- Global market rental rates rose by nearly 7%, accelerating from the 4% rental growth realized in 2016.

- The U.S. led all regions with 9% growth.

- Growth accelerated in Europe, led by the continent.

Why does it matter?

- Pricing remains historically strong, with low vacancies translating to higher rental rates as customers compete for available space.

- High-barrier-to-supply markets with geographic, legislative and other hurdles to new development have the strongest fundamentals.

- Customers who plan well and can act quickly will secure the best space.

What’s next?

- Rent growth is poised to continue. Customers are maxing out their existing real estate footprints and placing greater focus on major population centers and infill locations when it comes time to expand their operations.

- At the same time, development remains disciplined and the cost to develop new buildings is rising quickly in most markets around the world.

- Higher costs should lead developers to charge more in rent to build new buildings.

Global Overview

The Prologis Logistics Rent Index, introduced in 2015, examines trends in net effective market rental growth in key logistics real estate markets in the United States, Europe, Asia and Latin America.2 Our unique methodology focuses on taking rents, net of concessions, for modern assets. Prologis Research combines our local insights on market pricing with data from our global portfolio to produce the index.

Key findings from our 2017 survey.

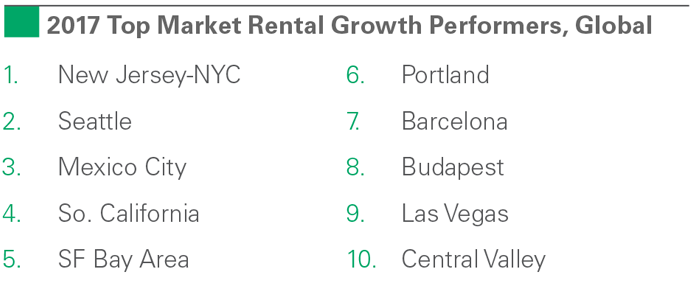

- Rent growth is broad-based and accelerating. Globally, rents rose nearly 7% in 2017, an acceleration from 4% growth in 2016.

- The U.S. is still the fastest-growing region. Rents rose 9% in 2017, an acceleration from 6% in 2016. In general, growth was steady for larger bulk product from 2016 (mid-single digits), but accelerated in large coastal markets and in infill submarkets where growth was more than 10% in 2017.

- Europe has experienced an acceleration and a rotation in growth leadership. Rents rose nearly 3% on a net effective basis, and faster on the continent than in the UK in 2017.

- Low vacancy is prompting competition among customers. A main hallmark of this cycle is disciplined supply, healthy demand and historically low vacancy rates.

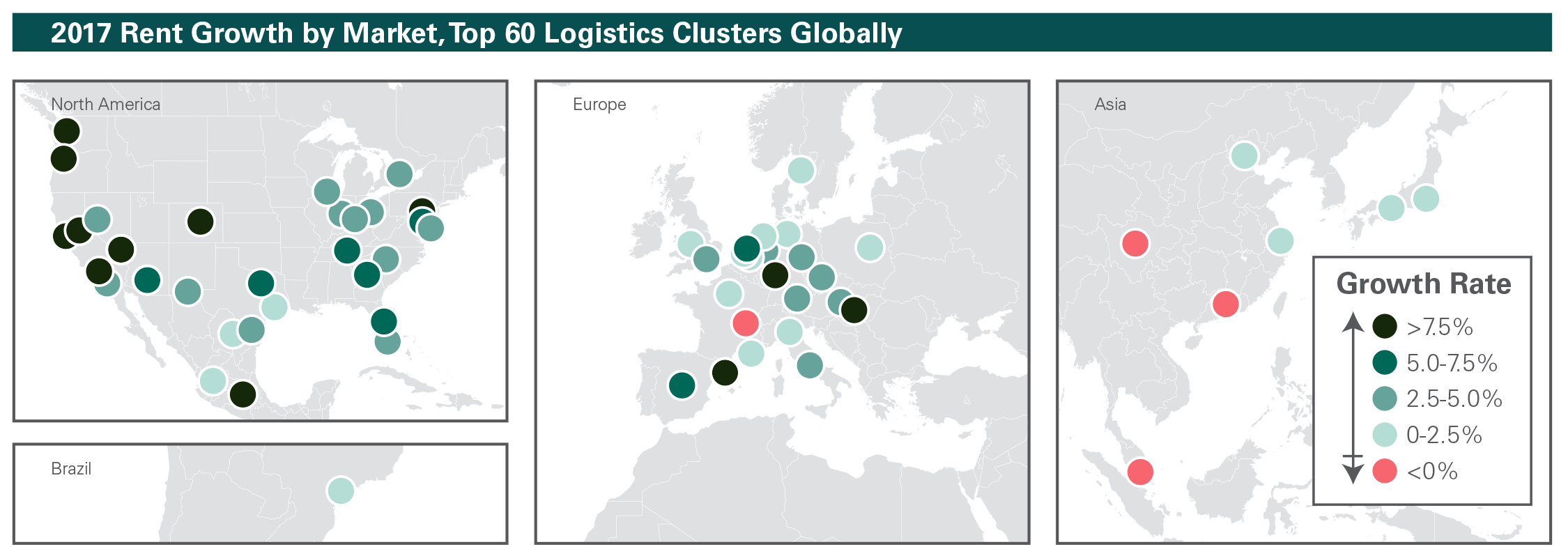

- Considerable dispersion exists across growth rates and their drivers. Local, on-the-ground knowledge is critical. Growth rates vary widely. In some markets, rental rate expansions are mature and remain robust—in others, growth is just beginning (only a handful are flat or negative).

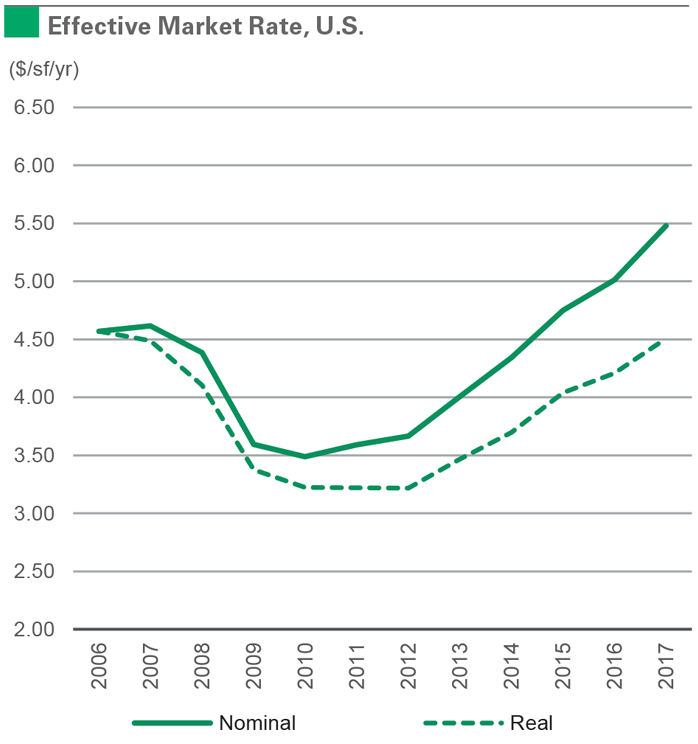

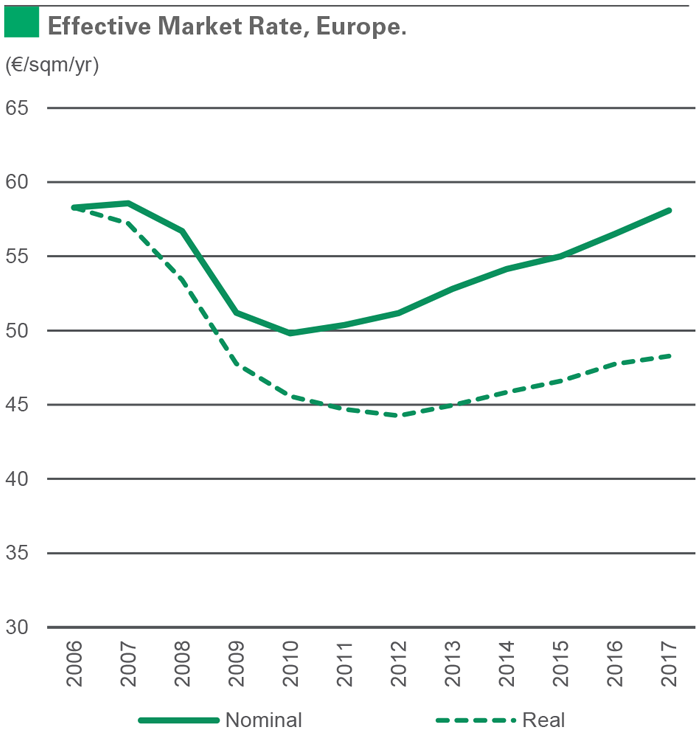

- Barriers to supply are a key differentiator. Rent growth was outsized in markets with limited new supply. Notable, high rental rates are not diminishing demand. Rents may seem higher than in prior cycles, but they remain below those levels on an inflation-adjusted basis. Moreover, some of the strongest rent growth has been recorded in the most expensive markets, such as the coastal U.S. and Germany.

Looking forward, logistics real estate markets appear poised for continued rent growth. Healthy operating conditions and synchronizing economic growth should provide a platform for another solid year of market rental growth in 2018. Key themes to consider:

- Very limited alternatives. Similar to the broader macro backdrop, customer sentiment and desire to grow is at its strongest point in years. However, low vacancies are forcing customers to bid pricing higher among both new and existing available properties.

- Escalating replacement costs. Costs for everything ranging from materials, to labor, to land and to municipal fees all are rising. Development underwriting is changing; if rents don’t continue to rise, the pace of development growth could slow (or reverse).

- Room for increases. Rent increases have become material as they accumulate over multiple years (as they have for five years in the U.S., for example). Yet, rents remain low on an inflation-adjusted basis. In addition, rents represent roughly 5% of supply chain costs (and supply chain costs represent a small share of total revenues), making rent a very small share of overall costs.3 Yet, the choice for superior real estate facilitates big improvements in capabilities and service levels.

- Emphasis is on quality. More than ever, customers have an emphasis on the locations and types of buildings necessary to meet the demands of modern supply chains. Their answer is to increasingly demand high-quality and infill locations in or near major consumption centers. New development is especially difficult (or, sometimes, impossible) to introduce in these locations.

What does it mean? Our study reminds us that real estate is inherently local. Key themes by stakeholder:

For customers, securing quality space remains challenging. In many markets, rent growth in recent years has been materially ahead of local consumer price indices. For customers who only lease space periodically, growth over multiple years means rents may be 20% higher, or more, than the last time they leased space. Moreover, the combination of low vacancies, improving economic growth and rising replacement costs suggests that rents will continue to rise in 2018. Forward-thinking customers with a thorough planning process and the ability to act quickly stand the best chance of meeting their real estate requirements at the most attractive price.

For investors, valuations in high-growth environments can be difficult. Rapid market rental rate growth means local knowledge is critical. In-place rents are materially below market, principally in the U.S. At the same time, the recovery has expanded and more markets are enjoying rent growth. Looking forward, local market supply/demand dynamics should underpin market rental growth. Markets with higher barriers to supply and very low vacancies will see customers competing for space and driving up rates.

United States

U.S. market rental growth remained the highest in the world and and grew by 9% in 2017. However, there was significant stratification among markets, submarkets and size categories. The double-digit pace of rent growth in large coastal markets was more than twice that of markets with lower barriers to supply. Similarly, within markets, infill submarkets tended to outperform associated non-infill submarkets. Finally, with new supply largely focused on larger product, rent growth for smaller-sized buildings outpaced that of bulk space after considering differences between markets.

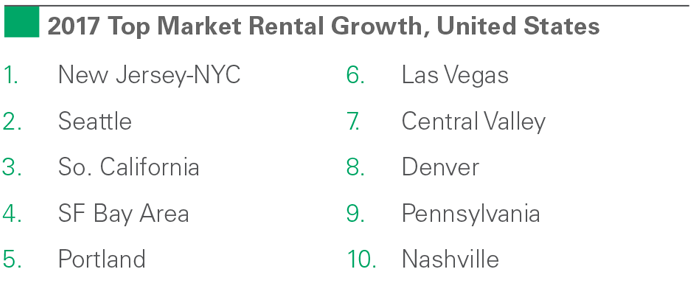

Rent growth in the West is outpacing other regions. Seven of the ten top-performing markets are in the West. In 2017, market-wide net effective rent growth ranged from nearly 8% in Denver to more than 15% in Seattle. High barriers to new supply, access to key global trade gateways and healthy economic growth support outperformance in these markets.

New supply is holding back rent growth in relatively few submarkets. A number of markets/submarkets we flagged as at risk of oversupply experienced below-average to negative rent growth in 2017. Trends were largely isolated to bulk product in these markets, with smaller-sized facilities recording healthy rent growth. These markets include Louisville, Indianapolis, Henry County (Atlanta) and South Dallas.

Multiple trends are aligning to lift rental rates. A lack of land and labor continues to limit new supply and should spur further customer competition for space in high-barrier markets. In lower-barrier markets, rising replacement costs are poised to require higher rental rates to justify new supply, particularly as cap rates level off. Through our data and conversations with customers, Prologis Research sees greater willingness to pay for premier locations and less substitution for adjacent markets than in past cycles. Rising service level expectations throughout the industry are driving this trend, and customers are prioritizing fast and reliable delivery to consumers. This structural shift underscores the stratification of rent growth by location and gives us a more optimistic outlook for future rent growth potential, particularly in high-barrier markets and submarkets.

Europe

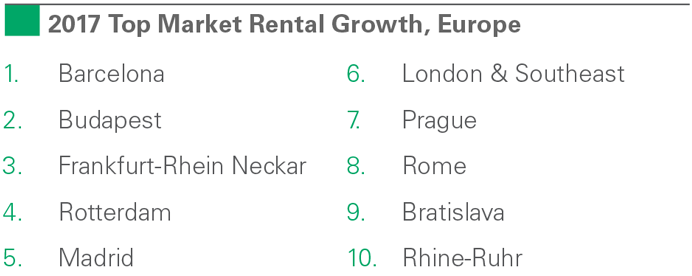

In Europe, market rental growth improved in 2017, but the composition of growth has been varied. Net effective rents rose nearly 3% in 2017, a slight improvement over 2016. However, the geographic drivers of growth are shifting, as continental EU improved considerably in 2017, with rental rates rising 3%, up from less than 2% in 2016. Northern European markets led the acceleration, but many markets across Southern and Central Europe improved, as well. By contrast, growth remained positive but slowed in the UK; rents there rose between two and three percent on a net effective basis.

Changes in the macro backdrop have helped to drive growth rates. On the continent, improving economic growth and customer sentiment, coupled with low market vacancies and disciplined supply, has led to a normalization in concessions and some bidding up of headline rates by customers. However, in the UK, slowing economic growth and uncertainty has led to more cautious decision-making and a slower pace of demand growth. Headline rents rose—but concessions rose, too.

The recent escalation and acceleration of replacement cost growth is boosting the rental rate outlook. Buildings under construction today still cost less to build than they did in the mid-2000s. However, pricing is changing on a real-time basis. Construction costs are rising by 4-6% per annum across the continent.4 Faster growth is occurring in the best economies and in the most active development markets, even in typically low and steady inflation markets like Germany. Some markets are building more than they ever have and are running into capacity constraints. Labor, materials and the availability of general contractors and skilled subcontractors are all factors.

Conditions are poised for a further acceleration on the continent. Market vacancies have fallen to their lowest point on record, and macroeconomic activity and customer sentiment are becoming stronger catalysts for growth than in prior years. Development has been disciplined and most activity has been build-to-suit with very little speculative activity. In addition, construction cost increases are expected to continue. One offset could be cap rate compression; cap rates have compressed by more than 250 bps in the current cycle, creating a lot of value in the process, but this has been a headwind to rental rate increases.5 Cap rates may compress further, but would need to compress significantly to fully offset higher replacement costs.

Other Regions

In Asia, mature supply and demand cycles are translating to rent growth, but conditions are varied by market and submarket. Differences are closely tied to barriers to supply and local market conditions. Highlights by major regions include:

- In Japan, market rents are rising modestly, in line with the soft pace of economic growth and inflation. Large increases in construction costs over the last five years, coupled with the potential for additional increases heading into the 2020 Olympics, has created a need to pass through a portion of increase to the marketplace. However, cap rate compression has been similarly significant, increasing values but acting as an offsetting factor in development economics. Modern logistics facilities help users upgrade their operations and reduce costs elsewhere in their supply chains. Buildings with good access to labor pools and strong links to infrastructure attract the most interest from customers. Elevated supply in Osaka Bay and the fringe areas of Tokyo held limited rent increases in those submarkets.

- In China, a variety of trends have emerged at once. Significant and ongoing economic growth creates infill submarkets quickly as cities expand. Replacement costs have been rising faster than inflation due to escalating labor rates. At the same time, cap rates and development yields have declined as the industry has matured in China. Taken together, rent growth has been strong, particularly in Tier 1.0 cities and infill submarkets. There are a handful of growth submarkets where concessions have risen due to a temporary imbalance between recently completed projects and the full emergence of demand. Going forward, growth appears poised to improve amid strong demand and an expansion of submarkets with a lack of land and new development.

In Latin America, conditions are varied and subject to local economic conditions and barriers to supply.

- In Mexico, market vacancies remain low and below 5% across the six main markets, providing a tailwind for broad-based market rental growth.6 Recent macro crosscurrents have had little effect on demand, but seems to have tempered new development in spite of the strength of market fundamentals. Market vacancies in Mexico City remain below 1%, and are among the lowest in the world. Scarcity of developable land near key roadways south of the tollbooth has driven land pricing spikes and constrained supply.

- In Brazil, market rental rates fell during the country’s worst economic correction in modern history. However, economic growth returned in 2017 and logistics rental rents stabilized. Moreover, the markets appear poised for considerable rent growth. Rates are depressed on a nominal and real basis and, even with a recovery in demand, will need to rise before development can begin.

2018 Outlook

Logistics real estate markets appear well-positioned for healthy rental growth. Strong operating conditions and synchronizing economic growth should provide a platform for another solid year of market rental growth in 2018. Key themes include the following:

1. Low vacancies are driving competition among customers. Low vacancies and an increasing growth bias among customers, supported by a further acceleration in the global economy, appears likely to support healthy growth in 2018 in nearly every market around the world.

2. Replacement costs are spiking. Led by labor rates, construction costs are rising at multiples of inflation in many markets around the world. High and rising land values also are a factor. Taken together, cost increases have contributed to greater developer discipline in the current cycle.

3. Room for increases. Rents remain low on an inflation adjusted basis. In addition, rents represent a small share of total and supply chain costs—big increases in rents do not have a big impact on cost structures. Yet, the choice for superior real estate facilitates big improvements in capabilities and service levels.

4. There is a greater emphasis on quality. More than ever, customers have a sharper view on the locations and types of buildings necessary to meet the demands of modern supply chains. Their answer is to increasingly demand high-quality and infill locations, those in and near major population centers. New development is especially difficult (or, impossible) to introduce in these locations, meaning vacancies are low, and customers compete more intensely for availabilities, pushing up pricing.

Endnotes

2. Prologis Research introduced the proprietary Prologis Rent Index in 2015. This 2017 report is our second update. To access the prior Index report, please click here.

3. Estimates compiled from CSCMP report prepared by AT Kearney, IMS Worldwide, public company filings, and Prologis Research

4. Prologis Research

5. Prologis Research

6. Mexico market fundamentals data from CBRE, Prologis Research