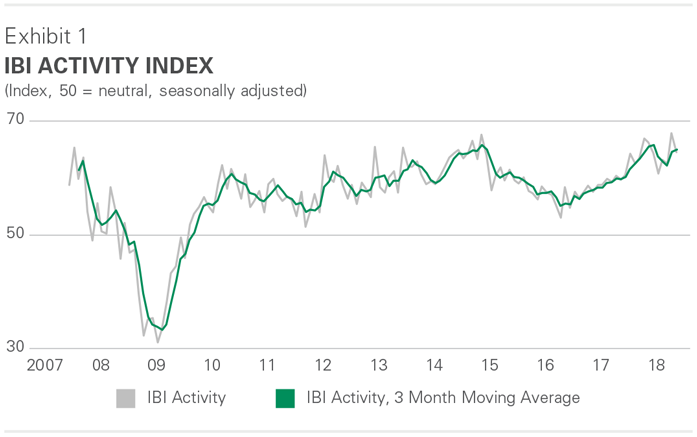

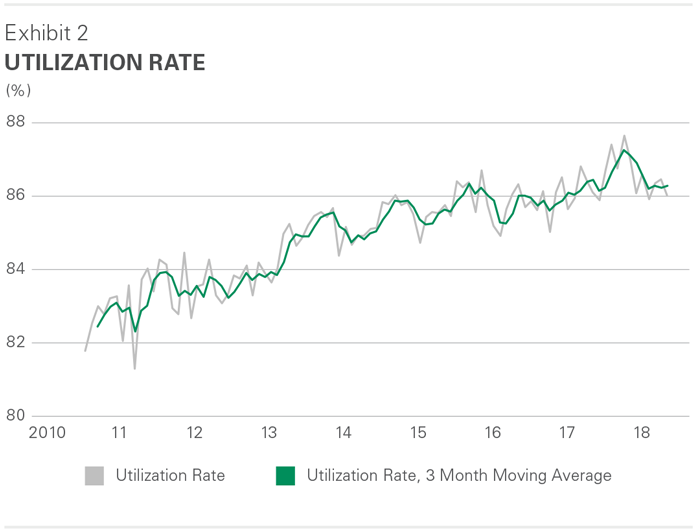

The flow of goods through U.S. logistics facilities grew at a strong pace through mid-2018, according to Prologis’ proprietary customer survey, the Industrial Business Indicator (IBI)TM. In June, the activity index came in at 64.5—readings above 50 reflect growth (see Exhibit 1). This reading has generally risen this year, an indication of real-time business activity rather than negative headline noise. Also, customers report they are using more than 86% of their leased space—an elevated level.

Two factors underscore these trends: better economic growth and disciplined development of logistics real estate. Demand for space currently exceeds availability. Prologis Research expects this dynamic to continue through the near term, with new supply absorbed as it comes online. The vacancy rate should stabilize at 4.6%, putting further upward pressure on rents.

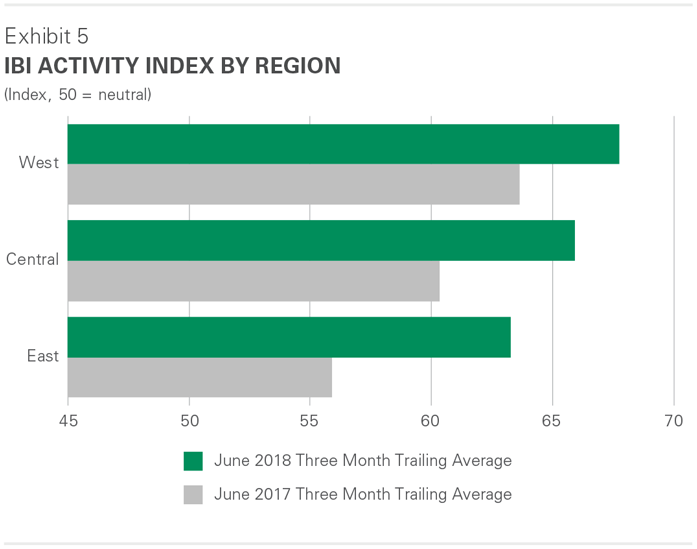

Customers are expanding as economic growth accelerates. Beginning in early 2017, a lack of available space began to limit customer expansion activity. Even with their businesses growing, logistics real estate users have had to make do with existing footprints; this is revealed by an IBITM utilization rate hovering at elevated levels between 86 and 87 percent (see Exhibit 2). With utilization above the commonly targeted level of 85 percent, customers are leasing new space at a brisk pace. An illustration of this trend: In the first half of 2018, net absorption totaled 123 million square feet while new supply was 119 million square feet. These totals were up 8% and 9%, respectively, from the first half of 2017.1 Generating demand in excess of new supply, economic growth likely accelerated in the first half of 2018 on the back of tax cuts, fiscal stimulus, higher consumer spending and improved confidence.2 Healthy leading indicators, such as the IBI and current capacity constraints, suggest that heightened demand will persist through the coming quarters. Still, Prologis Research is careful to note potential emerging potential risks to consumption activity (the primary driver of logistics real estate demand), among them rising oil prices and interest rates.

Trade policies pose little direct risk to logistics demand. As of mid-July, newly enacted tariffs on imports have focused on commodities and intermediate goods, which have a greater impact on companies that operate on the production end of the supply chain. Most logistics users add value near the consumption end of supply chains, and they pursue locations based on proximity to end consumers. As a result, we expect little direct impact on logistics real estate demand from new trade policies, which as of mid-July represent about 1% of global trade.3 Corroborating this view, no reports of altered or delayed growth plans have emerged in Prologis’ dialogue with customers and the brokerage community, and customers say they are pressing forward with their growth plans. However, we are wary of the potential indirect effects of new tariffs, which fuel uncertainty and act as a tax on consumers. Escalating protectionist policies would likely dampen global economic growth—a negative for all businesses.

We are seeing strong demand reflected in price rather than leasing volume

…these segments reflect broad-based expansion.

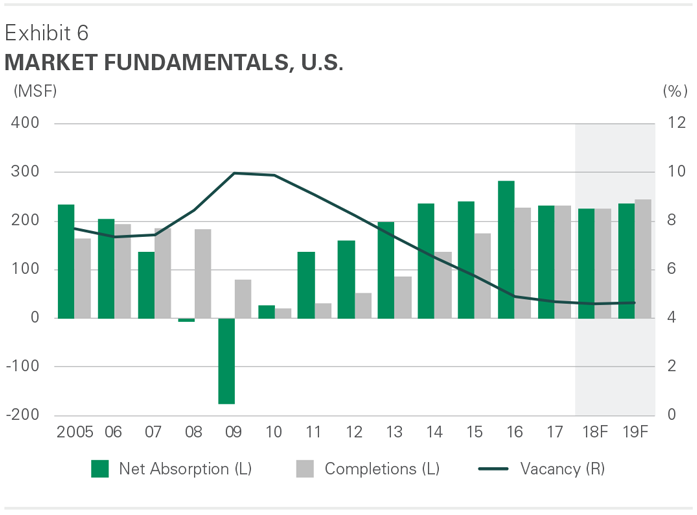

Development has been contained by structural barriers to new supply. In the first half of the year, only 94 million square feet of new product broke ground in markets where Prologis has a presence, on par with the same period in 2017. Market rents are now above replacement cost rents in a broad range of markets, which should be incentivizing more development. However, increased difficulty securing entitled land is keeping the amount of new construction low relative to prior cycles. Structural in nature, this lack of developable land and growing regulatory barriers should extend through this cycle and beyond. At the same time, cyclical and political forces are increasing construction costs: land, labor, materials and municipal fees. Prologis Research forecasts 225 million square feet of new supply in 2018, growing slowly to 245 million square feet in 2019.

Lack of new product and supply chain shifts are combining to push up rents. New supply has been concentrated in the peripheral submarkets of major metros and in smaller metro areas, while supply chain shifts have been concentrating demand closer to end consumers. These shifts include e-commerce, higher service level expectations, and the ability to optimize costs. Coupled with rising replacement costs, the disconnect between supply and demand has driven rents to new peaks in a broad range of markets, with the strongest growth in coastal markets and infill submarkets. Our forecast calls for more of the same in late 2018 and 2019. Net absorption should roughly match new supply, keeping the vacancy rate at a historic low level of 4.6% through 2019 (see Exhibit 6). Competition for limited availabilities and rising replacement costs should continue to drive up logistics real estate rents across the U.S. Prologis Research expects annual rent growth to reach 7% in 2018, following 9% growth in 2017. Planning for upcoming requirements remains crucial, given the value logistics real estate can create within supply chains.

Endnotes

2. Consensus Economics June 2018 report, U.S. Bureau of Economic Analysis Personal

Income and Outlays, University of Michigan Consumer Sentiment Report June 2018

3. Oxford Economics

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forwardlooking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2018, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 685 million square feet (64 million square meters) in 19 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,000 customers across two major categories: business-to-business and retail/online fulfillment.