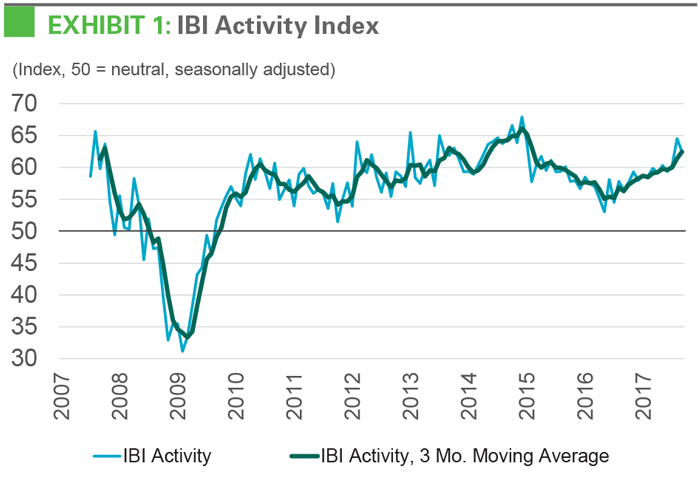

Customer activity is at its highest level since 2014, according to Prologis’ latest Industrial Business IndicatorTM (IBI), the company’s proprietary survey of its customers (see Exhibit 1). Continued demand and developer discipline kept the vacancy rate at an historically low level.1 Competition for limited space drove up rents, especially in major coastal markets, such as New York, San Francisco Bay Area and others, which have high barriers to new supply.

As a result of tight conditions, net absorption is being constrained by a shortage of space. Looking ahead, a supportive economic climate and structural changes in supply chains should continue to drive demand. The lack of developable land, record high land costs and scarcity of labor are acting as governors to new construction. Prologis Research anticipates a balanced supply/demand scenario in 2018; this should keep the vacancy rate at a record-low 4.6%.

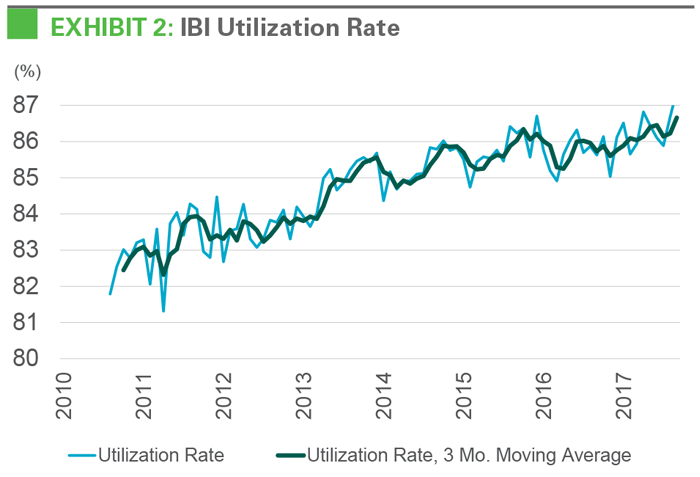

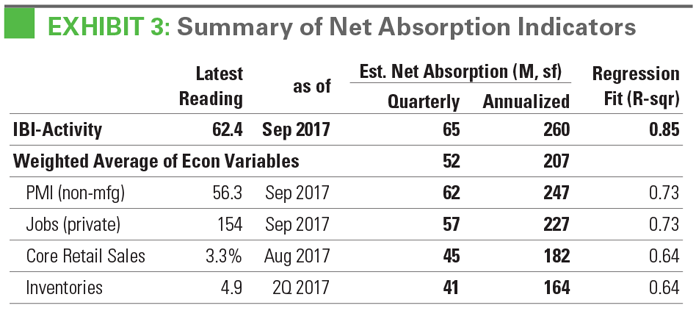

Leading indicators support expectations for demand growth. IBI activity readings from July through September surpassed 60, the highest since late 2014. Readings above 60 are consistent with notable increases in the flow of goods through logistics facilities, while any reading above 50 signifies net growth. With customer activity expanding, the IBI utilization rate has hovered near all-time highs—telling us that most customers are operating at capacity (see Exhibit 2). Customers will need more space to accommodate growth in their businesses. With its direct connection to logistics real estate users, the IBI has a strong correlation with demand. Other economic indicators also suggest a supportive environment for future growth. Based on the IBI and other key indicators such as consumption, our regression analysis suggests that the current demand run rate is above 200 million square feet (see Exhibit 3).

Source: Institute for Supply Management, Bureau of Economic Analysis, U.S. Census, Bureau of Labor Statistics, Prologis Research

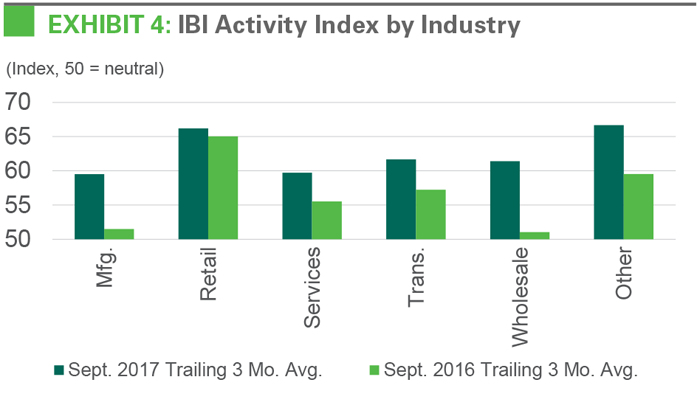

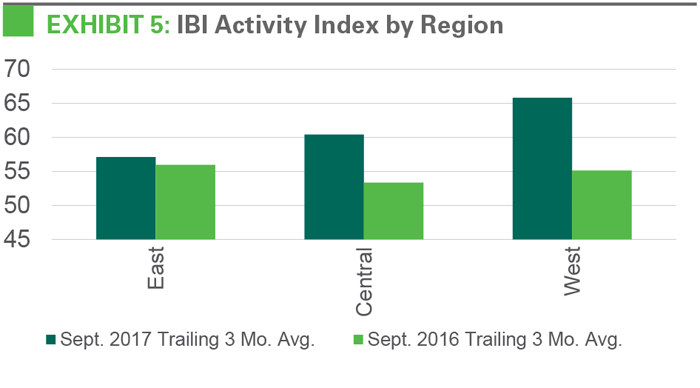

Broad-based demand is driving absorption of logistics space. Customers across surveyed industries reported stronger increases in activity levels heading into the fourth quarter of 2017. Activity for customers in retail, transportation and wholesale are growing at the fastest pace among customer industries (see Exhibit 4). This trend is in line with strong consumption growth, e-commerce-driven demand for transportation services and a bigger pre-holiday inventory buildup compared to 2016.2 Rising activity levels were recorded across U.S. regions, with the strongest growth in the West, an area characterized by strong demand for goods and high barriers to new supply (see Exhibit 5). Competition for space from customers across multiple industries is enabling landlords to raise rents throughout U.S. markets and underscoring how crucial it is for logistics users to plan well in advance.

Structural changes in the industry reinforce competition for desirable space. Customers increasingly view their logistics footprint as critical to revenue generation and cost optimization. Consumers and businesses are demanding goods faster, and reliable service is paramount. Companies gaining market share can tap into their supply chains to meet rising service level expectations. On the whole, rents comprise about 5% of total supply chain costs.3 The much larger portion of supply chain costs represented by transportation, labor and inventory carry can often be streamlined with a better logistics location. Together, these factors can justify a higher rental rate.

The development pipeline appears to be stabilizing rather than accelerating. In 2017, development starts surged in the first quarter, then moderated in the second and third quarters.4 As a result, the amount of space under construction increased by only 9% year-over-year in the third quarter of 2017, following much larger increases through the early part of the recovery. This deceleration in supply growth was unexpected based on the health of the market and historical development patterns, but makes sense in the context of an increasingly institutional composition of developers and capital partners; higher barriers to new supply; and rising replacement costs, including record land costs in many markets. Looking forward, construction should gradually inch up as rising rents allow more developments to pencil, but a lack of developable land should limit the amount of new product brought online annually.

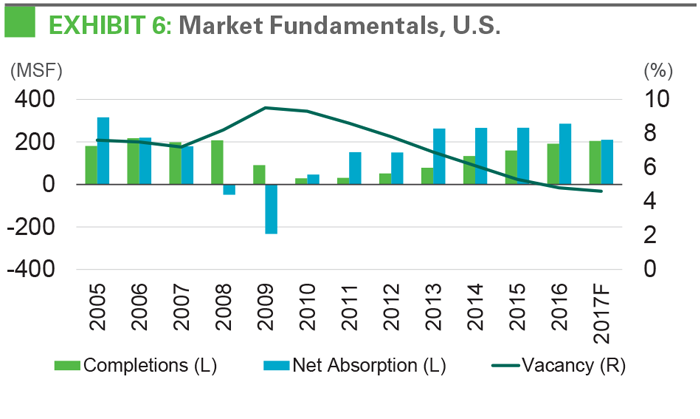

The leasing environment should remain challenging for customers. With development accelerating slowly, market conditions are likely to remain tight through at least the near term. In aggregate, the need for new space will continue to exceed the amount of new supply delivered, although lease-up times will lead to slight disconnects. In 2017, net absorption should total 210 MSF while 205 MSF of new supply comes online (see Exhibit 6). Similar conditions are expected in 2018. Prologis Research projects 220 MSF of net absorption in 2018, in line with 225 MSF of new supply. With the vacancy rate stabilizing at historic lows, customers should prepare well in advance for new requirements and expect rents to continue to rise.

Endnotes

2. U.S. Census, U.S. Bureau of Economic Analysis

3. A.T. Kearney / CSCMP, public filings, Prologis Research

4. Prologis Research