As e-commerce grows and evolves, so too will the supply chains, facilities and talent that support the critical functions of e-fulfilment. E-fufilment is essential to meeting consumer expectations, staying competitive and generating profit. In order to achieve these objectives, companies that sell goods online must invest in their supply chains, stay nimble and manage costs.

Prologis Research reveals that these trends have a positive impact on the broader European economy and job growth, as well as specific sectors, such as the logistics real estate that supports e-commerce logistics. While successful e-fulfilment relies on many factors working well in tandem, chief among them is location.

INTRODUCTION

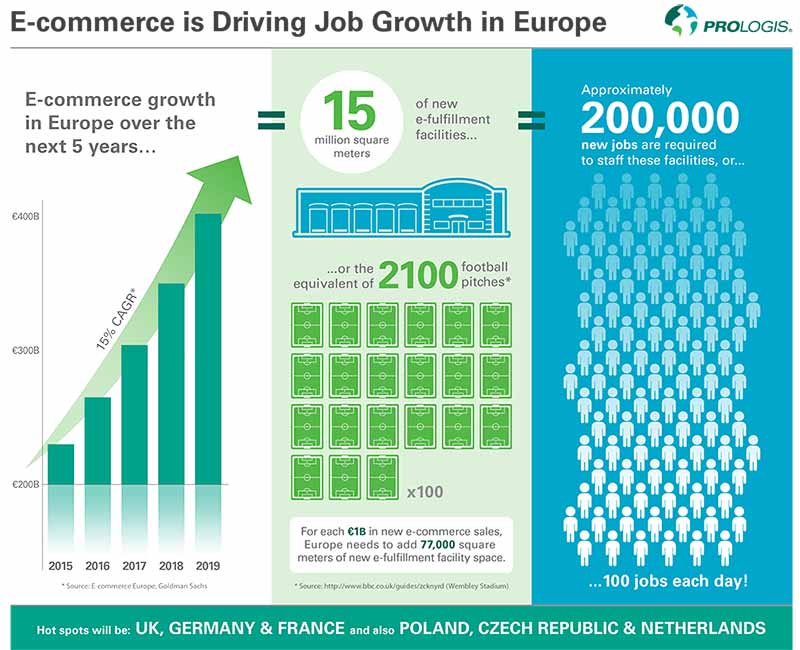

Prologis conducted an analysis of e-fulfilment leasing based on industry and proprietary data. Our key discovery is that growth in e-fulfilment over the last three years translated into five million square meters of new leases during that time. Specifically, for every €1 billion in new e-commerce sales, 77,000 square meters of new facility space was needed to fulfil those orders. Prologis believes this trend will continue. Implications that follow include:

- Job growth: We estimate that 200,000 new jobs will be needed to staff new e-fulfilment facilities over the next five years. This translates to 100 jobs per day.

- Multiplier effects: Both e-commerce sales and shipping volume are growing significantly in scale. We estimate that the e-commerce industry will need an additional 15 million square meters of logistics space.

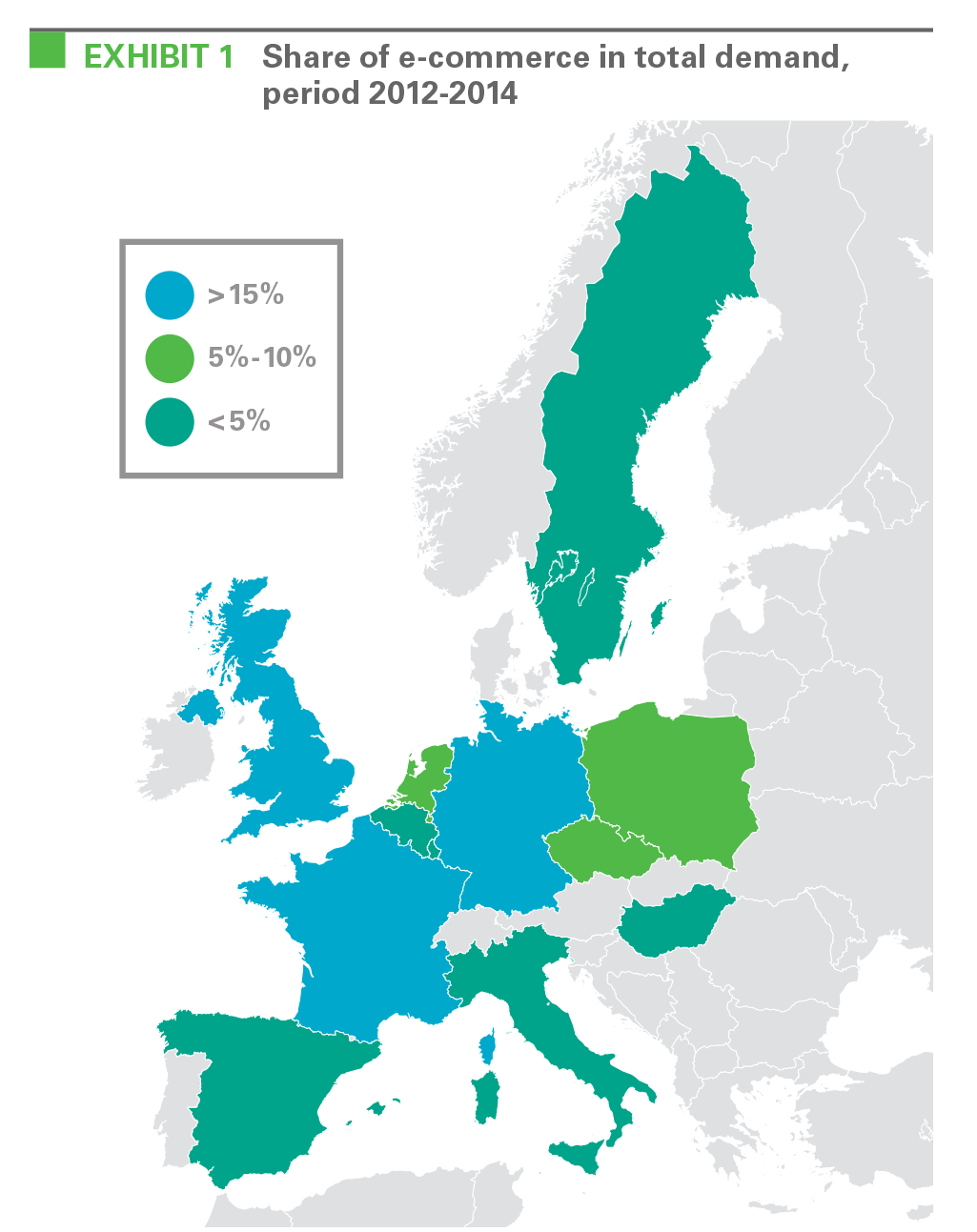

- Location: Facilities in Europe’s largest e-commerce markets, such as the U.K., Germany and France, as well as growth pockets like Poland, Czech Republic and the Netherlands, are the current hotspots.

Benefitting from a deep-dive analysis of individual leases during the last three years, this paper reviews how e-commerce is fulfilled today, recent leasing trends and customer location strategies. As e-commerce grows and evolves, so too will the supply chains, facilities and talent that support critical functions of e-fulfilment and logistics.

E-Commerce, E-Fulfilment & Logistics Real Estate Requirements

Changing shopping habits drive demand for logistics real estate. As consumer tastes and preferences for e-commerce have become more clearly established, retailers and shippers are investing in their online fulfilment capabilities, creating sizeable demand for logistics facilities. Online sales of goods in the European Union amounted to approximately €200 billion in 20141 and may double in the next five years with annual growth rates above 15 percent per annum.2 Just as importantly, e-commerce’s share of total retail sales is rising rapidly, from less than 5 percent in 2010 to more than 10 percent in 2020.3 The mix of businesses is also changing, bringing the desire to invest in e-fulfilment.

Prologis Research conducted a detailed lease-by-lease review to quantify this growth. We analyzed all new leases across 10 European countries over the last three years to quantify e-commerce related new leasing.4 We found three ways in which this demand surfaces.

- Direct Lease: Requirements for dedicated e-fulfilment facilities with retailers who are either online-only or who have dedicated facilities. This category is straight-forward to track.

- 3PL Lease: fulfilment activities that are performed by third-party logistics providers (3PLs). The nature of this use, whether for store distribution or e-fulfilment, is not always transparent.

- Omnichannel Lease: demand that surfaces as part of joint store distribution and e-commerce fulfilment. This can be difficult to identify compared with store distribution alone.

Approximately 5 million square meters of new e-fulfilment leases has occurred in the last three years. Demand varies for each of the categories we studied. For direct leases, we identified 3.4 million square meters of new leases. For 3PL leases, we conducted a deep-dive of our own portfolio to understand the e-commerce demand that could surface in this category. Our data suggest it equates to approximately 50 percent of direct leases. Therefore, we estimate that 3PLs account for 1-2 million square meters of additional e-commerce demand. For omnichannel leases, e-commerce- related demand is not quantifiable and as such represents incremental upside to our demand estimates.

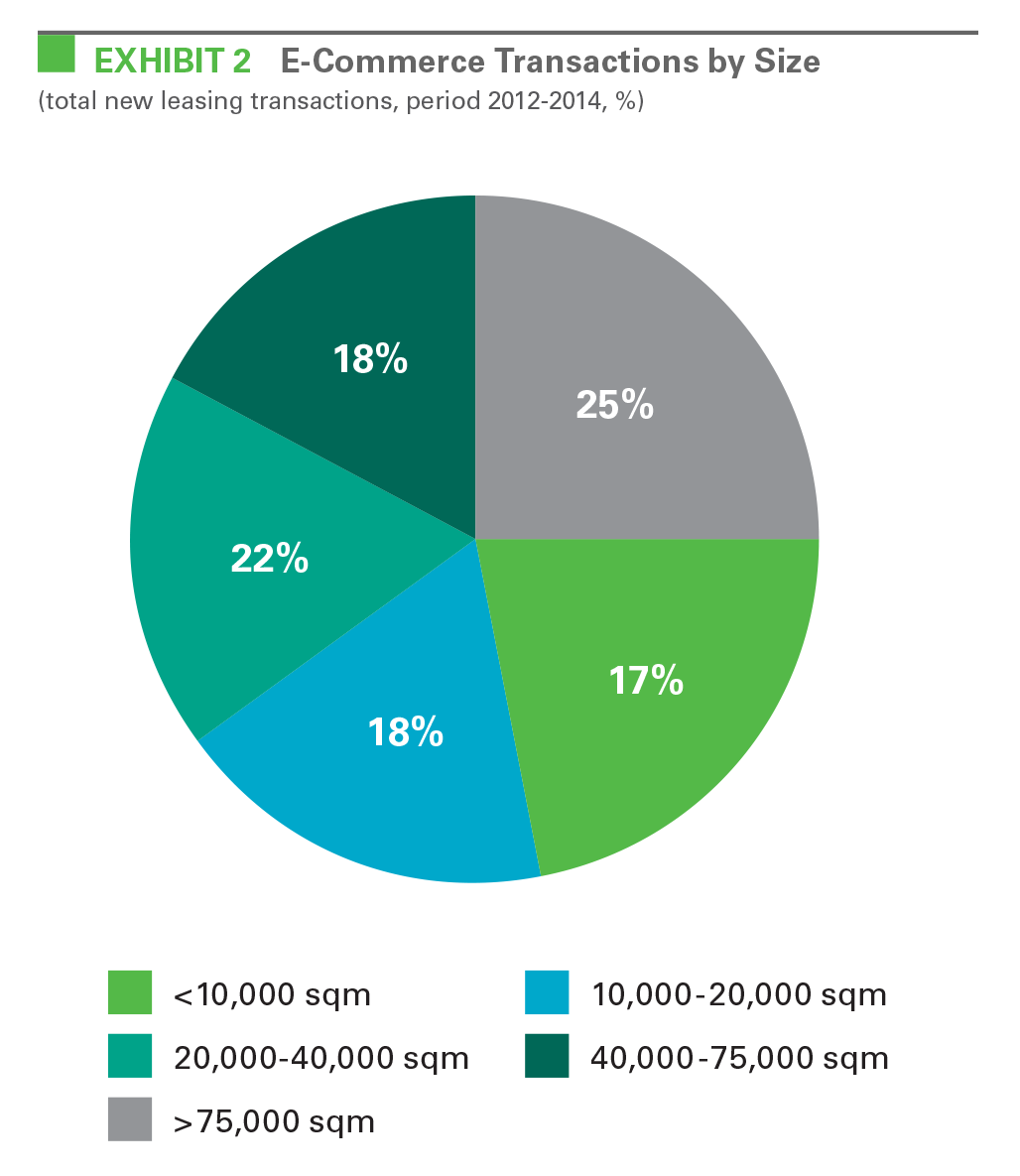

Demand is more diverse than many realize. There is a perception that e-commerce demands only new and large facilities, yet the data tell a different story. Nearly 60 percent of new direct leases were in units below 40,000 square meters in the past three years. In contrast, just 25 percent was signed for large-scale units above 75,000 square meters. This distribution follows naturally from the diverse nature of the online retailer industry, which is comprised of a wide range of large and small retailer concepts. Out of this diversified demand, half were new facilities and half were satisfied by existing assets. However, there’s substantial difference by size; smaller leases tend to be in existing assets while large leases tend to be in newer assets. These relatively high ratios of leases in existing stock show that e-commerce requires a specific set of requirements, but they can mostly be addressed by generic logistics real estate.

Each €1 billion of incremental online sales generates approximately 77,000 square meters of new logistics demand. During the last three years, e-commerce sales rose by €65B in the 10 countries in our study.5 By comparison with the 5.0 million square meters of new leasing, each €1 billion of incremental online sales corresponded to approximately 77,000 square meters of demand for logistics real estate. In aggregate, the ongoing expansion of in-store sales suggests cannibalization by e-commerce may be limited.

E-commerce growth should require 15 million square meters of logistics space in the next 5 years. Combining our multiplier of logistics demand (77,000/€1 billion) with estimates of e-commerce growth (€200 billion over five years) translates to potential incremental demand – either new requirements or expansion needs for additional space – amounting to 15 million square meters in Europe. However, factors such as a like lack of availability and omnichannel strategies could affect this estimate. In the past three years e-commerce leases accounted for 15 percent in the total take-up.6 With anticipated sales growth projections, this ratio could rise further as more firms invest in e-fulfilment. Most growth is expected to occur in Europe’s three largest e-commerce markets (U.K., Germany and France), which could account for approximately 10 million square meters alone.7

E- Fulfilment a Catalyst for Jobs

Growth of e-fulfilment can create upwards of 200,000 new jobs in the next 5 years. Activities within e-fulfilment facilities employ a combination of manual activity and automation equipment. Current industry averages equate to 10-15 employees per 1,000 square meters of distribution space permanently, and can at least double during the seasonal peaks. These employment levels are 2-5 times that of a traditional distribution center.8 These ratios and our estimate of 15 million square meters of incremental demand implies e-fulfilment will create 150,000-225,000 new jobs. This equates to approximately 100 jobs every day for the next five years. In addition, more jobs will be created by all the suppliers and supporting functions like IT and delivery. And, although e-commerce is shifting the balance of in-store and online sales, analysts still expect growth, albeit moderate, at brick-and-mortar retailers.

E-fulfilment is a strong job creator across Europe. In line with expected nominal growth of sales, Prologis Research believes many can be created in the UK, Germany and France. However, the rise of e-fulfilment in cost efficient locations, such as in Poland and the Czech Republic, is also creating growth from a low base. Finding qualified employees is and will remain one of the key location criteria for online retailers. Being located close to metropolitan areas offers the best opportunities for finding new employees with a range of qualifications and affiliated services.

Urban Sites and Greenfield Locations Poised to Benefit Alike

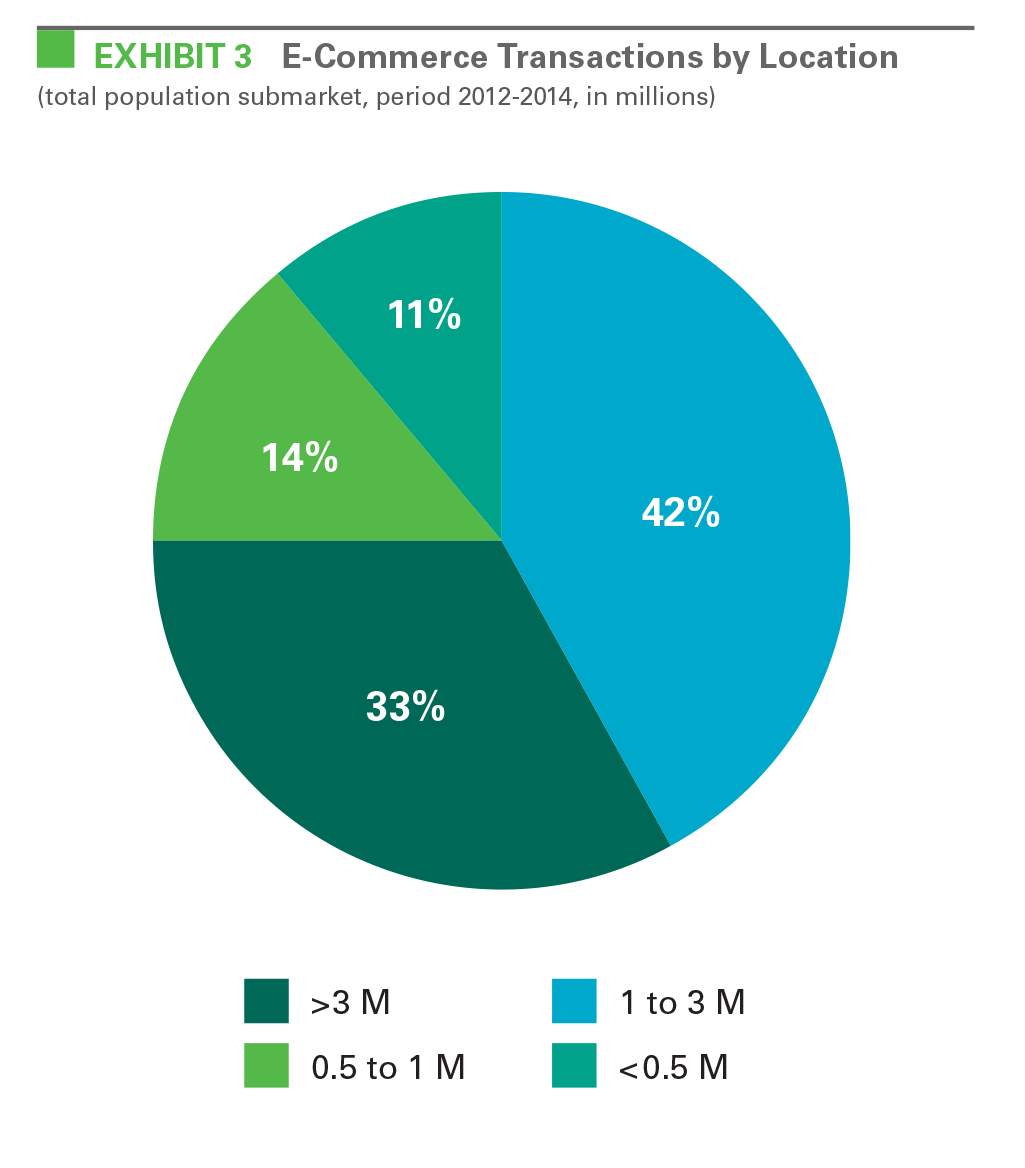

E-fulfilment leasing has been focused on the largest economies along with cost-efficient locations too. The top three markets for direct lease e-fulfilment represent the main consumption markets, with 28 percent of direct leasing occurring in Germany, 22 percent in the UK and 16 percent in France. Cost efficient fulfilment markets round out the top five markets, including Poland (13 percent of direct leases) and Czech Republic (9 percent). Leasing in these countries reflects the opportunity for more cost-efficient labor and also important new growth markets for the e-commerce industry. Turning to demand by market, approximately 75 percent of direct leases were in metropolitan areas with populations above one million, so proximity to people – either consumers or labor supply – are a key location consideration for e-fulfilment operations.

There are multiple factors influencing location strategies within markets. Supply chains, e-commerce or otherwise, focus on balancing costs with service. Factors such as the number of facilities and their locations, sizes and configurations are evaluated constantly. Transportation costs are critical. Ultimately, site selection comes down evaluating the (i) proximity to customers, (ii) availability of labor, and (iii) proximity to the distribution networks of parcel and express carriers. The best sites offer a balance of these requirements, allowing e-fulfilment operations to staff their operations, enjoy rapid deployment of deliveries, and manage transportation costs. Locations close to urban areas are well-positioned for the e-commerce sector.

In practice, demand can be segmented into two types of requirements, which include infill facilities for last-mile delivery and larger requirements serving regional e-fulfilment. For infill requirements, last-mile delivery focuses on locations and business parks proximate to city centers. These requirements tend to be smaller (<10,000 sqm) and can be met with existing facilities. For regional e-fulfilment requirements, traditional locations for modern logistics facilities attract the most demand. These locations offer a diversity of unit sizes, suitable facility features (e.g., coverage ratios and ceiling heights), proximity to key infrastructure nodes and locations that balance their transportation, labor and real estate cost structure. Traditional e-commerce demand has historically been concentrated within the regional e-fulfilment category, however growth has recently become more pronounced for infill last-mile facilities.

CONCLUSION

E-commerce retailers and distributors have only recently begun to invest in their supply chains to deliver goods more efficiently. Yet, with an estimated 5 million square meters of demand in the past three years, e-fulfilment has quickly become a central driving force of recovery and expansion in Europe’s logistics real estate markets. And, staffing needs for this growing industry are having a positive effect on the broader economic recovery thanks to new job creation, which has the potential to add some 200,000 jobs in the next five years. Supply chain and location strategies will evolve as e-commerce matures. The ability to lower transportation costs and improve customer service, via proximity to the end consumer, has and will continue to be a key factor for e-commerce requirements. Locations within and near metropolitan areas will likely benefit the most. Because online retailers are diverse, the best locations within a metropolitan area are also diverse. Modern logistics hotspots are expected to attract the most demand from medium-and large-sized retailers, while first-generation business parks are expected bring in smaller retailers.

ENDNOTES

- Ecommerce Europe, B2C goods only

- Goldman Sachs, Prologis Research

- Goldman Sachs, Prologis Research

- 10 countries included in this study are: United Kingdom, Germany, France, Netherlands, Spain, Italy, Sweden, Poland, Czech Republic and Hungary. Within each of the 10 countries included in this analysis, we identified leasing activity based upon our own local market presence along with multiple brokerage partners, including DTZ, CBRE, Cushman & Wakefield and Gerald Eve.

- Ecommerce Europe, B2C goods only

- Based upon our analysis and data from CBRE

- Based upon data from Ecommerce Europe

- Prologis and Prologis Research

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in industrial real estate. As of June 30, 2015, Prologis owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 670 million square feet (62 million square meters) in 21 countries. The company leases modern distribution facilities to more than 5,200 customers, including third-party logistics providers, transportation companies, retailers and manufacturers.

Copyright © 2015 Prologis, Inc. All rights reserved.