The Prologis Logistics Rent Index

We’re introducing the Prologis Logistics Rent Index. Our goal is to support transparency across the industry and the world for customers, investors and the broader industrial real estate community. We’re seeking to provide an indicator for comparison over time by using a consistent methodology.

- Chris Caton,

Global Head of Research, Prologis

Summary

The Prologis Logistics Rent Index. Prologis is introducing a new Logistics Rent Index, which examines trends in net effective rents globally and in four major regions including in the U.S. and Europe. Data for the Prologis Logistics Rent Index comes both from our global portfolio, which amounts to 669M square feet in which we lease more than 150M square feet annually, and our local knowledge of pricing in the more than 100 markets in which we operate. Please see our appendix for more details. Going forward, Prologis will publish an annual census of conditions worldwide. The Prologis survey considers only modern logistics real estate and focuses on net effective rental rates, which adjust for concessions.

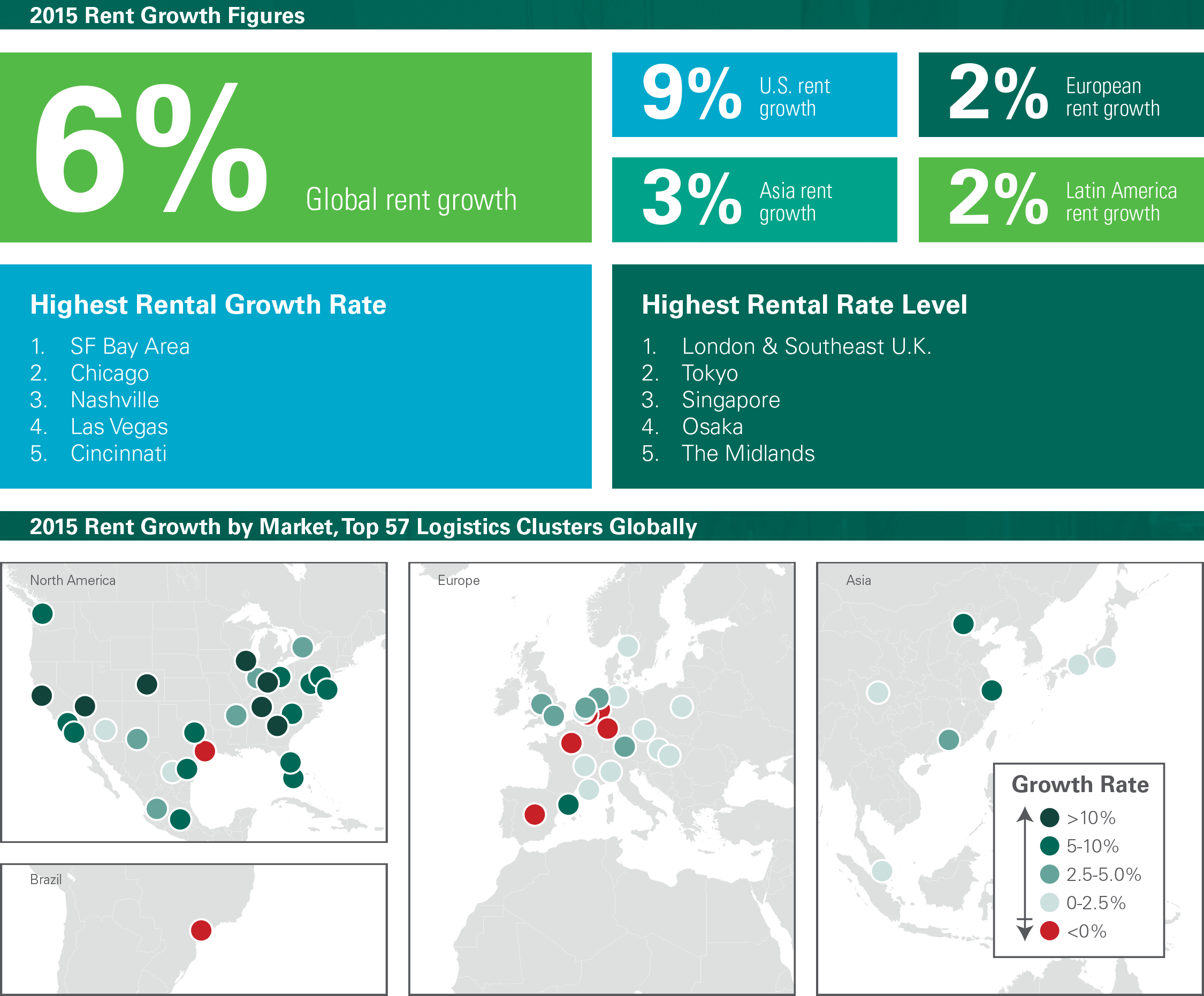

Key insights of the inaugural survey. Rental rates on a global basis rose 6% in 2015 and are up more than 20% in the last three years. In many markets, the combination of improving customer sentiment, a limited supply response and rising replacement costs has led vacancies to their lowest levels on record. Given the scarcity of quality available properties, customers who have been able to act earlier have had better results fulfilling their space requirements.

The world’s highest growth markets. The San Francisco Bay Area had the highest rental rate growth in the world in 2015. The rest of the top five are also in the U.S.: Chicago, Nashville, Las Vegas and Cincinnati. European markets were lower in the ranking, with the strongest markets located in the U.K. and Northern Europe, along with some initial jumps in Barcelona and the Southern Netherlands.

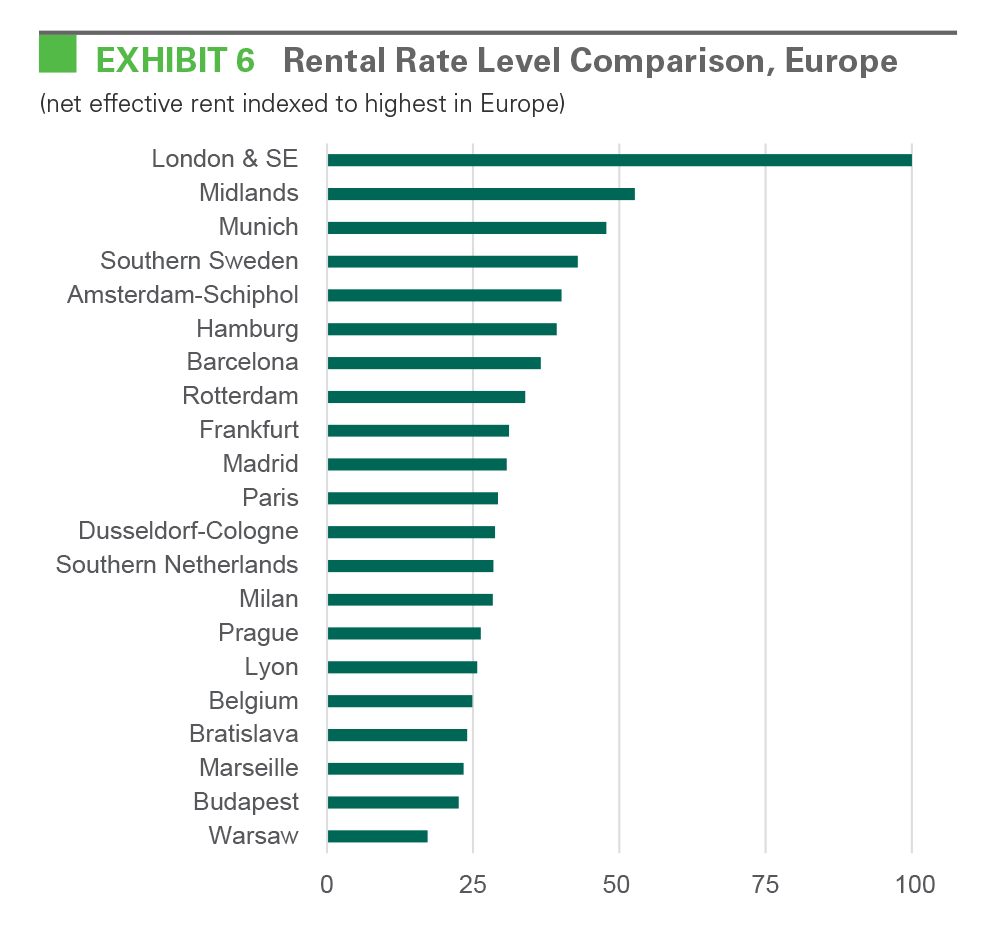

The world’s most expensive markets. Average rents in London and the Southeast U.K. are by far the highest in the world. The other top five markets are Tokyo, Singapore, Osaka and the Midlands.

Prologis’ outlook. Vacancies are likely to remain low in the near term, leading to further rental rate increases. Rent growth in the U.S. has been considerable and naturally will normalize as the expansion matures. Elsewhere, notably in Continental Europe, rent growth should accelerate given improving demand and low/falling market vacancy rates.

What does it all mean? Our study reminds us that real estate is inherently local. Key themes by stakeholder:

- For customers, securing quality space is a challenge in many markets around the world. Forward-thinking customers with a thorough planning process and the ability to act quickly stand the best chance of meeting their real estate requirements at the best price. Indeed, rents seem poised to rise by a further 5-10% in several of the leading markets this year. For customers who only lease space periodically, growth over multiple years means rents could be 10-20% higher, or more, than the last time they leased space.

- For investors, knowledge of current rental rate dynamics is critical—in-place rents can often be well below market, especially in the U.S. While growth continues (and is rising in late-recovery locations such as Europe), the cycle is also maturing. Markets with higher barriers to supply have very low vacancies, and customers are competing for vacancies and driving up rates. In many of the leading markets, replacement costs are rising quickly and changing the development cost equation, in turn supporting rent growth.

Forward-thinking customers with a thorough planning process and the ability to act quickly stand the best chance of meeting their real estate requirements at the best price.

For investors, knowledge of current rental rate dynamics is critical – in-place rents can often be well below market.

Introduction

Prologis is introducing a global rental rate index. While we have a presence in more than 100 markets on four continents, our study focuses on the largest 57 markets that substantially comprise all of the world’s 6 billion square feet of modern logistics space. Each of these markets generally has at least 20 million square feet (and many have more) and sufficient leasing velocity for a clear and contemporary view of rental rates. Our survey is based on Prologis’ proprietary data and our local teams’ knowledge of rental rates and concessions for modern logistics real estate, which is represented as Class-A and well located Class-B facilities and market-specific average lease sizes.i

We note three components of rental rate dynamics:

- Global growth trends and regional specifics, including the U.S., Europe, Asia and Latin America

- Aggressive concessions in certain markets and how those concessions skew rental rate dynamics

- Identifying the four types of growth markets and creating an outlook for the year ahead

Global Rent Index and Regional Detail

Outsized growth continues. Rental rates on a global basis rose 6% in 2015 and are up more than 20% in the last three years. Yet, real estate is inherently local, and these global trends are the sum of conditions at a market level. Across the landscape, conditions generally fall into four categories:

- Recovery. A basic unwinding of discounts offered during the Global Financial Crisis, which eventually takes rents back to a level that supports development. Examples of these markets from 2015 include Chicago, Atlanta, and Barcelona.

- Rising Replacement Cost. Low vacancies and economic growth driving higher replacement costs in markets where new supply is more active and more competitive, causing the development equation to change and requiring higher rents for new projects to pencil. Examples of these markets from 2015 include Dallas, the greater Shanghai region and the Midlands (U.K.). Perhaps the best examples include Tokyo and Osaka, where land values, construction costs and labor rates have moved considerably in the last several years, 2015 included.

- Barriers to Supply. Economic growth within higher barrier to supply markets, leading vacancies lower and causing competition among customers. Examples of these markets from 2015 include the San Francisco Bay Area, Los Angeles, New Jersey, South Florida, London, Munich and more.

- Crosscurrents. Challenging market conditions either as the result of soft economic conditions or aggressive development competition. Examples of these markets from 2015 include markets in Poland, Paris, Indianapolis and São Paulo.

When we put these market trends together, we find clear regional trends. The U.S., U.K., China and Mexico have experienced outperformance in growth whereas growth has been less robust in Continental Europe.

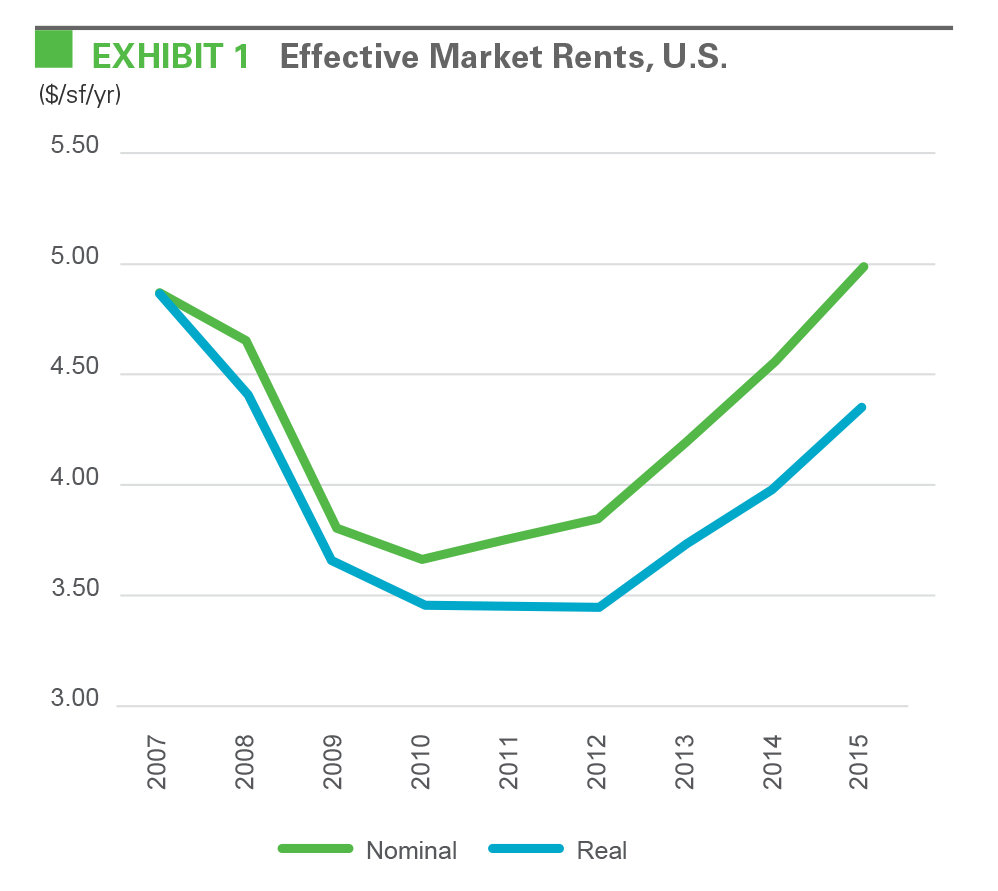

The U.S. has been the clear growth leader in recent years. Rental rates in the U.S. rose 9% in 2015 and are up more than 25% in the last three years. Low vacancies are nearly universal across the U.S., and customers are competing for availabilities, leading rental rates higher. In many places, growth has been robust as discounts from the last recession are still unwinding. Yet, in a sign of the expansion, more markets now have rates above prior peaks. While the prior peak is an interesting reference point, its usefulness is fading as other factors are not at all comparable to the prior cycle peak (for example, replacement costs or customer revenues and cost structures). Given these dynamics, rental rates should continue to rise beyond the prior peak over the long term rather than remain range-bound by historical averages.

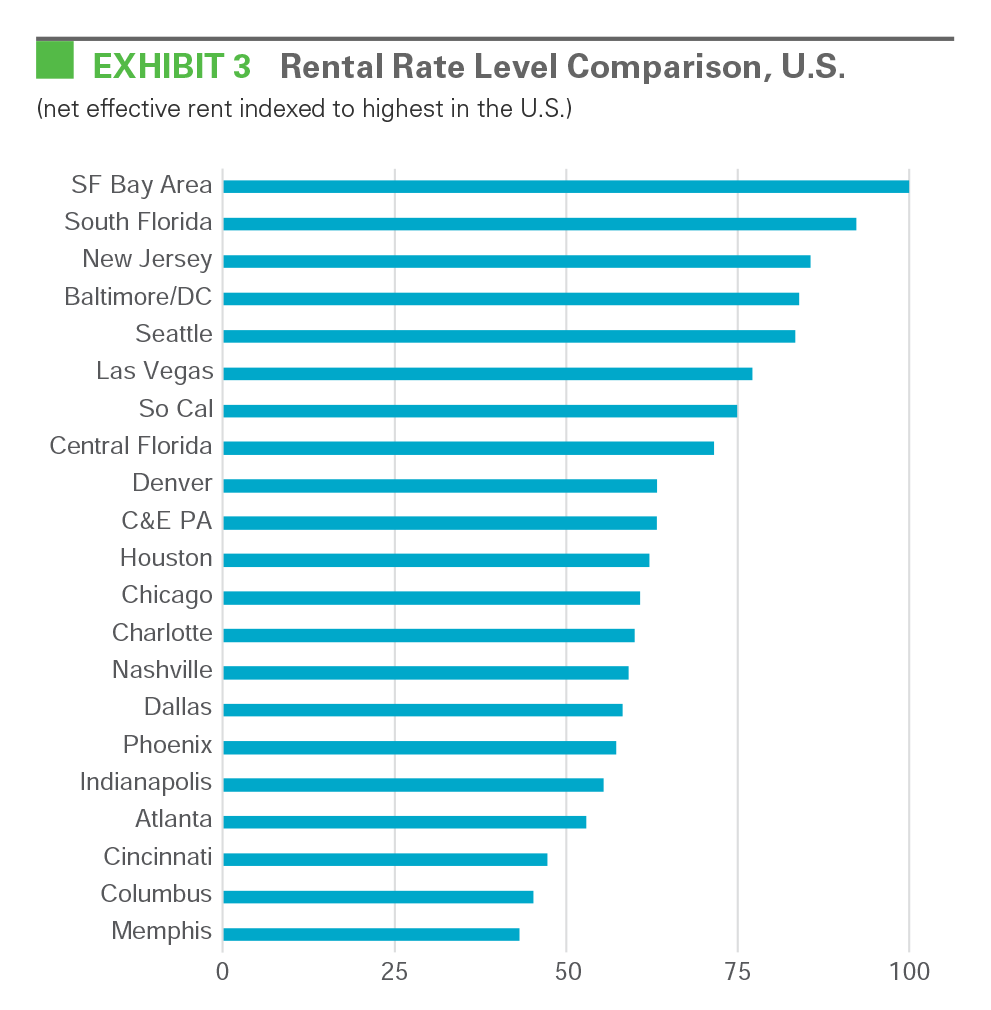

Rental rates have moved meaningfully in some markets. As noted above, growth drivers fall into four categories. Among Recovery markets, Chicago and Atlanta saw discounts from the last cycle unwind in 2015 and growth was significant (above 10% in both cases). This trend is also present in the Midwest. Many of these markets are beginning to fall into the Rising Replacement Cost category. Among High Barrier to Supply markets, vacancies are low and customers are forced to compete for space, notably in the San Francisco Bay Area but also in Seattle, Southern California and New Jersey. Relatively few markets experienced soft growth. Houston was the principal outlier; even though vacancy dynamics are stable, customers in multiple submarkets are able to drive pricing given concerns surrounding the backdrop for demand.

The highest rents in the U.S. are in supply-constrained markets with proximity to major population centers. The San Francisco Bay Area has the highest rents in the U.S., which is a reflection of its high geographic and regulatory barriers to new supply. The other top five highest rental rate markets in the U.S. include South Florida, New Jersey, Baltimore/DC and Toronto. The lowest rents in the U.S. are driven by land use policy and include Memphis, Columbus and Cincinnati, each of which has rents that are less than half of those in the SF Bay Area.

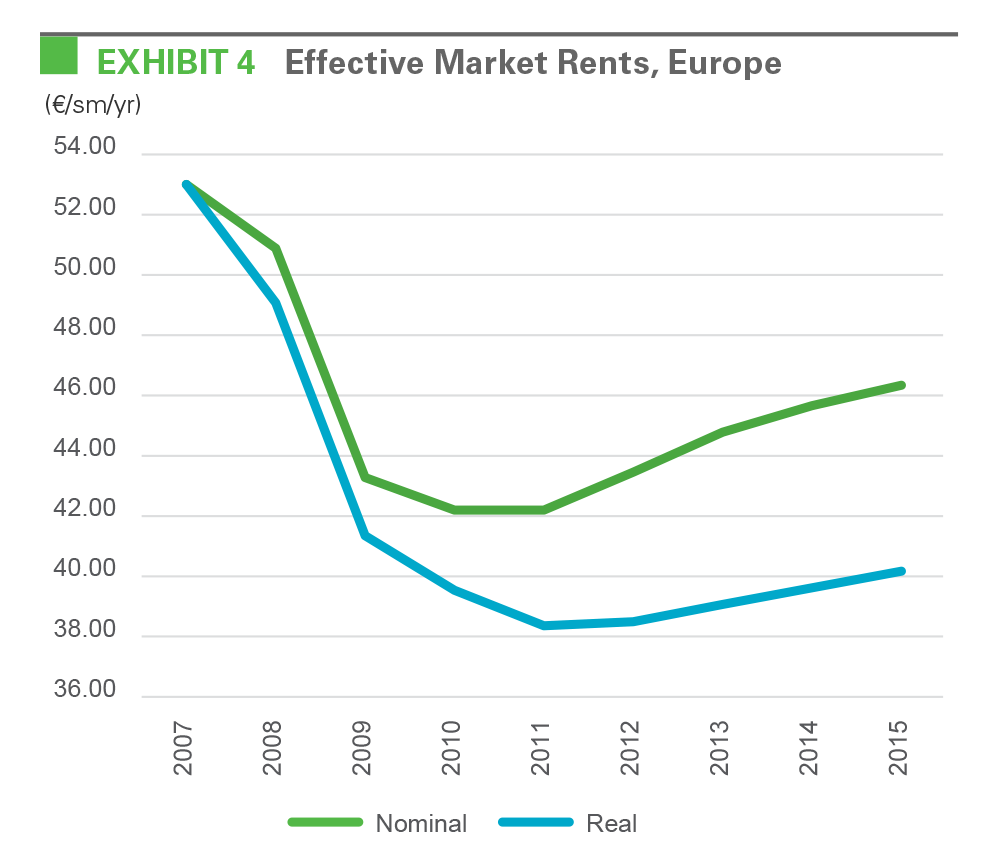

Positive, though fragmented, growth continues to define logistics conditions in Europe. Customers have a better opportunity to achieve historically low rental rates in Europe. Operating conditions have improved, but not to the point that allows for robust or widespread rent growth. Net effective rental rates rose 2% last year and are up 7% in the last three years. This modest pace is attributable to several factors, most notably the gradual economic recovery and its impact on business activity and decision-making. Also at work is a decline in cap rates: values have recovered quickly, inviting more supply in certain markets at this early point in the cycle compared to the U.S. While that supply is almost entirely build-to-suit in nature, as compared to speculative, it has nonetheless had a dampening effect on several submarkets across the region.

A broader range of markets is beginning to recover. Much of the rental rate recovery in Europe has been led by an unwinding of concessions and rent declines from the recession. The U.K., with its dynamic economy, has outperformed the region, so rising replacement costs and barriers to supply have become important drivers of growth. Indeed, two of the top seven rental growth markets in Europe during 2015 were in the U.K. Other mature economic expansions, such as markets in Germany, the Netherlands and Sweden, are also in the top seven. However, we see Southern European markets with depressed rents, and where excessive concessions are unwinding, such as Barcelona. In both cases, vacancies have moved below 10% and concessions have begun to unwind.

FOCUS BOX: CONCESSIONS SKEW MARKET PERCEPTIONS OF RENTAL RATES

Throughout this report, we refer to rental rates on a net effective basis. Net effective rents are principally net of free rent, but inducements also include extra tenant improvement capital and other considerations. By doing so, we focus on the true economic terms of the offer.

The global average free rent equates to roughly 5% of rent, or less than one month per year of term. Yet, a handful of markets use concessions aggressively, whereby inducements can amount to more than 25% of total rent. This can skew the market’s perception of rents. For example, a headline rate in Warsaw can be €2.75/sm/yr ($3.25/sf/yr), although concessions make the true economic offer to the customer (i.e., the net effective rent) as low as €1.75/sm/yr ($2.15/sf/yr), among the lowest rents in the world.

This practice has added, and will continue to add, volatility to local market conditions, creating challenges for users and investors alike. The appearance of high headline rent can lead to undisciplined development, especially in markets with active merchant builders, who sell on assets to buyers who focus on headline rents rather than their net effective level. These pricing dynamics have led asset value growth to stagnate as the rest of Europe has recovered. Recent investors have likely underpriced risk and will realize lower returns than they expect. Heavier concessions than might be commonly assumed will be needed to retain and renew customers at their present headline rental rates. Excess supply will keep concessions high and net effective rental rates low, which should ultimately lead to less, not more, development in the local marketplace, leading to less choice for customers. These crosscurrents reduce the visibility of market conditions looking forward, adding uncertainty in availability and pricing for customers and investors alike.

The practice appears to have spread in 2015 even though net effective rents are rising. Poland is among the most heavily concessioned market in the world. During 2015, there were more examples of high concessions in a handful of submarkets elsewhere in Europe, too.

Asian markets have been steady. Cycles in the Chinese and Japanese markets have been ahead of the rest of the world. Rents in 2015 rose 4% in China and about 2% in Japan – low by global standards but a positive figure in a market that has otherwise had relatively little inflation. In Japan, vacancy rates have been very low and customer demand is rising as customers recognize the benefits of modern logistics facilities. Demand is approaching its prior peaks from the last cycle—all in an environment of relatively weak economic growth. In China, the supply cycle is more mature, and vacancies have risen above 10% across the country’s main markets. In China’s largest population zones, vacancies are biased higher by growth in Tier 1.5 (e.g., Tianjin) and 2 cities (e.g., Chengdu). By contrast, land availability for logistics real estate uses is very limited in Tier 1 cities (e.g., Shanghai, Guangzhou) and vacancies are near zero. As a consequence, broad market average rental rate growth continues, but has slowed from its pace of high single digits several years ago to 4% in 2015.

Substantial differences in Latin America. The primary logistics-focused cities in Latin America include São Paulo and Mexico City, and their trends couldn’t be more different. Brazil is coping with a sharp economic downturn, which has tamped down customer activity. Supply has responded in kind and vacancies for modern facilities are relatively in check, although rents have slipped in secondary submarkets. In contrast, Mexico City’s vacancy rate has fallen to its lowest point in the cycle and rent growth has been healthy. Trends are even more pronounced along the border, where the recovery is occurring later and rents are jumping from trough levels. Rents in Mexico are predominantly in U.S. dollars—the recent devaluation of the peso has created margin pressure for customers in some markets, primarily Mexico City and Guadalajara.

We believe global vacancy rates will remain low for the next several years and rents should rise at, or above, inflation levels, driven by a combination of spiking replacement costs and customer demand for well-located facilities within and adjacent to major population centers.

Outlook

What might 2016 bring? More growth in rental rates characterized by increases in headline rates and reductions in concessions (notably in Europe). Viewed across the landscape, there are a range of markets where sourcing logistics facilities will remain challenging and rental rates are likely to experience outsized growth. Looking back at our four themes shaping rental rate growth:

- Recovery. Markets that seem poised to experience this type of growth include a broader range of regions in Europe, such as in the main markets of Spain and Italy.

- Replacement Cost Growth. Replacement cost equations are changing quickly and are becoming more important to rent growth in some markets. Markets that seem poised to experience this type of growth include certain markets in the U.S., such as Dallas and Chicago, many of the Tier 1.5 and 2 Chinese cities and the U.K., notably the Midlands.

- Barriers to Supply. Many markets with these characteristics appear poised to enjoy some of the strongest growth in the world. Examples include New Jersey, Los Angeles, Seattle, Tier 1 cities in China and several German markets, such as Munich.

- Crosscurrents. Examples of markets where conditions could remain challenging include São Paulo, Houston and Poland.

A further strengthening of the market. In sum, we believe global vacancy rates will remain low for the next several years—in many cases, at all-time lows. At the same time, replacement costs have begun to rise in the leading markets, causing changes in how developments are underwritten. Rents should rise at, or above, inflation levels, driven by a combination of spiking replacement costs and customer demand for well-located facilities within and adjacent to major population centers. Customers and investors should be mindful of these local trends and understand that the picture will continue to evolve. In the U.S., growth may remain outsized, although it could normalize in time toward low- to mid-single digit growth as supply and demand come into better balance. Elsewhere, growth appears poised to accelerate in land-constrained markets on the European continent. Customers should plan as far ahead as possible given low availabilities and quickly rising rental rates.

End Notes

The Prologis Logistics Rent Index is representative of pricing for modern logistics real estate and functional infill facilities. The index comprises of rental rates that are net of free rent and considered on a triple net basis (i.e., exclusive of operating expenses). The index covers 57 of the world’s largest logistics real estate markets. The global and regional indexes are rent-based weighted averages. Data comes from our local Prologis teams and is the then prevailing pricing for space in the major modern and functional infill submarkets within their respective markets.

The geographic composition of the index is 59% U.S., 23% Europe, 13% Asia and 5% Latin America. Market stock figures are Prologis estimates based upon data from CBRE, JLL, Gerald Eve and DTZ. The most notable markets outside our geographic coverage include Hong Kong, Australia and Moscow. Exchange rates as of December 31, 2015. were used to convert foreign currency into U.S. dollars. Growth rate figures are compiled on a local-currency basis (i.e., the Prologis Logistics Rent Index excludes the impact of changes in foreign exchange rates).

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in industrial real estate. As of December 31, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 669 million square feet (62 million square meters) in 20 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party logistics providers, transportation companies, retailers and manufacturers.

Copyright © 2016 Prologis, Inc. All rights reserved.