An Analysis of Demand by Leading Customer Industries

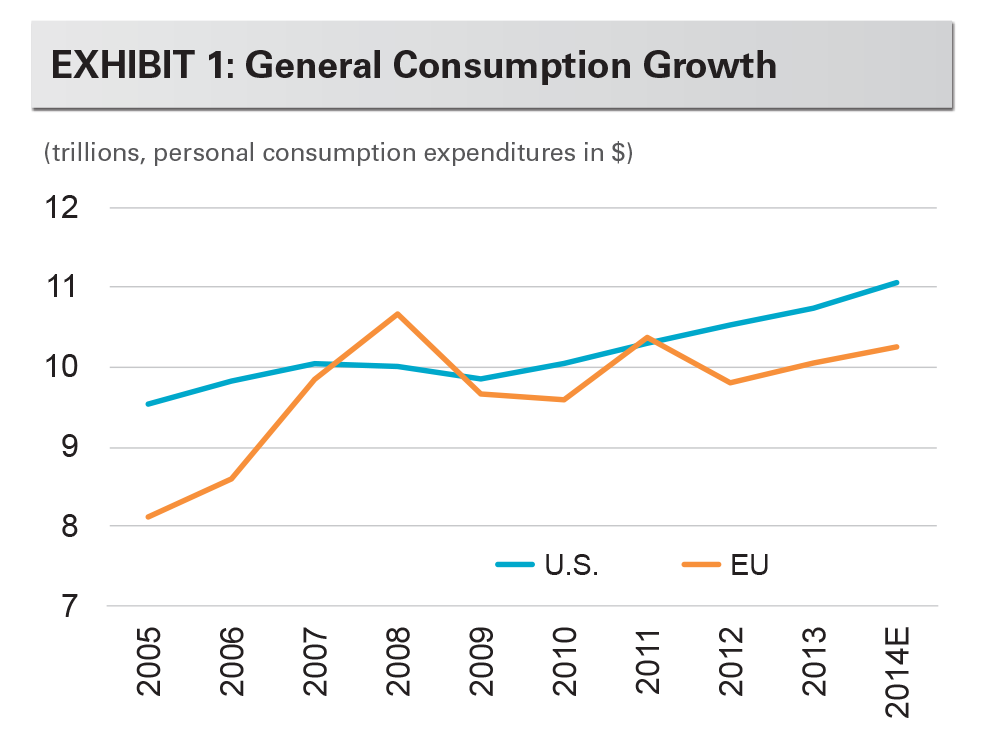

Logistics markets around the world continue to demonstrate improving fundamentals. Led by the U.S., global net absorption during 2013 reached roughly 350 million square feet,1 the highest level since the beginning of the global financial crisis, and activity remains healthy this year. Such improvement, which exceeded our own initial expectations, suggests the need for a closer look at the drivers of growth. Many customer segments are expanding, making for a diverse expansion. Notably, consumer-facing customers grew along with improvements in the housing- and auto-related industries. E-commerce clearly played a role as well across industries. Favorable demand trends and the declining availability of modern logistics facilities in the key markets around the world should push rents past their 2001 prior peak.

We studied demand growth across customer segments around the world. The major theme of 2013 was the broad diversity of demand. To better understand the underlying details, we focused our analysis on three key areas. First, consumer-facing customers, the largest industry concentration within logistics, comprised a large share of leasing activity last year. Second, several sectors experienced strong growth, including electronics, housing, auto and e-commerce. Third, we highlight third-party logistics (3PL) providers, who are likely to be a source of growth going forward.

The most active segment was the largest industry concentration: consumer-facing customers. These customers are composed of food and beverage, electronics, apparel, pharmaceuticals, sporting goods/toys and fast-moving consumer products. Last year, these tenants expanded and represented their typical sizable share of leasing volume. There are unique demand profiles among these constituent industries, but in general, these customers are large enterprises with sizable distribution activities. As such, they mostly favor midsize (100,000-250,000 sf) and larger facilities (>250,000 sf). Some, such as food and beverage and apparel, prefer to locate within global markets (major population centers), while others, such as consumer products, favor centralized locations (regional markets). Many of these goods serve basic daily needs, leading to stable businesses and growth that is more closely tied to population growth than to economic cycles.

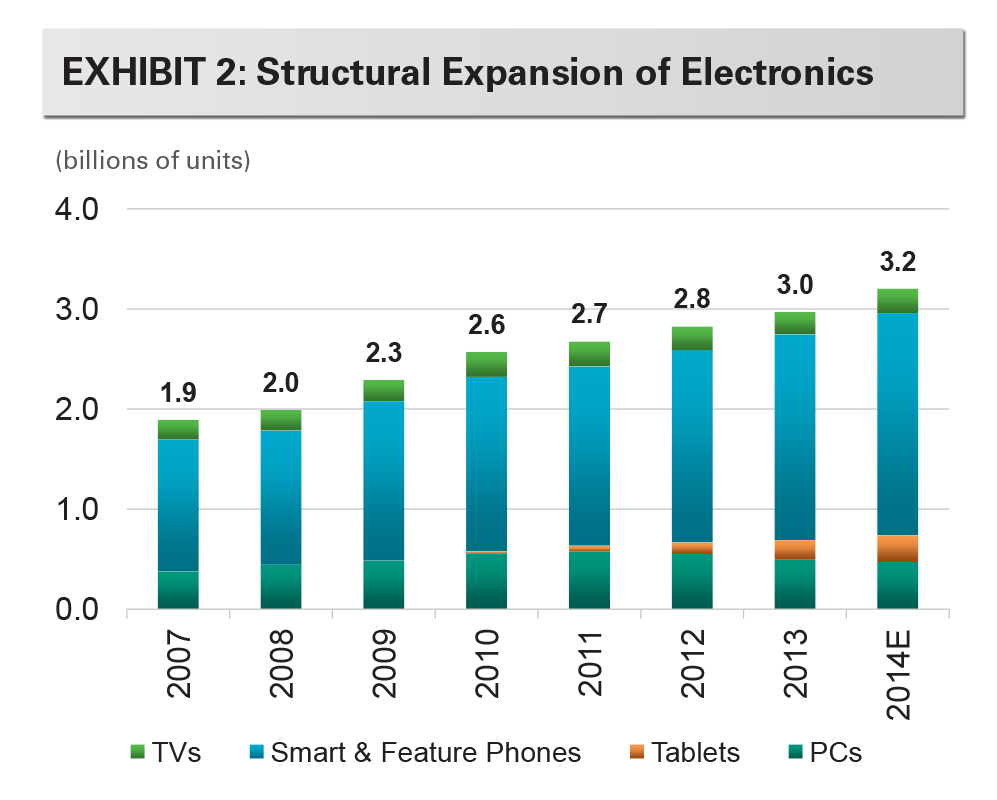

Distribution needs for electronics and computers played an important role in 2013 as structural growth of spending on consumer electronics continued. Notwithstanding the shift among electronics retailer business models to e-commerce, there is a structural expansion of electronics sales. The ecosystem of electronics retailers, distributors and suppliers represent a growing share of the requirements within logistics globally. The demand profile is diverse, reflecting the complexity of production and distribution to consumers. Finished goods distribution tends to occur in midsize and larger facilities. For production, the industry is served by a global supply chain of parts manufacturers, many of whom demand infill facilities in a variety of international markets. Looking forward, the structural expansion of consumer spending on electronics is expected to continue, driven by first purchases and augmented by the rise of affluence in emerging markets, as well as the technology upgrade cycle.

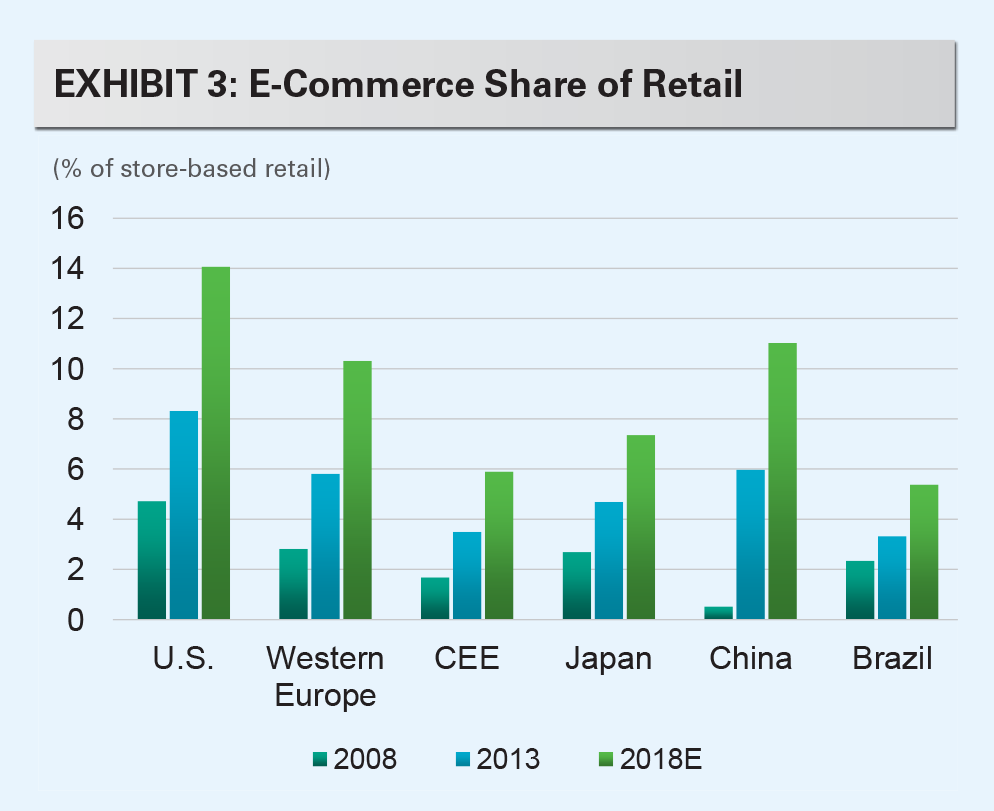

E-commerce: a driver across customer industries

The growth of online spending is well established. However, only in the last few years has it become an important trend in the leasing markets. Today, both the sheer dollar volume of online spending and its increasing share of customers’ businesses have shifted behavior. Industry participants are investing in their supply chains with a specific eye toward their e-commerce channel. The most visible e-commerce-related growth has come from dedicated online and mass merchant retailers, but demand has also been pronounced among apparel retailers, electronics brands and the sporting goods/ toys industries.

E-commerce is important in all our markets, from the U.S. to Japan and from Europe to Latin America. It is perhaps most pronounced in China, where consumption habits are evolving rapidly. Build-to-suit requirements have increased due to strong growth of e-commerce and the shortage of large facilities. In addition, requirements are also filling existing facilities. While requirements for larger spaces (e.g., >250,000 square feet) are common among e-commerce tenants, there are also smaller- and mid-size requirements. These requirements can originate from major retailers as a satellite location, or from small and midsize retailers as a primary online fulfillment center. Rising service requirements, elevated transportation costs and the importance of access to labor drive location selection, leading e-commerce demand to concentrate around major population centers.

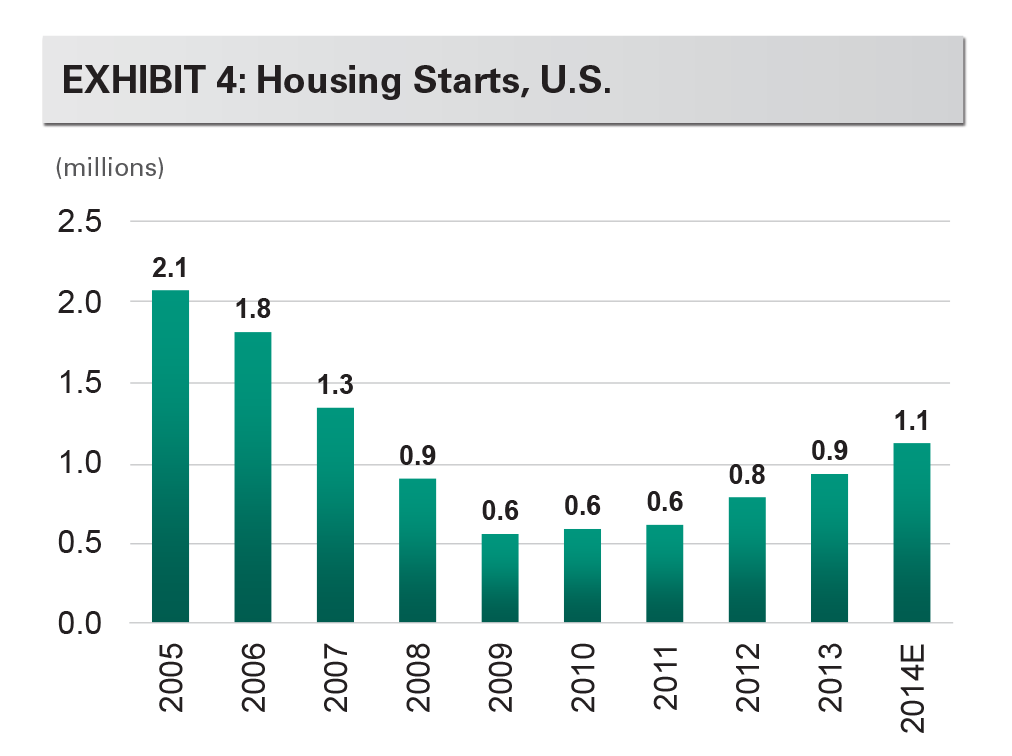

Leasing velocity increased across several cyclical industries; housing-related led the way. Housing starts rose by 19% in the U.S. in 2013, and further growth of 20% is forecast for 2014.2 As a result, we saw growth across a wide range of industries. Construction and building products have been the clearest examples; expansion among these tenants contributed to the emerging recovery among smaller spaces. In addition, home purchases trigger consumption of other higher-value and bulky goods. Furniture companies were active, particularly in the U.S., and appliance companies were active across all of our regions around the world. These customers favor midsize and larger facilities. In addition, higher transportation costs and compressed delivery windows increase demand for locations closer to end customers within global markets.

As we look forward, we believe housing-related customers have substantial room for growth and recovery. The current pace of home sales and housing starts are well below the pace indicated by demographic growth. As a result, forecasters anticipate significant growth in coming years as the pace of new construction rises toward a level consistent with population growth. Similar trends are emerging in Europe, with a notable improvement in the U.K., a positive first step for the broader European market.

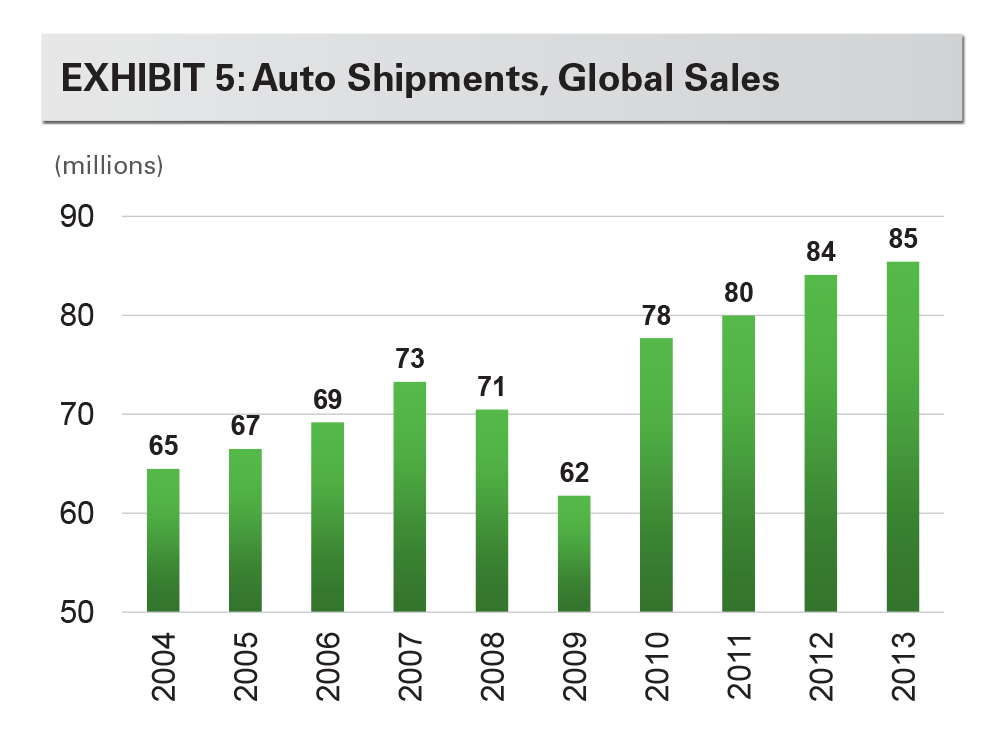

Auto-related customers have been active and growing. The cyclical recovery of auto sales is a clear driver. 2013 featured a healthy combination of new requirements and expansion of existing leases. There is a diverse customer base within the auto industry, which translates to a wide range of requirements, both by size and by market. In general, auto-related requirements comprise parts manufacturers and distributors for manufacturing new cars and for servicing existing vehicles. Large requirements also arise from the global auto brands. The uptick has been strongest in the U.S., Mexico and increasingly in Europe (led by Germany, Poland and the U.K.).

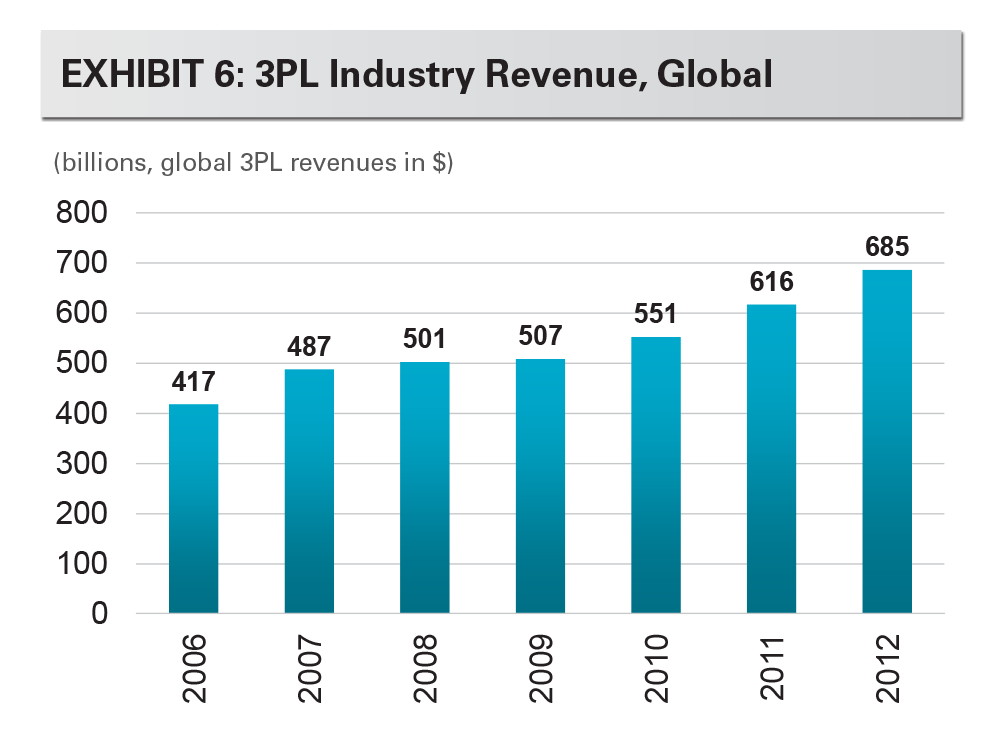

3PLs remain a key driver of leasing activity. They are the largest customer group and benefit from all of the industry trends discussed above. Demand within the consumer-facing segments, food and beverage, apparel, and electronics industries has been particularly significant for 3PL leasing. Outsourcing remains an important theme in all regions of the world. 3PLs help their customers realize the cost savings and service-level improvements of modern logistics facilities over old distribution models. However, many customers of 3PLs retained a cautious stance in 2013, more so in Europe than in the U.S., forcing 3PL leasing strategies to favor shorter lease terms and renew in place rather than seek the newest and most modern facilities. Consequently, 3PLs represent an upside growth opportunity as business recovers.

Conclusion

The outlook for the growth of customer businesses and logistics demand is strong. In fact, decision-making surrounding new leases clearly improved in the past year. The trend has been notable in cyclical recovery markets and more prevalent in North America than in Europe, for the time being. Rents are spiking in a wider range of markets – customers are increasingly recognizing the opportunity to lock in current rates ahead of further rate increases. Many users are beginning to see the potential for further sizable rental rate increases given today’s low vacancy rates, modest supply pipelines and upward trend in replacement costs, which drive up associated required rents to warrant new projects.

The demand backdrop should continue to improve. The fundamental business drivers for customers, including the ongoing growth of consumption, the expansion of electronics, and the continued upswing of the housing and auto cycles, should strengthen customers’ demand for logistics real estate. There remains room for further growth as well; sentiment among customers regarding their businesses is improving, but leasing so far has been focused on current needs, not prospective growth. In addition, the success of many customers’ e-commerce businesses requires them to address their logistics real estate requirements earlier and in greater magnitude than they had previously expected. Collectively, low vacancies are beginning to create shortages across more markets and product types, which should lead to additional outsized rent growth.

Endnotes

- In roughly 115 markets across the six global regions where Prologis operates, including the U.S., Europe, Japan, China, Mexico and Brazil

- Consensus Economics

Forward-Looking Statements

Copyright © 2014 Prologis, Inc. All rights reserved.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Prologis.

About Prologis

Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of December 31, 2013, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling approximately 569 million square feet (52.9 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises.

Prologis Research

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.