Logistics real estate occupiers reported accelerating activity in their U.S. facilities in early 2017, according to Prologis’ Industrial Business Indicator (IBI)™, the company’s proprietary index of customer activity. This leading indicator of industrial demand indicates healthy net absorption through 2017, after reaching 278 million square feet of demand in 2016. Continued net absorption caused the vacancy rate to fall to a new all-time low of 4.8 percent1, suggesting that limited availability may be a governor on the amount of space users can absorb.

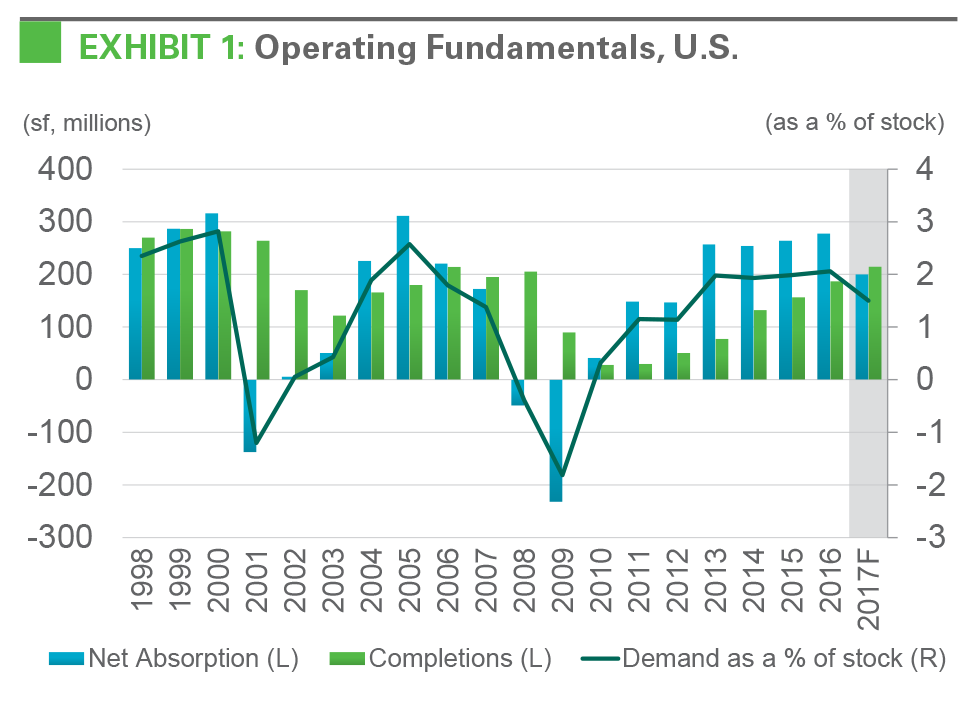

After four consecutive years of annual demand above 250 million square feet (see Exhibit 1), a deceleration in the pace of demand growth was expected as the cycle matured. At the same time, sustained high occupancy and strong market rent growth has invited more construction activity, especially from merchant developers backed by institutional capital. Prologis Research expects vacancies to remain stable in 2017, but notes the likelihood of higher deliveries in 2018 given that developers have had an active start to the year. While this shift will provide scant relief for logistics real estate users looking to expand their operations, new supply will begin to meet the pent-up demand for modern logistics facilities.

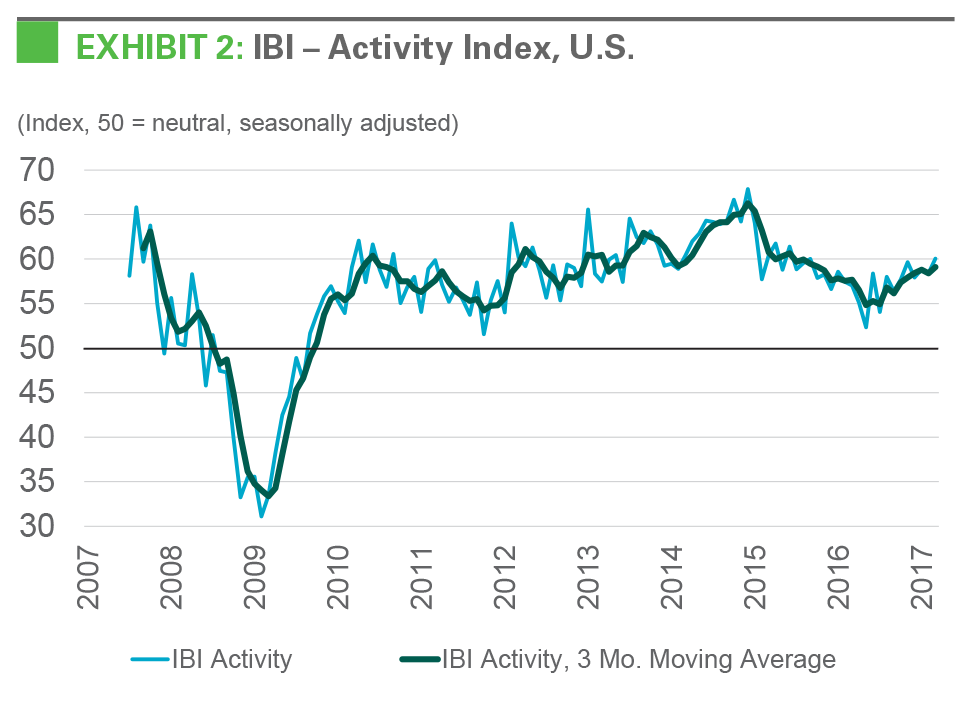

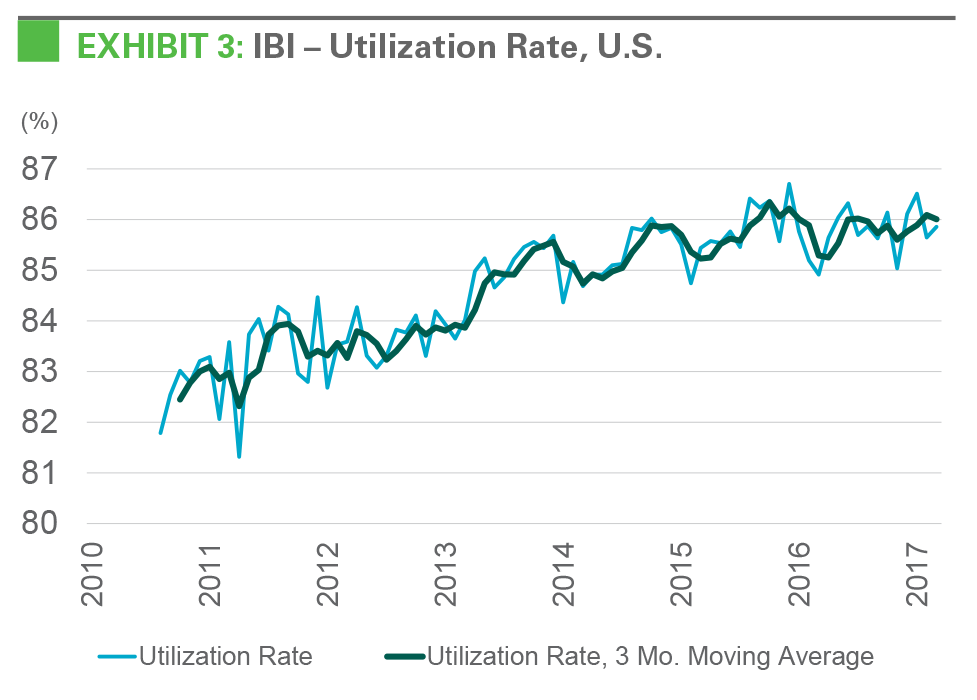

Logistics real estate occupiers maintained high utilization rates and reported higher levels of activity. Prologis’ IBI activity index improved to 60.1 in March 2017 on a seasonally adjusted basis, the highest reading since September 2015 (see Exhibit 2). Readings above 50 signify growth. According to the same survey, logistics real estate occupiers reported an average utilization rate of 85.9% in March, one percentage point above the year-ago rate (see Exhibit 3) and consistent with reports of full capacity. The healthy state of these two leading indicators of logistics demand bodes well for net absorption for the balance of 2017.

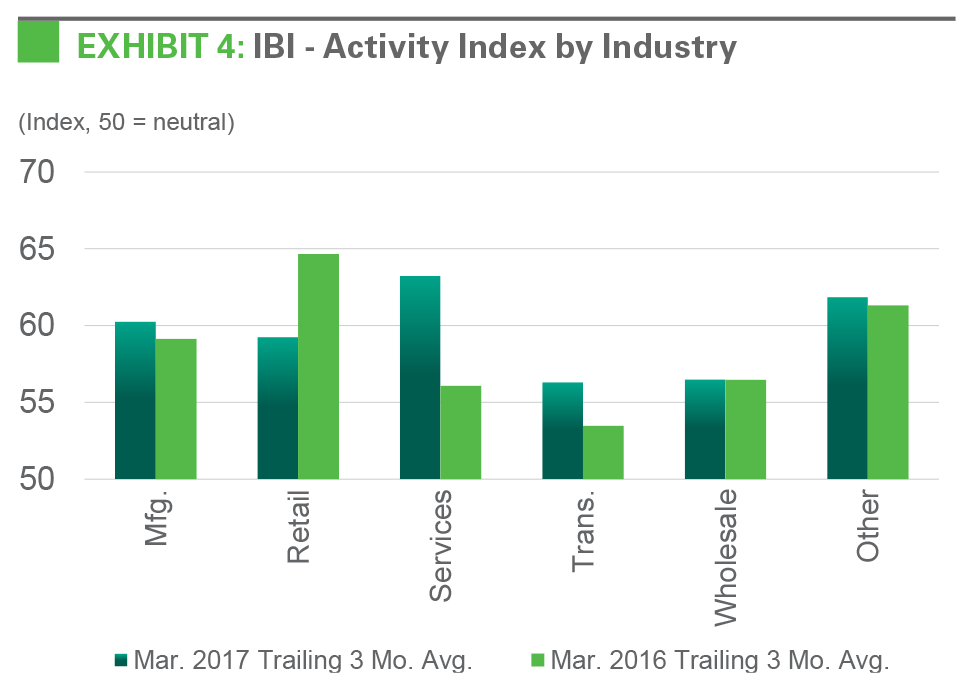

The magnitude of improvement differed by customer industry and region. Transportation companies reported the strongest improvement in activity in the first quarter, in line with increased traffic through the ports and on trucks (see Exhibit 4)2. Activity in logistics real estate facilities also grew for wholesalers and retailers, although at a slower pace than a year ago. Manufacturers and services firms, which comprise a relatively small share of occupiers surveyed, also recorded an acceleration in growth. The connection between IBI results and underlying economic fundamentals for occupiers in these industries illustrates how logistics real estate demand is affected by a broad range of economic drivers, limiting the risk posed to aggregate demand by specific industries.

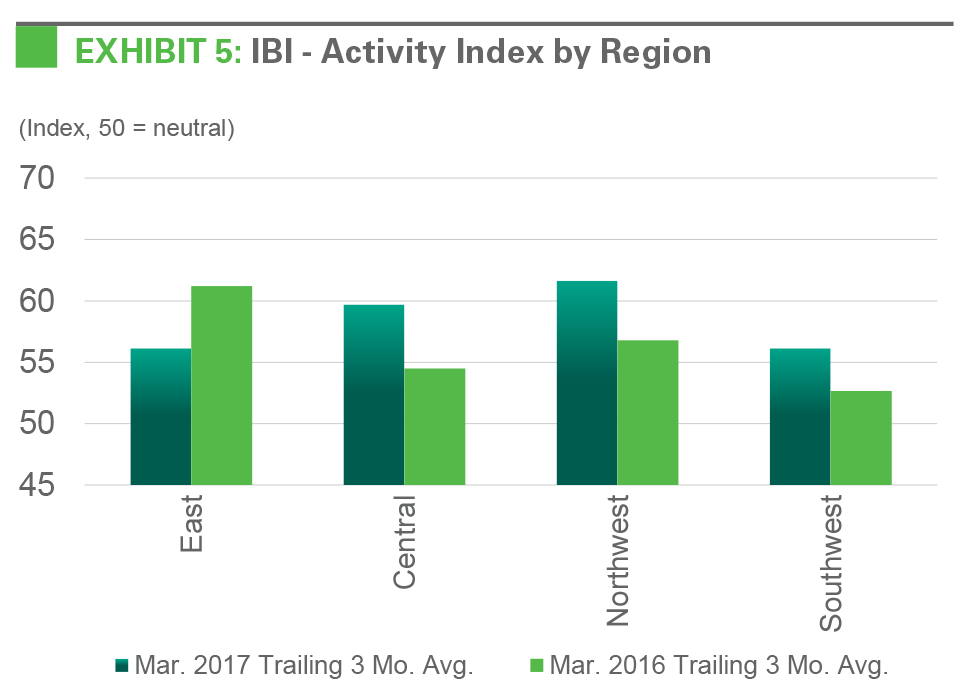

Activity increased in logistics facilities throughout the U.S. regions in March 2017, particularly in the Southwest. The combination of continued expansion of the regional economy and a jump in imports through the port of Los Angeles/Long Beach drove the large increase in March activity reported by Southwest logistics real estate users3. While activity in all regions is growing, the Northwest and Central regions also reported stronger activity year-over-year in March 2017, with a deceleration in the rate of growth in the East region (see Exhibit 5).

Forward-looking sentiment indicators strengthened significantly in late 2016 and early 2017. The ISM Non- Manufacturing Index of business sentiment averaged 56.4 in the first three months of 2017, up from 53.8 in the first three months of 2016. Per the Conference Board, consumer confidence surged in March 2017 to its highest level since December 2000. Other sentiment surveys, of CEOs, homebuilders and small businesses, among others—strengthened in tandem4.

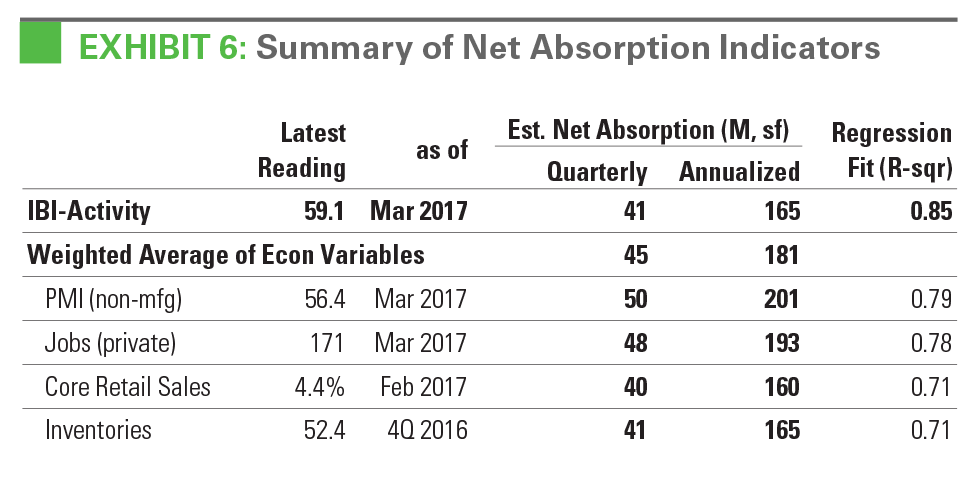

Yet recent data is consistent with a moderately paced economic expansion. Job creation in the private sector averaged 171,000 jobs per month in the first quarter, similar to the average trend of 2016, which was a slow year for GDP growth5. Both wage growth and inflation showed signs of firming, but remained low with an identical increase of 2.8% year-over-year in February 20176. Economists expect roughly 2.2% GDP growth in 20177, in line with the slow and steady pace of the expansion thus far. The disconnect between sentiment and hard data leads to a broad range of predictions for future demand, with an average of four key variables suggesting a current annual run rate of between 160 and 200 square feet (see Exhibit 6) of demand using an auto-regressive process.

A structural shift in the retail industry favors logistics real estate, but also contributes to volatile demand. There were nine retail bankruptcies in the first quarter of 2017, and major retailers announced hundreds of store closures. Meanwhile, e-commerce retail sales continued to expand at a double-digit pace8. With e-commerce companies requiring approximately 3x the logistics real estate of a traditional brick-and-mortar retailer9, a secular shift toward greater online consumer spending adds to aggregate demand for logistics real estate. This trend affects traditional retailers as they reconfigure their logistics networks alongside their store footprints.

Persistent low vacancy and continued rent growth drove elevated speculative construction starts in early 2017. Completions totaled 45 million square feet in the first quarter of 2017, up 14% from the first quarter of 2016. At the same time, the pipeline of speculative projects underway expanded noticeably, as a handful of merchant developers backed by institutional capital broke ground on projects throughout major logistics markets. While most new supply is in markets with strong demand and low vacancies, this brisk rise in the speculative construction pipeline could lead to pockets of oversupply, especially in low-barrier submarkets.

Market conditions will remain healthy as fundamentals shift toward equilibrium. This expansion has been one of the longest on record10. Both cyclical and structural factors lifted demand while the lingering effects of the financial crisis, among other factors, suppressed new development. Seven years of demand in excess of new supply has produced a historic low for vacancy and a challenging market for occupiers wishing to expand their logistics networks. Finally, the combination of increased speculative supply and moderation of demand growth is expected to result in a shift toward equilibrium market conditions. Prologis Research expects 200 million square feet of net absorption and 215 million square feet of new supply in 2017, holding the vacancy rate steady at 4.9% through year-end. While this vacancy level still represents a tight market, the shift of supply/demand dynamics will likely result in occupancies declining somewhat to a more sustainable, but still healthy, level in 2018 and beyond.

ENDNOTES

- CBRE-EA

- Cass Information Systems, National Retail Federation

- Ports of Los Angeles and Long Beach, U.S. Bureau of Labor Statistics

- The Conference Board, National Association of Home Builders/Wells Fargo, National Federation of Independent Business

- U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis

- U.S. Bureau of Labor Statistics

- Consensus Economics

- U.S. Census Bureau

- Prologis Research

- CBRE-EA, Prologis Research

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of March 31, 2017, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 678 million square feet (63 million square meters) in 19 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment.