The logistics real estate market has become far stronger than many had expected. Disciplined supply has been a key factor, but elevated and consistent demand has been just as important. The industry has a breadth of demand drivers linked to a range of industries, economic and demographic factors, and structural drivers. Our research reveals the following:

- An end-to-end view of the supply chain finds higher and more consistent growth closest to major consumption centers.

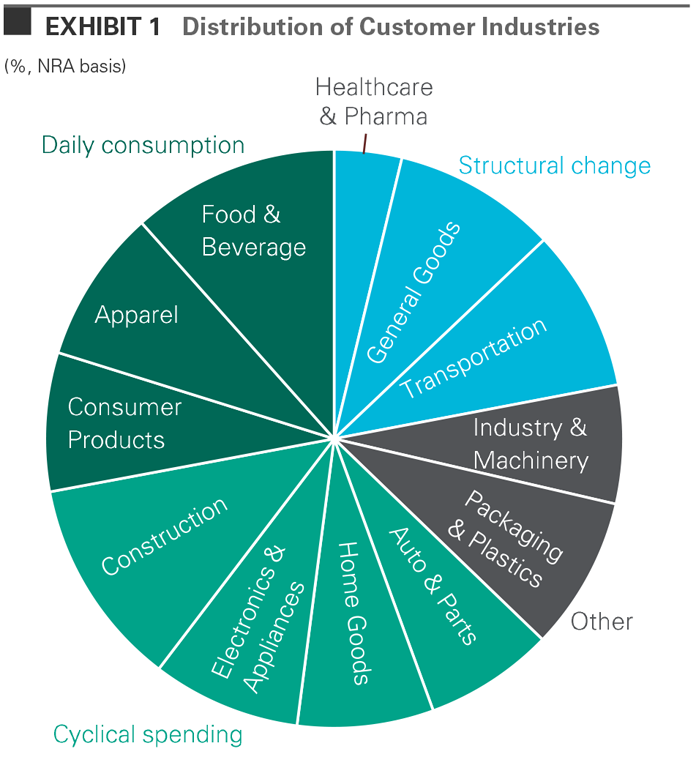

- Industry demand drivers fit into three main categories: daily consumption, cyclical spending and structural trends.

- Healthy growth across all three categories of demand drivers supports a robust outlook for logistics real estate.

- Among customer industries, the continued recovery of the housing market and rapid expansion of e-commerce should have a particularly positive impact on logistics real estate demand.

These trends affect customers’ real estate decision-making. With additional context of supply chain and customer trends, the strength of logistics real estate demand comes into focus. They also increase the confidence in continued strong and healthy growth.

INTRODUCTION

Logistics real estate markets are strong. Disciplined supply has been a hallmark of the logistics real estate expansion, but healthy and sustained demand has been just as important. Pointing to the combined effects of economic growth, pent-up demand from the Global Financial Crisis, and e-commerce only oversimplifies what drives the industry. This paper addresses four key questions aimed at clarifying the current expansion:

- What types of logistics real estate buildings and locations are the most in demand?

- What are the fundamental trends driving demand?

- What are the highest-concentration industries among logistics real estate users?

- What is the outlook for growth?

By delineating industry drivers and studying their components, a clearer industry outlook emerges.

1. WHAT TYPES OF LOGISTICS REAL ESTATE BUILDINGS AND LOCATIONS ARE THE MOST IN DEMAND?

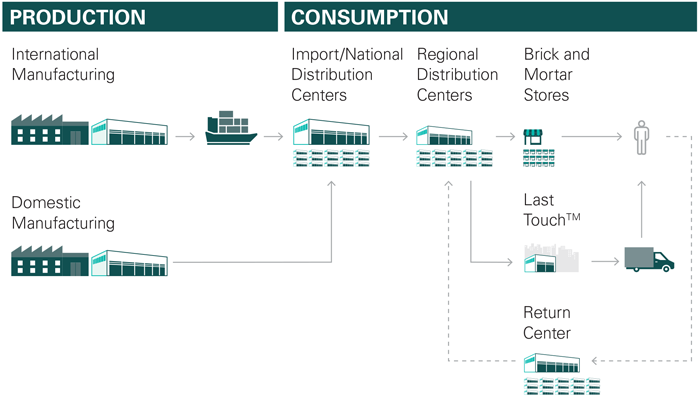

Buildings close to end consumers and those that can handle a high volume of goods are the most in demand. Supply chains, and the logistics real estate they require, are highly diverse. At their core, supply chains are the result of the need to optimize for increasingly high expectations of customer service (product variety, fast delivery) and cost (labor, transportation and real estate). As a result, supply chain configurations vary significantly from customer to customer.

A comprehensive view of supply chains reveals distinct implications for logistics real estate. Supply chains help match batch manufacturing with distinct consumption at various locations and times. Among the many factors shaping supply chains, four stand out:

- E-Commerce and changing consumer habits. Beyond fast and free shipping, consumers also want variety and the best prices. Retailers that can compete at this level will make the supply chain a competitive asset that drives revenue.

- High service level expectations for brick-and-mortar. Multiple long-term trends in the retail industry, such as just-in-time inventories and SKU proliferation (greater product diversity), have coalesced over the years to raise the importance of supply chains and their real estate. E-commerce has also changed habits and raised expectations for the in-store experience. Together, a greater appreciation for the capabilities enabled by and the cost-saving opportunities of the right real estate have elevated this level of decision-making to the C-Suite.

- Complex supply chains. Most supply chains remain long, although there are incidences of re- and near-shoring, which are regularly re-evaluated to optimize service and cost. Network strategies, and the real estate they require (e.g., location, size), changes.

- The agility and flexibility offered by data and predictive analytics. Knowledge of the location and velocity of products as they move through the supply chain allows for better planning and execution. It also allows for greater contingency planning and risk management.

These trends are producing the following changes across the real estate landscape:

- Evolution at the production end of supply chains. Optimal low-cost manufacturing locations move as wages rise. The distribution space that supports them must relocate, too.

- Consistency across the consumption end of supply chains. As distributors look to increase service levels and expand e-fulfilment networks, they are moving closer to consumers, into buildings in or near major population centers. On a market level, this shift creates an anchor for demand: population centers are static even as optimal production locations change. On a building level, this end of the supply chain must adapt to a wide range of distribution and delivery requirements.

- Higher demand growth at the consumption end of supply chains. The growth of e-commerce has led to new classes of facilities, including Last Touch® and return centers, in addition to support networks of import and regional distribution centers.

- Evolving size requirements. The need to handle a high volume and velocity of goods continues to support demand for mid-sized and large modern logistics facilities. Recently, outsized growth at the consumption end of the supply chain has created more demand for infill facilities (generally, smaller or mid-sized) in major population centers. At this end, location is typically more important than building specifications, and some older, less functional buildings, while not ideal, are perfectly serviceable.

2. WHAT ARE THE FUNDAMENTAL TRENDS DRIVING DEMAND?

Despite broad diversity among customer industries, the fundamental drivers of growth across logistics real estate fall into three categories:

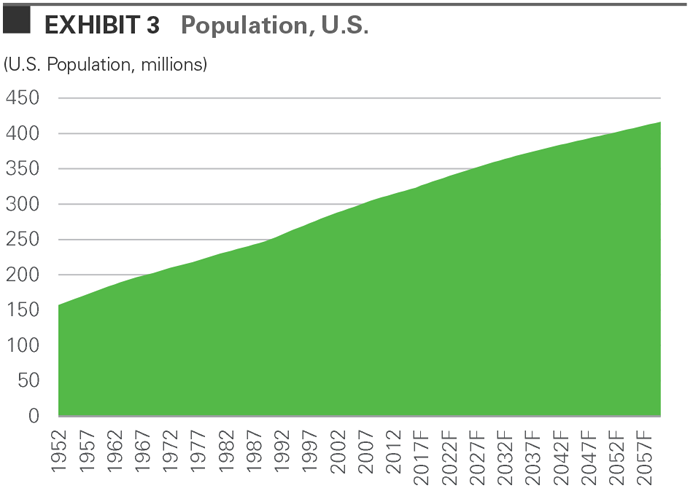

- Daily consumption. Customers in this category serve peoples’ basic daily needs. These businesses include food and beverage, fast-moving consumer goods and apparel. Demand growth in this category stems from population growth and supply chain modernization.

- Cyclical spending. This category includes customers that facilitate big-ticket consumption: residential construction, home goods (appliances, furniture and housewares) and autos. Demand growth in this category also follows population growth, but links to economic and consumer cycles, as well.

- Structural change. This category includes customers in industries undergoing a structural change. The two main examples are e-commerce and healthcare. E-commerce continues to grow at multiples of general retail sales as consumer preferences change; supply chains are still being established and broadened. Healthcare is an emerging driver, fueled by the aging populace, and includes the distribution of medical equipment, devices and supplies, and pharmaceuticals.

Together, these three fundamental drivers generate demand for logistics real estate throughout economic and real estate cycles. During periods of recession and slow economic growth, daily consumption and structural change continue to lift demand despite weak sentiment elsewhere. Past cycles have shown that well-located and institutional-grade facilities take share from less desirable properties. In economic expansions, such as in the current economic climate, cyclical spending can amplify demand growth and lead to big expansions in the market that often necessitate additional development. In the next section, we highlight key logistics real estate industry concentrations that derive growth from these demand drivers.

3. WHAT ARE THE HIGHEST-CONCENTRATION INDUSTRIES AMONG LOGISTICS REAL ESTATE USERS?

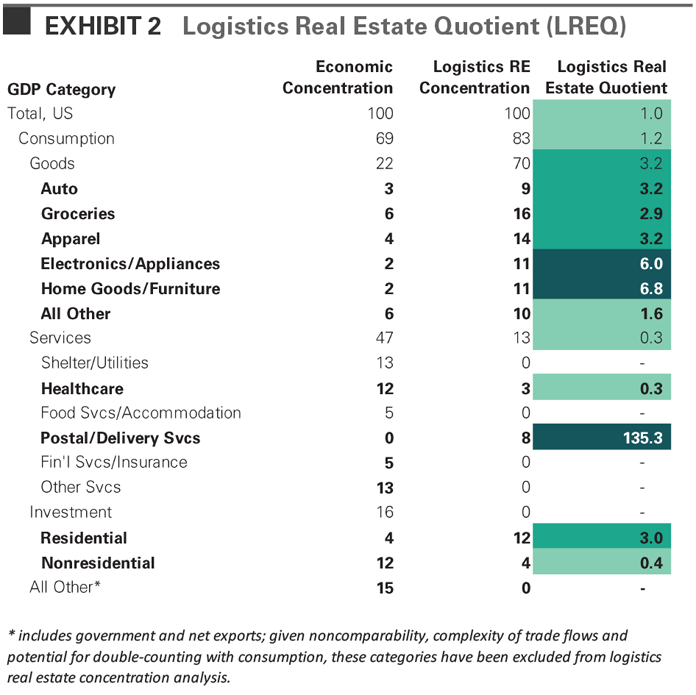

In the U.S., logistics real estate is largely occupied by movers and sellers—those who transport goods across the country and those who purvey them into businesses and homes. Looking at economic concentrations is one way to understand what leads these organizations to grow. Prologis Research has developed the Prologis Logistics Real Estate Quotient (LREQ)TM, a measure of the relative concentration of industries compared to the broader economy. Exhibit 3 shows the share of U.S. GDP by economic component, the share of Prologis square footage by corresponding customer industry and the ratio of these two shares: the Prologis LREQ TM.

Several clear economic concentrations stand out. This comparison reveals outsized concentrations in goods consumption (3x), auto (3x) and housing (5x), which includes residential construction (3x), home goods (7x) and appliances (6x)—all space-intensive—as well as transportation and distribution. Logistics real estate is less exposed to certain categories—manufacturing and government spending, for example. This LREQ accurately reveals space-intensive categories that, when combined with an understanding of fundamental demand drivers, illuminate the potential for continued growth.

4. WHAT IS THE OUTLOOK FOR GROWTH?

A positive demand outlook is supported by supply chain trends, housing normalization and healthcare.

Daily consumption is set to expand at a steady pace, translating to a strong outlook for logistics real estate demand. Industries such as food and beverage, consumer products and apparel account for nearly one-third of logistics real estate customers. While the economic climate may influence decision-making around the leasing of space, actual requirements are tied closely to population growth.

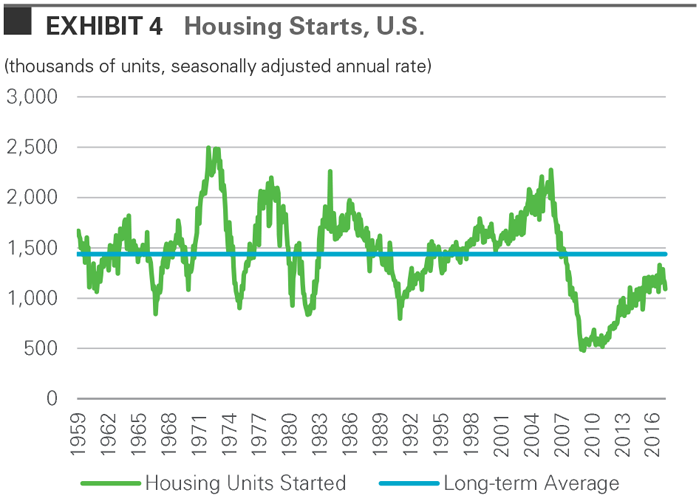

In the category of cyclical spending, the housing market still has room to normalize. This will drive demand in multiple ways. One way is through the growth of the construction industry. These customers handle the raw and finished materials used to build or remodel homes. They have become more active lessees of logistics real estate in the past two years. Yet, the housing recovery is still in its early stages. Prologis Research estimates that housing starts need to rise by 30% to reach a level consistent with demographic growth.

In addition, new household formation fuels demand growth from home goods customers. These customers store, transport and sell the items—appliances, furniture and housewares—used to furnish homes and apartments. While a factor, the gradual recovery of the housing market is only part of the story. The lingering effects of the Global Financial Crisis and social trends (such as millennials choosing to start families later) have weighed on the number of households formed in recent years, creating pent-up demand. Now the largest generation at about 95 million, Millennials are entering their 30s, a life stage associated with marriage, home-buying and family formation.1 This demographic shift should allow for increased household formation and demand for home goods in the coming years.

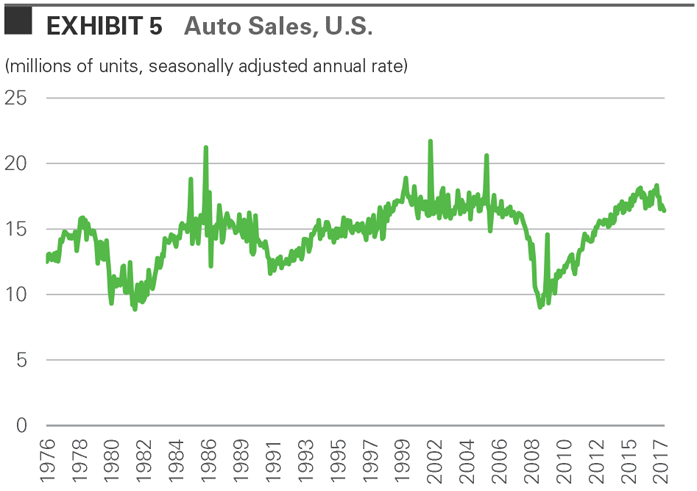

An early cyclical outperformer, the auto sector may downshift. These customers mostly distribute wear items and spare parts for the existing auto fleet, but a small portion also distributes materials for initial production. Use of the auto fleet, represented by miles driven, is the basis of demand for auto industry customers. In 2017, vehicle miles driven reached an all-time annualized high of 3.2 trillion miles.2 However, the trajectory of auto sales impacts logistics customer confidence in leasing decisions. Looking back at this cycle, auto sales recovered early, which coincided with strong leasing. At the same time, parts distribution supply chains were being reconfigured to accelerate service levels. Looking ahead, growth in the auto industry may decelerate, although the temporary impact of events such as Hurricanes Harvey and Irma will produce replacement demand for autos in the short term. In the medium term, parts distribution is as important as ever with more than 260 million vehicles on the road, but slowing sales may affect sentiment and moderate the pace of supply chain expansion.3

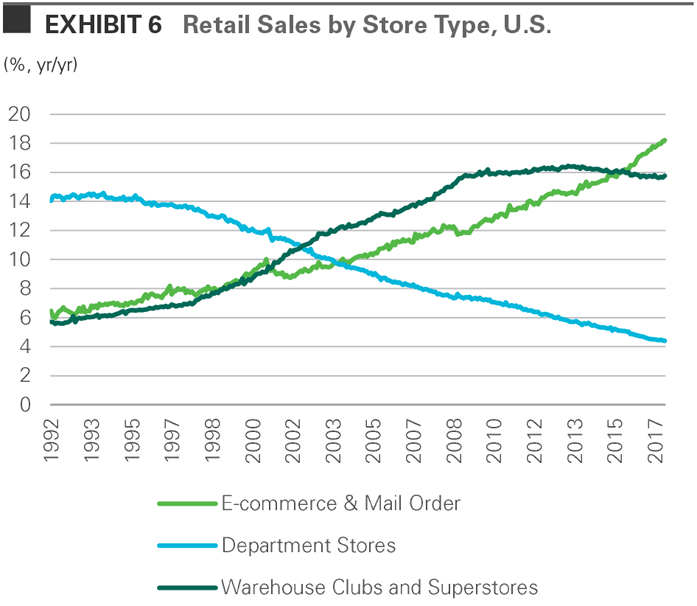

E-Commerce is adding tailwinds to consumption-driven demand. E-commerce includes pure-play online retailers, existing brick-and-mortar retailers with omni-channel strategies and consumer-direct wholesalers and manufacturers. With consumers increasingly using the internet and mobile devices to purchase the goods needed for everyday life, e-commerce sales have grown at a multiple of overall retail sales since this data has been tracked. This growth has a particularly powerful impact on logistics real estate demand, as e-commerce customers currently use three times the logistics space of a brick-and-mortar retailer.4 E-commerce supply chains extend from regional distribution to Last Touch® deliveries, generating broad-based demand for logistics real estate at each stage. While this multiplier will decline over time as customers become more efficient and cannibalize brick-and-mortar demand, we believe that e-commerce is still in its early beginnings.

E-commerce should generate strong demand for the foreseeable future. In the U.S., e-commerce sales comprise only 18% of core retail sales, illustrating the potential for further disruption.5 This segment is poised for robust growth as shopping habits continue to shift online, and will be further energized by Millennials, who are entering their peak spending years. High volumes and compressed delivery times are fueling the need for both modern big-box distribution space and Last Touch® distribution facilities.

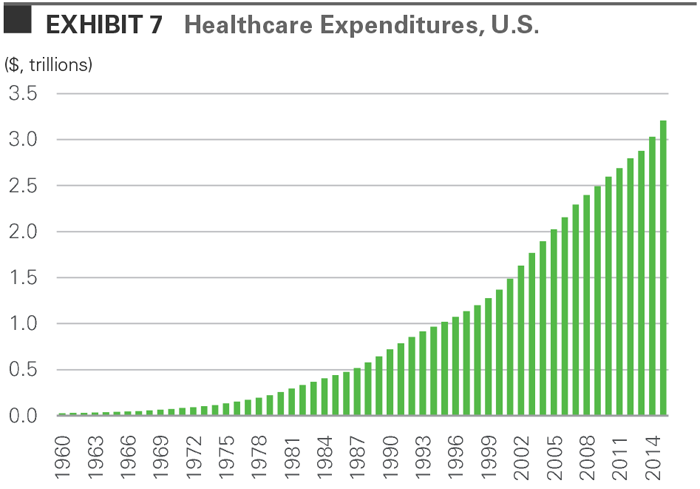

Healthcare is a growing structural force. Logistics real estate customers in the healthcare industry distribute medical equipment, medical supplies, pharmaceuticals and healthcare consumables. Healthcare expenditures, boosted by population growth and the aging of the Baby Boomers, creates demand from healthcare customers.

With medical systems investing in new facilities to treat a greater number of patients, demand for medical equipment and supplies has likewise grown. From 2005 to 2015, U.S. healthcare expenditures increased by nearly 60%.6 Although healthcare currently represents less than 5% of the logistics real estate customer universe, demographic trends point to continued expansion.7

CONCLUSION

Most logistics real estate demand is firmly rooted in the basic daily needs of consumers. As the foundation of demand, steady population growth should support continued expansion of domestic supply chains by a broad range of customers. Several trends add upside to this outlook:

- Normalization of the housing market, which will drive elevated demand from residential construction and home goods customers.

- E-commerce and rising service levels, which will deliver consumer goods directly and quickly, in turn supporting expansion at the consumption end of supply chains.

- An aging population, which will drive demand from customers distributing medical equipment, pharmaceuticals and supplies to expanding healthcare networks.

Although demand from the auto sector may eventually slow, taken together, these shifts in the logistics real estate customer base result in a net positive and robust outlook for future demand.

FOOTNOTES

- U.S. Census Bureau, Prologis Research<

- U.S. Federal Highway Administration, Prologis Research

- U.S. Department of Transportation, Prologis Research

- Prologis Research calculations based on major retailer companies’ financial filings, websites, and news articles and eMarketer published figures

- U.S. Census Bureau, Prologis Research

- Centers for Medicare and Medicaid Services, Prologis Research

- Prologis Research