Prologis’ approach to identifying and managing climate-related risks and opportunities

- Dynamic risk management strategy focused on resiliency

- Evaluating physical climate risk exposure at the asset level using science-based climate scenarios

Prologis has an established track record of ensuring its portfolio remains resilient for its customers and stakeholders. This commitment not only focuses on acute, near-term risks such as hurricanes and flooding but also considers longer-term trends resulting from the changing climate. We develop assets with a long-term ownership horizon in mind and have preparedness plans in place that have consistently differentiated our response and helped us to deliver business continuity to our customers. Looking forward, we are working with third parties on climate-related scenario analysis to evaluate the exposure of our global assets to physical, natural hazards across our portfolio, and to ensure we continue to be prepared for changes in frequency and severity of extreme weather events. Other components include TCFD aligned disclosure, engagement from our executive team and Board members, and a robust program to track our efforts through metrics and targets, including our Science Based Target for reducing greenhouse gas emissions across our operations and portfolio of assets.

Core Elements of Recommended Climate-Related Financial Disclosures

Governance

The organization's governance around climate-related risks and opportunities

Strategy

The actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning.

Risk Management

The processes used by the organization to identify, assess, and manage climate-related risks.

Metrics and Targets

The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

Governance

- Risk, including climate-related risks, are part of the Prologis board’s oversight responsibility. Board updates have focused on coastal risks, as well as ESG progress on greenhouse gas (GHG) reductions and solar installations.

- Our chief legal officer and general counsel oversees both the Risk Management and ESG teams with broad support and engagement across the entire organization. One example is our structured Investment Committee process, overseen by our Executive Committee, that requires risks and ESG considerations be evaluated for every investment decision.

Strategy for Management of Risks & Opportunities

- Prologis is a long-term owner of logistics real estate. This requires us to evaluate material risks and opportunities that may arise over the short-, medium- and long-term time horizons, including those associated with climate change. Evaluating risks and opportunities and the potential financial implications ensure the resilience of our assets and our customers operations, while also identifying opportunities to deliver sustainable solutions to our customers.

- Process for identifying and prioritizing risks & opportunities: Prologis’ utilizes a dynamic risk oversight process to identify, evaluate, and manage risks across our enterprise, including ESG related risks such as climate.

- By embedding ESG and risk management throughout the organization, Prologis evaluates the material risks and opportunities associated with climate change. This can include risks from potential severe weather, flooding, or coastal risk, and opportunities with enhanced energy efficiency products, renewable energy development, just to name a few. We assess these risks in the short, medium, and long term and identify them as acute or chronic. We also account for these risks and opportunities in our investment committee process.

- Some examples of climate-related risks and opportunities, include, but are not limited to the following:

- Prologis has taken a proactive, and customer-centric approach to mitigate our exposure to risks and create sustainable solutions that benefit our customers:

- Products and services

- Examples include the Prologis Essentials LED lighting program that helps our customers to lower energy costs and have more efficient operations by upgrading to highly efficient LED lighting that can lower energy costs by 60%-80%.

- Supply chain and/or value chain

- Our SolarSmart program enables our customers to utilize on-site renewable energy for their operations, lowering the emissions from their supply chain, as well as from our value chain. Solar installations on our rooftops are also adding more renewable energy into the local utility grids of regions we operate in.

- Operations (including types of operations and location of facilities)

- Responsible investment practices advance green design principles and mitigate environmental, climate and other ESG risks.

- Our portfolio is diversified across multiple geographies in 19 countries minimizing the material risk to our portfolio from any one asset being exposed to a particular physical climate-related risk.

- Using third-party data and internal tools for mapping and evaluating physical climate risk exposure at the asset level through science-based climate scenarios, we can proactively implement mitigation strategies that further the resilience of our global portfolio. This includes implementing site specific mitigation measures, such as raising a property out of the base flood elevation, raising the height of dock doors, and other measures to ensure the long-term resilience of our assets.

- Adaptation and mitigation activities

- Local and regional teams are equipped with disaster response plans and take various risks into consideration when developing or maintaining our assets to make sure that they are resilient to climate-related risks like flooding or extreme weather events.

- We implement site specific mitigation measures, some examples include: raising properties out of the base flood elevation and raising the height of dock doors; increasing the thickness of roof materials in hail prone areas; and other measures to ensure the long-term resilience of our assets to various natural hazards.

- For various acute risks including storm damage and flooding, Prologis has a comprehensive insurance program in place to transfer risk.

- Investment in research and development

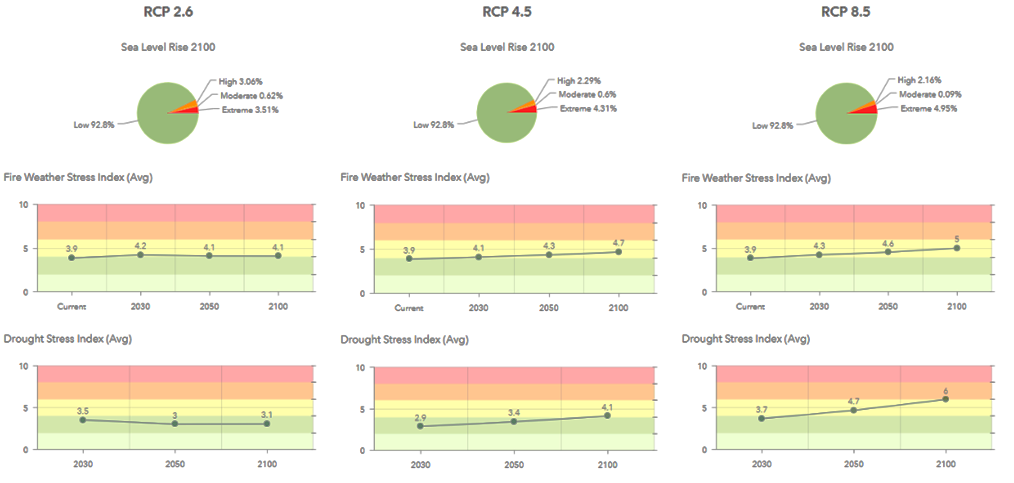

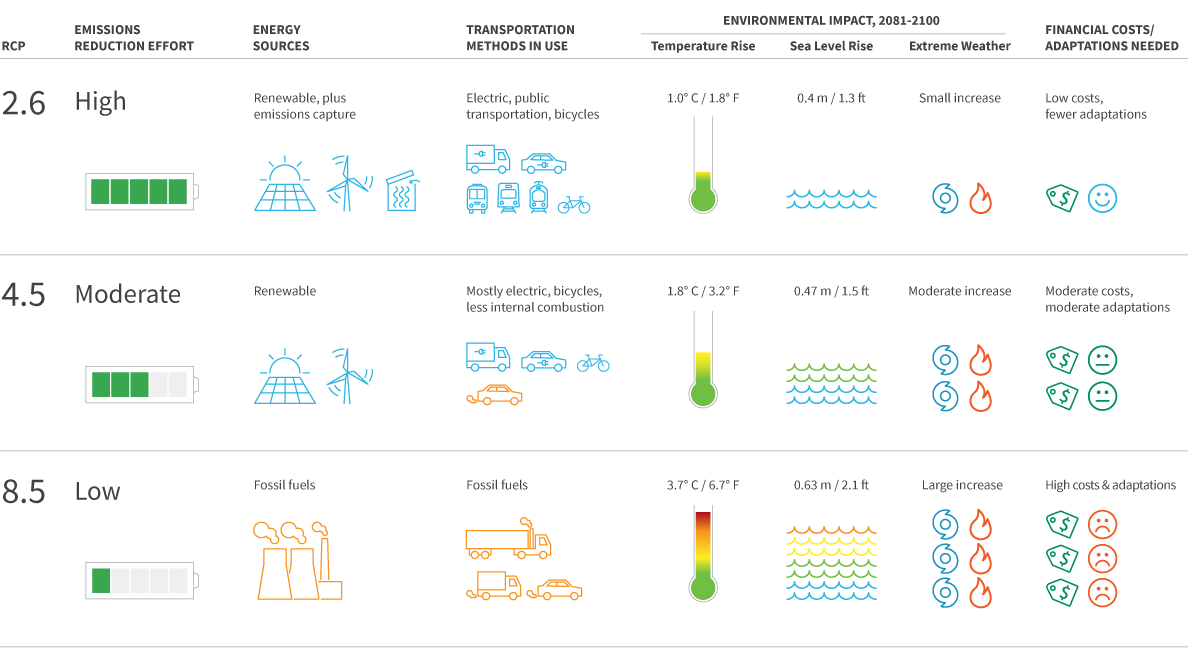

- Our Risk Management team has sourced third-party data that allows us to map, score and evaluate the exposure of our assets to current natural hazards and climate-related physical risks under the following climate-related scenarios:

- Our Risk Management team has sourced third-party data that allows us to map, score and evaluate the exposure of our assets to current natural hazards and climate-related physical risks under the following climate-related scenarios:

- Products and services

Risk to Prologis Assets

Representative image of Prologis Risk Management tool.

Representative Concentration Pathways (RCP) Effort-Outcomes Model

Targets & Metrics

- One of the primary metrics for assessing climate-related risks and opportunities is Prologis’ science-based target (SBT) for reducing Scope 1, 2, and 3 GHG emissions.

- In addition to measuring progress toward our SBT, Prologis also has targets and measures efforts to enhance the efficiency and sustainability of our assets.

- We aim for 100% LED lighting across our global portfolio by 2025.

- We aim for 400 MW of installed solar capacity by 2025.

- Further information on our progress towards these targets can be found in our 2020 Sustainability Report.