PROLOGIS INDUSTRIAL BUSINESS INDICATOR™

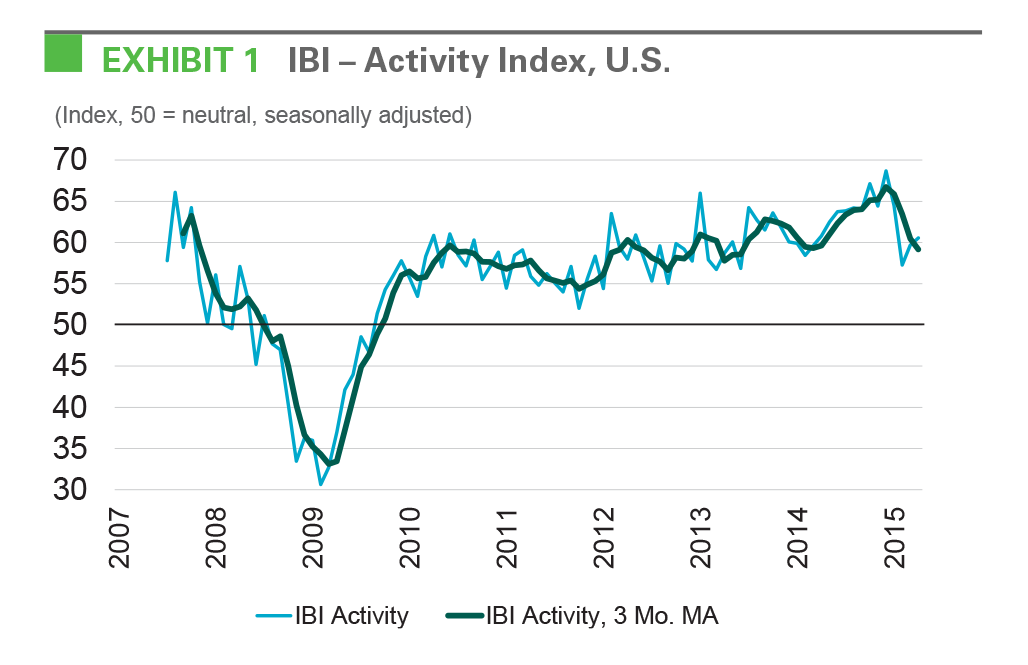

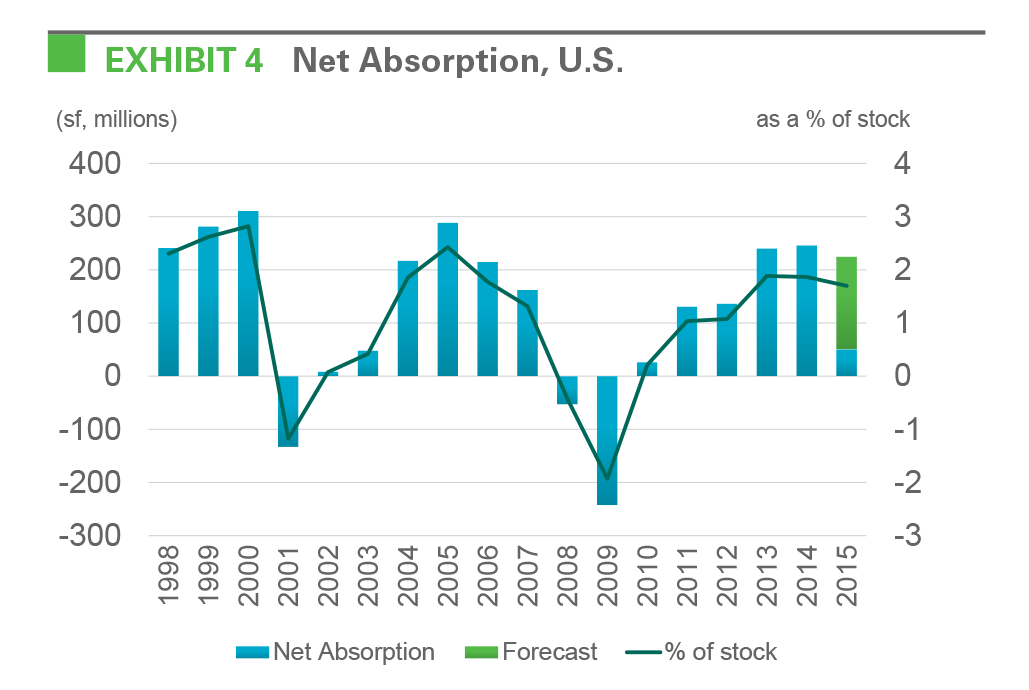

Despite apparent crosscurrents in the economy, the U.S. logistics real estate expansion continues, benefiting from a greater scope of demand by size category, geography and customer industry. Prologis’ most recent U.S. Industrial Business Indicator™ (IBI), the company’s proprietary survey of customer activity and facility use, shows a brisk return to growth after a soft first quarter that mirrored the hiccup in GDP growth. Readings of the IBI in March and April completely recovered, reflecting expansionary customer activity and high utilization rates. Indeed, demand for logistics real estate increased in early 2015, and net absorption is on track to reach 225 million square feet by the end of the year. With completions expected to total 170 million square feet, we believe market conditions will continue to tighten, prompting additional rent growth.

Healthy customer activity continues in 2015. Earlier in the recovery of industrial demand, growth was dominated by large requirements and, to a lesser extent, e-commerce. More recently, the recovery has broadened, driven by smaller customers and e-commerce users. The latest reading of the IBI in April was an impressive 60.6. While the IBI softened in the first quarter alongside softer GDP growth, more recent data in April illustrate a sharp return to normal since February. A similar pattern occurred in 2014, with a weak first quarter giving way to strong growth through the remainder of the year. The IBI is a diffusion index; results above 50 indicate positive growth and figures in the high 50s illustrate normal business activity, typically requiring new development.

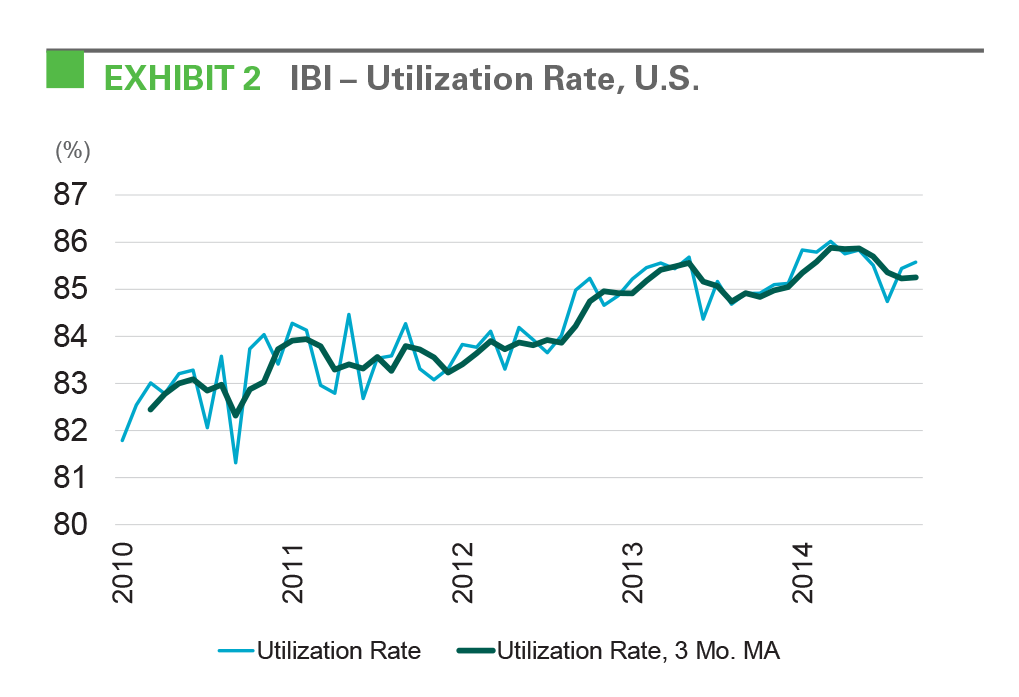

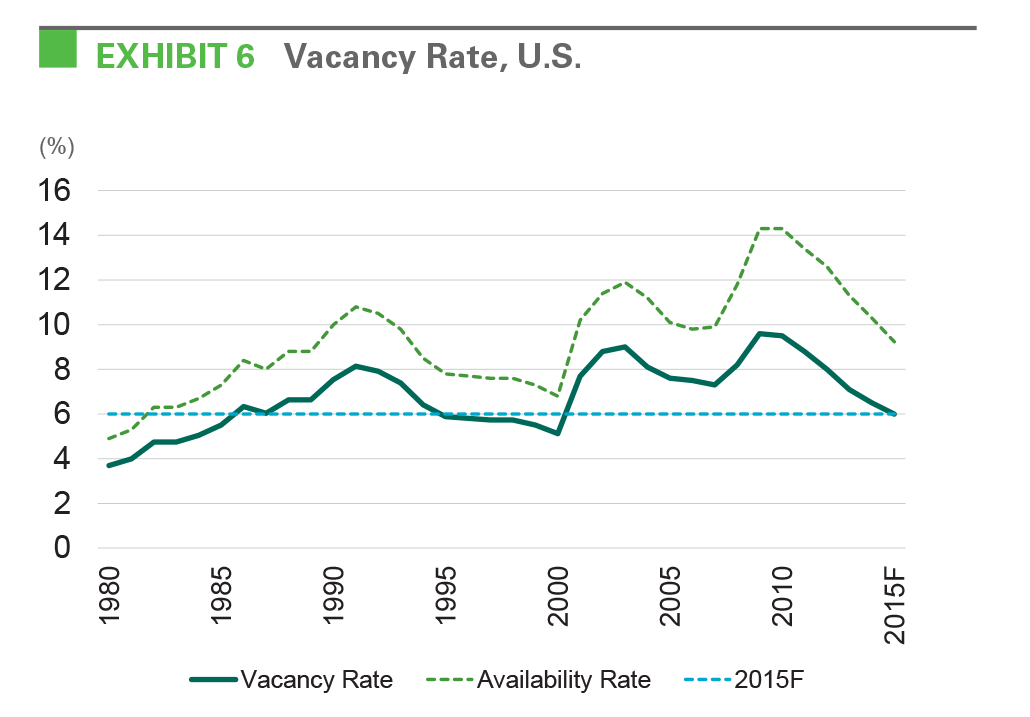

Utilization rates are near peak levels and customers are leasing space to accommodate growth. Throughout the recession and recovery, customers exercised caution, holding back on expanding their real estate footprints. However, this trend is reversing. Customers reported a utilization rate of 85.6% in April, an apparent plateau as illustrated by exhibit 2. This, coupled with ongoing demand growth, illustrates that customers are leasing new space versus growing within existing space. With elevated demand and the national vacancy rate at a 15-year low and falling, these dynamics are creating a rich environment for new development.

Lagging regions have caught up on the expansion. April readings by geography were remarkably consistent and all cleared 60, demonstrating the growing breadth of logistics demand. In the last three months, the Central region led but only slightly compared with other regions. The East region was the only region to show significant improvement compared with the same period last year. Several markets in this region, such as Atlanta and Pennsylvania, lagged the national economic recovery and recorded accelerating economic growth during recent quarters. In contrast, readings indicate stabilization in the Southwest and Central regions, which contain metro areas that boasted earlier economic recoveries.

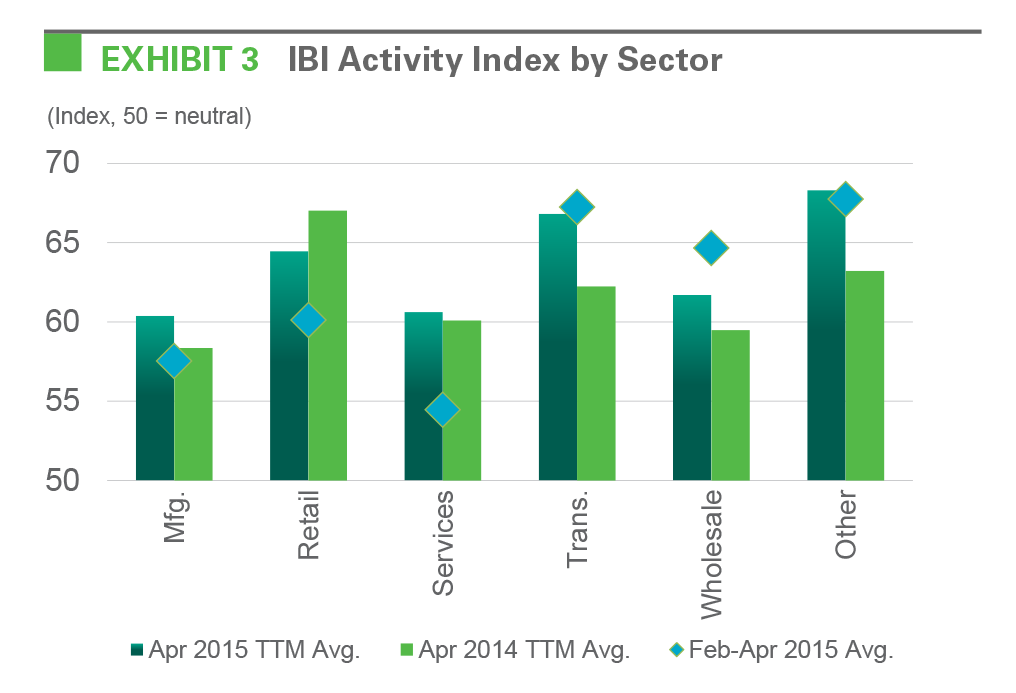

All industries are expanding. Similar to the regional analysis, all Prologis-served industries reported readings above 60 in April, reflecting broad-based expansion. The transportation, retail and wholesale trade sectors had the highest readings. Furthermore, the transportation, wholesale trade and manufacturing sectors posted the largest improvement in IBI readings.

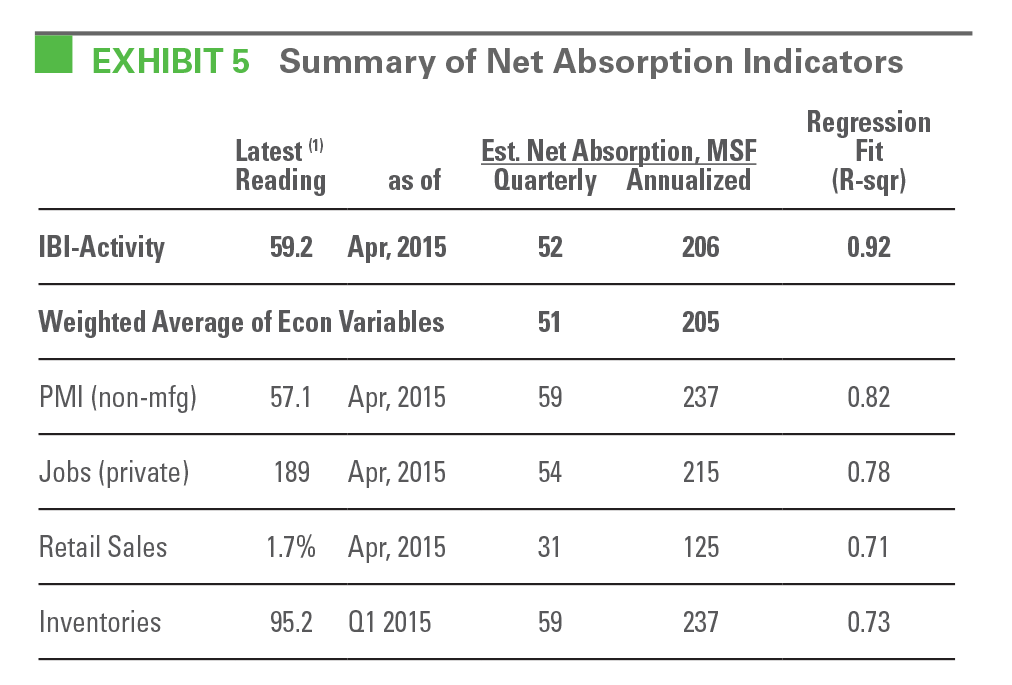

Recent economic indicators support burgeoning optimism after a first quarter GDP miss. The Purchasing Manufacturers Index showed an upswing in April. Retail sales disappointed slightly in the first quarter but grew in April, bolstered by auto and building materials sales. Consumer confidence remains elevated. Exhibit 5 shows that economic indicators are consistent with our IBI’s prediction for 206 million square feet of net absorption this year. Net absorption will likely surpass this prediction, reaching around 225 million square feet as we expect that negativity in the first quarter—stemming from weather, West Coast port strikes, the dollar shock and the restructuring oil industry—will dissipate in the near term, giving way to stronger growth in the remainder of the year.

Demand exceeds supply in most markets. However, in a few markets, supply has caught up. The total square footage of projects under construction in Dallas is comparable with the last four quarters of net absorption in the market. The same holds true in Atlanta, although construction is in-line with historical norms. The Inland Empire, a growth engine in Southern California, has a large construction base but also many prospective users.

We expect declines in vacancy as a result of steady demand. Prologis expects net absorption to total 225 million square feet by the end of 2015, above 170 million square feet of expected construction. Approximately 160 million square feet is now under construction. This demand-supply imbalance will likely drop the vacancy rate even further—to the low 6% range by the end of 2015 compared with 6.5% at the end of 2014. Elevated demand and obsolescence should drive the need for new supply in the coming years. Developer sentiment toward future demand is positive, evidenced by speculative construction increasing to 83% of first quarter starts in response to constrained availability. High-quality space in Los Angeles, the San Francisco Bay Area and New York-New Jersey is particularly scarce. Within these markets, we’ve seen a recent and notable tightening in infill submarkets. We expect growth to spill over into regional markets and activity to rise in small spaces as owners of small businesses, in particular, gain greater access to credit and in turn become increasingly active participants in the economic expansion.

CONCLUSION

The IBI reveals that the logistics real estate market is growing alongside a steadily expanding U.S. economy. The industry even showed resilience to the weak first quarter of macroeconomic performance. All geographic regions and industries served by Prologis have expanded in tandem. With strong fundamentals in place for another year, market conditions should again improve, providing leverage to drive outsized rent growth.

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

ABOUT PROLOGIS

Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of March 31, 2015, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 590 million square feet (54.8 million square meters) in 21 countries. The company leases modern distribution facilities to approximately 4,700 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

Copyright © 2015 Prologis, Inc. All rights reserved.