The Prologis Industrial Business Indicator (IBI) is a proprietary monthly indicator derived from three components: the Business Activity Index; the Space Utilization Index; and the actual reported rate of space being utilized by our customers. Each month, data is collected from a geographically diverse set of Prologis customers, representing a variety of business sizes, sectors and markets, moving inventory through the global supply chain.

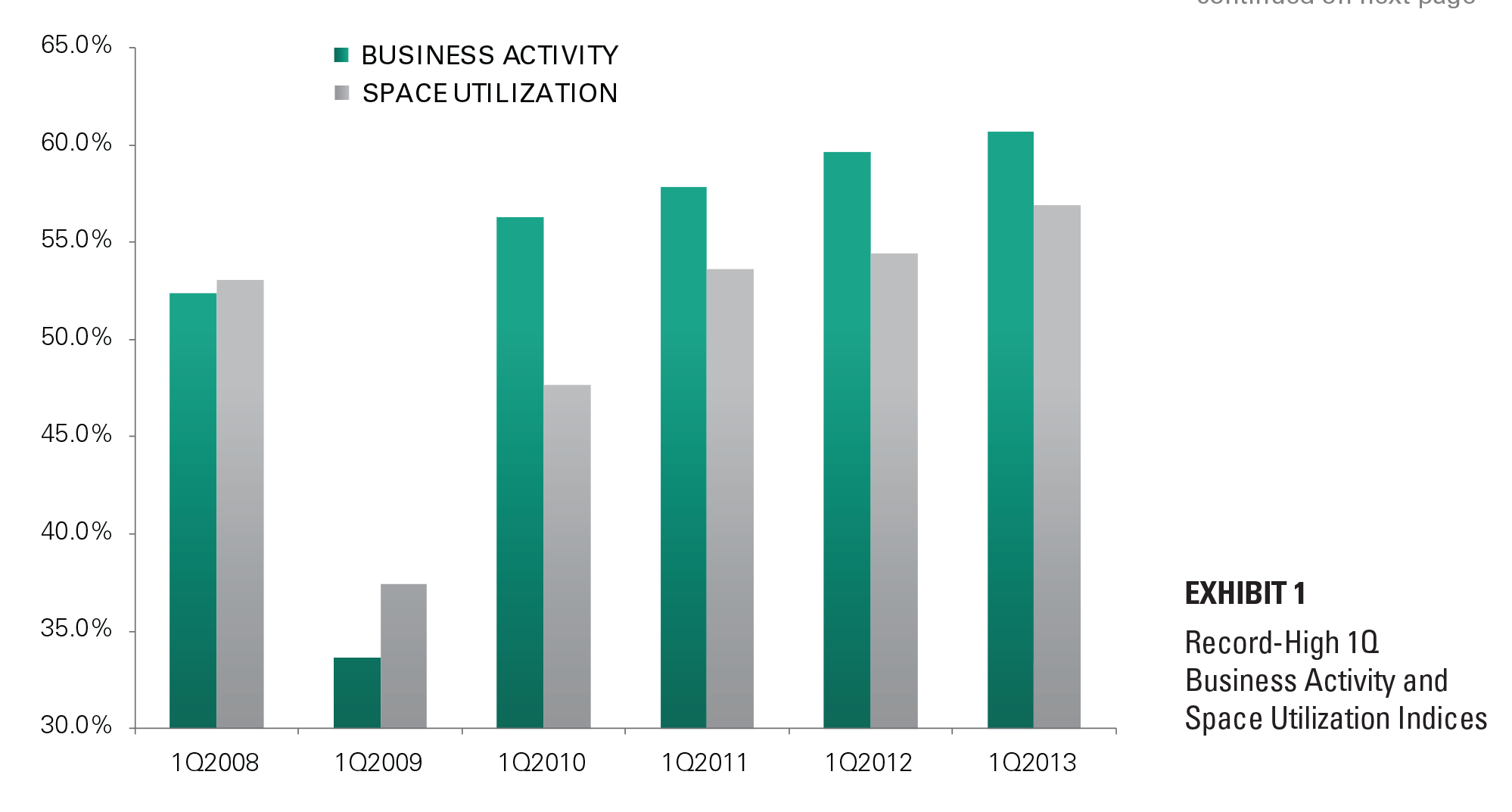

In March, the business activity index was down slightly from March 2012; however, the index remains elevated. In fact, the first-quarter IBI is the strongest first quarter since its inception in July 2007. This strength indicates that our customers’ businesses are expanding and the economic recovery is broadening and deepening. Importantly, the forward correlation of the index implies strong trade growth and positive U.S. net absorption in the coming quarters.

INDUSTRIAL RECOVERY ACCELERATING

The IBI Business Activity Index has proven to be a reliable indicator of near-term trade and net absorption, with one-quarter lagged correlations of roughly 0.9; thus, current high IBI business activity readings foretell healthy demand in the coming quarters. This proved the case in 3Q12. In our October publication of the index, we forecasted significant improvement in U.S. net absorption in the fourth quarter based on the strength of the index. Actual net absorption in the fourth quarter was 57 million square feet, the highest level in more than six years and more than double the average of the previous nine quarters. With the 1Q IBI Business Activity index at a record high, we expect demand to be stronger than the recent trend, and likely indicating that demand is gaining momentum, consistent with the strength in the fourth quarter.

RISING SPACE UTILIZATION AND INVENTORIES

The Space Utilization Index (Exhibit 1) is also at a record high in the first quarter and has been steadily rising. This is consistent with rising inventories and higher utilization of leased space by our customers. This leads to further leasing and ultimately to net absorption, as customers can no longer delay expansion decisions.

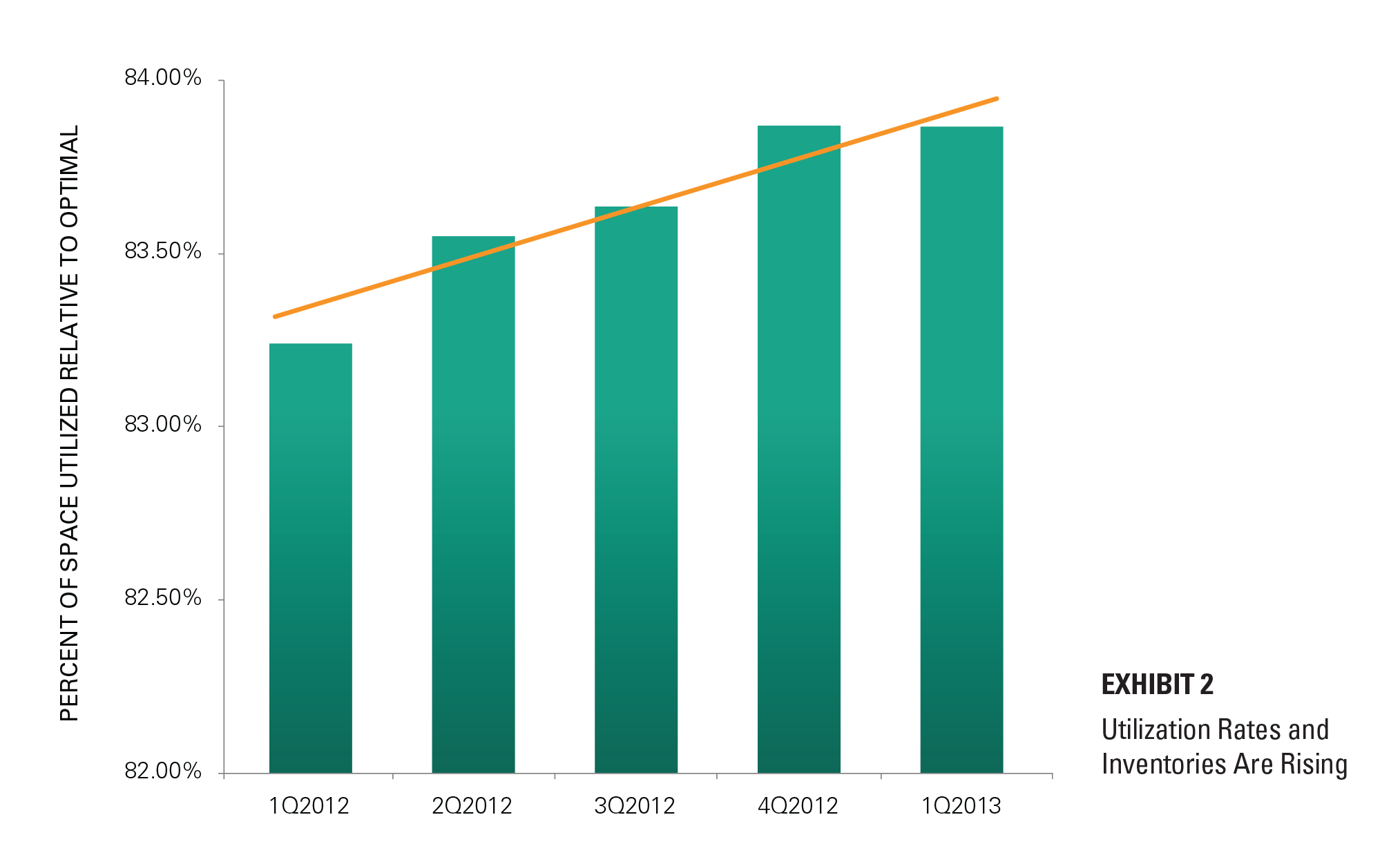

Real inventories increased by 2.6% in 2012, and are up by 7.5% from their trough in 2009. The IBI Utilization Index is consistent with real inventories continuing to grow at a similar pace. Over the past 30 months, the IBI has also been tracking actual reported utilization rates for our customers. Exhibit 2 demonstrates the change in the percent of space utilized over the previous year. The increase equates to the absorption of 80 million sf of “shadow space,” on top of the 125 million sf of actual net absorption in 2012. As utilization levels continue to rise, this absorption of shadow space transitions to absorption of space in the market, leading to tighter overall market conditions.

ALL CUSTOMER SEGMENTS IN AN ACCELERATING RECOVERY

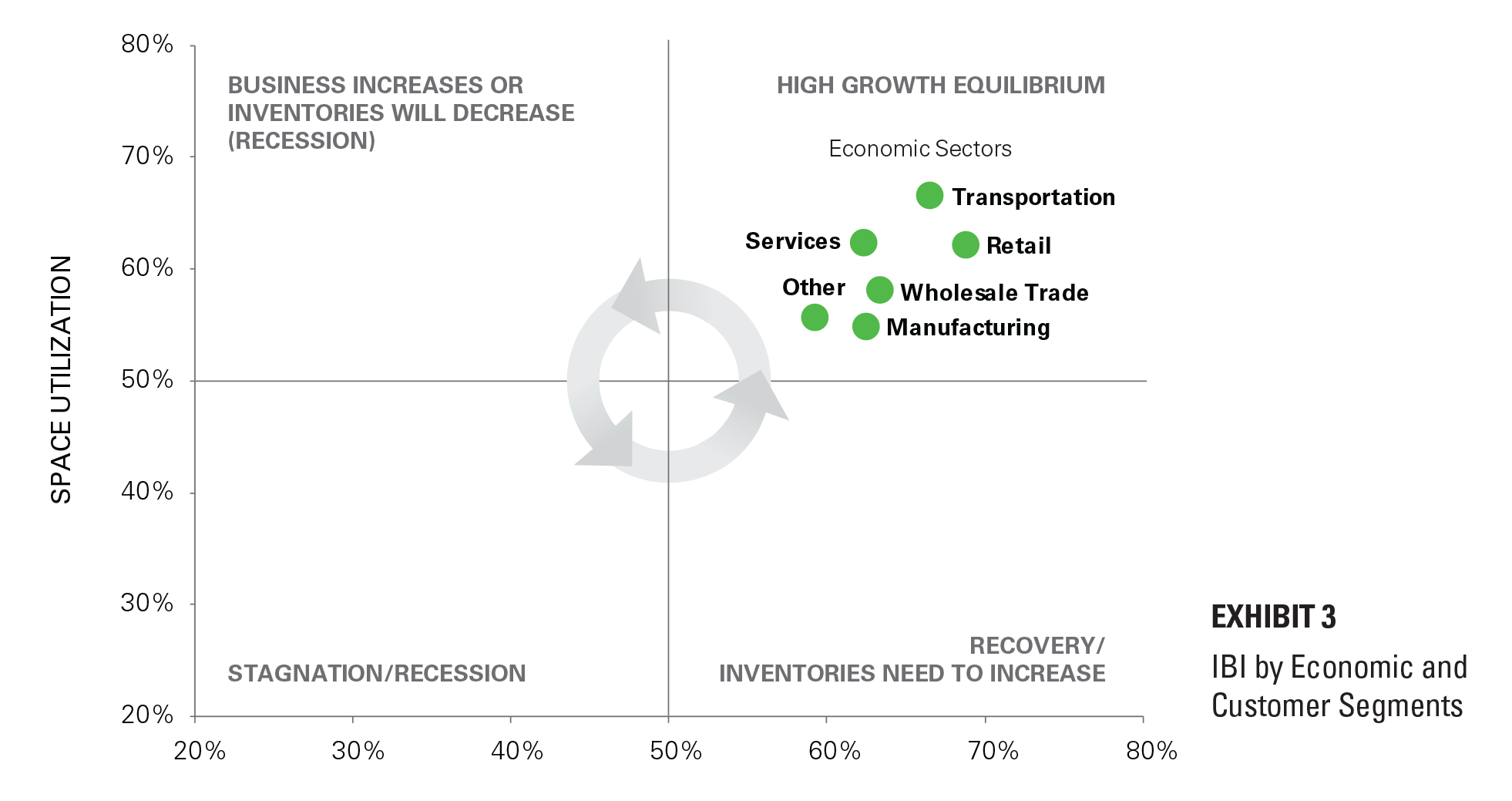

Exhibit 3 illustrates the March 2013 Business Activity and Space Utilization indices, by economic sector. As predicted in our previous IBI publication, all sectors moved into the upper-right quadrant in the fourth quarter, thereby indicating all sectors are now fully in expansion. This is an important step forward and indicative of a broad-based economic recovery. Notably, this marked the first time all sectors have remained in the “growth” quadrant for an entire quarter since 2008. In the first quarter, all sectors gained momentum and have moved further into the quadrant, indicating even stronger business activity and space utilization. For the first time since the financial crisis, the Prologis IBI is indicating that the recovery in the United States is broad, diverse and accelerating.

Forward-Looking Statements

Copyright © 2013 by Prologis, Inc. All rights reserved.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis

Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of December 31, 2012, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 554 million square feet (51.5 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

White Paper Contributors

Chris Caton, Vice President

Dave Twist, Vice President

Audrey Symes, Senior Associate

Michael Steingold, Analyst