Prologis Industrial Business Indicator™

Logistics real estate market conditions are supported by robust customer activity and elevated utilization of space, as evidenced by the U.S. Industrial Business Indicator™(IBI), Prologis’ proprietary index of customer activity. The index was in the growth range through October 2015, for the 37th consecutive month. Based on positive demand sentiment, Prologis expects net absorption of 240 million square feet in 2015, with projected deliveries of 160 million square feet. This imbalance between demand and supply should push the vacancy rate down to 5.8% by year-end, leading to a shortage of desirable space in most markets and giving landlords the leverage to further raise rents.

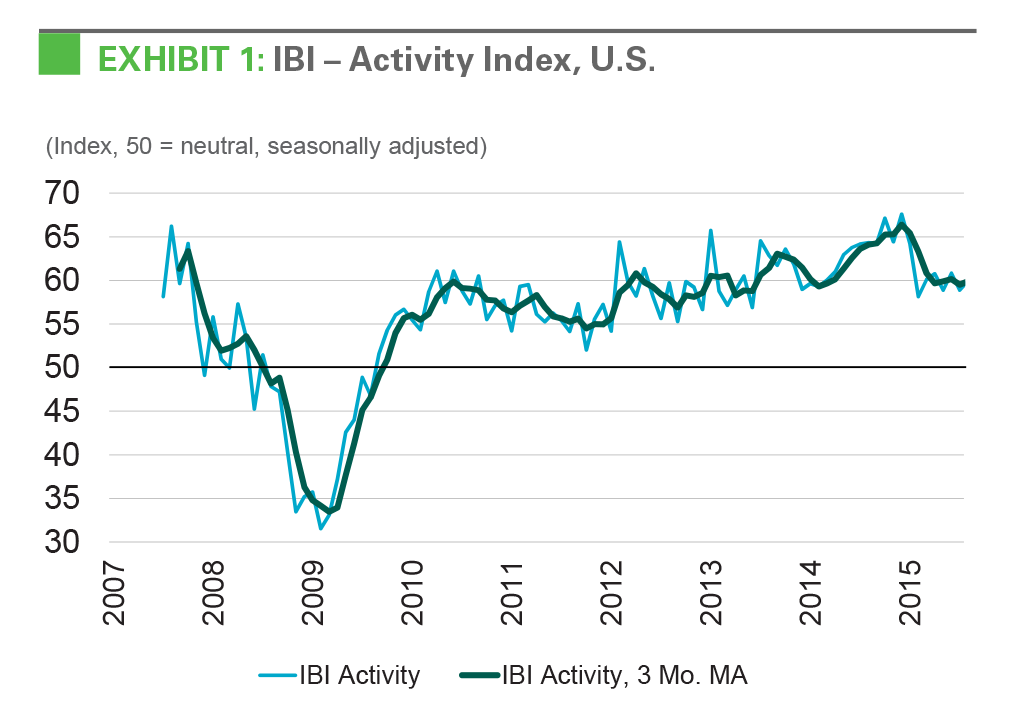

Demand was broadly positive. Nationally, IBI activity readings in the high-50s indicate logistics real estate expansion consistent with the need for new construction. In October, the seasonally adjusted IBI activity index reached 58.5, in line with year-to-date averages but below the heights reached in late 2014. Because the survey asks respondents to compare current activity to year-ago activity, a moderation in the headline reading does not indicate a contraction but rather points to a maturing demand cycle.

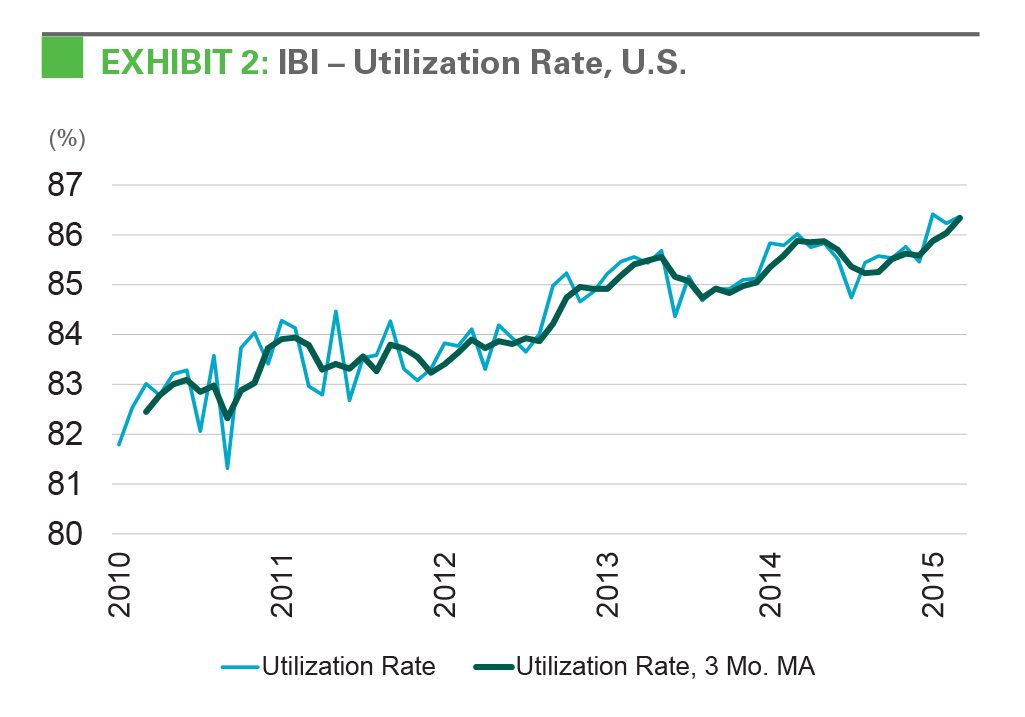

Space utilization inched upward. Customers reported an average utilization rate of 86.4% in October, up from 86.2% in September and 86.0% in October 2014. October’s reading also represents a new peak: It is the highest rate reported since the survey began. Elevated activity and record utilization will fuel new leasing as customers continue to grow out of their existing real estate. As a result, utilization will likely tick down in coming quarters as customers expand into new space.

Industry-level customer activity mirrored economic trends. All industry categories surveyed by Prologis recorded activity in the growth range in October, but momentum within the readings differed. In line with headwinds from slowing demand in emerging markets and the strong dollar, the IBI activity index in manufacturing, transportation and services revealed softening growth relative to year-ago levels. In contrast, customers in retail, wholesale trade and other categories recorded stable-to-accelerating growth. With consumer spending driving GDP growth in recent quarters, this segment of the economy should continue to drive logistics real estate demand.

Space utilization was up across industries. Despite decelerating growth in some industries, utilization rates remained broadly elevated. For respondents in the services industry, for example, the utilization rate increased by nearly three percentage points year-over-year in October, an extension of the trend of the past year. Space utilization also increased or stabilized at a high level for the retail, wholesale trade, transportation and other categories. Manufacturing, the weakest of the industries surveyed, recorded a modest decline in the utilization rate in recent months.

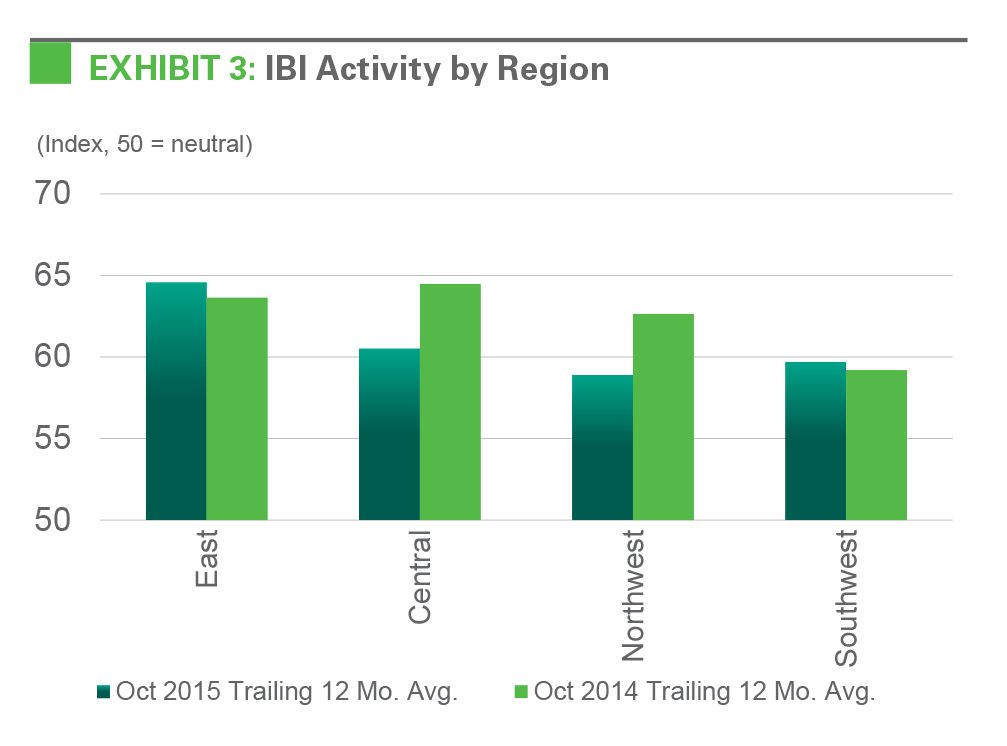

Activity in the East and Southwest regions strengthened. Strong IBI activity readings spanned all four U.S. regions in October, ranging from 54.4 in the Northwest to 65.5 in the East. The East region, which lagged in the recovery, is now benefiting from strong job creation and increasing import volumes. Compared with other regions, the Southwest saw a more gradual uptick in customer activity, a trend that extended through October. The Central region recorded a swifter recovery in customer activity than did other regions and now displays an earlier normalization of the trend. Additionally, economic fundamentals have slowed in some major Central regional economies such as Houston.

Economic fundamentals support an outlook for continued growth for logistics real estate. Notwithstanding temporary volatility from a correction in business inventories, third quarter GDP growth, the October jobs report and other indicators suggest that the U.S. has the potential for an extended period of economic growth. Consumer confidence is elevated and spending has increased at a moderate and steady pitch. Overall, business sentiment remained intact through summer’s financial market turmoil. Housing market indicators also continued to improve. Given the tight labor market and prospects for continued economic growth, wages are likely to accelerate, bolstering household finances. Going forward, rising consumption and import volumes should likely support demand for logistics real estate. Structural changes such as the adoption and optimization of dedicated e-commerce fulfilment facilities will continue to boost demand.

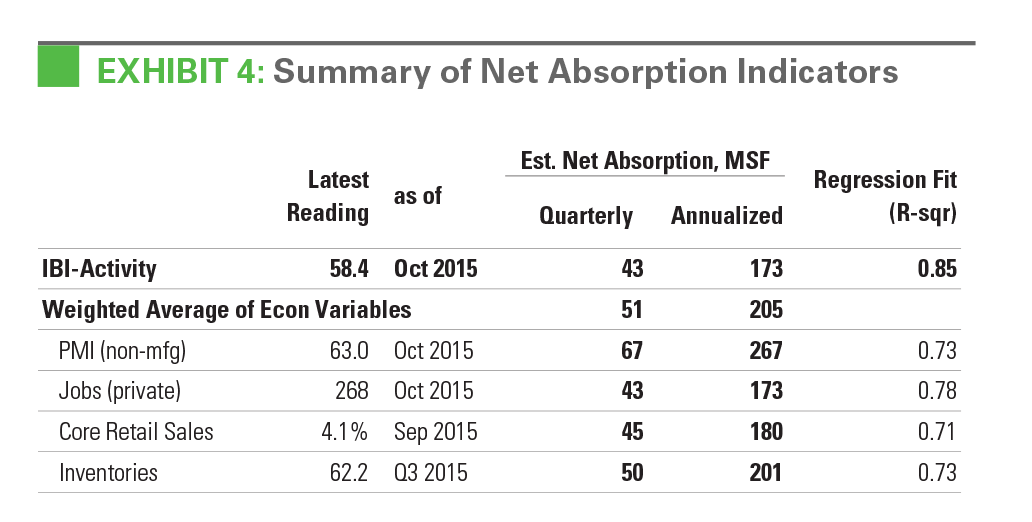

The near-term forecast is for sustained demand amid still-lagging supply. Based on our econometric analysis, current economic variables correspond with annualized net absorption of 205 million square feet (see Exhibit 4). However, this analysis includes an auto-regressive component. This component is resulting in a downward bias based on this year’s quarterly net absorption trends- -namely, a weaker-than-normal third quarter after a strong second quarter. While we intend to continue to monitor these trends, we expect this bias will normalize in the fourth quarter as long as net absorption is not skewed by external events such as weather. Prologis forecasts a total of 240 million square feet of net absorption in 2015 and 225 million square feet in 2016, while deliveries should reach 160 million square feet in 2015 and 215 million square feet in 2016. As a result, the national vacancy rate should tighten to 5.8% by year-end and stay at or close to this level through year-end 2016. Given heightened demand and tight market conditions, the outlook for rents and returns is optimistic.

FORWARD LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in industrial real estate. As of September 30, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 671 million square feet (62 million square meters) in 21 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party logistics providers, transportation companies, retailers and manufacturers.

Copyright © 2015 Prologis, Inc. All rights reserved.