PROLOGIS U.S. INDUSTRIAL BUSINESS INDICATOR™

Logistics real estate users once again absorbed space at a faster pace than expected, outpacing new deliveries and sending the vacancy rate to a new all-time low of 5.0% in the third quarter of 2016.1 Net absorption is on pace for its fourth consecutive year in excess of 250 million square feet. In addition to more rapid growth in select sectors of the economy such as autos and new home construction,2 the shift of consumption activity to e-commerce channels is the main driver behind this demand outperformance, which is occurring even as economic growth is poised for one of its slowest years since the 2009 recession. Prologis’ proprietary index of customer activity, the U.S. Industrial Business Indicator™ (IBI), indicates steady growth in logistics real estate activity and heightened utilization of existing buildings, in line with historically-strong logistics market conditions. Adding to the scarcity of available space, construction of new logistics stock has been disciplined, resulting in new deliveries lagging demand. Going forward, Prologis Research expects this condition to continue through 2016, with 250 million square feet of net absorption and 185 million square feet of new supply forecasted for the full year. This demand-supply imbalance will keep the vacancy rate in the low 5%-range, prolonging the challenge for logistics real estate users looking to expand.

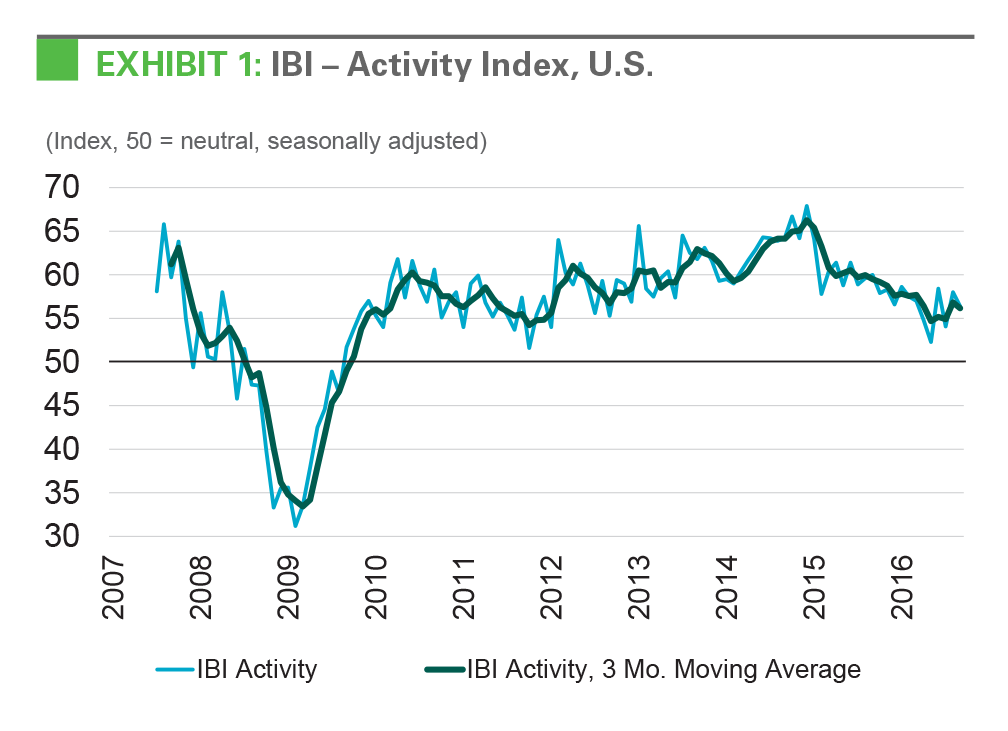

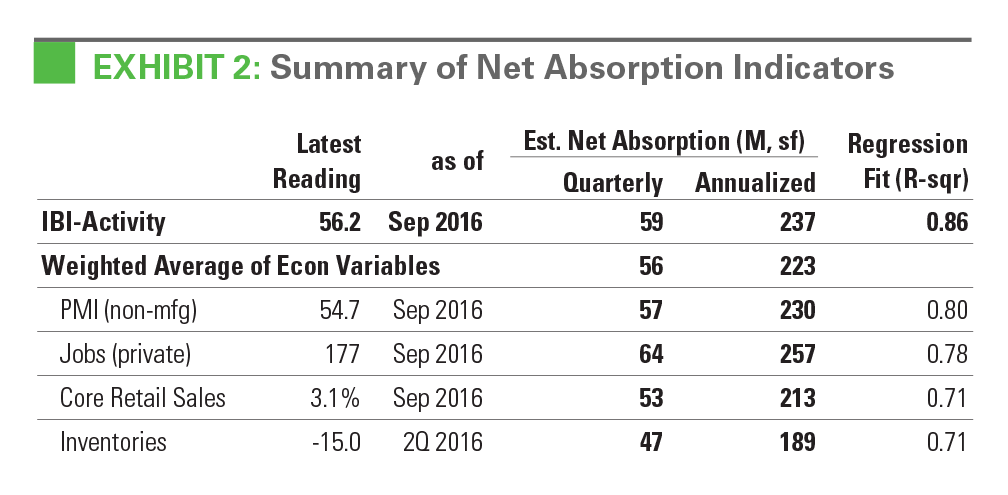

Logistics real estate occupiers are showing steady growth in activity. The IBI activity index came in at a seasonally-adjusted 56.4 in September, with readings above 50 indicating growth (see Exhibit 1). While this level indicates slightly slower growth than the prior month (58.0), September’s reading was a notable improvement from the slowdown recorded in the second quarter of 2016. This modest acceleration is in line with consumption activity, the primary driver of U.S. logistics real estate demand, as retail sales and consumer confidence remained in a healthy range through September.3 Looking ahead, the IBI result, combined with recent demand outperformance and moderate growth in other key economic indicators, supports expectations for annual demand in the 200-250 million square foot-range (Exhibit 2).4

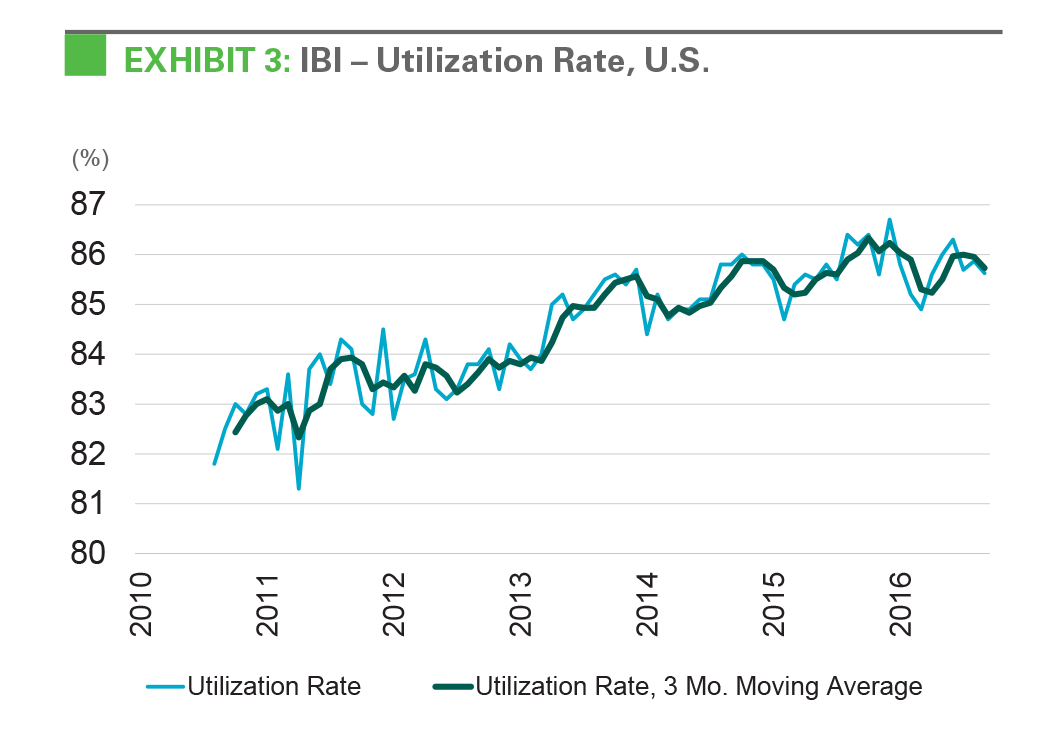

Record occupancy and elevated utilization suggest that most logistics real estate occupiers are operating at or near capacity. The utilization rate for logistics real estate was 85.7% in September, down slightly from 86.0% a year prior (Exhibit 3). The all-time peak for utilization was 86.7% in December 2015, with an average level of 85.0% since 2012. Compared with five years ago, logistics real estate users are occupying 3.8% more of the logistics space available in the market and are utilizing 1.8% more floor space, for a combined impact of 4.9% growth in utilized logistics space.5 This figure is in line with market conditions: Given the shortage of available space and rapidly rising rents, many users are remaining in place and making the most of their existing footprint, even if their businesses would be better served by expanding into a larger or newer space, or a better location. Ultimately, customers with limited existing capacity will need to expand into new space as their businesses grow. In tandem, elevated utilization and occupancy are supporting the need for a higher level of logistics real estate construction.

Demand surprised to the upside again in the third quarter of 2016. In spite of lackluster economic growth and a shortage of available space in most markets, net absorption of logistics real estate reached 77 million square feet in the third quarter of 2016. Adjusted for seasonality, this level of demand equates to an annual run rate of about 300 million square feet - a high-water mark for the recovery. Given the length of the current cycle and tight market conditions, this acceleration surprised many market participants. However, the importance of well-positioned distribution facilities has been rising at the same time as availabilities have become scarcer and costlier. As a result, logistics real estate occupiers have been actively positioning themselves for the future, potentially in anticipation of even more difficult market conditions to come.

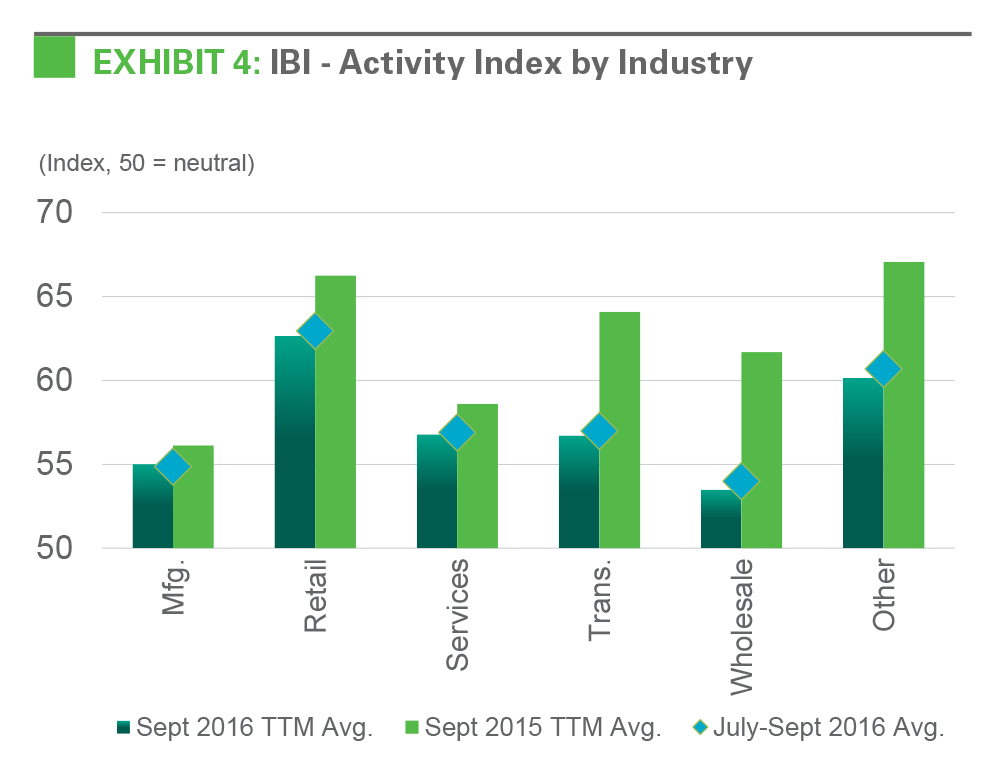

All customer industries were more active in September, but with a wide spread between rates of growth. Retailers reported the fastest rate of growth during September, with the latest non-seasonally- adjusted activity rating coming in at 66.0 (Exhibit 4). Wholesalers, on the other hand, recorded essentially stable activity with 50.6 in September, down from a three-month trailing average of 54.0. For these two customer types, this trend is in line with inventory and sales trends tracked by the Census Bureau. In recent months, retailers have recorded rising inventories and rising sales, which boosts activity in distribution centers. Wholesalers have reported more stability in the level of sales and have been reducing inventory levels, which supports slower growth in logistics real estate activity.

A disciplined supply response is contributing to a shortage of modern logistics space. Approximately 53 million square feet of new supply came online during the third quarter of 2016, trending toward Prologis Research’s view of a stable run rate in a period of normal demand. While demand outperformance has been a major driver behind the current shortage of available space, a lack of construction activity has been just as critical in the creation of the current market environment. In a typical cycle, rapidly rising rents and sustained strong demand would have invited a much higher level of development than is now underway. Several structural trends underlie this disciplined approach to development. First, heightened municipal requirements are increasing the cost of construction and the development timeline. Second, part of the fall-out of the Global Financial Crisis is constrained construction lending by local and regional banks and the implementation of new regulatory requirements, which favor large financial institutions and well-capitalized developers by requiring greater equity investment. The institutionalization of both the financing and development spheres has been demonstrated in a more cautious approach to development risk and greater sensitivity to market conditions. Market-level data is increasing available and transparent, offering developers better insight into market conditions and supporting more informed decision-making. Finally, increased building size and complexity has also contributed to longer development timelines and increased difficulty in finding suitable locations for new logistics real estate facilities, especially in coastal infill markets. Even as low vacancies and a lack of new supply suggest that new development is feasible, tendencies toward risk aversion and the structural trends outlined above will continue to dampen the magnitude of future logistics real estate supply cycles.

Consumption and the shift to e-commerce will support strong demand for logistics real estate. Given steady job creation, healthy household balance sheets and upward pressure on wages, the outlook for consumer spending is positive.6 Indeed, confidence indicators and retail sales activity have been reflecting increased spending power. Many consumers have used this increased spending power to purchase new automobiles and spur new home construction, two sectors that have driven leasing activity in recent years. Furthermore, the shift of purchasing activity from in-store to online is adding significant potency to the impact of consumption on logistics real estate demand. Prologis Research conducted an in-depth review of the supply chains of online only, omnichannel and brick-and-mortar retailers, and found that e-commerce retailers required three times as much distribution space as a traditional retailer. Looking ahead, U.S. e-commerce retail sales are expected to continue growing at a double-digit pace through at least the next five years.7 The combination of rising consumption and the structural shift toward e-commerce will add tailwinds to demand through this cycle and beyond.

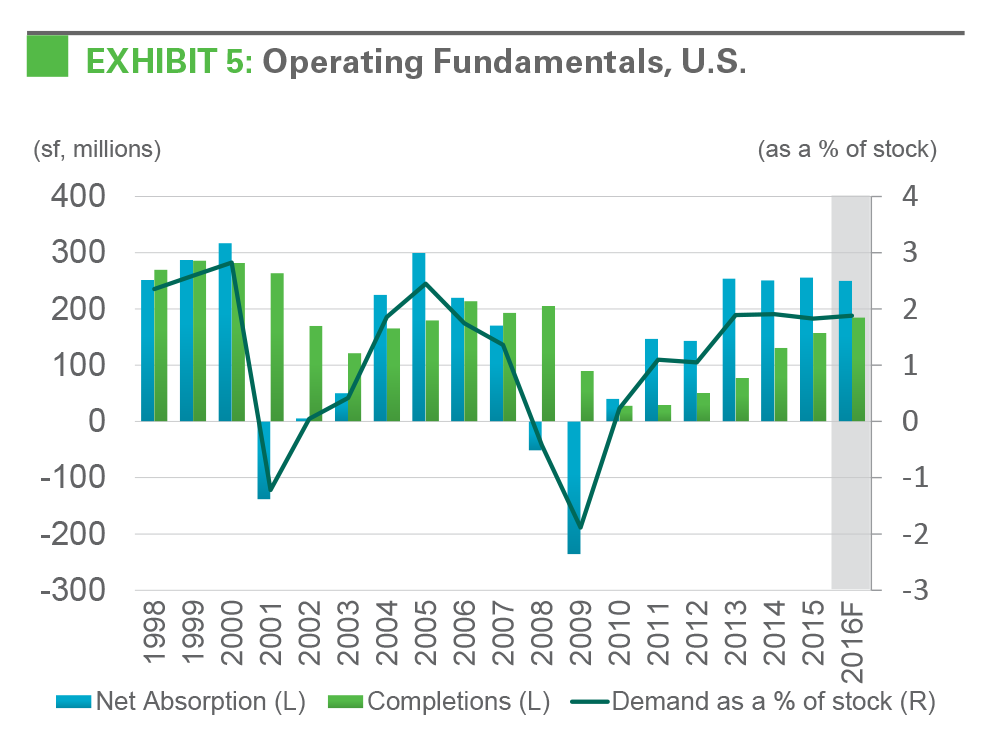

Prologis Research forecasts outperformance in 2016. Strong absorption of logistics real estate space year-to- date and limited near-term risks to consumption prompted Prologis Research to increase our expectations for demand in 2016 to 250 million square feet (Exhibit 5). Likewise, limited year-to-date deliveries and a measured level of construction starts supports our forecast for 185 million square feet of new supply in 2016. As a result, the U.S. logistics real estate vacancy rate should hover in the low 5% range through the near term future, allowing for further rent growth and underscoring the importance of advance planning for logistics real estate occupiers with growing requirements.

Endnotes

- CBRE-EA

- U.S. Bureau of Economic Analysis, U.S. Census Bureau

- U.S. Census Bureau, The Conference Board

- Based upon 15-year regression analyses, with data when available, using an auto-regressive process. IBI and PMI are the three-month moving average index levels. Jobs series is the three-month moving average change for private sector employment in thousands. Core retail sales (ex. autos and gasoline) are yr/yr growth in the three-month moving average. Private inventories change is quarterly in billions of 2009 dollars. The weighted average is based on R-squareds.

- CBRE-EA, Prologis Research

- U.S. Bureau of Labor Statistics, U.S. Federal Reserve

- Goldman Sachs

Forward Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

Prologis Research

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2016, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 665 million square feet (62 million square meters) in 20 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment.