Activity in U.S. warehouses increased at a brisk pace in early 2018, according to Prologis’ proprietary customer survey, the Industrial Business Indicator™ (IBI). The activity index recorded 63 in March, with readings above 50 signifying growth. Strengthening consumption drove the increased flow of goods1, while a lack of availabilities in the logistics real estate market kept the utilization rate near its record high.

Looking forward, the outlook for logistics real estate demand is constructive. A broad base of users continues to build out their regional and local distribution capabilities to meet rising service level expectations. Given limited new deliveries in the market, Prologis Research expects the operating environment to remain challenging for users looking to expand. The vacancy rate should stabilize at a historic low of 4.6%2 through 2019, putting upward pressure on rents.

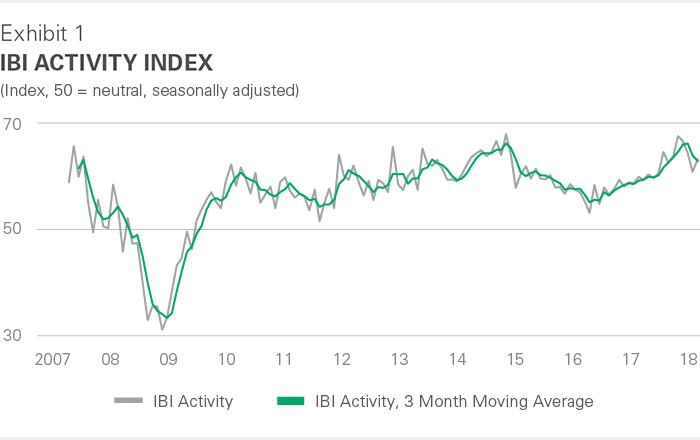

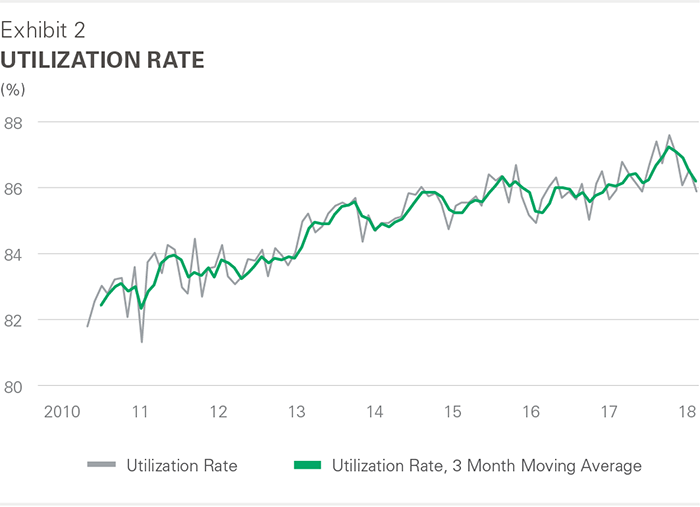

Sustained growth bolstered by structural trends. Since July 2017, the IBI activity index remained above 60, a level consistent with strong growth (see Exhibit 1). Readings firmed across customer industries, reflecting broad-based demand. The transportation segment recorded particularly strong improvement, as rapid e-commerce growth3 lifted activity through parcel delivery networks. Across industries, the utilization rate hovered between 86% and 87% through the first three months of 2018 – near its record high (see Exhibit 2).

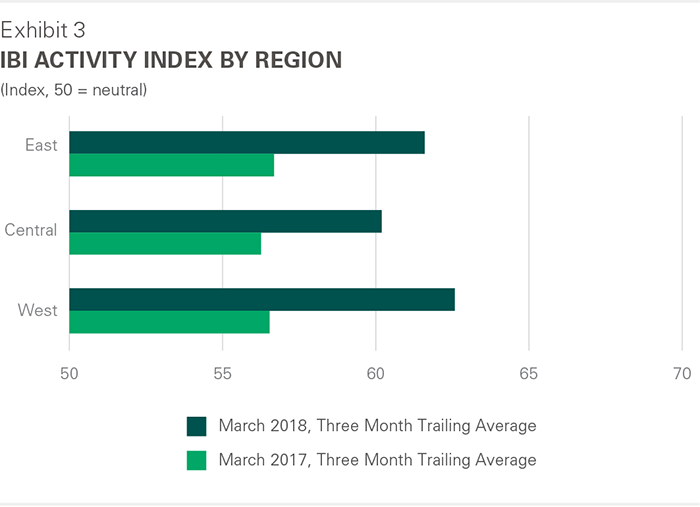

The West region surges, due to underlying drivers and capacity constraints. All U.S regions displayed stronger activity and utilization readings in late 2017 and early 2018 (see Exhibit 3). Yet, activity accelerated most quickly in the West, the most capacity-constrained region by vacancy at 3.4% as of Q1’18.4 In January and February 2018, West Coast imports increased by 11.7% year-over-year.5 With limited options for expansion, many users of logistics real estate had to accommodate growth in existing distribution networks. Leasing trends reflect this dynamic. A lack of alternatives drove more early renewals, longer lease terms, and a high level of pre-leasing in the construction pipeline relative to recent years and prior cycles.

Development activity contained amid rising barriers to new supply. Deliveries totaled 51 million square feet in the first quarter of 2018, down 10% year-over-year.6 At the same time, the construction pipeline fell to 212 from 220 million square feet in 4Q’17.7 Only 40 million square feet of new product broke ground in major U.S. markets during the first quarter.8 Difficulty securing entitled land and rising constructions costs restrained the amount of new supply, even as rents have escalated quickly. Only a few pockets of robust supply exist, concentrated in outlying submarkets in Atlanta, Dallas, and Pennsylvania.

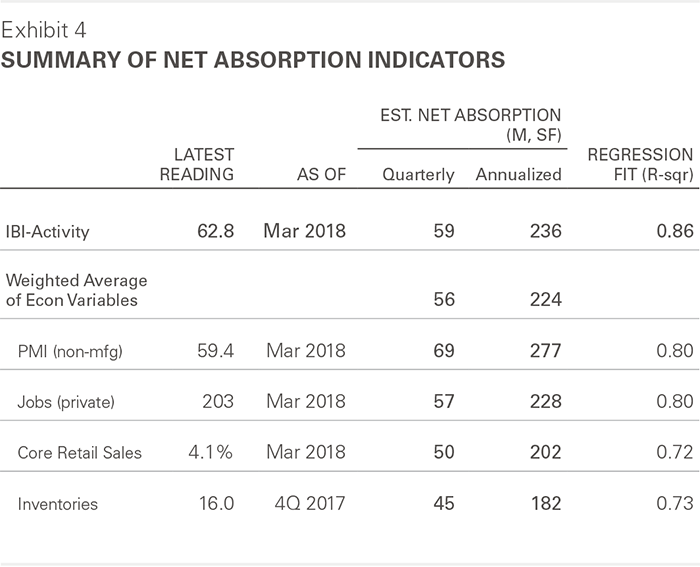

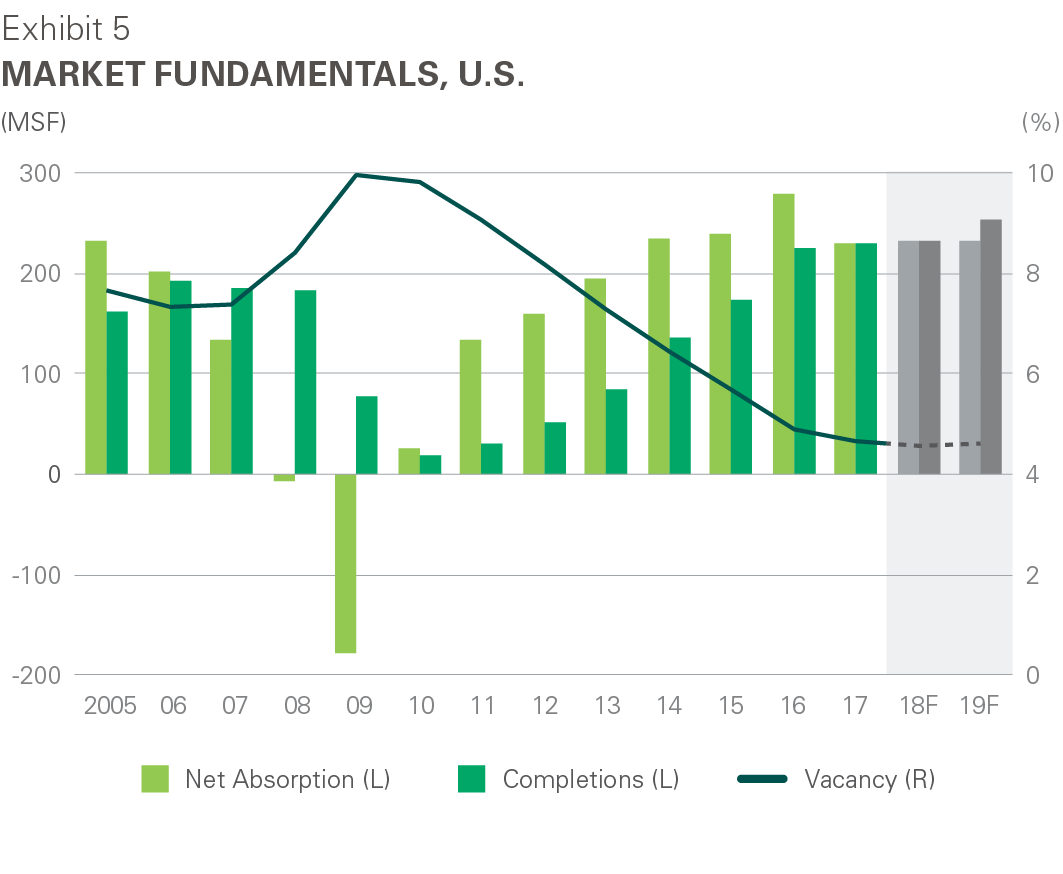

Outlook for sustained low vacancy should drive further rent growth. Current leading indicators of demand suggest an annual run rate of 220 to 240 million square feet (see Exhibit 4). Looking ahead, economists forecast 2.8% GDP growth in 2018, which should provide a supportive economic climate for logistics demand.9 Rising service levels and e-commerce growth should add tailwinds. On the supply side, the forces that are driving developer discipline are largely structural. Therefore, Prologis Research expects a gradual increase in new supply, matched by demand as occupiers lease new space as it becomes available. We forecast 235 million square feet of both net absorption and completions in 2018, keeping the vacancy rate at its historic low level of 4.6% (see Exhibit 5). Competition for limited availabilities should push rents upward, and extend the challenging environment faced by customers trying to expand.

Endnotes

2. CBRE, JLL, Cushman & Wakefield, Colliers, Prologis Research

3. U.S. Census, 4Q’17 E-commerce report

4. CBRE, JLL, Cushman & Wakefield, Colliers, Prologis Research 5. Port of Los Angeles, Port of Long Beach, Northwest Port Alliance, Port of Oakland 6. CBRE, JLL, Cushman & Wakefield, Colliers, Prologis Research 7. CBRE, JLL, Cushman & Wakefield, Colliers, Prologis Research 8. Prologis Research 9. Consensus Economics, April 2018 report