Increasing Customer Business Activity

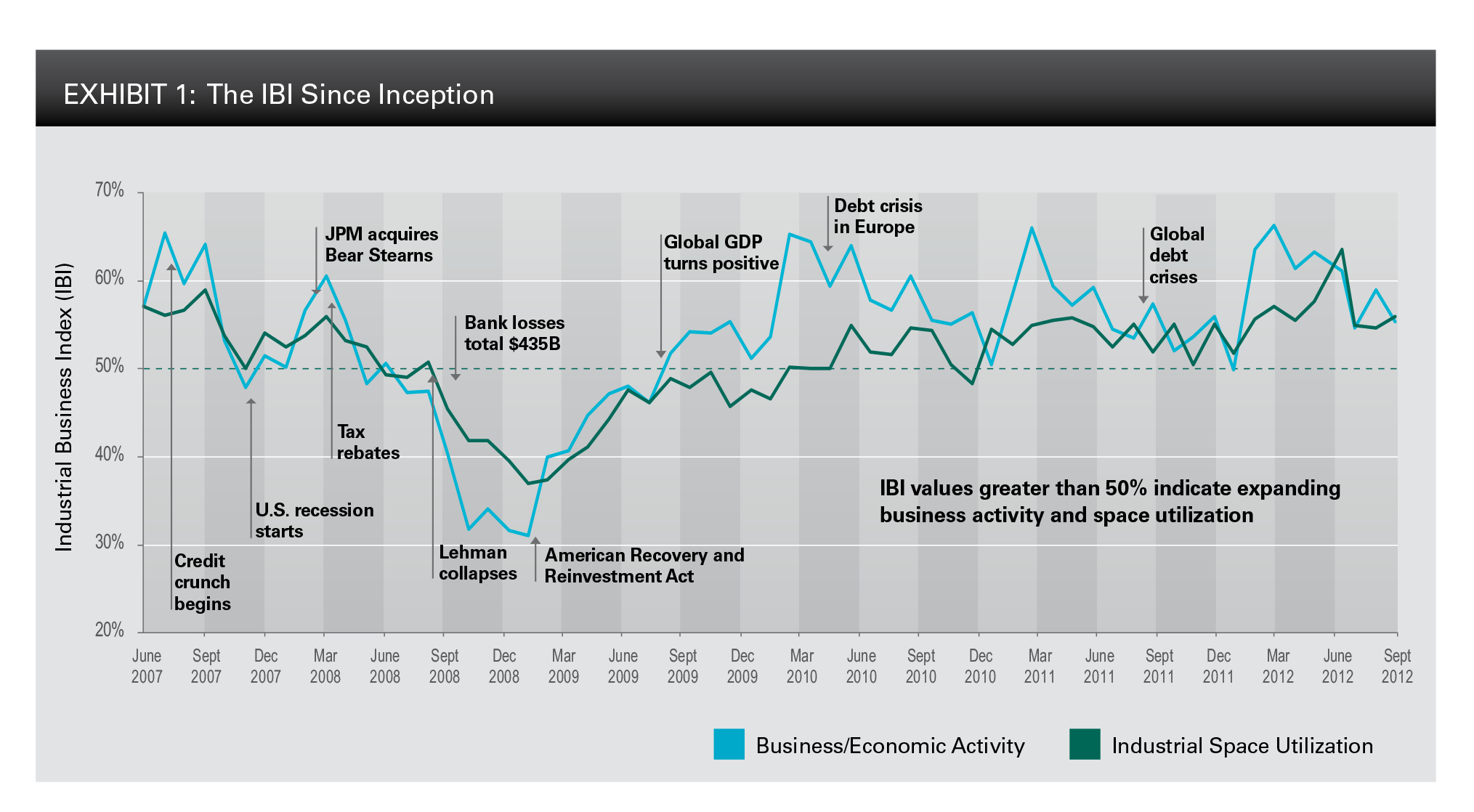

The Prologis Industrial Business Indicator (IBI) is a proprietary monthly diffusion index derived from three components: the business activity index, the space utilization index and the actual rate of space being utilized. Each month, we collect data from a geographically diverse set of our customers, representing a variety of business sectors and markets currently moving inventory through the global supply chain.

The IBI business activity index has proven to be a reliable indicator of near-term trade and net absorption, with one-quarter lagged correlations of roughly 0.9; thus, current high IBI business activity readings foretell healthy demand in the coming quarters.

In September, the business activity index remained relatively strong at 55, indicating that our customers’ businesses are expanding as we head into peak season. In fact, the business activity index (year-to-date) is the strongest on record, likely indicating the recovery is broadening and deepening (Exhibit 1).

Rising Space Utilization

The space utilization index increased from 54.2 in August to 55.6 in September, indicating that our customers are increasing their inventories in preparation for the peak season. Real inventories increased at a 2.8% annualized rate in the second quarter following 3.3% growth in the first quarter. The IBI space utilization index is also forecasting solid inventory growth in the coming quarters. This is not surprising given real inventories are still down 3.6% from their pre-crisis peak levels.

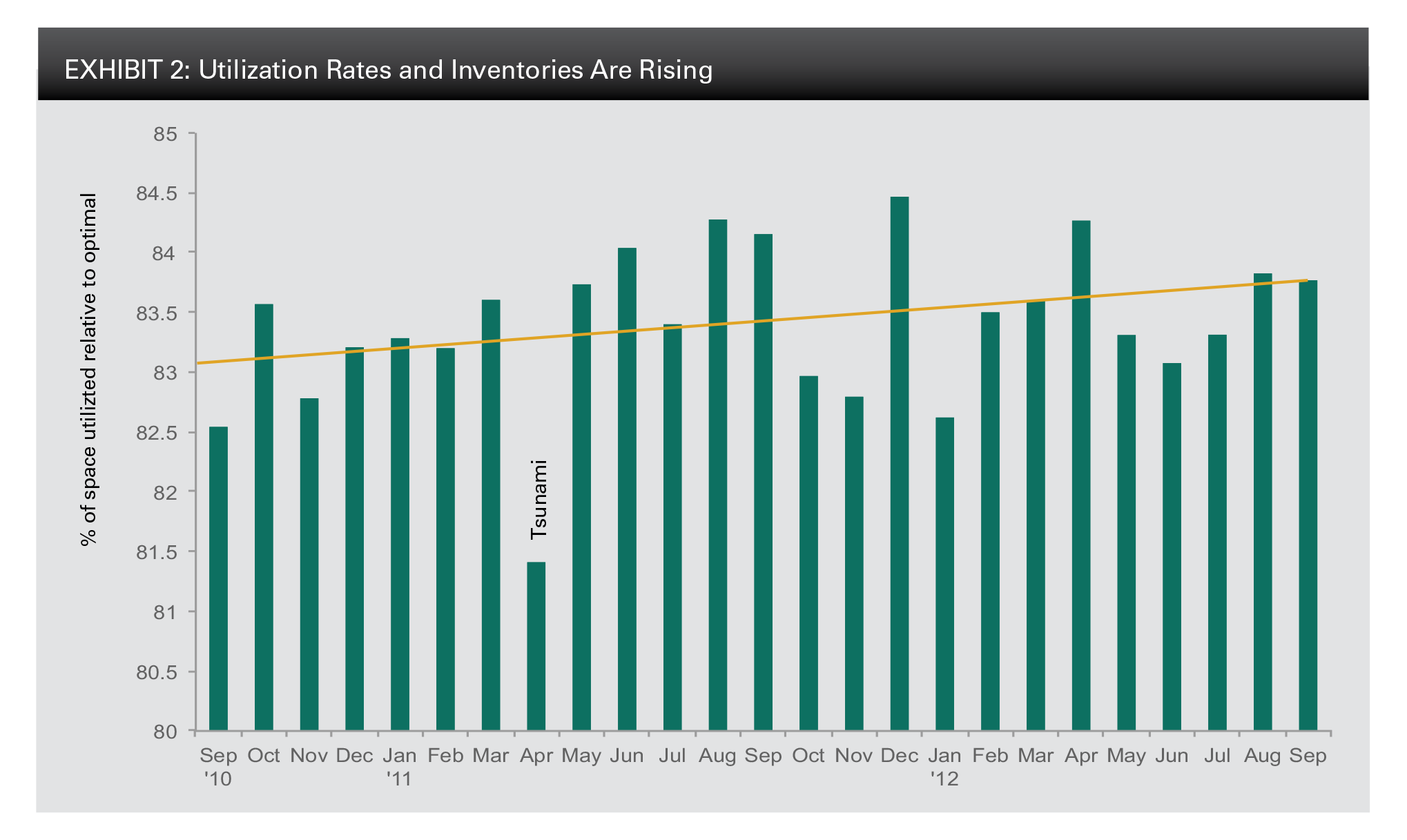

During the past 24 months, the IBI has also been tracking actual utilization rates—the percentage of space being used relative to what is considered “optimal” by our customers. Actual utilization rates have been trending up over this time period, reaching 83.8% in September (Exhibit 2). Extrapolating this upward trend in utilization to the broader market implies that utilization rates are about 1% higher on a national basis. This increase in utilized space equates to more than 100 msf of net absorption of “shadow space” this year, as customers continue to build inventories and further utilize their space. As the “shadow space” is taken up, occupancy and net absorption will follow.

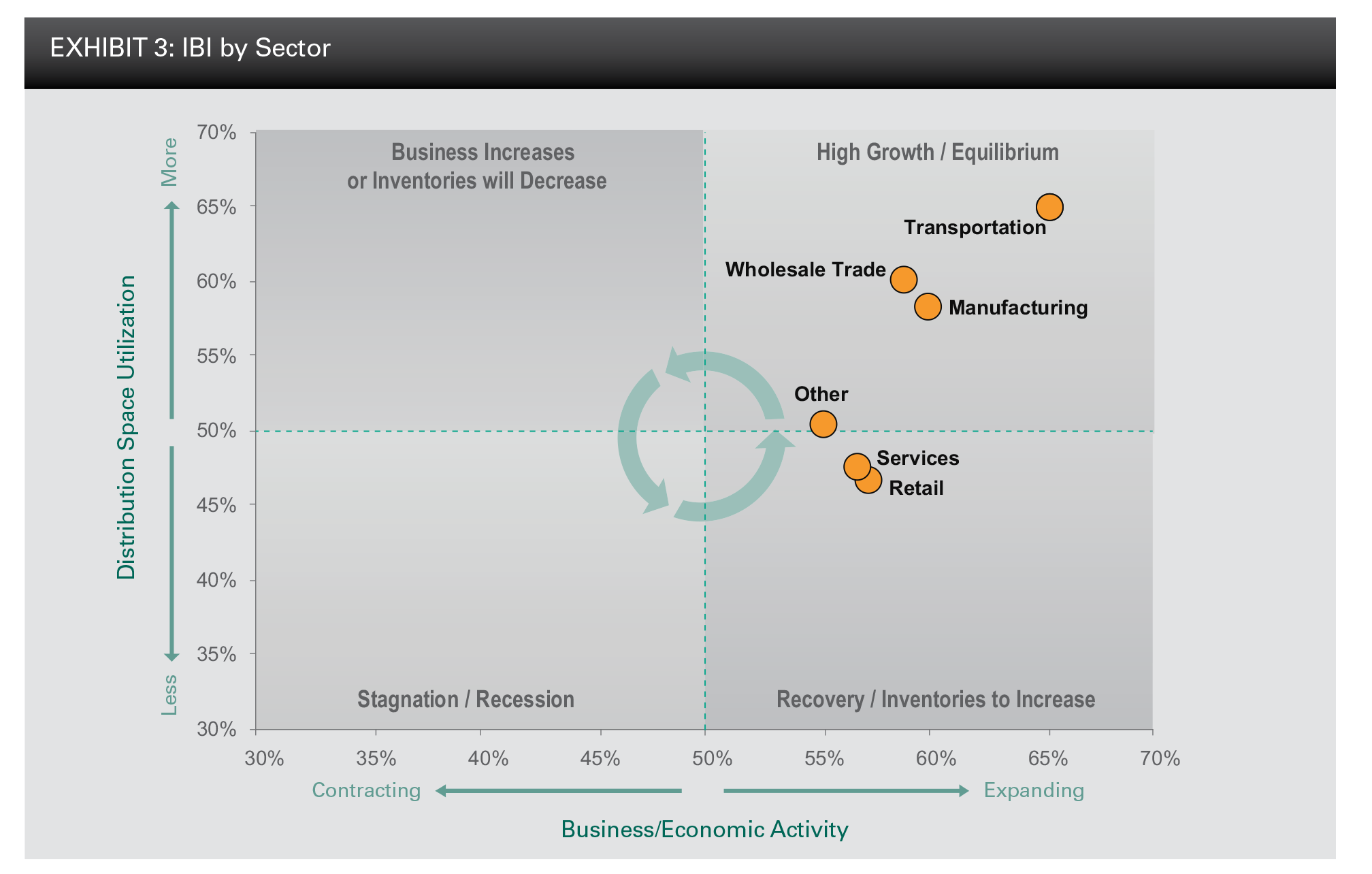

Exhibit 3 illustrates the September 2012 business activity and space utilization indices, by economic sector. Business activity is above 50 for all Prologis sectors, indicating the expansion is broadening, an important step in stabilizing the economic recovery. A year ago, transportation and manufacturing were identified as laggards by the IBI (lower left quadrant); today they are leaders among the other sectors (upper right quadrant), as our customers in those industries show expanding business activity and increased space utilization. The recovery in these sectors is important to the overall national recovery, and virtually all of the Prologis customer sectors are indicating increased business activity and space utilization. The retail space utilization index is still below 50, as retailers are slower than the other sectors to rebuild inventory, but this index is improving and we expect it to rise above 50 in the next two months as we enter peak holiday shopping season and retailers continue to restock.

Growing Demand for Industrial Space

The September 2012 IBI suggests the recent macroeconomic events have had a lighter impact on the U.S. economy than in previous years. As the correlation between the IBI business activity index and net absorption and global trade are 0.9 on a quarter-forward basis, the index is consistent with accelerating growth in global trade and demand for industrial real estate over the next few quarters.

About the Authors

David C. Twist is Vice President, Research, for Prologis, responsible for the company’s global research initiatives. He has been in real estate-related research since 1990. Twist is a member of the National Association of Industrial & Office Properties (NAIOP) and the CFA Institute. He received a bachelor’s degree in quantitative economics from the University of California, San Diego.

Audrey Symes is Senior Associate, Research, for Prologis. Her responsibilities include producing white papers on industry trends and creating and tracking indicators of industrial logistics real estate demand. Her past professional real estate research experience includes positions at Rosen Consulting Group and RREEF. She holds a BA with Honors in Economics from Stanford University and an MA in Economics from New York University.

About Prologis

Prologis Inc. is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of June 30, 2012, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 569 million square feet (52.9 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.